Updated January 2026

The fastest-growing fintechs and accounting platforms in the UK don’t build dozens of bank integrations in-house. Instead, they work with trusted financial data aggregators that handle secure connections, data normalisation, and regulatory requirements, allowing teams to focus on their core product.

Access to clean, reliable financial data is now central to how lending, accounting, and payment workflows are built. Whether it’s verifying income, reconciling transactions, or powering financial dashboards, the choice of aggregator shapes both development timelines and user experience.

The business adoption numbers reflect this shift. According to Open Banking Limited’s July 2025 Impact Report, over 3 million UK businesses are now connected to bank data through regulated aggregation platforms, with SMEs driving the majority of integrations.

Many companies now combine open banking APIs with other data aggregation method such as investment or wealth feeds. This mix gives them wider coverage and cleaner insights without maintaining every connection themselves.

In this list, we’ve highlighted seven financial data aggregators that operate in the UK and Europe. Each one serves a different type of business need, from broad coverage to enriched data and faster deployment so you can identify the platform that best fits your product.

Comparison of the 7 Best Financial Data Aggregators (2026)

| Provider | Primary Focus | UK Coverage | Data Enrichment | Pricing | Best For |

|---|---|---|---|---|---|

| Finexer | UK-native AIS aggregation | ~99% UK banks incl. business accounts | Standardised & categorised data | No setup fees; usage-based | Fintechs, lenders, accounting platforms |

| Salt Edge | UK + EU multi-market coverage | Strong UK/EU bank network | Categorisation & normalisation | Enterprise pricing | Cross-border platforms |

| Yodlee (Envestnet) | Global incl. wealth & investments | UK banks + legacy feeds | Txn categorisation; investment data | Enterprise tiers | Large institutions, wealth & credit |

| Yapily | Open banking API infrastructure | Wide UK + EU coverage | Basic enrichment | Custom contracts | Developer-led teams |

| Moneyhub | UK-first aggregation + insights | Deep UK coverage incl. business | Categorisation, consent tools | Custom B2B pricing | Lenders, accounting, planning |

| Bud | UK aggregation with enrichment | Major UK banks | Advanced categorisation | Contract-based pricing | Fintechs needing enriched data |

| Modulr | Data + payments infrastructure | UK-regulated connectivity | Standardised bank data | Usage-based, enterprise | Data + payments in one |

1. Finexer

When UK businesses assess AIS partners, the priorities are clear: complete bank coverage, clean transaction data, reliable onboarding, and transparent commercial terms. Finexer is built specifically to address these needs for fintechs, accounting platforms, lenders, and embedded finance products that depend on stable access to UK banking data.

Why Finexer stands out for data aggregation

- Extensive UK bank coverage

Finexer provides AIS connectivity to 99% of UK banks, including major business and corporate accounts. This depth of coverage is essential for platforms serving SMEs, accountants, and lenders who rely on accurate and comprehensive data. - Regulated infrastructure

As an FCA-authorised Account Information Service Provider (AISP), Finexer manages the regulatory layer end to end. Businesses can access account and transaction data without taking on direct regulatory obligations. - Structured and enriched data

All transaction data is standardised and categorised, making it immediately usable for accounting automation, credit decisioning, reconciliation, and financial analysis without additional cleaning or enrichment layers. - Fast onboarding with dedicated support

Finexer provides 3–5 weeks of hands-on integration support, enabling teams to go live far quicker than typical market timelines. Documentation, consent flows, and standardised schemas are already in place, which reduces engineering overhead significantly. - Affordable pricing model

There are no setup costs, and pricing is usage-based, allowing businesses to start without large upfront commitments. This makes Finexer cost-effective for both early-stage fintechs and larger platforms looking to scale efficiently. - White-label consent flows

Businesses can fully brand the customer consent experience, maintaining user trust and a seamless interface while meeting regulatory requirements.

Why it matters

Finexer functions as a complete data aggregation layer for UK financial products. By combining broad bank coverage, enriched data, regulatory compliance, guided integration, and flexible pricing, it removes the need for in-house bank connections and compliance processes. This allows teams to work with high-quality financial data in weeks rather than months.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Book Demo2. Salt Edge

Salt Edge is one of the established financial data aggregators that provides regulated access to both UK and European banks. It is authorised by the UK Financial Conduct Authority (FCA) as an Account Information Service Provider (AISP), allowing businesses to use its aggregation services without seeking their own regulatory permissions.

The platform connects to thousands of banks through secure APIs, covering both consumer and business accounts. Its key strength lies in its multi-market coverage, making it suitable for companies that operate across the UK and EU or serve customers with accounts in multiple jurisdictions.

Salt Edge delivers structured and enriched transaction data, including categorisation and normalisation, which can reduce the amount of in-house data processing required. Its APIs are documented and developer-focused, with consistent data schemas to support integrations in lending, reconciliation, analytics, and financial reporting workflows.

For UK businesses that need connectivity beyond domestic banks, Salt Edge offers a way to maintain a single aggregation layer while expanding coverage into European markets.

3. Yodlee (Envestnet)

Yodlee is one of the longest-standing financial data aggregators, widely used by wealth management platforms, lenders, and financial institutions. While many newer platforms focus exclusively on regulated open banking APIs, Yodlee combines both open banking connections and legacy data aggregation methods, giving businesses access to a wider range of financial data sources.

The platform provides coverage for both consumer and business accounts, with a strong presence in the UK and international markets. Its appeal lies in its breadth of connectivity, including support for investment accounts and non-traditional financial institutions that may not yet offer fully regulated APIs.

Yodlee’s aggregation tools deliver structured transaction data, and its APIs support integrations for credit decisioning, analytics, financial planning, and reconciliation workflows. Many platforms use Yodlee when they need historical or investment data that goes beyond standard banking feeds.

For UK businesses that require a mix of regulated access and extended data coverage, Yodlee serves as a bridge between traditional aggregation methods and open banking frameworks.

What are financial data aggregators?

Financial data aggregators are platforms that connect to banks and financial institutions through secure APIs. They collect, standardise, and enrich financial data, giving businesses real-time access to transactions, balances, and income insights.

How do financial data aggregators work?

Financial data aggregator platforms use regulated APIs to connect with banks, retrieve account data, and deliver it in a structured format. This data can then be used for accounting automation, credit checks, reconciliation, or financial analysis.

4. Yapily

Yapily is a regulated open banking platform that provides financial data aggregation and payment initiation capabilities for businesses operating in the UK and across Europe. It is authorised by the UK Financial Conduct Authority (FCA) and focuses on providing enterprise-grade infrastructure for fintechs, lenders, and financial institutions.

The platform connects to a wide range of UK and European banks through secure APIs, supporting both consumer and business accounts. Yapily’s strength lies in its coverage breadth and API consistency, making it suitable for companies that want to build their own user interfaces and workflows on top of stable, low-level banking data access.

For developers, Yapily provides clear documentation, standardised schemas, and a data model designed to simplify the integration of multiple banks into a single platform. This is particularly useful for teams that prefer to own more of the front-end experience while relying on Yapily for the underlying connectivity.

While Yapily is often used for both data aggregation and payment initiation, its role as a financial data aggregator is most relevant for platforms that need broad coverage, regulatory compliance, and direct API control without white-label layers.

5. Moneyhub

Moneyhub is a UK-based platform that provides regulated financial data aggregation through open banking APIs, alongside analytics and consent management tools aimed at enterprise clients. It holds authorisation from the Financial Conduct Authority (FCA) as both an AISP and PISP, making it suitable for businesses that need compliant access to financial data.

The platform focuses primarily on UK bank coverage, supporting both personal and business accounts. Its aggregation layer delivers categorised transaction data, account balances, and income insights, which can be integrated into accounting software, lending platforms, and financial management tools.

Moneyhub also places emphasis on data enrichment and consent management, offering tools that help businesses build customer-facing experiences while maintaining control over compliance obligations. Its APIs are well-documented and designed for teams that want to integrate banking data without building enrichment or consent flows from scratch.

For B2B use cases, Moneyhub is most commonly adopted by lenders, financial planning platforms, and accounting technology providers that require a UK-first approach to financial data aggregation.

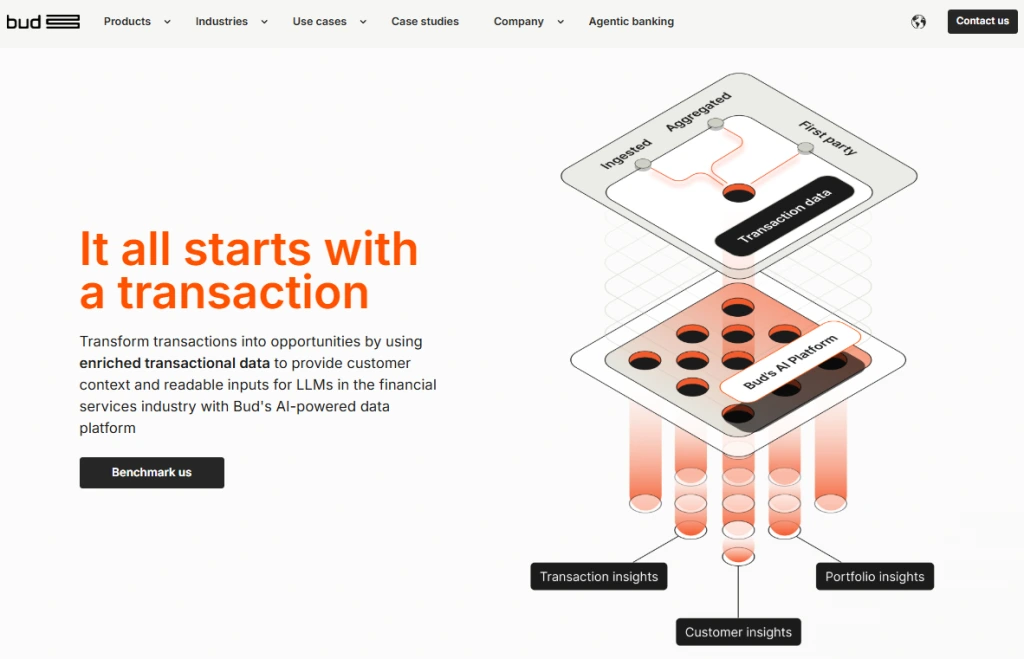

6. Bud

Bud is one of the financial data aggregator platforms that concentrates primarily on the UK market, offering regulated connectivity to major banks through open banking APIs. It is authorised by the Financial Conduct Authority (FCA) as both an AISP and PISP, allowing businesses to use its infrastructure for regulated data access without seeking their own approvals.

Bud’s core strength lies in its data enrichment capabilities. Beyond basic bank connectivity, the platform applies categorisation and transaction analysis to deliver structured financial data that can be used directly in accounting, credit decisioning, or financial management applications. This reduces the need for businesses to build enrichment pipelines internally.

For developers, Bud provides RESTful APIs and clear documentation designed to make integrations straightforward. Its focus on UK bank coverage and enriched data has made it a relevant option for lenders, accounting platforms, and fintech products that require clean, standardised financial information for UK-based users.

Bud’s positioning within the UK ecosystem makes it well suited for companies seeking financial data aggregation with a strong emphasis on categorisation, insight generation, and compliance.

7. Modulr

Modulr is one of the UK-regulated financial data aggregator platforms that combines data connectivity with embedded payments infrastructure. It is authorised by the Financial Conduct Authority (FCA) and focuses primarily on serving UK businesses through API-based financial services.

While Modulr is often associated with its payment capabilities, it also provides financial data aggregation services through regulated open banking APIs. This includes secure connections to major UK banks and access to account information, transaction data, and balance details. For businesses building financial products, this enables both data retrieval and payment initiation through a single provider.

Modulr’s platform is designed for developers and product teams that want to integrate banking data APIs into their workflows without managing separate compliance layers. Its strong UK focus makes it particularly suitable for accounting platforms, fintechs, and B2B payment solutions that need stable access to financial data alongside payments.

For companies that want a single infrastructure provider for both data and payments, Modulr offers a regulated, developer-friendly option within the UK ecosystem.

Conclusion

Choosing the right financial data aggregator platform comes down to three things: your business model, data needs, and the markets you serve.

Some platforms focus on broad UK–EU coverage, while others specialise in data enrichment, categorisation, and UK-centric compliance features. For fintechs, lenders, accounting platforms, and embedded finance providers, this choice directly affects integration speed, data quality, and compliance overhead.

Key factors to consider

- Coverage & Regulation – Does the platform connect to the banks and jurisdictions your product needs, and is it FCA-authorised?

- Data Quality & Enrichment – Will the data support accounting, lending, or analytics workflows without extra processing?

- Integration & Cost – How fast can you go live, and does the pricing structure fit your stage?

The providers in this list represent some of the best financial data aggregators available in 2026. Each brings different strengths, from cross-border connectivity to developer-friendly APIs and enriched insights.

A well-chosen aggregator isn’t just a data source. It’s a strategic layer of your product infrastructure — one that helps you build faster, stay compliant, and deliver a better experience to customers.

Are financial data aggregators safe to use?

Yes. Reputable financial data aggregator platforms use regulated APIs, encryption, and customer consent to keep data secure. Information is only shared for agreed purposes, making them safer than manual processes.

Why should UK businesses use financial data aggregation?

Financial data aggregation reduces integration time, improves data quality, and ensures compliance. UK fintechs, lenders, and accounting firms use it to launch products faster and access reliable banking data.

Which industries benefit most from financial data aggregator platforms?

Lending, accounting, fintech, embedded finance, and wealth management benefit most. These industries rely on real-time, enriched financial data for accuracy, efficiency, and compliance.

Don’t waste months building fragile bank integrations. Finexer lets you integrate bank data API with zero setup fee, Book your demo today!