Stop Reviewing Payslips Manually

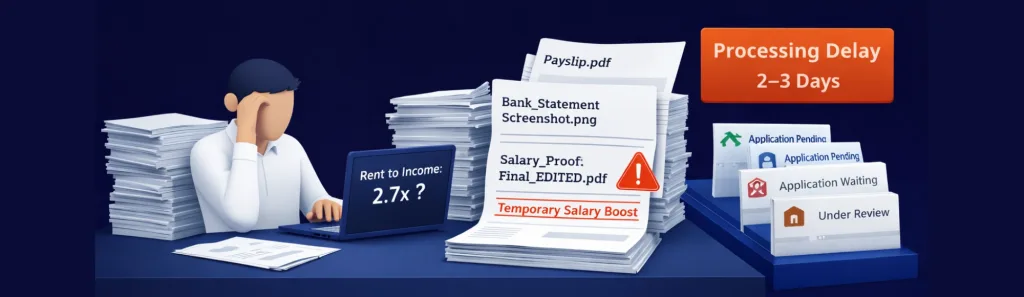

Rent affordability check processes still rely on documents tenants provide. Letting agents waste hours reviewing edited PDFs, screenshots of bank statements, and fake payslips. Manual rent-to-income calculations introduce delays, and relying on unverified documents creates fraud risk.

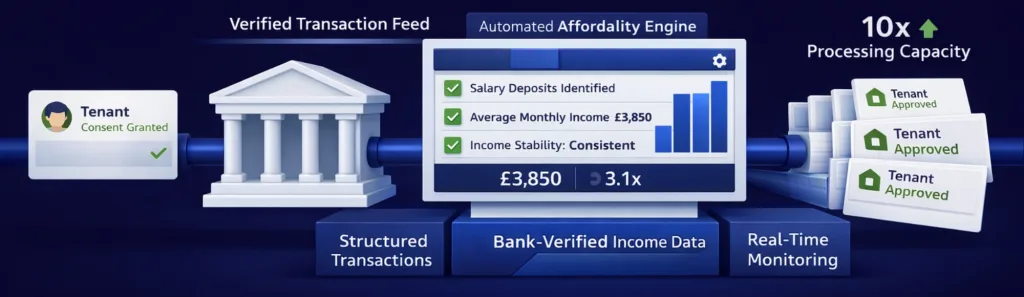

Bank-verified transaction data changes this. Through FCA-authorised Open Banking infrastructure, letting agents access real income data directly from UK banks.

After working with PropTech platforms and letting agents, we’ve seen the pattern. Teams spend 2–3 days processing each application, manually categorising income, and cross-checking statements. Tenant approval becomes a bottleneck because the data foundation is weak.

The Real Problem with Manual Rent Affordability Checks

Traditional affordability check rent workflows break under their own weight. Letting agents and PropTech platforms face:

- Tenants uploading edited PDF payslips

- Screenshots of bank statements missing crucial months

- Fake salary deposits created temporarily

- Manual rent-to-income calculations prone to error

- 2–3 day processing delays per application

- Human review bottlenecks at scale

For platforms handling hundreds of applications monthly, this creates operational chaos. Manual verification teams can’t scale. Fraud slips through. Landlords wait days for approval decisions.

Most rent affordability check solutions still rely on documents tenants self-submit – not verified bank data.

What a Modern Rent Affordability Check Actually Requires

Bank-verified income checks operate differently from document review. A real affordability check rent workflow needs infrastructure that provides:

- Direct bank account access (with tenant consent)

- Automated salary deposit identification

- Average monthly income calculation from real transactions

- Ongoing transaction visibility for monitoring

- Structured transaction feeds for integration

- Historical data up to 7 years (bank-dependent)

The critical difference is verification. Income data comes directly from the bank. No tenant editing, no PDF manipulation, no questions about authenticity during landlord review.

For letting agents and PropTech platforms, tenant approval speeds up dramatically. Instead of requesting payslips and waiting, you request consent and receive verified income data immediately.

Why Manual Affordability Check Rent Processes Fail at Scale

Scaling manual rent affordability check processes creates compound problems:

High fraud risk: Payslips edited in basic software pass visual inspection but contain false income figures.

Human review bottlenecks: Each application requires 30–60 minutes of manual verification work. Scaling requires hiring more staff.

Inconsistent income categorisation: One team member identifies salary deposits differently than another. Audit trails become unreliable.

Delayed landlord approvals: Waiting 2–3 days for verification creates tenant drop-off. Properties sit vacant longer.

Mixed transaction complexity: Tenants with freelance income, multiple jobs, or business accounts require manual interpretation. Processing time doubles.

These problems don’t improve with volume. They get worse.

What We See in Practice

After working with UK PropTech platforms and letting agents running Open Banking for renting workflows, patterns are clear:

Payslips edited in basic software showing inflated salaries. Bank statements with missing months. Income temporarily inflated before application. Mixed personal and business transactions requiring manual sorting. Manual verification teams overwhelmed by application volume.

Platforms implementing tenant background verification tools without verified bank data still face these operational issues. The front-end interface looks modern, but the data layer relies on documents.

This is where infrastructure matters more than features.

How Bank-Verified Data Changes Rent Affordability Checks

Bank-verified transaction data transforms rent affordability check operations:

Consent-based Open Banking access: Tenants authorise direct bank connection. No document uploads required.

Direct retrieval of salary deposits: System identifies regular income deposits automatically from transaction feeds.

Structured transaction categorisation: Transactions arrive pre-categorised with merchant data enrichment.

Automated rent-to-income logic: Calculate affordability ratios using real monthly income averages, not stated figures.

Ongoing verification capability: Monitor income changes over tenancy period for portfolio risk management.

For PropTech and real estate platforms, this changes what’s operationally possible. One team can process 10x the application volume because verification is automated.

Where Finexer Fits

Finexer provides the bank data layer enabling rent affordability checks. We don’t decide tenant approval or calculate affordability ratios. We provide verified financial data that letting agents and PropTech platforms use to build stronger verification workflows.

This distinction matters for technical teams evaluating infrastructure:

99% UK bank coverage: Access transactions from nearly all UK financial institutions through single integration.

Historical transaction data: Retrieve up to 7 years of transaction history (bank-dependent) for comprehensive income verification.

Webhooks for updates: Receive real-time notifications when new transactions are available or consent status changes.

FCA-authorised infrastructure: Regulated Open Banking provider ensuring compliance with UK financial regulations.

3–5 weeks onboarding support: Integration assistance from technical team during implementation period.

Understanding Open Banking for PropTech helps platforms see how verified data infrastructure fits within broader tenant verification workflows.

You need infrastructure that delivers clean, verified transaction data without overcommitting on approval decisions.

Common Mistakes PropTech Platforms Make

| Mistake | Why It Fails | Better Approach |

|---|---|---|

| Accepting PDF uploads | High fraud risk, no verification | Consent-based bank data access |

| One-time income check | No ongoing monitoring capability | Continuous transaction feeds |

| Manual income calculation | Slow processing, human error | Automated salary deposit detection |

| Limited bank coverage | Tenant drop-off, poor UX | 99% UK bank coverage |

The shift to verified data doesn’t mean abandoning existing rent affordability check tools. It means strengthening the data foundation beneath them.

What I Feel About Tenant Verification Infrastructure

Tenant verification is breaking under manual workflows. PropTech platforms spend thousands on front-end UX while ignoring the data quality problem underneath.

Infrastructure matters more than interface design. A sophisticated tenant portal running on unverified PDFs creates false confidence. Simpler workflows built on bank-verified income data provide stronger fraud protection.

The UK rental market is moving towards real-time financial verification. Platforms building affordability check rent processes on verified data infrastructure now will have significant advantage when regulatory expectations increase.

Who This Infrastructure Serves

Bank-verified rent affordability check infrastructure works for:

- Letting agents processing tenant applications at scale

- PropTech platforms offering tenant referencing services

- Landlord SaaS platforms managing portfolio risk

- Property management companies requiring income verification

- Tenant referencing providers modernising verification workflows

Not suitable for:

- Individual landlords doing manual one-off checks

- Platforms serving markets outside UK

- Applications requiring instant approval without consent flow

Implementation Considerations

When evaluating infrastructure for rent affordability check automation, platforms should ask:

- Does the provider hold FCA authorisation for Open Banking?

- What percentage of UK banks can tenants connect?

- How far back does historical transaction data reach?

- How are salary deposits identified and categorised?

- What webhook events are available for workflow automation?

- What ongoing technical support is provided during integration?

Finexer covers 99% of UK banks, provides usage-based pricing, and typically deploys 2–3 times faster than alternative infrastructure options. Integration support runs 3–5 weeks depending on your existing verification systems.

The technology works. The question is whether your platform is ready to shift from document collection to data infrastructure.

What is a rent affordability check?

A rent affordability check verifies whether a tenant’s income is sufficient to afford monthly rent payments, typically requiring income to be 2.5-3x the monthly rent amount under UK letting standards.

How do you verify income for affordability check rent?

Modern affordability check rent processes use Open Banking to access bank-verified transaction data directly, identifying salary deposits and calculating average monthly income without relying on tenant-uploaded documents.

Can rent affordability checks use bank data?

Yes, rent affordability check systems integrated with Open Banking infrastructure can access verified transaction data directly from UK banks with tenant consent, eliminating reliance on payslips or screenshots.

How long does a rent affordability check take?

Traditional manual rent affordability check processes take 2–3 days. Bank-verified systems using Open Banking infrastructure complete income verification within minutes once tenant provides consent.

Do letting agents need tenant consent for bank data?

Yes, all affordability check rent processes using Open Banking require explicit tenant consent before accessing bank transaction data, ensuring compliance with UK data protection and financial regulations.

Upgrade Your Rent Affordability Checks Today

Connect with UK banks instantly. See why PropTech platforms trust Finexer for secure, compliant, and verified tenant income data.

Book Demo Now