Most SaaS and fintech platforms don’t struggle with the concept of getting bank data. They struggle with unreliable connections, broken refreshes, manual statement uploads, and poor transaction structure.

An AIS API solves these problems by providing regulated infrastructure to access bank account data consistently. This article explains when platforms actually need an account information service API, what AISP Open Banking infrastructure must deliver, and what to look for when evaluating account information service providers.

When Do Platforms Actually Need an AIS API?

Platforms integrate an account information service API when building: embedded finance features, automated income verification, account aggregation, transaction reconciliation, or affordability checks for lending and credit products.

These workflows require structured access to bank account data that updates reliably without manual intervention.

What Must an AIS API Deliver in Practice?

Consent-based access: Users authorise read-only bank access via AISP Open Banking without sharing credentials.

Multi-bank connectivity: 99% UK bank support means users don’t encounter “bank not supported” errors.

Normalised data: Production-grade AIS APIs deliver standardised transaction formats regardless of bank.

Enrichment: Merchant names get standardised, transactions get categorised, saving months of development time.

Historical access: Verification needs 3-6 months minimum. Some banks provide up to 7 years (bank-dependent).

Real-time updates: Webhook-based AIS APIs provide real-time bank data when transactions post.

Without normalisation, categorisation logic breaks across banks. Without webhooks, financial snapshots lag behind reality.

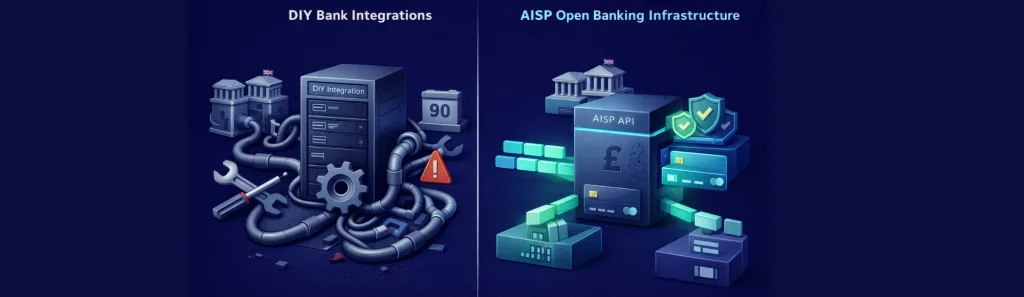

Account Information Service Providers vs DIY Bank Integrations

Direct bank integrations don’t scale. Each UK bank has different API implementations. Maintaining 50+ bank connections requires dedicated engineering effort.

Account information service providers handle bank connections, regulatory requirements, and API differences through AISP Open Banking infrastructure. This abstraction lets platforms focus on features, not infrastructure maintenance.

The maintenance burden of DIY integrations exceeds API costs within months.

Bank Account Aggregation API as a Product Primitive

Platforms use bank account aggregation APIs to power unified customer profiles, real-time financial snapshots, and embedded verification workflows.

Aggregation isn’t the product. It’s primitive. The bank account aggregation API delivers data. Your platform delivers the experience and business logic.

What We See in Practice

Reconciliation is harder than connection: Connecting to banks is easy. Matching transactions across different formats is hard.

Reliability trumps speed: An AIS API that fails 5% of the time creates more problems than one that’s slightly slower but reliable.

Consent UX affects conversion: Clunky bank authorisation flows damage trust and drop onboarding conversion rates.

Common Mistakes Teams Make

Choosing based on coverage slides: Every provider claims comprehensive coverage. Reliability per bank matters more than checkbox completeness.

Ignoring consent UX: Generic redirects damage conversion. White-label flows maintain product continuity.

Over-engineering early: Build for your first use case before architecting for hypothetical features.

What Should You Look For in an account information service API Provider?

- UK bank coverage: 99% including challengers

- Historical depth: Up to 7 years (bank-dependent)

- White-label consent: Maintains brand continuity

- Sandbox access: Test before production

- Onboarding support: 3-5 weeks hands-on vs 3-6 months self-service

- Usage-based pricing: No large upfront commitments

Operational reliability matters more than technical specs.

Where Does Finexer Fit?

Finexer provides AISP Open Banking connectivity infrastructure using FCA-authorised infrastructure for UK platforms.

We connect to 99% of UK banks. Integration takes 3-5 weeks with hands-on support. Pricing is usage-based without large upfront commitments. Sandbox APIs available for testing.

Platforms use Finexer’s AIS API to build income verification, reconciliation, affordability checks, and account aggregation features.

What I Feel About AIS APIs

account information service APIs have become infrastructure-level decisions for platforms building financial features. But most evaluation processes treat them like feature purchases.

I’ve watched platforms spend months comparing coverage charts and pricing spreadsheets, only to discover the real differences emerge during integration. Does the provider’s consent flow feel native to your product? Can you get webhook responses when you need them? Does categorisation actually work across your user base?

The technical specifications matter less than operational fit. An AIS API is infrastructure you build on for years. Choose based on reliability, not marketing collateral.

What is an AIS API?

An AIS API is an Account Information Service interface that provides programmatic access to bank account data via AISP Open Banking with user consent.

What do account information service providers do?

Account information service providers handle bank connections, regulatory compliance, and data normalisation so platforms can access structured bank data via APIs.

What is AISP in Open Banking?

AISP (Account Information Service Provider) is an FCA-authorised entity that can access bank account data on behalf of users through Open Banking APIs.

How does a bank account aggregation API work?

A bank account aggregation API connects to multiple banks via AISP Open Banking, retrieves transaction data with user consent, normalises formats, and delivers structured data via REST endpoints.

How long does AIS API integration take?

Most platforms complete AIS API integration in 3-5 weeks with hands-on technical support, including sandbox testing and production deployment.

Ready to Build with Reliable Bank Data Access?

See how Finexer’s AIS API provides Open Banking connectivity infrastructure for UK platforms.

Book Demo Now