Every time an invoice lands in your inbox, someone has to open it, extract the details, log it into your system, and forward it for approval. Multiply that by 50, 100, or even 300 times a month, and it’s clear why invoice handling becomes a silent time sink in small finance teams.

The good news? You don’t need a big budget or a full accounts payable department to fix it.

Automated invoice processing platforms are now built with small businesses in mind, offering tools that can read invoice data, route it for sign-off, and sync it with your accounting software automatically. Open Banking APIs are making this process even faster by connecting directly to bank accounts for real-time payment matching

In this guide, we’ve rounded up 8 tools that help you do just that. They’re fast to set up, easy to use, and cut hours from your weekly admin load.

If staying on top of supplier invoices feels harder than it should, these are the platforms that can simplify your process, without requiring a full system overhaul.

What Is Automated Invoice Processing?

Automated invoice processing refers to the use of software to capture, extract, and manage invoice data without manual input. Instead of typing details line-by-line, businesses can use automation to pull data directly from PDFs, emails, or scanned documents and route them through pre-set approval workflows.

A typical invoice processing system includes:

- Invoice capture – uploads via email, portal, or drag-and-drop

- OCR (Optical Character Recognition) – extracts key fields like supplier name, amount, invoice number, and due date

- Data validation – checks for missing or mismatched entries before approval

- Approval routing – sends invoices to the right team member based on rules

- Export or sync – integrates with your accounting software or ERP

For small businesses, this means fewer delays, reduced admin time, and more visibility into cash flow, without the overhead of manual tracking or spreadsheet logs.

📚 Guide to Prevent Duplicate invoice in AR workflows

Top Automated Invoice Processing Software in 2025

Not all invoice automation platforms are built with small businesses in mind. Many are oversized, overly complex, or priced for enterprise teams.

The tools featured below are different they’re designed for SMEs that need to speed up invoice workflows without hiring more staff or investing in heavy systems.

Each tool listed here offers core automation features such as OCR-based data capture, approval routing, and accounting software integration. We’ve also included notes on best-fit use cases, pros, cons, and where each platform fits best.

Quick Comparison: Invoice Automation Tools That Actually Work for SMEs

| Tool | Best For | Key Feature | Accounting Integration | Pricing Model |

|---|---|---|---|---|

| Dext Prepare | Accountants & SMEs | Auto-coding & OCR capture | Xero, QuickBooks, Sage | Usage-based |

| Tipalti | Multi-entity finance teams | Global compliance + payouts | NetSuite, Xero | Subscription |

| Zoho Invoice + Books | Zoho users & startups | OCR + multi-stage approval | Zoho ecosystem | Tiered plans |

| Xero + Hubdoc | Xero-centric businesses | Email fetch + sync | Xero | Included in plan |

| QuickBooks + Bill Capture | Freelancers & micro-SMEs | Scan-to-record | QuickBooks Online | Bundled feature |

| Pleo Invoices | Teams managing spend + invoices | Unified invoice & expense | Xero, QuickBooks, Sage | Subscription |

| Yooz | Mid-volume finance teams | Approval routing + OCR | ERP + accounting tools | Custom quote |

| AutoEntry | Bulk scanning & bookkeeping | Multi-format OCR capture | Sage, QuickBooks, Xero | Pay-per-document |

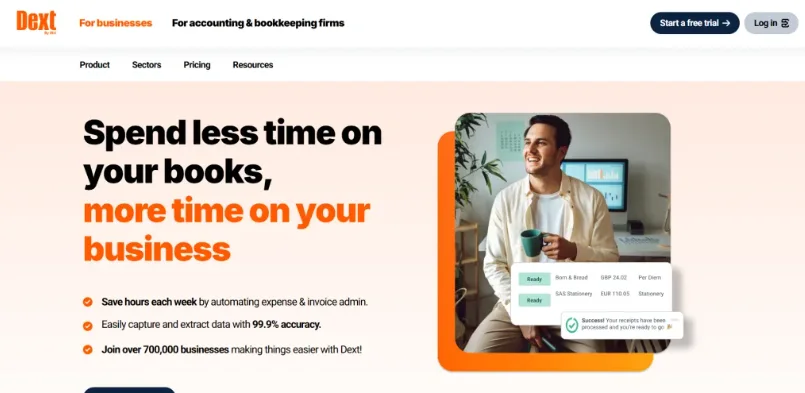

1. Dext Prepare: Fast, Accurate Invoice Data Capture for SMEs

Why It Matters for Small Finance Teams

Manual invoice entry becomes unscalable the moment your incoming volume grows beyond a handful per day. Delays, miscodes, and rework drain time and inflate costs. Dext Prepare addresses this by offering automated invoice processing tailored for small businesses and accounting firms.

What It Helps You Do

- Convert scanned receipts, emailed bills, and supplier PDFs into structured invoice data

- Eliminate manual data entry using reliable OCR invoice scanning for SMEs

- Auto-assign supplier rules, tax codes, and nominal ledger entries

- Push invoices into systems like Xero, QuickBooks, and Sage in seconds

- Apply custom rules for VAT, multi-line invoices, and multi-currency input

Real Use Case

UK-based accounting practices frequently use Dext to handle thousands of documents per month. One Midlands-based firm reduced invoice admin time by over 75% by pairing Dext Prepare with Xero and applying batch auto-coding rules to repeat suppliers.

Things to Consider

- While it’s among the most accessible invoice processing automation tools, full functionality often depends on pairing with compatible accounting platforms

- Best suited for small to medium-sized businesses rather than larger enterprises needing end-to-end AP automation

- Mobile app is functional but best results come from desktop workflows

Ideal For

Firms seeking invoice data capture software that integrates cleanly into existing accounting tools. It’s particularly strong for practices managing documents on behalf of multiple clients and wanting to streamline approvals and VAT handling.

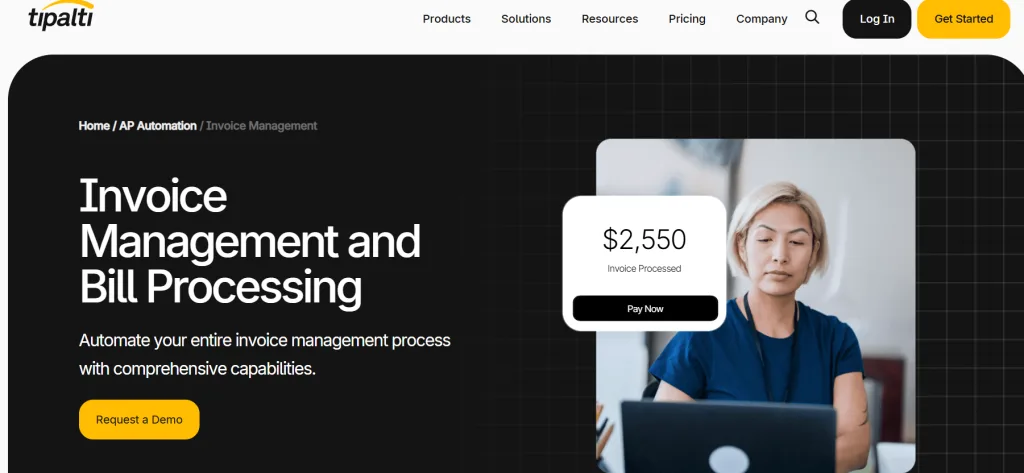

2. Tipalti: Global-Ready Invoice Automation with Built-In Compliance

Why It Matters for Finance Teams Scaling Across Borders

As businesses grow internationally, so do invoice formats, supplier requirements, and approval structures. Tipalti simplifies this by offering automated invoice processing combined with global compliance, tax handling, and cross-border payment capabilities.

What It Helps You Do

- Capture invoice data automatically using machine-learning OCR

- Configure multi-level approval workflows based on spend thresholds or departments

- Auto-validate VAT IDs and handle tax compliance across multiple jurisdictions

- Manage supplier onboarding with self-service portals and tax form collection

- Sync seamlessly with ERPs and accounting tools like NetSuite, Xero, QuickBooks

Real Use Case

A UK-based SaaS firm processing 4,000+ monthly invoices across 6 countries adopted Tipalti to automate invoice approvals and payments. It cut their cycle time from 15 days to under 4 while ensuring vendor compliance with international tax requirements.

Things to Consider

- As a full-stack accounts payable automation for small business and mid-market firms, Tipalti is better suited for those with multi-entity or multi-currency operations

- May be too feature-heavy for sole traders or firms processing fewer than 300 invoices a month

- Deployment and training are more involved than lightweight capture-only tools

Ideal For

Businesses needing invoice processing automation tools that go beyond data capture and into compliance, global payments, and financial controls. Especially valuable for scaling startups or SMEs with supplier bases across multiple regions.

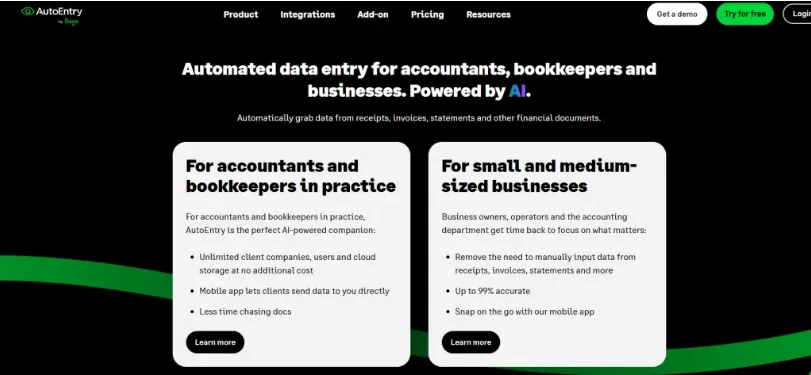

3. AutoEntry: Smart Invoice Scanning Built for Accountants and Bookkeepers

Why It Matters for Document-Heavy Workflows

If your finance team is drowning in scanned invoices, supplier statements, or handwritten receipts, manual entry quickly becomes a bottleneck. AutoEntry offers precise, cloud-based OCR invoice scanning for SMEs, making it a go-to solution for accountants managing client books or SMEs processing in bulk.

What It Helps You Do

- Capture invoice details from photos, scans, emails, or PDFs

- Automatically categorise line items, VAT rates, and supplier names

- Extract data from multi-page and multi-currency documents

- Sync captured data into accounting platforms like Sage, QuickBooks, and Xero

- Archive and search past invoices with full audit trails

Real Use Case

An East London property management firm integrated AutoEntry into its AP flow to capture over 800 monthly supplier invoices. By configuring rules for recurring contractors, they cut down invoice entry time by over 60%, ensuring faster month-end close and reduced bookkeeping hours.

Things to Consider

- It’s one of the more affordable invoice data capture software options, but features like approval routing or direct payment aren’t included

- Best paired with an accounting system to automate the second half of the process

- Pay-per-document pricing works well for variable volumes, but costs can add up at scale

Ideal For

Bookkeepers and small businesses looking for a reliable way to scan and categorise supplier documents at scale, with minimal learning curve. AutoEntry delivers automated invoice processing without forcing full system change.

4. Yooz: End-to-End Invoice Automation for Small Finance Teams

Why It Matters for Paper-Heavy Invoicing

Businesses still receiving paper or email-based invoices often struggle to scale their accounts payable workflows. Yooz offers automated invoice processing with built-in approvals, data extraction, and real-time status tracking designed specifically for finance teams handling mid-volume invoices.

What It Helps You Do

- Capture invoices using OCR invoice scanning for SMEs via email, scan, or upload

- Auto-populate supplier, VAT, and line-item fields with editable templates

- Route invoices for approval based on role, department, or amount

- Send approved entries directly into your ERP or accounting software

- Track processing status at every stage to avoid late payments or bottlenecks

Real Use Case

A UK-based consultancy used Yooz to reduce manual invoice input across four offices. By training Yooz to recognise key suppliers and common formats, they cut down AP processing time by 50% and significantly reduced late payment fees.

Things to Consider

- Strong on capture and approvals, but less suited for firms looking to handle supplier payments in the same platform

- Some users may find the UI dated compared to newer invoice processing automation tools

- Most effective when paired with tools like Sage or Xero for reconciliation

Ideal For

Companies needing reliable, rules-based invoice data capture software that can also manage basic approvals without complex customisation. Especially useful for finance leads seeking to tighten controls without heavy IT involvement.

5. Zoho Invoice + Zoho Books: Modular Invoice Workflow for Cost-Conscious SMEs

Why It Matters for Startups and Agencies

If you’re already using Zoho’s ecosystem or managing clients and expenses manually, Zoho Invoice, combined with Zoho Books, offers a simple path to automated invoice processing. It’s especially suited to businesses that want flexibility without complexity.

What It Helps You Do

- Create and send invoices with customizable templates

- Use OCR to scan supplier bills and receipts

- Automatically record scanned invoices into Zoho Books

- Set up multi-stage approval workflows based on amount or department

- Integrate with payments, CRM, and expense tracking within Zoho

Real Use Case

A small UK consultancy automated invoice capture for service provider bills using Zoho’s mobile scan feature. Paired with Zoho Books, they reduced data entry hours by 45% and streamlined monthly bookkeeping.

Things to Consider

- Best suited for Zoho users and may require workarounds to sync with non-Zoho ERPs

- OCR accuracy is solid for standard documents but struggles with non-standard invoice layouts

- Free and low-cost tiers exist, but advanced workflow features may require subscription

Ideal For

Small teams already using Zoho or seeking an affordable invoice processing automation tool that scales with a growing client base.

6. Xero + Hubdoc: Capture-First Automation with Seamless Accounting Sync

Why It Matters for Small Teams Working in Xero

If your business uses Xero as your accounting backbone, Hubdoc extends its capability with automated invoice processing by capturing bills and supplier statements directly into Xero no manual entry required.

What It Helps You Do

- Automatically fetch invoices from supplier portals and email

- Use OCR to extract details then sync directly into Xero for approval

- Apply rules to auto-publish documents based on supplier or invoice type

- Archive and retrieve past invoices with confidence

Real Use Case

A freelance illustration studio in Bristol used Hubdoc to process monthly supplier statements and utility bills. By setting up supplier-specific rules, they reduced their invoice handling time by 60%, allowing faster project billing.

Things to Consider

- Requires a Xero subscription and Hubdoc add-on (bundled in some Xero plans)

- Limited built-in approval workflows less suited for firms needing multi-level approvals

- Focused on capture, the separate payment process or bank matching remains manual

Ideal For

Freelancers and small businesses committed to Xero who want robust invoice data capture software to cut down on manual entry and shadow bookkeeping.

7. QuickBooks Online + Bill Capture: Scan-to-Record Invoices with Minimal Setup

Why It Matters for Freelancers and Micro-Businesses

If you’re using QuickBooks Online and want to stop typing invoice data, Bill Capture enables OCR invoice scanning for SMEs with minimal setup, helping freelancers and micro-businesses save time from day one.

What It Helps You Do

- Snap a photo of a supplier invoice from your phone or upload it via email

- Automatically extract vendor, amount, and due date using OCR

- Review and post invoice entries directly inside QuickBooks Online

- Maintain an archive with image-to-record linkage for audit support

Real Use Case

A London-based sole trader used Bill Capture to manage receipts and invoices while traveling. It cut manual bookkeeping time by half and ensured accurate month-end close.

Things to Consider

- Primarily focused on capture, approval workflows aren’t supported

- Works best for businesses without complex PO or departmental structures

- Quality of OCR fluctuates depending on invoice format and clarity

Ideal For

Sole traders and micro-businesses seeking invoice data capture software that integrates flawlessly with QuickBooks Online without requiring training or setup.

8. Pleo Invoices: Integrated Invoice and Expense Capture for Fast-Growth SMEs

Why It Matters for Teams Handling Both Invoices and Expenses

If your finance team juggles supplier invoices and expense receipts, Pleo Invoices centralises both workflows, offering streamlined invoice processing automation tools and corporate spend tracking in a single interface.

What It Helps You Do

- Upload or forward supplier invoices and expense receipts through the Pleo app

- Automatically capture invoice details using OCR

- Route both invoices and expense claims through unified approval workflows

- Export data to Xero, QuickBooks Online, Sage, or other ERPs

- Track supplier payment status alongside employee expense reimbursements

Real Use Case

A growing e-commerce business in Leeds adopted Pleo Invoices to standardise both invoice and expense workflows. They achieved invoice entry automation and reduced expense approval delays by 65%.

Things to Consider

- Works best when used alongside corporate card management (Pleo’s core product)

- Some features are tailored to expense use cases, and invoice-specific logic may feel supplementary

- Price includes spend management, which may be unnecessary for expense-lite teams

Ideal For

SMEs looking for a combined invoice processing automation tool and expense management solution, especially when scaling employee and supplier spend together.

How Finexer Enhances Invoice Processing Software

1. Instant Bank Data Fetching for Invoice Matching

- Finexer enables secure access to real-time bank transactions from 99% of UK banks.

- This allows invoice software to automatically match invoices with incoming payments or outgoing supplier transactions, reducing reconciliation delays and manual checks.

2. Supplier Bank Account Verification (Before Payout)

- Finexer’s account verification APIs confirm that supplier bank details are accurate and owned by the intended recipient.

- This prevents fraudulent or misdirected invoice payments, a common risk when processing large volumes of invoices manually.

3. Trigger Payments Instantly via Open Banking

- With Finexer’s Payment Initiation API, invoices approved in your system can trigger real-time payments directly from your business or client’s account, removing the need for external banking logins or manual transfers.

- Useful for batch payment runs, supplier settlements, or even client pay-ins.

4. Automated Source of Funds Checks for High-Value Invoices

- Invoices flagged for compliance (e.g. above a threshold or in regulated sectors like property or legal) can be verified using Finexer’s Source of Funds API, reducing reliance on PDF bank statements or lengthy back-and-forths with clients.

5. White-Label Ready for Invoice Platforms

- Finexer’s APIs can be embedded directly into invoice software, letting platforms offer bank data capture, verification, and payment capabilities under their own brand, without redirecting users.

6. Developer-Friendly + UK Compliance Ready

- FCA-authorised and built for fast implementation, Finexer helps invoice platforms go live with compliance-backed financial connectivity in days, not months.

Who It’s Built For

- UK-based businesses that already have an OCR or approval layer but lack real-time bank visibility

- Teams struggling with end-of-month delays caused by late or missed payment tracking

- Developers or finance leads who want clean, machine-readable data to trigger payment workflows

Why Fintechs Integrate with Finexer

✅ FCA-authorised and built for compliance from day one

✅ Live in days, not months: fast integration for small teams or larger finance functions

✅ Usage-based pricing: ideal for firms that want automation without enterprise lock-in

✅ White-label ready: let your brand own the invoice and reconciliation experience

If you’ve already invested in capture or approval workflows and now need real-time bank data to complete the loop, Finexer is the missing link. It’s automation where it matters in the payments, not just the paperwork.

“Our clients in the legal and accountancy sectors expect the highest standards of efficiency and security, and Finexer’s solutions help us deliver on those expectations every day,”David Kern, CEO of VirtualSignature-ID.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat is automated invoice processing?

Software that captures, extracts, and processes invoice data without manual entry.

What are the benefits of automation in invoice processing?

Faster approvals, fewer errors, better visibility, and real-time matching.

Are invoice automation tools suitable for small businesses?

Yes. Many tools offer affordable plans built for SMEs with basic AP needs.

How does Open Banking improve invoice automation?

It lets tools fetch live bank data to match or trigger payments automatically.

Connect Finexer to your invoicing stack and speed up reconciliation, supplier checks, and payment runs instantly!