Credit files show fragments of a customer’s history, not how they manage money today. With income swings, BNPL exposure, and changing spending habits, traditional assessments miss key behavioural signals.

Open Banking Data fills this gap by revealing real financial patterns — how income arrives, how expenses behave, and where stress begins to build. The value comes from interpreting this data responsibly and within clear consent boundaries.

Used correctly, Open Banking Data offers a transparent, compliant way to understand financial behaviour. This guide shows how lenders can extract behavioural insights without breaching consent or over-collecting information.

📚 Guide to categorised Bank Data with Finexer

Why Behavioural Insights Now Matter More Than Ever

Credit risk is no longer defined by a borrower’s past; it’s defined by how they manage money today. Traditional reports don’t show income volatility, discretionary spending, BNPL cycles, or emerging financial stress — all of which affect repayment ability far more than an old score.

Open Banking Data fills this gap by revealing real-time financial behaviour. Instead of relying on assumptions, lenders can see how customers earn, spend, save, and prioritise commitments. This is crucial in an environment where:

- Income is increasingly irregular due to gig work and part-time roles

- BNPL usage creates hidden repayment cycles

- Thin-file customers don’t have enough credit history

- Cost-of-living changes reshape spending habits overnight

Behavioural insights built from Open Banking Data give credit teams a clearer, more current picture of affordability without lengthening onboarding or creating friction.

What Open Banking Data Can Legally Reveal and What It Can’t

Open Banking was designed to give customers control over their financial information, not to give lenders unrestricted visibility. That means every insight must come from data the customer has knowingly shared and only for the purpose they agreed to.

What Open Banking Data can legally reveal:

- Verified income inflows (salary, benefits, gig work, transfers)

- Essential outgoings (rent, utilities, council tax, childcare)

- Repayment behaviour (loan instalments, BNPL, credit commitments)

- Spending patterns (frequency, stability, and category-level trends)

- Indicators of financial pressure (overdraft use, late fees, gambling activity)

What it cannot reveal without explicit permission:

- Data from accounts the customer did not consent to

- Information outside the agreed scope or purpose

- Sensitive metadata that falls outside transaction-level insights

- Any behavioural scoring not justified by the requested service

The principle is simple: insights must come only from the Open Banking Data the user has consented to share, and the analysis must stay within the boundaries presented during the consent journey.

This protects customers, maintains regulatory compliance, and builds trust around how financial behaviour is being used.

Turning Open Banking Data into Behavioural Insights

| Behavioural signal from Open Banking Data | What it shows | Why it matters for credit decisions |

|---|---|---|

| Income patterns | Stability, frequency, and changes in salary, benefits, or gig income over time. | Reveals how dependable a customer’s inflows are and whether they can sustain repayments. |

| Spending priorities | Split between essential outflows (rent, bills) and discretionary spending. | Helps lenders see how much can be redirected to repayments without creating pressure. |

| BNPL activity | Repayment cycles, stacked instalments, and new BNPL commitments. | Surfaces hidden obligations that may not appear in traditional credit files. |

| Debt load | Recurring instalments and overall repayment behaviour on loans and credit. | Shows existing burden and repayment discipline before adding new credit. |

| Cash-flow stability | Month-to-month buffers, volatility, and end-of-month balance patterns. | Indicates resilience to shocks and ability to handle unexpected expenses. |

| Risk indicators | Overdraft reliance, gambling spikes, late-fee loops, and similar stress signals. | Highlights early signs of financial strain that increase default risk. |

Using Behavioural Insights Without Crossing Consent Lines

Even when behavioural patterns are available, lenders must stay within the exact permissions the customer agreed to.

The goal is simple: use insights responsibly, without overreaching.

How lenders stay compliant

- Collect only the Open Banking Data shown during the consent journey

- Analyse transactions strictly for the purpose stated (for example, affordability checks)

- Avoid deriving insights that go beyond what the customer was told

- Store and process data under purpose limitation and minimal-retention rules

- Keep consent screens clear so customers understand exactly what is being used

The outcome

Lenders get richer behavioural signals while maintaining transparency and customer trust. The process becomes accurate, compliant, and predictable without adding friction to onboarding.

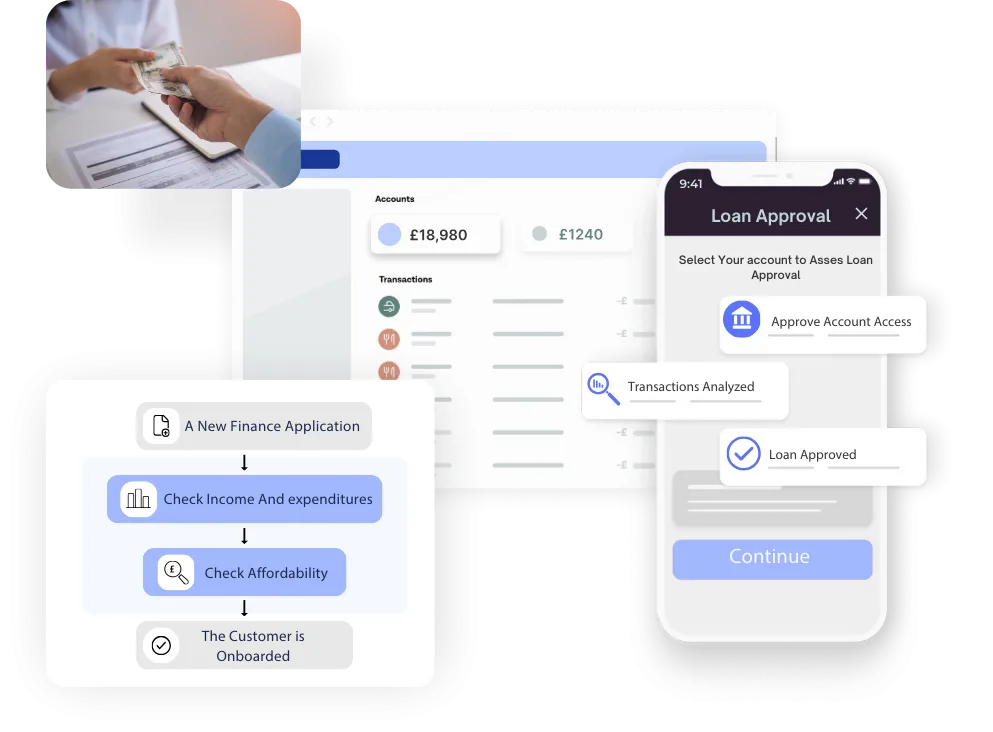

Finexer: High-Quality Open Banking Data for Behavioural Intelligence

Finexer gives lenders the strong data foundation needed to build accurate behavioural insights. Every transaction is delivered in a clean, consistent, consent-led format, making it easier for risk and underwriting teams to identify patterns, run models, and build their own decision logic with confidence.

What Finexer delivers

- Direct access to customer-approved Open Banking Data

- Up to seven years of historical transactions for long-term trend analysis

- Categorised transactions for clearer visibility of income, essentials, debt, BNPL, subscriptions, and discretionary spend

- Unlimited transaction fetch so affordability reviews are never based on partial data

- Coverage across 99 percent of UK banks

- A stable, uniform data structure that plugs smoothly into scoring models or internal analytics

- Clean labelling that reduces manual work and improves model accuracy

Why lenders choose Finexer

Finexer’s data layer helps risk teams build behavioural intelligence faster by providing:

- Consistent formatting across all UK banks

- Clear inflow and outflow patterns

- Structured categories that align with affordability and risk workflows

- High-quality data that integrates effortlessly with existing underwriting tools

With Finexer, lenders get the clarity and structure they need to build meaningful behavioural insights from Open Banking Data without complexity or data gaps.

Conclusion

Modern lending depends on understanding how customers manage money in real life, not just what their credit file says. Behavioural signals such as income stability, spending patterns, BNPL cycles, and emerging financial pressure are now essential to accurate underwriting.

Open Banking Data gives lenders access to these signals in a transparent, consent-led way. When structured properly, it becomes a powerful input for affordability checks, risk scoring, and customer assessment without adding friction to onboarding.

With Finexer providing clean, complete, and well-organised Open Banking Data, lenders have the foundation they need to build stronger behavioural models and make clearer lending decisions.

What makes Open Banking Data useful for behavioural analysis?

It shows real income flows, spending habits, recurring commitments, and financial pressure signals that are not visible in traditional credit files.

Can lenders build their own scoring models using Open Banking Data?

Yes. Lenders can use the transaction data to power internal affordability checks, behavioural models, and risk engines.

How does Open Banking Data improve underwriting accuracy?

It adds real-time visibility into financial behaviour, helping lenders identify stability, volatility, and repayment capacity more clearly.

Finexer gives your team categorised bank data built for UK lending, Speak with our team to see how it fits your underwriting workflow.