Table of Contents

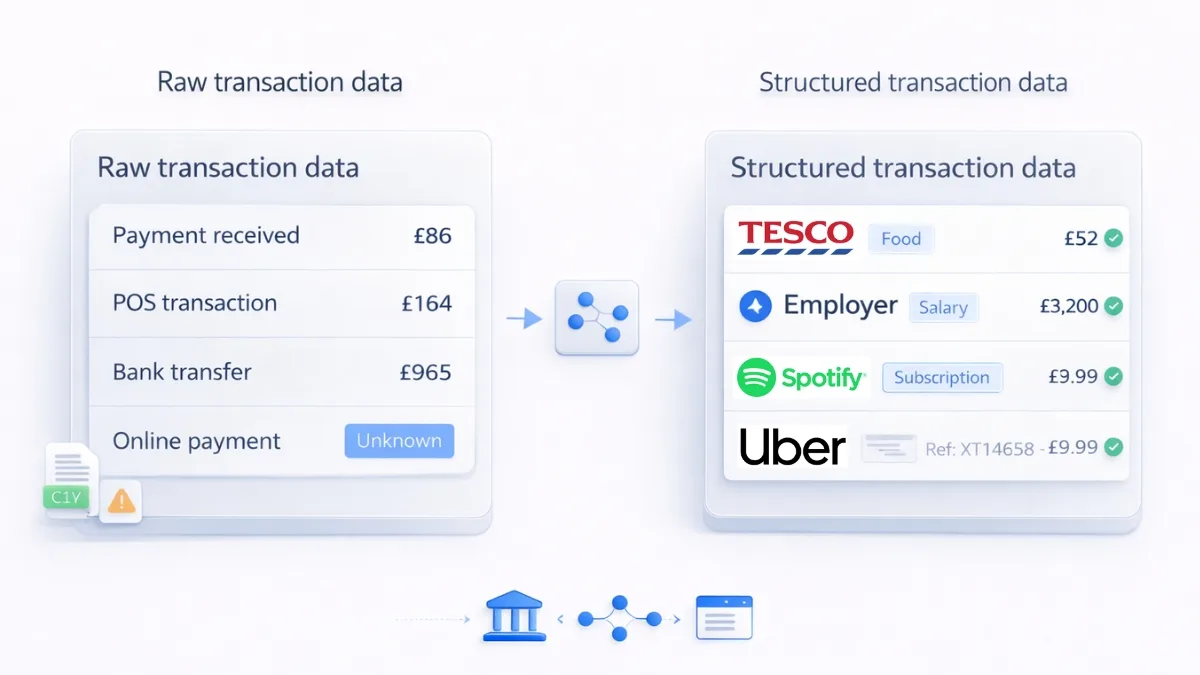

UK platforms building financial features cannot automate workflows when transaction data arrives unclear and unstructured. Accounting software, lending platforms, and fintech products need data enrichment API access providing merchant details, transaction categories, and structured information without manual processing.

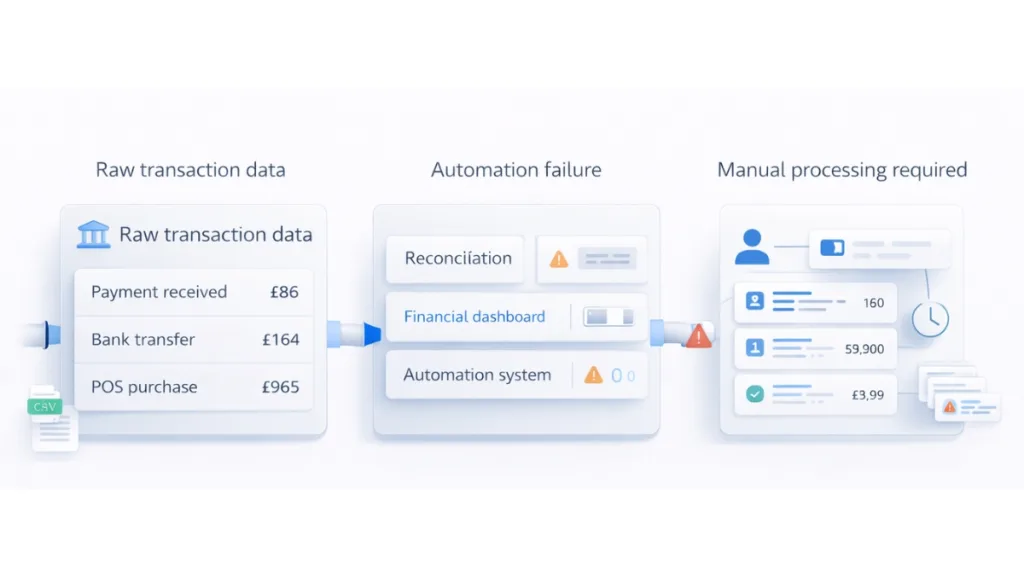

Raw transaction descriptions prevent automation. Teams categorise transactions manually. Financial dashboards show incomplete information. Reconciliation workflows require operational overhead that prevents scaling when transaction volumes grow.

This blog explains how platforms use data enrichment API infrastructure to retrieve structured bank transaction data, what capabilities eliminate manual categorisation, and how reliable connectivity enables financial automation that manual processes cannot support.

Key Takeaways

What problem does this solve?

Platforms cannot automate financial workflows when raw transaction data lacks structure and requires manual categorisation.

Why does infrastructure matter?

Manual enrichment prevents scaling. Data enrichment API access provides structured transaction information enabling automated workflows without operational overhead.

What breaks without proper infrastructure?

Reconciliation requires manual work. Financial dashboards show unclear data. Engineering teams build internal enrichment systems. Automation becomes unreliable.

What should platforms evaluate before integration?

Transaction data completeness, merchant identification accuracy, data enrichment API reliability, UK bank coverage, historical data access, enrichment consistency.

Where does Finexer fit operationally?

Finexer provides bank transaction infrastructure. Platforms retrieve structured data through data enrichment API integration. Platforms build financial automation, reconciliation, and analysis features on top.

Why do platforms need data enrichment API infrastructure?

Accounting platforms cannot automate reconciliation when transaction descriptions are unclear. Users expect automatic categorisation that matches expenses to correct accounts. Manual processing creates operational delays that damage user experience.

Accounting platforms require:

- Structured transaction data for automated categorisation

- Merchant information enabling accurate expense classification

- Consistent data format supporting reconciliation logic

- Historical transaction access for past period matching

Lending platforms depend on:

- Cash flow analysis using structured transaction information

- Financial behaviour patterns from enriched transaction data

- Verified transaction details for underwriting decisions

- Complete financial visibility for risk assessment

Fintech platforms building features need:

- Transaction insights for financial dashboard creation

- Structured data enabling spending analysis

- Merchant identification for category-based reporting

- Integration-ready information reducing development time

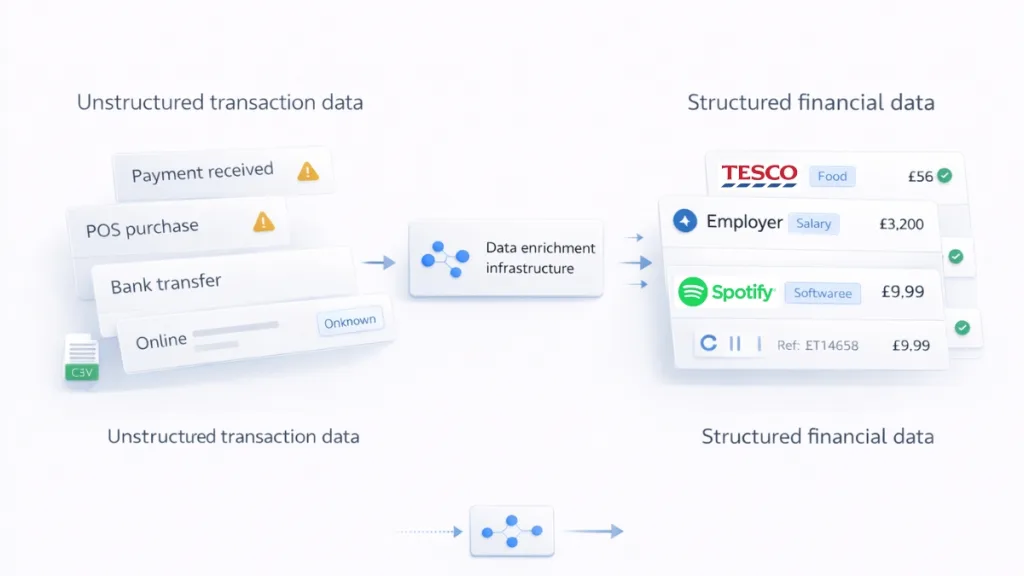

Raw transaction descriptions vary significantly by bank. Generic labels like “Payment received” or “POS purchase” lack detail needed for automation. Manual categorisation becomes necessary when transaction data needs operational intervention to become useful.

Who needs transaction enrichment infrastructure?

Cloud accounting SaaS platforms process client transactions requiring automatic categorisation. Finance teams cannot review descriptions manually at scale. Structured transaction data through data enrichment API enables automated expense classification.

Bookkeeping platforms handle small business transactions where merchant identification improves accuracy. Manual categorisation prevents scaling when client numbers grow. Enriched data provides reliable information supporting automated workflows.

Business lending platforms analyse cash flow patterns using transaction details. Underwriting decisions depend on spending behaviour visibility. Data enrichment API access enables comprehensive financial assessment without manual review.

Personal finance apps display spending insights requiring transaction categorisation. Users expect automatic merchant identification and category assignment. Infrastructure providing enriched information supports dashboard features without internal development.

Payroll SaaS platforms identify salary payments from transaction streams. Automated detection requires structured data showing payment types. Enriched transaction information enables reliable payroll tracking without manual classification.

What happens when transaction data lacks structure?

Reconciliation workflows break when unclear descriptions prevent automatic matching. Finance teams spend hours categorising transactions manually. Month-end close extends while staff process transaction data that automated systems cannot interpret.

Financial dashboards show incomplete information when transaction details are missing. Users see generic descriptions instead of meaningful merchant names. Product value decreases when insights depend on data clarity that raw feeds cannot provide.

Engineering costs increase when teams build internal enrichment systems. Maintaining categorisation logic across different banks requires ongoing development effort. Product roadmaps slow when resources focus on infrastructure rather than features.

Operational scaling becomes impossible when manual categorisation prevents volume growth. Hiring additional staff increases costs faster than revenue. Platforms cannot compete against alternatives offering automated transaction processing through data enrichment API integration.

Automation reliability suffers when unstructured data creates processing errors. Reconciliation logic fails on unclear descriptions. Exception handling becomes necessary for transactions that structured data would process automatically.

What infrastructure enables transaction enrichment?

Platforms need secure bank transaction access providing enriched financial data. Each platform user authenticates accounts once through banking apps. Platforms retrieve structured information automatically without managing enrichment complexity internally through data enrichment API.

Transaction enrichment requirements:

- Merchant names and business identification

- Transaction categories and spending classifications

- Payment types and transaction characteristics

- Consistent data format across different banks

Data structure needs for automation:

- Standardised fields enabling unified processing logic

- Reliable categorisation supporting reconciliation workflows

- Complete merchant details improving analysis accuracy

- Historical consistency maintaining data quality over time

API integration capabilities:

- REST endpoints providing structured transaction data

- Webhook notifications for real-time transaction updates

- Batch retrieval supporting historical data access

- Consistent response format simplifying platform integration

Consent management must be automated. Platforms cannot ask users to re-authenticate repeatedly without destroying experience. Permission tracking needs visibility into expiry dates with proactive renewal.

How does Finexer enable transaction data enrichment?

Finexer provides FCA-authorised infrastructure enabling platforms to retrieve structured bank transaction data through open banking data enrichment API.

Key capabilities:

- 99% UK bank coverage

- FCA-authorised infrastructure

- Real-time webhooks

- Up to 7 years historical data

- Usage-based pricing

- White-label ready

- 2-3x faster integration

- 3-5 weeks onboarding support

- Saves up to 90% on transaction costs

Platforms integrate data enrichment API through REST endpoints. Users authenticate accounts via secure open banking flows. Platforms receive enriched transaction information in consistent JSON format.

Transaction data includes structured fields providing merchant identification, transaction categories, and payment details. Platforms write processing logic once and apply across all UK banking institutions using data enrichment API infrastructure.

Real-time webhooks notify platforms when new transactions occur. Enriched data arrives immediately. Transaction feeds continue automatically supporting continuous financial workflows.

Consent lifecycle management is automated with clear permission tracking. Users receive notifications before access expires. Re-authentication happens smoothly without disrupting data retrieval through data enrichment API.

Historical transaction access extends up to seven years depending on bank support. Platforms retrieve complete enriched history enabling comprehensive financial analysis without manual processing.

For platforms requiring enriched transaction data, reliable infrastructure removes categorisation bottlenecks.

Data enrichment infrastructure evaluation checklist

| Evaluation Criteria | Why It Matters | What to Look For |

|---|---|---|

| Merchant identification | Generic descriptions prevent accurate categorisation | Consistent merchant names and business details |

| Category accuracy | Incorrect classifications create reconciliation errors | Reliable transaction categorisation logic |

| Data consistency | Format variations require custom processing per bank | Standardised structure across all institutions |

| UK bank coverage | Users cannot access enriched data from unsupported accounts | 99% coverage including challengers and building societies |

| Historical enrichment | Past transactions need same quality as current data | Consistent enrichment depth across time periods |

| API reliability | Enrichment failures disrupt financial workflows | Proven uptime metrics with real-time monitoring |

Platforms building transaction enrichment features should confirm data enrichment API infrastructure supports automation requirements.

What we see in practice

Most platforms underestimate the engineering cost of building internal transaction enrichment systems. Initial manual categorisation appears manageable but scaling becomes impossible when transaction volumes grow.

Merchant identification quality determines automation success. Platforms receiving generic descriptions cannot categorise accurately. Manual intervention becomes necessary when enrichment data lacks sufficient detail.

Category consistency affects reconciliation accuracy across different banks. Platforms must maintain separate logic when enrichment quality varies by institution. Unified processing becomes possible only with standardised data.

Engineering teams discover maintenance burden after initial data enrichment API integration. Banks change transaction formats without notice. Enrichment systems require constant updates when built internally rather than consumed as infrastructure.

For platforms requiring SME transaction enrichment, reliable connectivity determines feature quality.

Common use cases

Accounting platforms:

- Retrieve enriched transaction data for automated expense categorisation

- Access merchant information enabling accurate account classification

- Use structured data supporting reconciliation workflows

- Build financial reporting using consistent transaction categories

Lending platforms:

- Analyse cash flow patterns using enriched transaction details

- Assess financial behaviour from structured spending data

- Retrieve complete transaction history for underwriting decisions

- Enable risk profiling using merchant and category information

Fintech platforms:

- Build financial dashboards using enriched transaction data

- Display spending insights with merchant identification

- Create category-based financial analysis features

- Enable budgeting tools using structured transaction information

Payroll platforms:

- Identify salary payments using enriched transaction data

- Track payroll deposits with structured payment information

- Automate reconciliation using enriched transaction details

- Build reporting features using consistent data format

LawTech platforms:

- Verify financial activity using enriched transaction history

- Support compliance workflows with structured financial data

- Enable source-of-funds verification using detailed transaction information

- Build audit trails using consistent enriched data

What is a data enrichment API?

A data enrichment API provides platforms with structured bank transaction data including merchant details, categories, and payment information. Platforms retrieve enriched data through secure APIs rather than processing raw descriptions manually.

What is transaction enrichment for platforms?

Transaction enrichment adds structure to raw bank transaction data. Platforms receive merchant names, spending categories, and payment details enabling automated financial workflows without manual categorisation.

Why do platforms need data enrichment API access?

Raw transaction descriptions prevent automation. Platforms need structured data enabling reconciliation, financial analysis, and dashboard features without operational overhead processing unclear information.

How does data enrichment API work?

Platforms integrate data enrichment API infrastructure retrieving bank transaction data through open banking. Infrastructure provides enriched information with merchant identification and categories rather than generic descriptions.

Can platforms build enrichment infrastructure internally?

Platforms can build features and analysis, but maintaining data enrichment API across UK banks requires ongoing engineering effort. Most platforms use infrastructure providers rather than building internal systems.

Access structured transaction data with reliable data enrichment API infrastructure and comprehensive UK bank coverage.