Accessing credit shouldn’t feel like hitting a wall, and earning passive income shouldn’t require a stock market degree. That’s where P2P lending platforms come in, offering a direct connection between borrowers who need funds and investors looking to grow their capital.

By using technology to bypass traditional banks, peer to peer P2P lending platforms let individuals and small businesses borrow money online while allowing investors to hand-pick the loans they want to fund. The result? Faster decisions, better rates, and a new way to approach lending that puts people at the centre.

In this guide, we’ll explore five of the best P2P lending platforms that are helping connect borrowers and investors through smart, regulated technology in 2025.

1. Zopa

Best For

Borrowers with strong credit histories and investors seeking lower-risk consumer loans.

How It Works

Zopa began as one of the UK’s earliest peer to peer P2P lending platforms, offering personal loans funded directly by individual investors. While Zopa has since transitioned into a full digital bank, it still reflects the core mechanics of P2P lending through personal loan offerings, backed by decades of lending data and credit profiling.

Borrowers apply through Zopa’s app or website, where credit checks, income assessments, and affordability reviews are completed digitally. Investors (when active in P2P mode) select lending tiers based on risk appetite, and Zopa manages repayments, collections, and interest distribution.

Notable Features

- Strong borrower vetting with transparent credit score criteria

- Fixed interest rates with clear repayment terms

- FCA-authorised and PRA-regulated

- Borrower-friendly early repayment options

Who Should Use It

Zopa suits borrowers looking for personal loans without hidden fees and investors prioritising stability and clear risk bands. It remains a trusted name for those familiar with the UK’s best P2P lending platforms, especially among legacy investors and fintech watchers.

📚6 Alternative Credit Scoring Methods

2. Funding Circle

Best For

Small business owners needing growth capital and institutional or retail investors interested in SME lending.

How It Works

Funding Circle operates as a specialised P2P lending platform focused on UK small and medium-sized enterprises (SMEs). Borrowers can apply for unsecured business loans with fixed terms and rates, often receiving decisions in as little as 24 hours. On the other side, investors fund loan portions through a diversified portfolio approach, where their capital is spread across multiple businesses to reduce risk.

The platform uses technology-driven credit assessments, incorporating financial data, business performance metrics, and Open Banking feeds to evaluate applicants. While Funding Circle initially targeted individual investors, it now includes institutional backers as a major funding source.

Notable Features

- Transparent loan offers with no early repayment fees

- Loans up to £500,000 for eligible UK businesses

- Proprietary risk models and automated credit scoring

- FCA-regulated platform with high repayment transparency

Who Should Use It

Funding Circle is ideal for growing businesses that don’t qualify for traditional bank lending and for investors who want access to UK SME debt as an asset class. It remains one of the best P2P lending platforms for business-focused returns and regulated digital lending.

3. Plend

Best For

Borrowers with thin or non-traditional credit files, and investors seeking to support ethical lending.

How It Works

Plend is a newer entrant to the UK’s peer to peer P2P lending platform landscape, aiming to improve financial inclusion through alternative credit scoring. Instead of relying solely on traditional credit histories, Plend uses Open Banking data to assess real-time affordability, spending habits, and cash flow, making it possible for more people to access fair loans.

Borrowers apply via a quick online process, granting permission for Plend to view their bank data. Investors, in turn, fund these loans with clear visibility into borrower profiles, anonymised risk data, and social impact reporting.

Notable Features

- Uses Open Banking to assess affordability beyond credit scores

- Promotes ethical lending through transparent terms and inclusive practices

- FCA-regulated with full borrower consent and data protection

- Monthly reporting for investors on impact and performance

Who Should Use It

Plend is one of the best P2P lending platforms for socially responsible investors and borrowers who’ve been excluded by traditional lenders. It combines ethical principles with tech-driven lending, helping more people access affordable credit.

4. Kuflink

Best For

Investors looking for property-backed loans and borrowers needing short-term bridging finance.

How It Works

Kuflink is a UK-based P2P lending platform that connects investors with borrowers seeking property-secured loans. Borrowers typically include property developers, landlords, or business owners needing short-term finance. Each loan is secured against real estate, which is professionally valued and underwritten by Kuflink’s in-house credit team.

Investors can choose individual deals or invest through auto-select portfolios. One standout feature: Kuflink co-invests up to 5% in every loan, giving investors added confidence that the platform has skin in the game.

Notable Features

- All loans secured against UK property

- Kuflink co-invests in every loan listed

- Flexible terms, including interest-only and bridging finance

- Regulated by the FCA and authorised for retail and institutional investors

Who Should Use It

Kuflink suits investors looking for asset-backed lending opportunities with defined exit strategies and borrowers who can offer real estate security. It stands out among peer to peer P2P lending platforms for its property focus and built-in risk controls.

5. CrowdProperty

Best For

Property developers and investors interested in short-term development finance.

How It Works

CrowdProperty is a specialist P2P lending platform focused exclusively on property projects across the UK. It connects developers seeking funding for residential or mixed-use developments with investors looking for short-term, secured lending opportunities.

The platform performs thorough due diligence on every project and provides transparency into the funding structure, development schedule, and exit strategy. Each loan is secured with a first legal charge on the property, offering added protection for lenders.

Notable Features

- First-charge security on every loan

- Specialised in UK residential and small-scale commercial property projects

- Transparent updates throughout project life cycle

- FCA-regulated with detailed risk disclosures

Who Should Use It

CrowdProperty is a solid choice for experienced investors seeking property-backed returns and for developers needing structured, short-term funding. It’s one of the best P2P lending platforms for real estate finance with clear security and oversight.

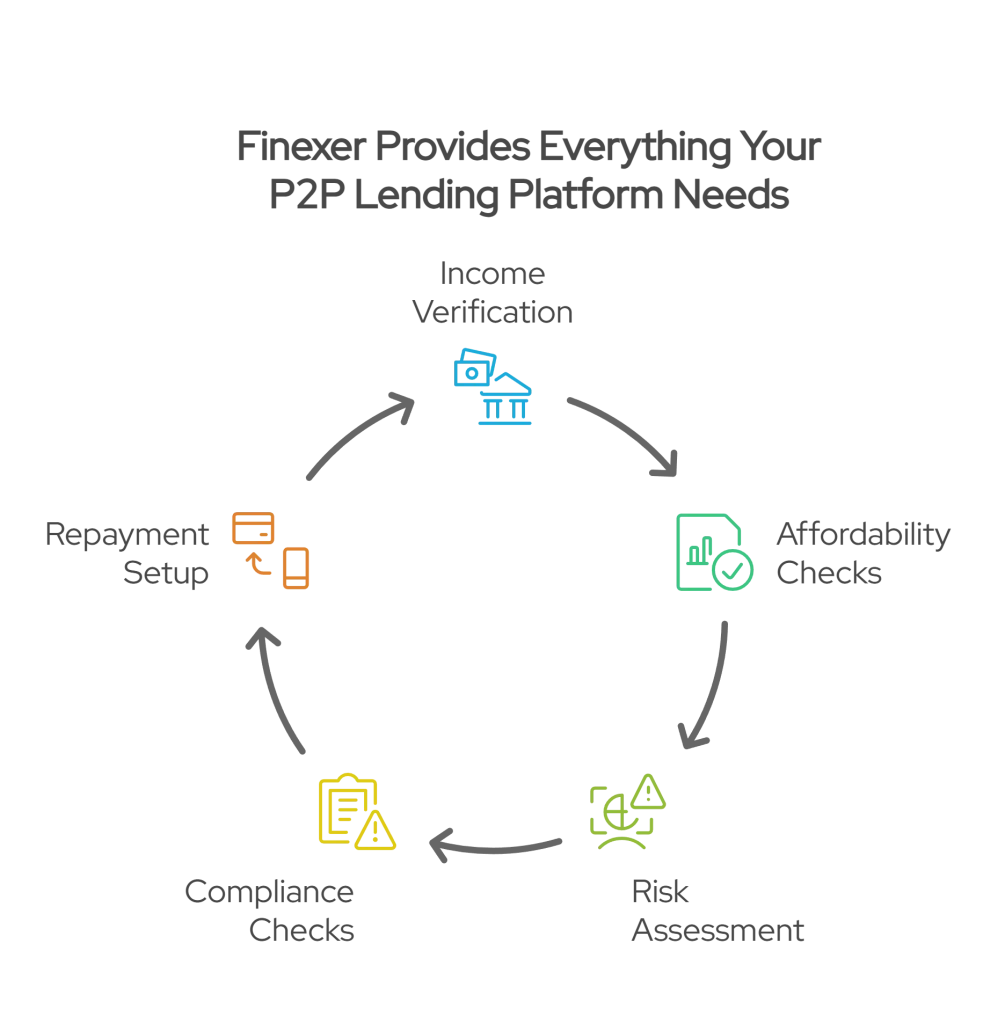

How Finexer Supports P2P Lending Platforms

P2P lending platforms need more than matching algorithms; they require reliable access to real-time financial data, fast borrower verification, and secure payment infrastructure. Finexer provides these building blocks through developer-friendly Open Banking APIs, purpose-built for UK-based lending models.

What You Can Do with Finexer:

- Verify Income in Seconds

Access live income streams directly from a borrower’s bank account, no uploads, no manual checks. - Assess Affordability with Real Data

Categorised transaction data helps you understand spending behaviour, recurring liabilities, and true repayment capacity. - Perform Source of Funds Checks

Identify account ownership and validate the origin of incoming funds using Finexer’s layered verification tools. - Enable Instant Repayments & Collections

Set up one-off or recurring repayments with Pay by Bank, no reliance on cards or manual transfers. - Accelerate Go-to-Market

With transparent pricing, UK-wide bank coverage, and FCA-authorised infrastructure, Finexer gets your lending platform live in days, not months.

Get Started

Need verified income, affordability checks, or repayment tools? Finexer gives you plug-and-play APIs to embed these features directly into your lending platform.

Try NowConclusion

The rise of P2P lending platforms has opened up new opportunities for both borrowers and investors in the UK. Whether you’re a business owner struggling to access bank finance or an investor seeking alternatives to traditional markets, these platforms offer a tech-driven route that prioritises transparency, control, and accessibility.

From legacy names like Zopa and Funding Circle to newer entrants like Plend, Kuflink, and CrowdProperty, each platform brings a unique focus, whether that’s unsecured consumer loans, SME finance, or property-backed lending. The common thread is direct access, reduced friction, and more inclusive lending models powered by data and automation.

As peer to peer P2P lending platforms continue to mature, they’re not just filling gaps in the financial system; they’re reshaping how credit and investment work in the UK.

What is a P2P lending platform?

A P2P lending platform connects borrowers with investors directly online, offering loans without involving traditional banks.

Are P2P lending platforms regulated in the UK?

Yes. UK P2P platforms must be authorised and regulated by the Financial Conduct Authority (FCA) to operate legally.

How risky is it to invest through peer-to-peer lending?

There is a risk of borrower default, but some platforms offer risk controls like loan diversification or asset-backed lending.

Can individuals borrow money from P2P lending platforms?

Yes. Most platforms offer loans to individuals for personal, business, or short-term borrowing needs.

What are the typical returns for investors?

Returns usually range from 4% to 8% annually, depending on platform, loan type, and risk level.

Use Finexer’s Open Banking APIs to power key features across your P2P lending journey from onboarding to repayments !