Many creditworthy people still get rejected for loans because they don’t have a long borrowing history. Traditional credit scoring models rely heavily on credit cards, loans, and mortgages, which leaves out freelancers, gig workers, recent graduates, and even small business owners who manage their money well but don’t have a standard credit file.

This gap is now being filled with alternative credit scoring methods.

Lenders are starting to use other types of data from bank transactions and rent payments to behavioural patterns and employment history to make more informed decisions. These approaches provide a clearer picture of financial health and open up access to credit for people who’ve long been underserved by the system.

In this blog, we’ll look at six practical alternative scoring methods lenders are using in 2025, and how they’re being applied in real-world lending decisions.

Keep reading or jump to the section you were looking for:

1. Open Banking-Based Scoring

What It Measures

Income patterns, cashflow, spending behaviour, recurring payments, and account balances directly from the user’s bank account.

How It Works

With consent, lenders connect to an applicant’s bank account via an Open Banking API. They receive real-time transaction data, including salary deposits, rent payments, and daily spending. Some APIs also enrich this data by categorising expenses, flagging risk signals (like frequent overdrafts), or summarising disposable income.

This gives lenders a detailed financial snapshot without needing a traditional credit report.

Best For

- Applicants without a credit history

- Freelancers and self-employed individuals

- Small business owners

- Thin-file borrowers and new-to-credit users

Pros

- Real-time data, not outdated credit reports

- Provides a clearer view of current financial health

- Improves access for creditworthy but unscored users

- Can be used to verify affordability and income in minutes

Limitations

- Requires user permission and API access

- Interpretation varies by lender’s risk model

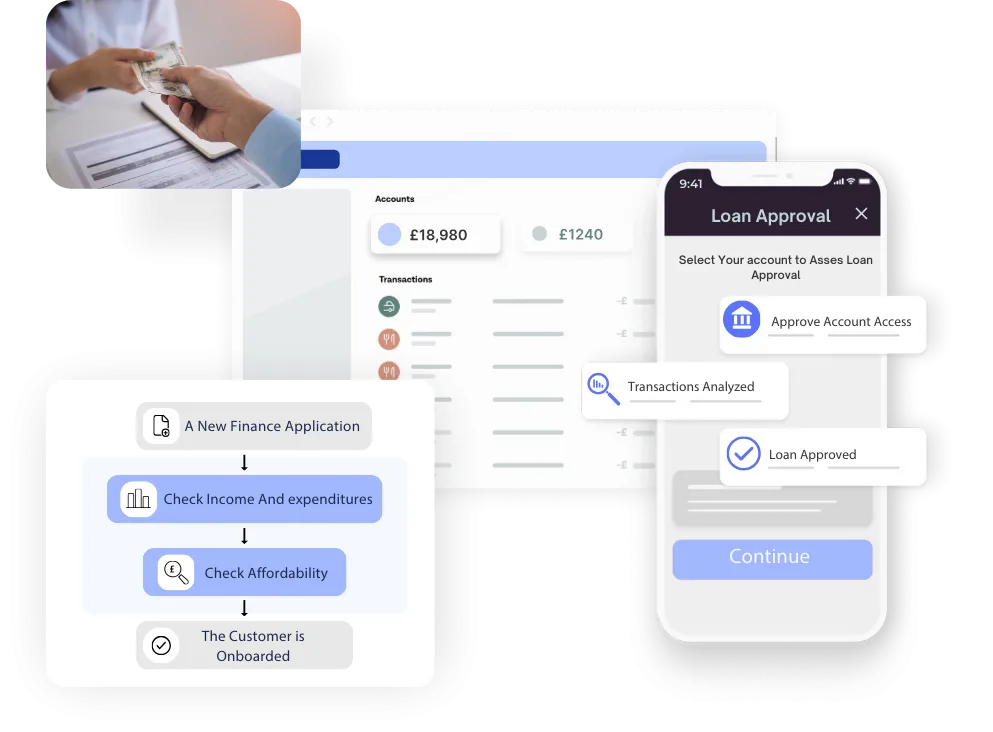

How Finexer Supports Credit Scoring and Lending Workflows

Lenders using Open Banking don’t just need raw data; they need it categorised, verified, and ready for decision-making. Finexer delivers exactly that:

- Affordability & Income Check

Assess a borrower’s real-time income, cash flow, and obligations instantly with no paperwork or credit file dependency. - Instant Identity & Bank Verification

Confirm account ownership and identity in seconds to reduce fraud and stay compliant with KYC/AML requirements. - Real-Time Credit Risk Insights

Go beyond bureau scores by analysing spending habits, financial stability, and key risk signals within transaction data. - Instant Payouts and Repayments

Send and receive funds via Open Banking APIs with verified accounts, supporting fast disbursement and better repayment tracking. - Automated Onboarding

Let borrowers connect their bank in just a few clicks. Finexer pulls verified financial data instantly, reducing drop-offs and delays. - Recurring Payment Setup

Easily establish flexible, recurring repayment plans that match borrower income patterns, improving collection rates.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try Now2. Rent & Utility Payment History

What It Measures

Timely payments of recurring household expenses such as rent, electricity, water, internet, and council tax.

How It Works

Some lenders now factor in an applicant’s history of paying essential bills on time. Data is sourced from rent payment platforms, utility providers, or credit reference agencies that track these records. While not traditionally included in a credit report, consistent bill payments can indicate financial responsibility, especially for people with no loans or credit cards.

This method supports creditworthiness assessment using real-life spending behaviour.

Best For

- Tenants with no mortgage or credit history

- Young adults or students starting financial independence

- Low-income applicants with regular payment history

- Immigrants or new residents without UK credit files

Pros

- Adds useful data for thin-file applicants

- Recognises real-world financial responsibility

- Encourages timely rent and utility payments

- Often integrates into credit bureau data (e.g., Experian Boost)

Limitations

- Not all providers report to credit agencies

- Payment delays may be due to disputes or billing errors

- Inconsistent access to data across providers

Example

Experian Boost allows UK consumers to add rent, council tax, and utility payments to their credit profile, which can increase their score with certain lenders. It’s part of a broader shift toward non-traditional credit scoring methods that reflect how people actually manage their money.

3. Employment and Income Verification Data

What It Measures

Job stability, income frequency, salary level, and employment status either through employer records, payroll systems, or government data.

How It Works

Instead of relying solely on past credit usage, lenders can assess an applicant’s income and work history directly. This is done using APIs that connect to payroll platforms, HR software, or employment databases. Some systems also detect multiple income streams or contract-based work, which is especially useful for freelancers and gig workers.

By combining this with other credit scoring methods, lenders can better understand an applicant’s capacity to repay.

Best For

- Salaried employees with consistent pay

- Gig workers with verified platform income

- Self-employed professionals using digital payroll

- Applicants with low or no traditional credit score

Pros

- Confirms income from a verified source

- Detects job changes, gaps, or contract instability

- Helps lenders verify affordability in real time

- Useful in pre-approval checks and ongoing monitoring

Limitations

- May exclude informal or cash-based income

- Not all employers or platforms share employment data

- Data freshness and access vary by source

Example

APIs like Argyle and Credfin offer real-time employment verification by linking directly to payroll systems or contractor platforms. These tools are increasingly used alongside alternative credit scoring models to strengthen risk assessments without depending on credit bureaus alone.

4. Behavioural and Device-Based Scoring

What It Measures

User behaviour during the application process, such as typing speed, device consistency, time on page, and interaction patterns.

How It Works

This method uses behavioural analytics and device data to flag suspicious activity or support identity and intent verification. Lenders monitor how applicants interact with their platform for example, whether someone types in their details carefully or copies and pastes quickly, switches devices mid-application, or browses terms before applying.

This can be combined with other non-traditional credit scoring inputs to strengthen fraud checks and build additional confidence in the applicant’s intent.

Best For

- Digital lenders operating entirely online

- High-volume, low-ticket lenders needing fast verification

- Credit platforms looking to reduce fraud risk during onboarding

Pros

- Helps detect fraud or bot activity in real time

- Offers additional data points when credit history is unclear

- Can be used alongside financial or identity data

- Works passively in the background

Limitations

- Behavioural signals alone can’t determine creditworthiness

- May introduce false negatives for genuine users with unusual devices

- Data interpretation varies across providers

Example

Lenders using behavioural scoring platforms like Innovis or device intelligence tools like SEON often combine these insights with Open Banking or employment data. This layered approach supports more flexible credit risk assessment without adding friction to the customer journey.

5. Social and Alternative Digital Data

What It Measures

Digital presence, professional profiles, network strength, transaction history on marketplaces, and online financial activity.

How It Works

Some alternative credit scoring models incorporate data from public digital sources such as LinkedIn, e-commerce profiles, freelance platforms, or even mobile usage patterns. The idea is to use signals like verified employment on social networks, seller ratings, or customer reviews to build a picture of reliability and stability.

This method is still considered experimental in regulated lending, but it’s gaining interest, especially in microcredit and emerging markets.

Best For

- Freelancers and gig workers on digital platforms

- Marketplace sellers (e.g., eBay, Etsy, Fiverr)

- Applicants in countries or regions with limited formal credit systems

Pros

- Offers additional context in the absence of financial history

- Can be useful for early-stage credit offers or pre-qualification

- Supports a more inclusive view of economic participation

Limitations

- Regulatory concerns around data privacy and consent

- Difficult to standardise across regions or platforms

- Lower adoption in formal lending due to lack of validation frameworks

Example

Some digital lenders use profile verification and transaction data from freelance marketplaces to support alternative credit scoring for borrowers without traditional employment or credit records. This method works best when layered with bank transaction data or income verification.

6. Psychometric Scoring

What It Measures

Cognitive traits, decision-making patterns, risk tolerance, consistency, and reliability are often assessed through questionnaires or in-app interactions.

How It Works

Psychometric credit scoring uses a short quiz or digital assessment to evaluate how applicants think and behave. These assessments are designed to detect traits that may correlate with repayment behaviour, such as impulsiveness, planning ability, or attention to detail.

It’s typically used in combination with other credit scoring methods, especially in markets or segments where financial history is limited or unavailable.

Best For

- First-time borrowers with no credit file

- Rural or underserved populations

- Alternative lenders offering microloans

- Markets without strong credit infrastructure

Pros

- Can be deployed quickly with minimal data

- Useful in early-stage credit decisions or onboarding

- Doesn’t rely on traditional financial systems

- Offers a unique lens into borrower intent and reliability

Limitations

- Not always predictive without supporting financial data

- Cultural differences may affect how questions are interpreted

- Less accepted by regulated financial institutions

Example

Platforms like Tala and Lenddo have used psychometric assessments in emerging markets to offer microloans without needing a formal credit history. While still niche in the UK, this method highlights the range of alternative credit scoring tools lenders can explore to widen access.

Conclusion

Traditional credit scores were never designed to serve freelancers, first-time borrowers, or small business owners. Yet these groups make up a growing share of today’s applicants. That’s why lenders across the UK are adopting alternative credit scoring methods not just to reduce risk, but to avoid missing out on viable borrowers.

The most practical shift is happening through Open Banking, where lenders can assess income, cashflow, and affordability in real time. It offers a clearer, more accurate view of someone’s financial health, without relying on outdated reports or guesswork.

What is alternative credit scoring?

Alternative credit scoring uses non-traditional data like bank transactions or rent payments to assess someone’s creditworthiness beyond a credit bureau score.

How does Open Banking support credit scoring?

Open Banking lets lenders access real-time bank data, helping them assess income, spending, and affordability for more accurate and inclusive credit decisions.

Who benefits most from alternative credit scoring methods?

Freelancers, gig workers, immigrants, and thin-file applicants benefit most, as they often lack a traditional credit history but show reliable financial behaviour.

Can lenders replace credit bureau data completely?

In some cases, yes. With Open Banking, income verification, and behavioural data, many lenders now use alternative credit scoring to make lending decisions independently.

Looking to improve how you assess creditworthiness? Finexer gives lenders access to real-time transaction data from 99% of UK banks 🙂