Teams searching for financial data aggregation software aren’t looking for software. They’re looking for reliable infrastructure to access structured bank transaction data.

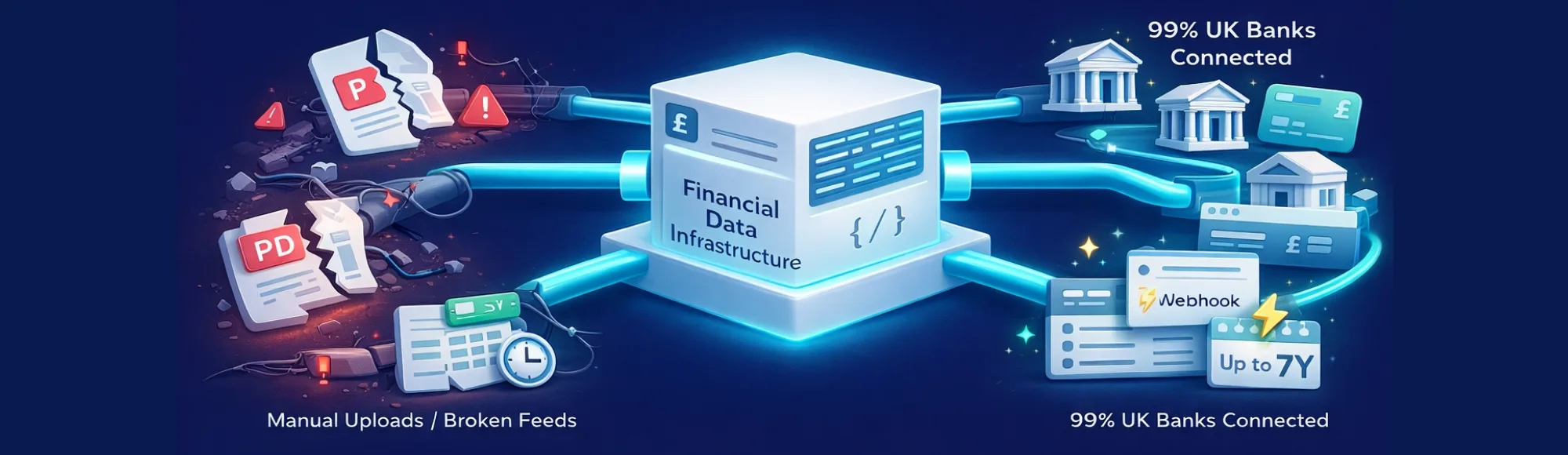

Your platform needs verified transaction data for verification, reconciliation, or risk monitoring. Users currently upload PDFs or export CSVs. Those workflows break constantly.

This article explains what it looks like in production, common implementation mistakes, and what to evaluate when choosing infrastructure.

When Do Platforms Need Financial Data Aggregation?

FDA appears across multiple workflows: income verification during onboarding, transaction reconciliation for accounting platforms, affordability checks for lending, risk monitoring for credit products, and payment timing optimisation.

These use cases require reliable access to structured bank transaction data that updates automatically.

What Does Financial Data Aggregation Look Like Inside Real Products?

It requires ongoing infrastructure, not one-time data pulls.

Users authorise read-only bank access via Open Banking. Platforms receive new transactions automatically via webhooks. Financial data aggregators normalise data formats across banks. Transaction data gets categorised and enriched. Structured data arrives via REST APIs.

This infrastructure supports account aggregation via Open Banking without requiring platforms to manage bank connections directly.

What We See in Practice

We work with platforms transitioning from manual processes to financial data aggregation(FDA).

PDF uploads that never work: Users upload wrong file formats. PDFs from different banks have inconsistent structures requiring manual data extraction.

Broken feeds: Screen-scraping providers break when bank websites change. Support tickets pile up.

Inconsistent formats: Transaction descriptions vary wildly. “TESCO STORES” vs “Tesco Extra” breaks categorisation logic.

These problems are standard for platforms without proper FDA infrastructure.

Common Mistakes Teams Make

Underestimating bank coverage: Supporting only major banks covers 40% of UK users. The other 60% bank elsewhere.

Building one-off integrations: Connecting to one bank’s API directly requires separate maintenance for each additional bank.

Ignoring data enrichment: Raw transaction data arrives unstructured and requires manual processing without enrichment.

Financial Data Aggregation vs Basic Account Aggregation

Account aggregation means accessing bank account data. FDA means accessing data reliably with structure and enrichment.

| Capability | Basic Account Aggregation | Financial Data Aggregation |

|---|---|---|

| Data Format | Raw transaction data | Enriched and categorised |

| Consistency | Varies by bank | Normalised across banks |

| Updates | Manual refresh | Webhook notifications |

| Historical Access | Limited or none | Up to 7 years (bank-dependent) |

| Production Ready | Heavy development needed | API-ready structured data |

Platforms building financial products need the latter.

What Should You Evaluate When Choosing FDA Infrastructure?

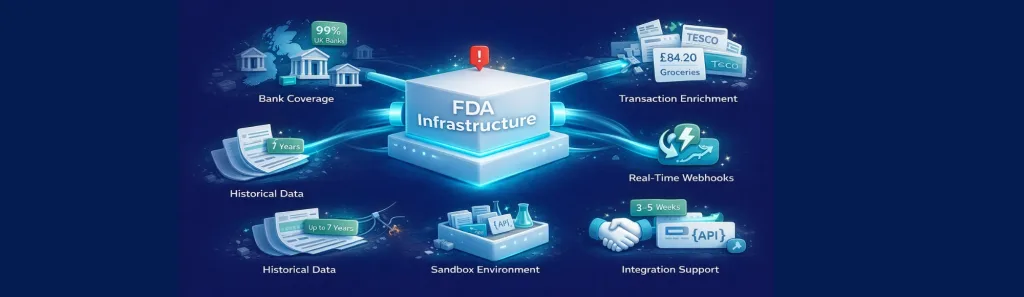

If your platform is evaluating financial data aggregation infrastructure, focus on these capabilities:

- UK bank coverage: 99% coverage including challengers and building societies

- Historical depth: Up to 7 years available (bank-dependent) for verification workflows

- Real-time updates: Webhook notifications when new transactions post

- Transaction enrichment: Pre-categorised with standardised merchant names

- Sandbox access: Realistic test environment before live connections

- Onboarding support: 3-5 weeks hands-on technical assistance during integration

How Does Finexer Support Financial Data Aggregation?

Finexer provides Open Banking connectivity using FCA-authorised infrastructure for platforms building financial products.

We handle bank connections across 99% of UK banks, transaction data retrieval and enrichment, historical data access (up to 7 years bank-dependent), REST API and webhook delivery, and regulatory compliance.

Your platform handles product features, verification logic, data storage, and business rules.

Integration typically takes 3-5 weeks with hands-on technical support from our team.

What I Feel About Financial Data Aggregation

It gets misunderstood frequently. Teams assume they need financial data aggregation software when they actually need infrastructure.

I’ve watched platforms spend months evaluating consumer-facing aggregation apps, only to realise those products don’t expose APIs. Or they evaluate FDA software vendors that want to own the end-user relationship.

Platform businesses need infrastructure they can build on top of. Not software that replaces their product.

When teams position it correctly-as infrastructure, not software-the evaluation becomes clearer. You’re choosing reliable Open Banking connectivity, not competing financial products.

What is financial data aggregation?

It is the process of accessing, normalising, and structuring bank transaction data from multiple accounts via APIs for production use.

What is the difference between account aggregation and financial data aggregation?

Account aggregation provides access to bank data. FDA adds normalisation, enrichment, ongoing updates, and production-ready infrastructure.

What should platforms look for in an API for bank transactions?

UK bank coverage, transaction enrichment, historical depth, webhook support, sandbox environment, and hands-on onboarding assistance.

How long does FDA integration take?

Typically 3-5 weeks with hands-on technical support during integration, though timelines vary based on platform architecture and specific use case requirements.

Does financial data aggregation work with challenger banks and building societies?

Yes, with 99% UK bank coverage including traditional banks, challenger banks, and building societies ensuring comprehensive user account compatibility.

Ready to Build on Reliable Financial Data Aggregation Infrastructure?

See how Finexer’s Open Banking APIs provide structured bank transaction data for your platform.

Book Demo Now