UK businesses today depend on accurate and continuous access to financial data. From processing payroll and validating income to performing affordability checks, the quality of that data directly affects how quickly teams can make informed decisions. This is where banking data aggregation plays a crucial role.

Instead of juggling multiple bank logins or manual statement uploads, Open banking connects accounts through secure APIs, giving finance teams a single, live view of balances and transactions. It reduces the effort of data collection, lowers errors, and ensures information stays current across all connected systems.

However, as transaction volumes grow and clients expect faster insights, not every solution can handle the scale required. A scalable banking data aggregation ensures that even with thousands of accounts or years of historical data, performance remains consistent and compliant.

In this blog, we’ll look at what makes an aggregation platform scalable, what to evaluate before choosing one, and which providers in the UK are leading the way.

What “Scalable” Really Means in Banking Data Aggregation

Scalability in banking data aggregation means handling more data and connections without slowing down. A scalable platform can process thousands of transactions, connect to multiple banks, and stay stable even during peak usage.

It also means flexibility. As your business grows, your data needs change from tracking a few accounts to managing hundreds. A good banking data aggregation system keeps the same speed and accuracy no matter how much data it handles.

Many tools limit how often you can fetch transactions or how much history you can access. Scalable solutions remove those limits, giving businesses full visibility into past and present financial data.

Simply put, scalability ensures your data stays fast, accurate, and reliable as your business expands.

Evaluation Criteria for Scalable Banking Data Aggregation Platforms

Before choosing a provider, it’s worth knowing what makes a banking data aggregation platform truly scalable. Here are the main areas to review:

| Evaluation Area | What to Check |

|---|---|

| Bank Coverage | Does it connect to all major UK banks and business accounts? |

| Data Depth | Can it access several years of transaction history? |

| Performance | Does it stay stable during high-volume requests? |

| Compliance | Is the provider FCA-authorised and consent-based? |

| Integration | Can developers test and deploy easily with clear APIs? |

| Support | Is onboarding and ongoing assistance available when needed? |

A strong banking data aggregation platform should deliver complete coverage, extended data access, and consistent reliability — not just during setup, but as your business scales.

These benchmarks help you find a provider that fits both your current and future data needs.

Top Scalable Banking Data Aggregation Solutions (2025)

Below are some of the leading options for UK businesses that depend on scalable banking data aggregation to power payments, accounting, or compliance workflows.

1. Finexer

Finexer is built for UK businesses that depend on accurate, large-scale financial data. It connects with 99 percent of UK banks and removes the data limits many providers still impose. Teams can access up to seven years of transaction history per account, with no restrictions on volume or refresh frequency.

This extended visibility supports audits, affordability checks, and financial reporting — all from verified, consent-based connections.

Best For: Accounting, payroll, legal, and fintech platforms that need reliable, high-volume data access.

Key Highlights:

- Unlimited transaction fetching (up to 7 years of history)

- Coverage across 99 percent of UK banks

- 3–5 weeks of hands-on onboarding and testing support

- Deploys 2–3 times faster than most providers

- Usage-based pricing with no setup fees

Finexer’s architecture is designed for consistent performance at scale, allowing businesses to integrate live financial data securely, with the depth and stability needed for long-term growth.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking Data Aggregation.

Try Now2. Bud Financial

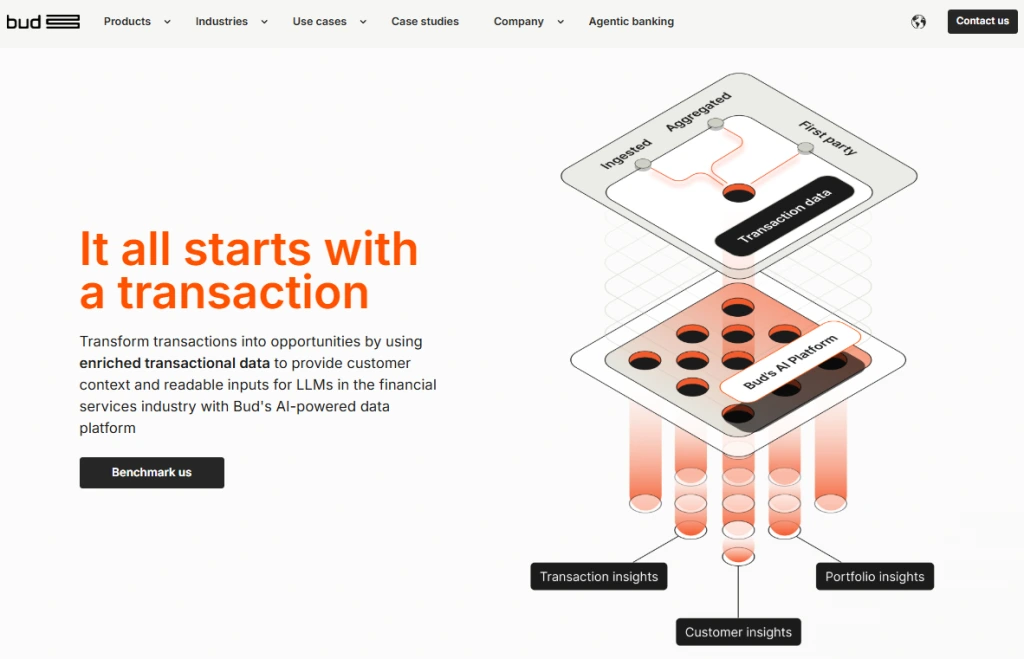

Bud Financial focuses on making bank data more meaningful through enrichment and categorisation tools. It helps lenders, accounting apps, and personal finance platforms turn raw transactions into clear spending insights and income patterns.

Unlike providers that only aggregate accounts, Bud’s system analyses and labels transactions to identify trends such as recurring bills, merchant categories, or salary deposits. This makes it useful for credit assessment, budgeting tools, and customer analytics.

Best For: Financial institutions and fintechs that want to combine data aggregation with behavioural insights.

Key Highlights:

- Strong transaction categorisation and enrichment features

- Ideal for affordability and credit analysis

- Developer-ready APIs with enterprise-level compliance

- Broader integration options across banking and lending platforms

Bud’s platform fits businesses that value deep data intelligence alongside aggregation, especially when building insight-driven products.

3. Moneyhub

Moneyhub combines data access with payment functionality, giving businesses a complete view of their financial ecosystem. It acts as both an Account Information Service Provider (AISP) and a Payment Initiation Service Provider (PISP), allowing firms to access account data and process payments through one connection.

For teams building accounting, payroll, or financial wellness tools, this dual capability means fewer integrations and faster workflows. Businesses can view customer transactions, analyse spending, and initiate direct bank payments without switching systems.

Best For: Companies needing both data access and payment initiation under one provider.

Key Highlights:

- Dual AISP + PISP functionality

- Real-time data refresh and payment flows

- Extensive UK bank coverage

- Trusted by financial institutions and consumer apps

Moneyhub suits firms that prefer a single platform for both data aggregation and payments, though smaller businesses may find setup and pricing more complex than lighter solutions.

4. Salt Edge

Salt Edge is known for its wide PSD2 and Open Banking coverage across Europe. It provides secure access to financial data and payment initiation tools, making it a reliable choice for businesses operating across multiple regions.

Its strong focus on compliance and audit readiness makes it especially suitable for regulated institutions such as lenders and financial platforms that need detailed reporting trails. Salt Edge’s connections extend beyond the UK, offering coverage for both consumer and business accounts across several EU markets.

Best For: Multi-country businesses and regulated financial service providers.

Key Highlights:

- PSD2 and UK Open Banking compliant connections

- Broad European bank coverage

- Built-in consent management and audit tracking

- Suitable for cross-border financial applications

Salt Edge works well for firms with European operations, though UK-focused platforms may find its setup heavier compared to local providers.

5. Plaid

Plaid is a global data connectivity platform that helps fintechs and finance teams access customer bank information securely. It’s widely used by apps that operate across multiple regions, offering reliable integrations with banks in the UK, Europe, and North America.

The platform is known for its developer-friendly APIs and consistent uptime, making it popular among large fintechs and enterprise platforms. However, its pricing and focus on international markets can make it less tailored to UK-only use cases.

Best For: Businesses building multi-region financial products or apps requiring cross-border data connectivity.

Key Highlights:

- Strong international coverage across the UK, EU, and US

- Developer-first architecture with robust documentation

- High reliability and proven enterprise adoption

- Broader market reach beyond Open Banking

Plaid suits global teams that prioritise scale and geographic coverage, though local firms may prefer UK-specific providers offering deeper data access or more flexible pricing.

How to Choose the Right Aggregation Platform

Selecting the right provider depends on how your business uses financial data. A good platform should balance coverage, performance, and compliance without forcing you into unnecessary complexity.

Here are a few points to consider before making a decision:

- Depth Over Breadth: Access to several years of transaction history is often more useful than global coverage. Look for providers that prioritise detailed, high-quality UK data.

- Data Refresh Frequency: Ensure the system updates accounts in real time or at least multiple times a day, especially for accounting and affordability checks.

- API Usability: Developer-friendly documentation and sandbox environments make integration faster and smoother.

- Pricing Flexibility: Usage-based pricing scales better as your business grows compared to rigid per-user models.

- Compliance Readiness: Choose FCA-authorised and consent-based solutions to stay fully aligned with Open Banking standards.

A scalable data aggregation platform should grow with your business — supporting more clients, deeper histories, and higher transaction volumes without trade-offs in speed or accuracy.

Building for Scale with Finexer

As businesses handle more accounts, transactions, and clients, scalable data access becomes a core part of daily operations. The best aggregation platform isn’t just the one that connects to banks — it’s the one that can grow with your needs while maintaining accuracy, compliance, and uptime.

Finexer delivers exactly that for UK businesses. With no data caps, access to up to seven years of transaction history, and 99% UK bank coverage, it’s designed for teams that rely on consistent, high-volume financial data. Each deployment is guided by Finexer’s onboarding team, ensuring stable integrations, validated feeds, and full compliance from the start.

Whether you’re building an accounting platform, compliance tool, or fintech application, Finexer gives you the scalability and performance needed to operate with confidence.

What is banking data aggregation?

It’s the process of securely connecting multiple bank accounts through APIs to access balances, transactions, and financial insights in one place.

Why is scalability important in banking data aggregation?

Scalability ensures the system can handle more connections, data volume, and users without slowing down or losing accuracy.

Are these aggregation platforms FCA-regulated?

Yes. Reputable providers like Finexer, Bud, and Moneyhub operate under FCA authorisation for Open Banking compliance.

Turn fragmented bank feeds into a single, live data source. Request a live demo and get unlimited sandbox access!