Letting property in the UK comes with rising risks: from missed payments to Right to Rent fines. That’s why more landlords are turning to tenant background verification tools, digital platforms that check a renter’s credit, employment, and income in minutes.

According to Homeppl’s 2023 tenancy fraud report, 91% of all detected fraud cases involved tenants providing false or misleading information, underscoring the prevalence of deceptive practices in tenant applications.

Traditional referencing methods like calling employers or requesting payslips are slow and prone to errors. Modern tools now offer fully digital tenant verification, pulling verified data from credit bureaus, bank accounts, and ID documents, all with tenant consent.

Whether you manage one property or a portfolio, these tools reduce admin, flag risks early, and help ensure your next tenant is financially reliable.

How We Chose These Tenant Verification Tools

We evaluated each platform using the following UK-relevant criteria:

- Data coverage: Includes credit files, tenant income verification, and tenant employment verification

- Compliance: Covers Right to Rent rules, consent logging, and GDPR standards

- Speed: Delivers results within minutes, not days

- UX: Clear journeys, mobile-friendly dashboards, and integration options

- Pricing: Transparent costs for landlords and letting agents

Every tool featured supports UK landlords with modern, fast tenant background verification journeys.

Do I Need Consent for Digital Tenant Background Checks?

Yes. Whether you’re running a credit search or performing tenant income verification, tenant consent is mandatory under UK GDPR. Most tools provide a pre-built digital consent process, usually a checkbox or e-signature as part of the onboarding flow.

Comparing the 5 Best Tenant Background Verification Tools in the UK

| Tool | Best For | Income Verification | Credit Check | Fraud Detection | White-Label / API | Pricing Summary |

|---|---|---|---|---|---|---|

| Finexer | Platforms embedding Open Banking income checks | ✔ Real-time via Open Banking | ✔ Account-backed KYC | ✔ Through KYC + bank data | ✔ White-label + Webhooks | Usage-based; no extra setup costs or monthly minimums |

| Homeppl | Fraud-prone or non-traditional tenant profiles | ✔ Open Banking + Documents | ✔ Deep file check | ✔ 150+ behavioural fraud tests | ✔ API + enterprise-ready | Custom based on volume/risk |

| Goodlord | Agencies needing an all-in-one lettings platform | ✔ Payslip, HMRC, Open Banking | ✔ Equifax | ✘ | ✔ Platform-integrated | Tiered plans (Essential–Priority) |

| Checkboard | ID + AML-focused teams needing income checks too | ✔ Via Open Banking | ✘ | ✔ Document & biometric screening | ✔ API + Zapier | From £7.99 / invite (Lite plan) |

| RentProfile | Agencies wanting branded reports + rent guarantees | ✔ Optional (request-based OB access) | ✔ Experian | ✔ Risk-scored profiles | ✔ White-label + API | ~£18 per tenant incl. add-ons |

1. Finexer – Fast, Affordable Tenant Background Verification

Best for: Letting agents and platforms needing API-first tenant background verification powered by Open Banking.

Finexer provides instant access to verified tenant income and affordability data across 99% of UK banks. Unlike traditional referencing that relies on uploaded payslips or employer letters, Finexer pulls real-time transaction data directly from the tenant’s bank account, removing manual errors and fraud risk.

Key Features:

- Real-time tenant income verification via Open Banking

- Categorised bank data (e.g. salary, gambling, recurring expenses)

- 90-second tenant consent journey with branded UX

- Optional white-label flows and webhook alerts for integrations

Pros:

- The fastest way to verify tenant income with zero document handling

- Designed for integration into PropTech, PMS, and referencing platforms

- Transparent usage-based pricing; no setup or cancellation fees

Cons:

- Built for income-focused checks

- Requires platform embedding or workflow integration

Pricing:

Transparent, pay-as-you-go pricing with no setup fees, no monthly minimums, and no hidden charges. Finexer offers startup-friendly terms, making it cost-effective for growing agencies and platforms to scale without long-term commitments.

Why Businesses Choose Finexer?

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.”

— David Kern, CEO, VirtualSignature ID

“Our business isn’t about the volume of consents, it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Can I verify a tenant’s income without collecting payslips?

Yes. Tools like Finexer and Checkboard use Open Banking APIs to connect securely to a tenant’s bank and pull verified income data, eliminating the need for manual documents like payslips or PDFs.

Is Open Banking safe for tenant verification?

Yes. All providers must comply with FCA regulations and use bank-level encryption. Tenants must give explicit consent, and the tools cannot move money only read financial data relevant to the background check.

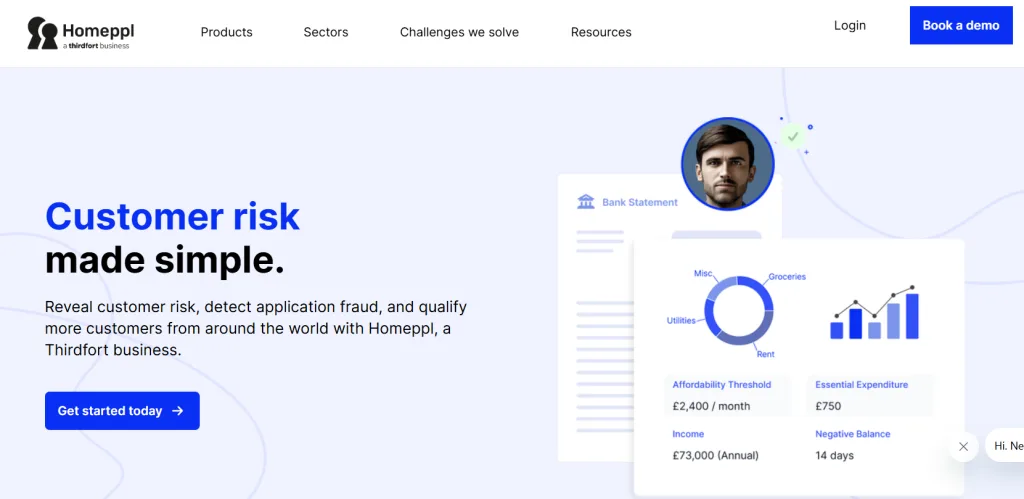

2. Homeppl

Best for: Agencies needing advanced fraud checks on documents or high-risk tenant profiles.

Homeppl brings fraud analytics into the tenant verification process with behavioural checks and AI that detect fake documents, duplicate applications, or risky behavioural patterns. It’s particularly suited for letting agencies working with overseas applicants or irregular employment types.

Key Features:

- AI-driven fraud detection for payslips, bank statements, and IDs

- Advanced tenant employment verification through document and behavioural cross-checks

- Coverage in 195+ countries with multilingual support

- Detailed risk scoring with confidence ratings

Pros:

- Unmatched protection against document tampering

- Deep analysis of tenant applications beyond basic checks

- Strong enterprise support and reporting

Cons:

- May flag legitimate documents as suspicious, requiring manual review

- Tenant journey can feel lengthy due to added fraud checks

- Not optimised for low-volume, single-property landlords

Pricing Snapshot:

- Custom pricing tailored to your monthly application volume and fraud detection requirements

- Higher per-reference cost than standard tools, justified by advanced fraud analytics and broader approval coverage

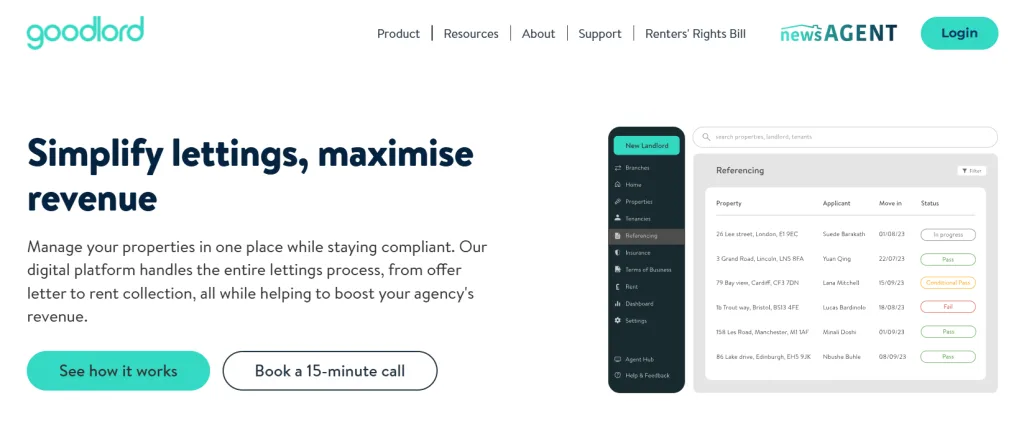

3. Goodlord

Best for: Letting agents using a full tenancy lifecycle platform with built-in tenant verification tools.

Goodlord offers tenant referencing as part of its broader lettings platform. It includes income verification, credit checks, and Right to Rent compliance in a unified dashboard, ideal for agents already managing contracts and payments through Goodlord.

Key Features:

- Equifax-powered credit check and adverse history

- Multiple tenant income verification options: payslips, Open Banking, HMRC links

- Automated Right to Rent check via IDVT

- Real-time status tracking and alerts

Pros:

- Supports a wide range of tenant types: PAYE, self-employed, benefit recipients

- Referencing integrates with contracts, rent collection, and insurance

- Trusted by 1,000+ UK agents with active FCA registration

Cons:

- Conditional passes may require rent in advance or guarantors

- Full referencing tools only available inside the Goodlord ecosystem

Pricing:

Tiered pricing: Essential (basic checks), Pro (income verification), and Priority (faster turnaround). Contact Goodlord for quotes.

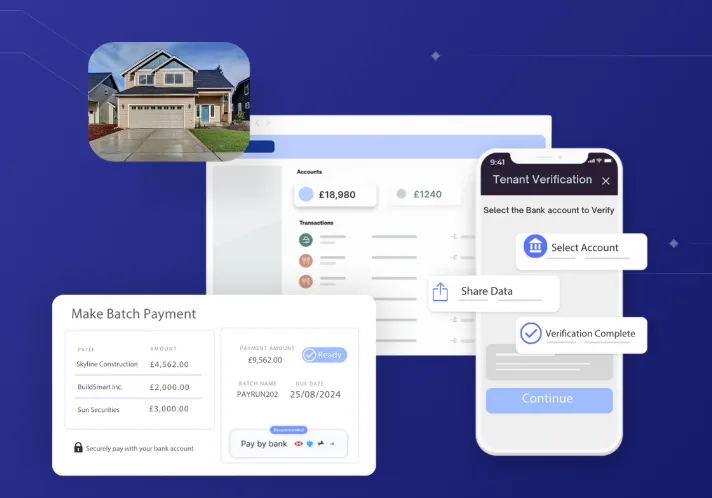

4. Checkboard

Best for: Hybrid letting or legal teams needing ID, AML, and income checks in a single journey.

Checkboard combines biometric identity verification with Open Banking-backed tenant income verification, making it ideal for agencies that want to minimise manual document handling. It’s also used in conveyancing and legal onboarding.

Key Features:

- Biometric ID check with NFC passport scanning

- Bank statement analysis via Open Banking

- AML screening and affordability scoring

- Built-in Pay by Bank and e-signature support

Pros:

- Handles ID, income, and AML in one invite

- Supports self-employed and freelancers with real-time banking data

- White-label flows and web dashboard included

Cons:

- Lite plan limits invitations per month

- Custom risk scoring and analytics require higher-tier plans

Pricing Snapshot:

Starts at £7.99 per verification on Lite. Volume pricing available for agencies.

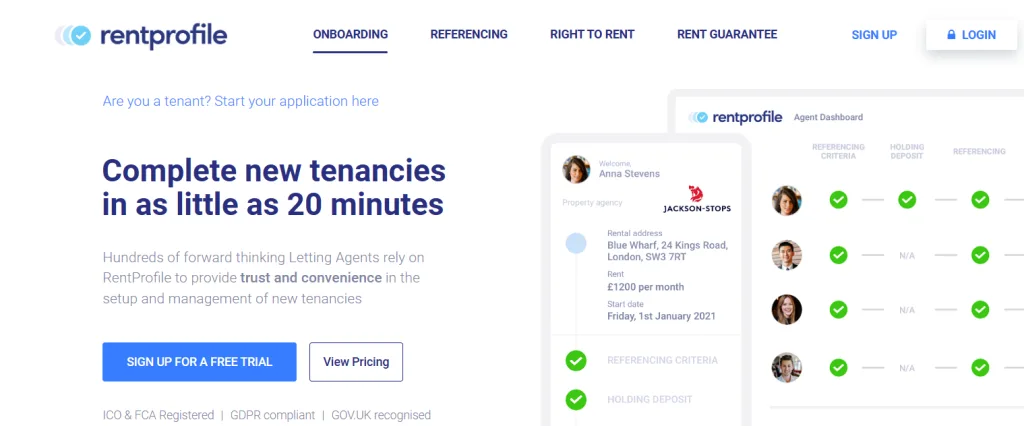

5. RentProfile

Best for: Letting agents who want white-labelled tenant background verification with risk scoring and optional rent guarantees.

RentProfile delivers clear reports with credit checks, identity validation, and income signals. It’s well-suited for agencies that want to maintain branding while assessing tenant suitability quickly.

Key Features:

- Credit file access with identity and affordability insights

- Digital landlord and employer references

- Optional Open Banking income view (on request)

- Branded emails, reports, and dashboards

Pros:

- Reports flag potential fraud, late payments, and financial risk

- White-label setup supports a branded client experience

- Add-ons available: Right to Rent, rent guarantee insurance

Cons:

- Income checks via Open Banking are not the default; must be requested

- Not built for large-scale automation or bulk uploads

Pricing:

Around £18 per tenant reference (varies by package and optional add-ons).

Choose the Right Tool for the Right Task

Tenant background verification isn’t one-size-fits-all. Some tools excel at instant income verification, others at fraud detection or full referencing workflows. The key is understanding which parts of your process need speed, automation, or deeper scrutiny.

- Finexer

Best for verifying tenant income in real time using Open Banking data. No document uploads or delays. - Homeppl

Ideal for screening high-risk or non-traditional tenants with advanced fraud detection and behavioural analysis. - Goodlord

A strong choice if you want referencing built into a broader lettings platform that includes contracts and Right to Rent compliance. - Checkboard

Great for combining ID, AML, and income checks in a single digital invite especially in legally sensitive or regulated workflows. - RentProfile

Suited for agents who want branded reports, employer references, and optional risk coverage like rent guarantee insurance.

Each of these tools solves a specific part of the tenant onboarding process. Choose what fits your current needs, or combine them for a more complete and efficient approach.

What is tenant background verification and why is it important?

Tenant background verification is the process of checking a renter’s credit history, income, ID, and fraud risk before offering a tenancy. It helps landlords avoid defaults, protect against fraud, and ensure the tenant can afford the rent.

What’s the difference between credit checks and income verification?

A credit check shows a tenant’s past borrowing behaviour, including late payments or CCJs. Tenant income verification, on the other hand, confirms current earning levels, often using Open Banking to review real-time bank activity like salary deposits.

Get Bank-Verified Tenant Income in 90 Seconds, Without Chasing Payslips! Try Finexer Now 🙂

![5 Best Tenant Background Verification Tools in the UK (2025) 1 5 Best Tenant Background Verification Tools UK [2025]](/wp-content/uploads/2025/05/Tenant-Background-verification-jpg.webp)