Financial crime drains £290 billion from the UK economy each year, while global losses have reached £1.8 trillion. KYB UK regulations have grown stricter, especially after high-risk money laundering countries increased by 116% between 2019-2021.

Businesses must perform full KYB checks on their corporate clients to prevent such massive losses. Companies often spend over £100 million yearly on remediation activities because of financial crimes. Business verification presents many challenges, so we created this complete guide that covers everything from KYB fundamentals to advanced verification processes.

This piece examines the quickest KYB tools available in 2025. You’ll learn to direct your way through multiple data points while meeting UK compliance requirements. Our guide shows how to utilise live verification systems that protect your business and optimise operations.

Keep Reading or jump to the section you are looking for:

What is KYB and why it matters in the UK

KYB (Know Your Business) is a due diligence process that reviews and verifies business entities before establishing commercial relationships. This process authenticates that companies you deal with are legitimate, reliable, and do not pose threats to your organisation.

KYB differs from KYC (Know Your Customer) checks. While KYC focuses on individual consumers, KYB verifies businesses, their owners, shareholders, and suppliers. These checks prove that companies exist and actively trade. They also help you learn about their corporate structure, main activities, and where they operate.

Organisations might need up to 150 different data points to complete a detailed KYB check. The process involves collecting and proving information from multiple sources like the Financial Conduct Authority (FCA), Charities Commission, and Companies House.

Identifying Ultimate Beneficial Owners (UBOs) and Persons of Significant Control (PSC) is vital to KYB. These people own or control the business, and verifying them gives a full picture of potential risks.

KYB matters by a lot in the UK as it forms the foundations of Anti-Money Laundering (AML) compliance. Companies without proper KYB processes might enable fraud or illegal activities unknowingly. This leads to sanctions and fines. Bad publicity from the whole ordeal spreads faster online, which erodes customer trust and scares away investors.

The UK requires KYB checks for businesses in regulated sectors, including:

- Banking and financial institutions

- Legal and professional services

- Accountants and tax advisers

- Estate agents and property developers

- Insurance providers

- FinTech companies

- Gaming and gambling businesses

These sectors need KYB not just as a regulatory requirement but as a vital measure to protect against money laundering, terrorist financing, and fraud. It also protects businesses from financial losses, legal issues, and damage to their reputation.

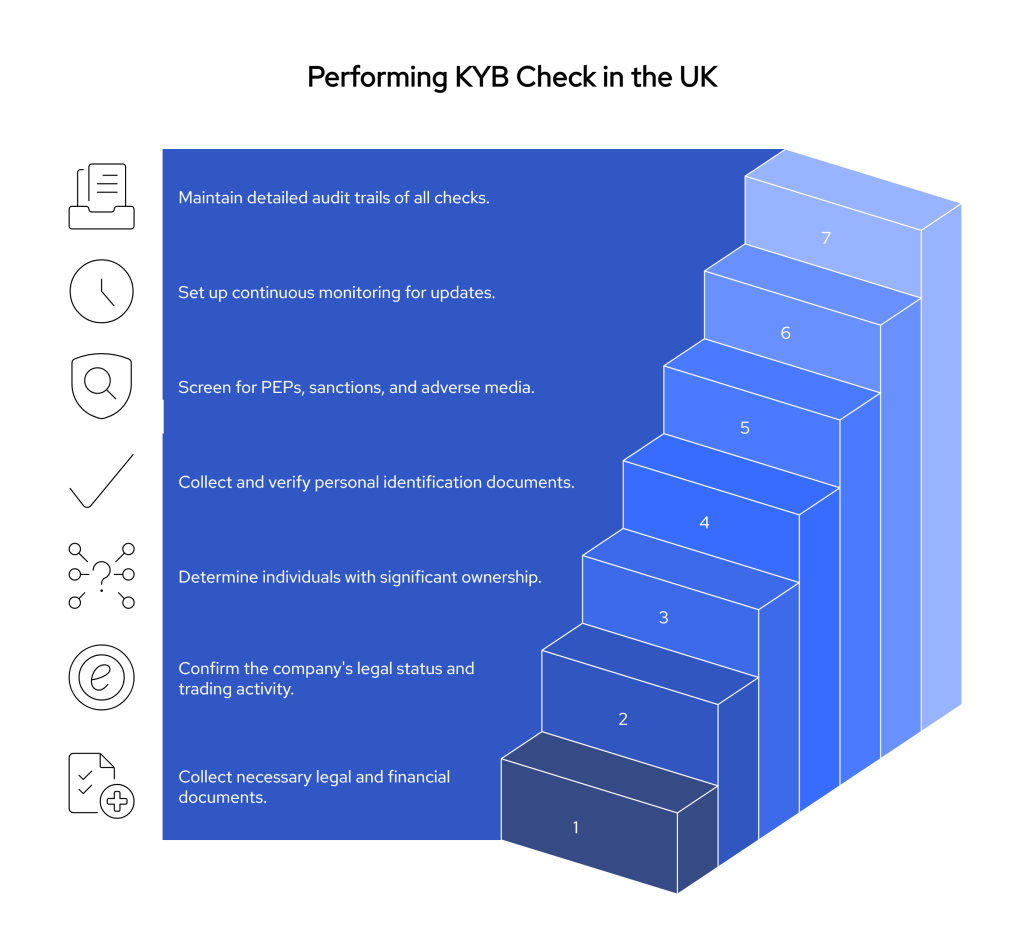

How to perform a KYB check in the UK

Your business needs a systematic approach and proper documentation to run effective KYB checks. The right checks will keep you compliant with regulations and protect your business from financial crime risks.

Step 1: Gather Essential Documents

Start by collecting all the required documentation from the business entity:

- Certificate of Incorporation

- Company registration details

- Articles of Association

- Financial statements and annual returns

- Proof of registered address and trading address (if different)

Step 2: Verify Company Information

You need to get into the ownership structure and cross-reference it with Companies House records. This step proves the company exists legally and shows its current trading status. UK companies must maintain a register of people with significant control (PSC Register) and submit this information to Companies House since July 2016.

Step 3: Identify Ultimate Beneficial Owners

Finding UBOs plays a vital role in thorough verification. UK businesses must identify people who own or control 25% or more of the entity. Ask for a company structure chart when dealing with complex structures, especially with offshore entities.

Step 4: Conduct Individual Verification

After identifying UBOs, verify all key persons individually. You’ll need:

- Two forms of identification for beneficial owners or principal controllers

- Primary photo ID (passport, driving license, or national identity card)

- Secondary proof of address (utility bill, bank statement, etc.)

Step 5: Run Background Checks

Screen all identified individuals against:

- PEPs (Politically Exposed Persons) lists

- Global sanctions databases

- Adverse media reports

Step 6: Implement Ongoing Monitoring

KYB checks don’t stop after the first round. Your business must set up systems that monitor continuously. Best practices now include automated daily screening against more than 1,100 real-time PEPs and Sanctions lists.

Step 7: Maintain Detailed Records

Create an audit trail of all verification activities. Keep these records secure but make them available for regulatory inspections. Your records should show all screening activities, flagged matches, and resolution outcomes.

Best KYB tools for fast and reliable verification in 2025

Businesses today need quick KYB tools that optimise verification processes and ensure compliance. The market now offers several advanced solutions that blend AI technology, database access and automated workflows to verify businesses quickly and reliably.

Finexer

Finexer takes a fresh approach to KYB by using live data from UK banks to verify if a business is real, active, and financially healthy, not just registered on paper. Instead of relying only on documents or registry checks, Finexer connects to 99% of UK banks and confirms whether a company is actually trading, who owns the account, and what kind of activity is happening.

This makes Finexer ideal for regulated UK businesses that need to move fast, stay compliant, and go beyond surface-level checks. You can instantly verify company bank accounts, assess financial activity, and screen directors or UBOs through integrated ID and facial verification tools, all in one place.

Because Finexer is built for UK-based teams, you won’t be paying for global features you don’t need. Plus, there are no setup fees or monthly minimums, just pay for what you use.

Pricing is usage-based, with no upfront costs or contracts required.

Success Story: How VirtualSignature ID Uses Finexer for Faster Business Verification

When VirtualSignature ID needed a faster, more reliable way to verify businesses involved in high-value property transactions, they turned to Finexer’s Open Banking-powered KYB solution.

Property deals — especially those involving large sums — require strict checks for Anti-Money Laundering (AML), proof of funds, and identity validation. But traditional KYB methods were slowing down deal timelines. Waiting days for documents, chasing UBO declarations, and manually validating company details meant lost time and disrupted workflows.

By integrating Finexer, VirtualSignature ID was able to:

- Instantly verify business bank accounts and confirm that corporate clients were actively trading.

- Validate proof of funds directly from the source — 99% of UK banks — without requesting paper bank statements.

- Screen key stakeholders using Finexer’s integrations with ID and PEPs & Sanctions databases.

- Maintain a complete audit trail, ready for legal or compliance reviews at any time.

The result? Faster onboarding, fewer back-and-forth delays, and better risk control — all built into a single workflow.

With Finexer, VirtualSignature ID transformed business verification from a bottleneck into a built-in advantage.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Other KYB Tools

Trulioo GlobalGateway

Trulioo gives you access to over 700 million business entities through 180+ government registers and public records. Their data updates every 15 seconds to ensure accuracy. Trulioo stands out with its AI and natural language processing capabilities that standardise data across hundreds of languages. The platform helps businesses meet global regulatory standards including AML/CFT requirements and works with regulatory agencies like FCA and FinCEN.

iDenfy KYB Solution

iDenfy boasts a 4.9/5 rating and connects instantly to 180+ company registries from more than 120 countries. The platform automatically flags or blocks company applications based on custom rules. The system monitors and performs due diligence against more than 1,100 PEPs and sanctions lists. Users can start at €1.20 per year with additional costs of €2.00 per AML screening.

Vespia AI-Powered Platform

Vespia makes business verification 90% faster than manual reviews. The platform checks business registries across 4,000+ databases and delivers complete reports that verify business legitimacy. A built-in widget combines with banking websites so customers can run background checks before large transactions. Banks can implement the system easily through API and SDK integration.

TheKYB

TheKYB delivers API-ready KYB data or a backoffice management system. The platform pulls data directly from official business registries across 250+ countries without intermediaries. Their integrated approach evaluates UBO under complex structures, unwraps beneficiary layers and checks licenses. Users can retrieve both free and paid business filings with one click.

ComplyAdvantage

ComplyAdvantage built the first unified data graph with over 400 million companies and related directors across 200+ countries. Their AI solution relates relationships between individuals and businesses to detect hidden financial crime risks. The platform screens data from 20,000+ active sources in real time, starting at approximately GBP 1.99 per verification.

Choosing the Best Tool for Business Verification

The right KYB tool doesn’t just tick a compliance box — it helps you make better decisions, onboard faster, and reduce risk at every stage of your customer relationship.

If you’re looking for registry-level checks, platforms like Trulioo, Vespia, and iDenfy offer wide international coverage and automated workflows. For companies dealing with layered ownership structures, ComplyAdvantage and TheKYB bring advanced entity mapping and risk detection.

But if your focus is on UK-based businesses and you want live, bank-level insights into whether a company is actively trading, Finexer is a strong choice.

Finexer helps you go beyond static documents by connecting directly to 99% of UK banks. You’ll know who owns the business bank account, what kind of financial activity is taking place, and whether the company is operational — all without waiting days for paperwork. It’s fast, flexible, and ideal for teams who want real-time confidence before onboarding a client.

No matter which provider you choose, make sure it fits your use case — whether that’s verifying thousands of companies at scale, checking one high-risk client thoroughly, or building compliance into your own platform.

Business verification is no longer a slow, manual task. With the right tool, it becomes a competitive edge.

What is KYB and how does it differ from KYC?

KYB (Know Your Business) is a process for verifying the legitimacy of businesses before entering into commercial relationships. Unlike KYC, which focuses on individual customers, KYB involves checking business registration details, ownership structure, and financial records to ensure compliance and prevent financial crimes.

How do you perform a KYB check in the UK?

To perform a KYB check, collect essential company documents, verify information with Companies House, identify Ultimate Beneficial Owners (UBOs), conduct individual verifications, run background checks against sanctions lists, implement ongoing monitoring, and maintain comprehensive records of all verification activities.

What are some of the best KYB tools available in 2025?

Some of the top KYB tools in 2025 include Trulioo GlobalGateway, iDenfy KYB Solution, Vespia AI-Powered Platform, TheKYB, and ComplyAdvantage. These tools offer features like real-time verification, extensive database access, and AI-powered risk assessment to streamline the KYB process.

Why is KYB important for UK businesses?

KYB is crucial for UK businesses as it forms the foundation of Anti-Money Laundering (AML) compliance, helps prevent fraud and illegal activities, and protects companies from financial losses and reputational damage. It’s particularly important in regulated sectors such as banking, legal services, and fintech.

How often should KYB checks be performed?

KYB checks are not one-time events. Best practices include implementing systems for continuous monitoring, with automated daily screening against PEPs and Sanctions lists. Regular reviews and updates of business information are essential to maintain compliance and mitigate ongoing risks.

Looking for an Affordable & Reliable KYB Tool? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂