Payroll processing payments fail at the payment layer-not the calculation layer. Bank APIs solve this by connecting payroll platforms directly to employee bank accounts, enabling real-time salary payouts instead of 3-day BACS delays.

Your software calculates salaries correctly, generates payslips on time, yet payments still require manual bank file uploads, days-long clearing delays, and failed transfers discovered only after employees complain. The bottleneck isn’t logic-it’s how money actually moves from your platform to employee accounts.

Why Do Payroll Payments Fail in Most Platforms?

Payroll processing software handles calculations. Payment infrastructure moves money. When platforms rely on BACS files uploaded manually to banking portals, several operational issues emerge.

Payments queue for 3-working-day clearing cycles. Cut-off times force rigid payment schedules. Failed transfers surface days after submission when reconciliation reveals missing payments. Finance teams spend hours matching bank statements against payroll files.

The fundamental problem: batch file systems weren’t designed for platforms needing real-time confirmation and programmatic control.

What Do Modern Payroll Platforms Need for Payment Automation?

Payroll platforms competing on reliability need payment infrastructure that confirms settlement quickly, not days later.

Modern payroll processing services require:

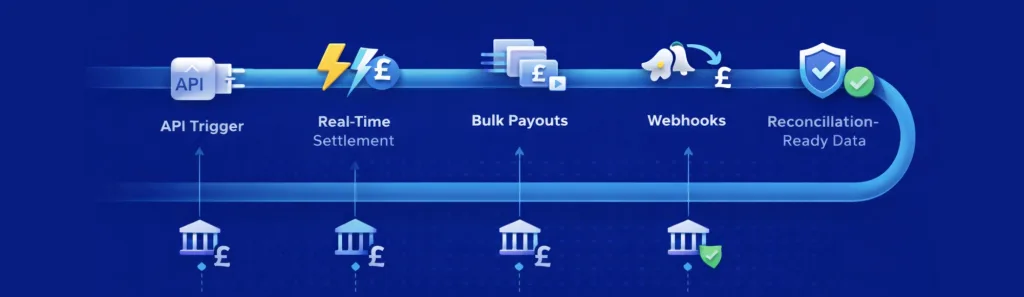

- API-triggered payouts instead of file uploads

- Real-time settlement confirmation

- Bulk payment handling for simultaneous employee payouts

- Webhook notifications when transfers complete

- Reconciliation-ready transaction data

This shifts payment operations from manual intervention to automated flows.

How Do Bank APIs Automate Payroll Processing Payments?

Payroll processing software generates payment files for manual upload in traditional systems. API-based infrastructure initiates payments programmatically.

The flow:

Platform triggers payout via API → Banking rails execute transfer → Confirmation returns to platform → Ledger updates automatically

This eliminates file generation, manual uploads, and delayed confirmations. Payments settle within minutes rather than days. Failures surface immediately with specific error codes enabling instant retry logic.

What Should Payroll Platforms Look for in Payment Infrastructure?

When assessing infrastructure for payroll processing services, prioritise these capabilities:

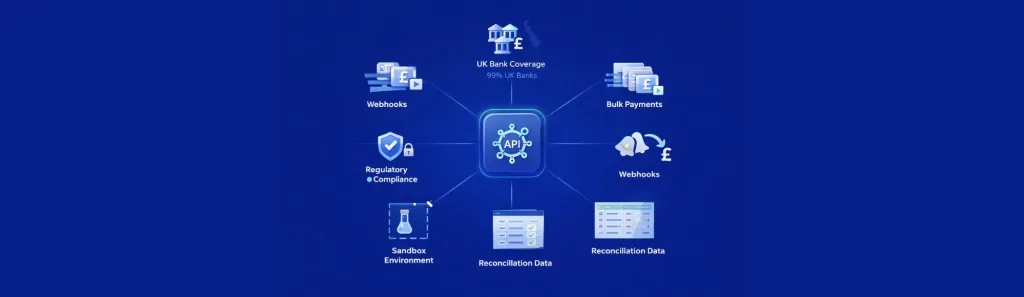

UK bank coverage – Connectivity to 99% of UK banks means employee accounts work regardless of bank choice

Bulk payment support – Simultaneous payout initiation for hundreds or thousands of employees without degraded performance

Webhook infrastructure – Asynchronous notifications informing platforms immediately when payments settle or fail

Reconciliation data – Transaction-level details enabling automatic ledger updates without manual matching

Sandbox environment – Testing infrastructure matching production behaviour before live deployment

Compliance matters equally. Infrastructure must operate using FCA-authorised open banking connectivity, ensuring payment data handling meets UK regulatory requirements.

How Does Finexer Enable Payroll Processing Payments?

Finexer provides payment infrastructure enabling payroll platforms to automate salary payouts:

- Open banking connectivity across 99% of UK banks

- API-based payment initiation for real-time settlement

- Webhook notifications for payment status

- Usage-based pricing aligned with transaction volume

The platform provides 3-5 weeks of onboarding assistance ensuring integration aligns with your payroll architecture.

Explore payroll payment infrastructure

Which Platforms Benefit from Automated Payroll Payments?

Payroll SaaS platforms – Embedded payment infrastructure eliminating manual bank file exports for customers

Gig economy platforms – Instant contractor payouts following completion milestones

Embedded payroll products – Payment capabilities added to existing business software without building banking relationships

Enterprise payroll systems – Bulk employee payments with automatic reconciliation reducing finance team workload

See payroll processing timeline considerations

What I Feel Like

After observing platforms implement payment infrastructure, the difference between successful and struggling implementations is clear.

Successful platforms treat payment infrastructure as invisible plumbing. They invest engineering capacity in payroll logic, employee experience, and business rules. Not in building file upload systems or managing banking relationships.

Struggling platforms try building everything themselves. They discover payment infrastructure requires ongoing maintenance, regulatory compliance, and operational expertise that diverts resources from their actual product.

Understand open banking for payroll

What is payroll processing payment?

The actual movement of salary funds from business to employee bank accounts, distinct from calculations or payslip generation.

How do you automate payroll processing payments?

Use bank APIs for programmatic payment initiation with real-time confirmation instead of manual file uploads with days-long clearing cycles.

Does payroll processing software work with all UK banks?

Yes, with 99% UK bank coverage through open banking infrastructure, virtually all employee accounts work regardless of bank.

What happens if a payroll payment fails?

You get immediate failure notification with error codes enabling instant retry logic rather than discovering issues during post-settlement reconciliation.

How long does it take to integrate payroll payment APIs?

Typically 3-5 weeks with dedicated onboarding assistance, though timelines vary based on architecture complexity.

Ready to Automate Payroll Payments?

See how Finexer powers payment infrastructure for platforms

Book Demo Now