In 2025, Xero remains one of the leading accounting software providers for small and medium-sized businesses in the UK. Its growth has been supported by a combination of accounting features, real-time reporting tools, and a wide network of partner integrations.

For accounting platform startups with under £10 million in revenue, competing with established names like Xero brings several challenges. These include building customer trust, matching key product features, and managing technology development with limited resources.

Today, the increasing use of APIs offers a way for emerging platforms to compete more effectively. APIs allow startups to offer essential services such as bank connectivity, payment handling, and compliance support without the need for large internal development teams.

This blog explains how accounting platform startups can build a strong Xero alternative by using Finexer’s API services.

Keep Reading or jump to the section you’re looking for:

Xero’s Current Market Dominance

In 2025, Xero still holds around 30 percent of the UK SME accounting-software market. Its emphasis on real-time reporting, straightforward compliance tools, and a wide range of partner connections has kept the user base growing.

The company has lately added financial-literacy programmes for small firms, new payment features to reduce late invoices, and closer ties with UK banks. Its third-party app store also lets customers adapt workflows to their own needs, which helps retain users.

For accounting-platform startups, grasping the full scope of Xero’s offer is essential. Competing means delivering core bookkeeping features and also covering areas such as cash-flow insight, payment handling, and live bank data fields where the market leader has invested heavily.

📚 Cloud accounting software for Startups

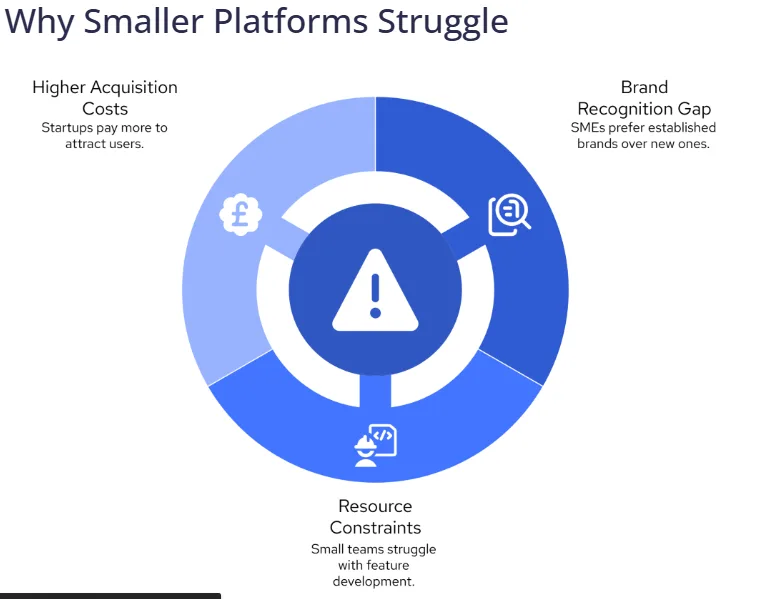

Why Smaller Platforms Struggle

- Brand recognition – Xero is familiar to many SMEs, so it is often chosen first even when other products match key features.

- Resource gap – Because it can fund larger development teams, the incumbent releases new tools and security updates more often than a startup can.

- Acquisition cost – With strong word-of-mouth and bigger marketing budgets, the platform attracts users at a lower cost per client, leaving newcomers to spend more on targeted campaigns.

To close this gap, accounting-platform startups must focus on clear advantages i.e speed of delivery, niche specialisation, or better real-time data, rather than trying to mirror everything the larger provider already offers.

The Role of APIs in Accounting Software

APIs are changing how accounting platforms deliver services. Instead of building every feature from the ground up, startups can now integrate with trusted providers to offer essential capabilities such as bank connectivity, real-time transaction access, payment services, and compliance support.

This approach helps smaller platforms add important features faster and with lower development costs, allowing them to better meet customer expectations without needing large internal teams. For accounting platform startups, APIs provide a practical route to expand services, shorten development cycles, and stay competitive against larger providers.

📚 Cloud accounting software for Startups

Finexer’s API Capabilities for New Accounting Startups

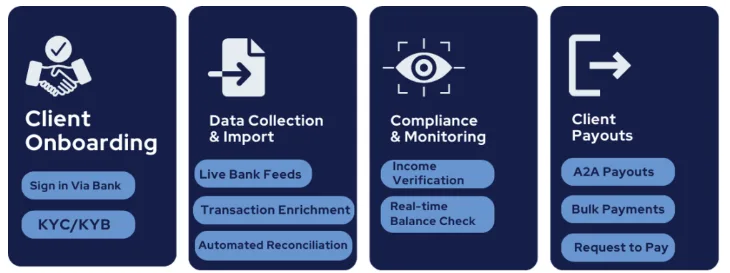

Xero offers an established API, primarily focused on accounting data and basic bank feed management. However, a new accounting platform may need broader functionality to meet growing customer demands, especially around real-time banking access and flexible payment options.

Finexer’s Open Banking API vs Xero

| Feature Category | Xero APIs | Finexer APIs | What It Means for Startups |

|---|---|---|---|

| Bank Data Access | Basic bank feeds, updated daily | Real-time feeds from 99% of UK banks | Timely financial data for better reporting and decision-making |

| Payment Processing | Invoice creation and reconciliation | Direct account-to-account payments | Expanded payment options beyond traditional invoicing |

| Compliance | OAuth 2.0 for user authentication | PSD2 compliance, full encryption, UK data centres | Stronger regulatory coverage and data protection |

| Developer Tools | Basic webhook and API support | Full sandbox, multiple webhook endpoints, RESTful API design | Easier development, faster testing, and simpler maintenance |

Five Strategic Advantages for a New Accounting Platform by Finexer

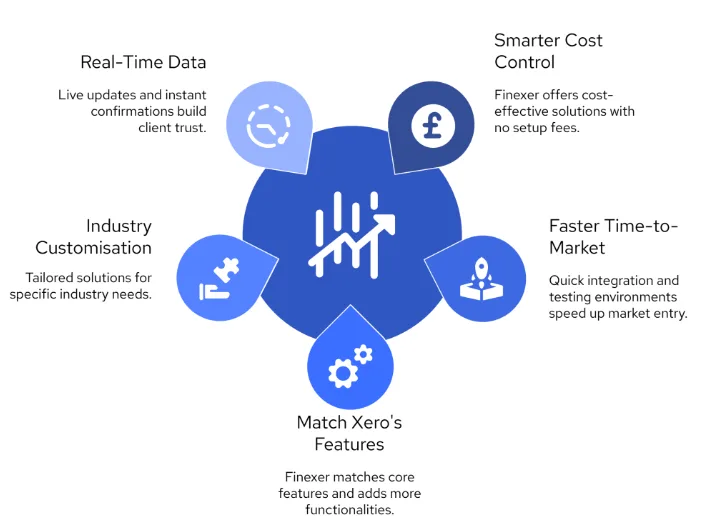

1. Smarter Cost Control for Growth-Stage Teams

Building direct bank integrations in-house can cost startups between £4,000 and £12,000 per connection, with ongoing maintenance costs rising each year . For early-stage platforms, this expense often delays feature launches or drains funds from customer acquisition.

By using Finexer’s ready-built API services, startups shift from heavy upfront investment to a flexible, usage-based pricing model. There are no setup fees, no minimum usage contracts, and no long onboarding cycles. This structure allows teams to keep budgets tight while still offering critical features like live transaction feeds and direct payments that SMEs now expect.

Finexer’s commercial model is designed specifically for companies scaling from first customers to established brands, making it a far more sustainable choice than building or buying large, bundled systems.

2. Faster Time-to-Market Without Development Bottlenecks

Speed is critical when competing with Xero. Finexer provides live connections to 99 percent of UK banks and includes a complete sandbox testing environment that mirrors production systems.

This means a startup’s technical team can move from initial integration to a live, revenue-generating feature in few weeks.

Instead of spending months building PSD2-compliant bank connectivity from scratch, teams can focus on customer experience and onboarding flows. Faster release cycles lead to faster learning, faster adaptation, and faster growth, which is critical when competing against platforms with established user bases.

3.Match Xero’s Core Features and Offer More with Finexer

Today’s SMEs expect more than basic bookkeeping. They want full visibility into their finances, flexible payment methods, and data security that meets FCA standards.

Finexer covers these expectations with:

- Real-time multi-bank transaction feeds updated daily

- Direct account-to-account payment initiation with no reliance on card networks

- Full PSD2 compliance and UK data residency for all financial data

- Usage-based commercial model without volume lock-ins

Startups can quickly match Xero’s core features while adding better payment flexibility and more control over data privacy, areas where large platforms sometimes offer limited options.

4.Industry-Specific Customisation that Larger Platforms Cannot Offer

Broad platforms like Xero must build for a wide audience. This leaves space for startups to tailor their product to specific industries that need more precise workflows.

Using Finexer, startups can:

- Custom-label transactions for industries like property rental or healthcare

- Adjust payment flows for B2B or subscription-driven businesses

- Create faster onboarding processes aligned to sector-specific needs

These tailored experiences create deeper loyalty and reduce competition with generic accounting solutions.

A well-positioned platform that fits an industry’s unique needs can carve out a defensible market space, even against far larger competitors.

5.Real-Time Financial Data That Improves Client Trust

For SMEs, cashflow visibility is critical. Waiting a full day for updated bank data increases the risk of late decisions and errors.

Finexer delivers:

- Real-time balance updates pulled directly from client bank accounts

- Instant payment confirmation when invoices are paid

- Daily synced feeds across 99% of UK banks without delays

This allows startups to offer dashboards and alerts that clients can rely on at any time, matching and in some areas exceeding what traditional platforms like Xero provide.

Consistent, reliable data strengthens client trust — a key factor for startups aiming to grow through referrals and long-term customer relationships.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Implementation Roadmap: Getting Started with Finexer APIs

Finexer’s API documentation is designed for clarity and quick deployment, helping technical teams move efficiently from planning to live production.

A typical integration journey can be broken down into the following stages:

Initial Access and Testing

- Secure API credentials from Finexer’s onboarding team

- Set up a development environment using Finexer’s full sandbox, which mirrors live conditions

- Familiarise the team with key endpoints, authentication flows (OAuth 2.0), and webhook options

Building the Connection

- Integrate bank data feeds across supported UK institutions

- Implement direct account-to-account payment flows if required

- Configure authentication and consent models to meet PSD2 standards

Internal Testing

- Run end-to-end transaction simulations

- Verify data retrieval speed, transaction accuracy, and user authorisation flows

- Check real-time updates across different banking institutions

Go-Live Deployment

- Migrate successful test configurations to production

- Implement monitoring to track transaction health, API call success rates, and webhook triggers

- Launch new features to customers with clear communication on capabilities and benefits

- Typical startups can move from initial access to first live transactions in six to eight weeks, depending on internal team size and resourcing.

How Sysynkt Strengthened its Accounting Platform with Finexer’s Open Banking APIs

About Sysynkt

Sysynkt is a cloud accounting platform that brings together web services in a unified portal, helping finance teams manage banking, procurement, purchase invoicing, employee expenses, and sales invoicing more efficiently. The platform focuses on delivering business process automation to both small businesses and large enterprises, with a particular emphasis on integrating open banking into finance operations.

Sysynkt’s goal was clear: to integrate Account Information Services (AIS) for seamless business bank reconciliation and Payment Initiation Services (PIS) for bulk supplier payments and employee expense processing within its accounting system.

The Challenge

Before working with Finexer, Sysynkt faced a significant industry gap.

Most major open banking Third-Party Providers (TPPs) focused primarily on consumer offerings, while the specific needs of businesses were often overlooked.

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

Sysynkt needed a partner who could deliver more than standard Open Banking services — they required tailored business-grade solutions that aligned with their commitment to serving complex enterprise needs.

Why Sysynkt Chose Finexer

The introduction to Finexer came through a recommendation within the Open Banking community, but the partnership grew based on shared values and a collaborative working style.

“We realised we had a lot in common with Finexer in how we approach services for our customers. This made it a highly collaborative partnership from the start.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

Sysynkt recognised that Finexer’s flexible approach, willingness to understand client-specific needs, and focus on supporting B2B use cases made it the right fit for their platform ambitions.

How Finexer Helped

Finexer addressed Sysynkt’s business-specific challenges by offering:

- Tailored Open Banking Offerings: Solutions designed around business workflows rather than consumer transactions.

- Customer-Centric Support: A partnership model where Sysynkt’s priorities were understood and supported at every stage.

- Reliable Security and Compliance: FCA-regulated infrastructure ensuring all integrations met the highest regulatory and security standards.

- Ease of Integration: A straightforward technical setup, allowing Sysynkt to implement AIS and PIS capabilities without complex internal redevelopment.

“Finexer’s willingness to work closely with us, rather than treating us as just another customer, was truly refreshing.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

The Result

By partnering with Finexer, Sysynkt successfully integrated Account Information and Payment Initiation Services directly into its accounting platform. This strengthened its value proposition to clients by:

- Delivering real-time business bank reconciliation

- Enabling direct account-to-account bulk supplier and employee expense payments

- Offering a seamless finance-office experience across multiple banking and invoicing processes

Sysynkt’s B2B automation platform is now better equipped to serve complex business needs across its global client base, setting a new benchmark for accounting-platform automation powered by Open Banking.

Looking Ahead

Sysynkt views Finexer as a long-term strategic partner as they continue to expand their Open Banking-powered finance solutions.

“Finexer is more than a provider—they’re a partner who aligns with our mission to deliver world-class services. We’re happy with where we are and look forward to growing alongside Finexer.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

The collaboration between Sysynkt and Finexer demonstrates how business-focused Open Banking integrations can transform the capabilities of modern accounting platforms, helping them meet higher client expectations while remaining agile in a competitive market.

The Future of API-Powered Accounting Platforms

The accounting software market in the UK remains competitive, with established providers like Xero setting a high standard for SMEs’ expectations. However, accounting platform startups with limited resources are no longer at a disadvantage when it comes to delivering core features that businesses rely on.

Open Banking APIs, such as those offered by Finexer, provide a direct path for startups to access real-time financial data, support account-to-account payments, and meet regulatory requirements without needing large internal teams or extended development timelines.

By focusing on integration rather than building every feature from scratch, startups can offer the capabilities that SMEs demand while maintaining control over costs, improving their speed to market, and differentiating through sector-specific specialisation.

The success story of Sysynkt shows how a startup can use Finexer’s infrastructure to create a competitive accounting platform that supports business clients at scale. With the right API partnerships, startups can meet today’s customer expectations for real-time insights, flexible payment solutions, and secure financial operations.

As Open Banking adoption continues to expand across the UK, the ability to connect financial services into accounting workflows will no longer be a competitive advantage — it will be a requirement. Accounting platform startups that act early and choose partners built for business needs, like Finexer, will be better positioned to grow sustainably and capture more of the SME market.

How can accounting platform startups compete with Xero in the UK?

Startups can compete by integrating real-time bank feeds, offering direct account payments, and focusing on specific industries. Using APIs like Finexer’s helps deliver essential features quickly without large development costs.

What features do SMEs expect from a Xero alternative?

SMEs expect real-time bank reconciliation, automated payments, secure data handling, and easy onboarding. Platforms must deliver these essentials to be seen as a serious alternative in the UK accounting software market.

How long does it take to integrate Finexer’s APIs?

Most startups complete Finexer’s API integration in six to eight weeks. Finexer provides a full sandbox, real-time UK bank feeds, and technical support to make the process faster and more reliable.

What compliance standards does Finexer meet?

Finexer is FCA-authorised and PSD2-compliant. All financial data is encrypted and stored within UK data centres, helping startups meet regulatory standards without managing infrastructure directly.

Can startups customise the Open Banking integration?

Yes, Finexer allows full customisation of transaction labels, payment flows, and onboarding processes. This enables startups to build industry-specific solutions that meet specialised client needs.

Grow your Accounting Startup with Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂