Category: Products

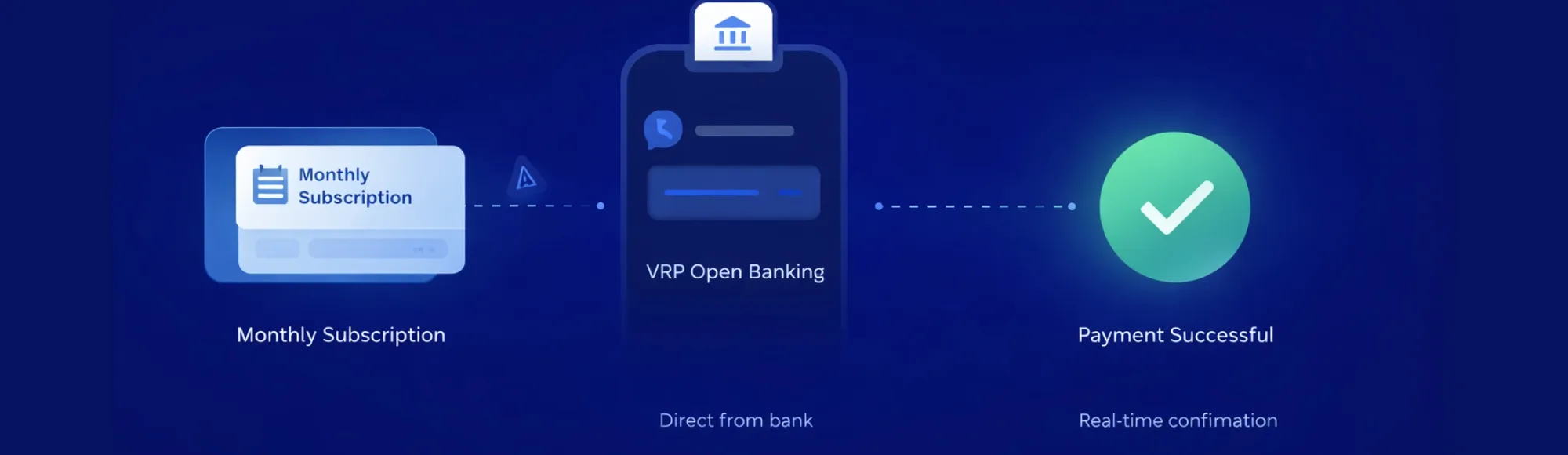

How VRP Payments Reduce Churn in UK Recurring Billing

Get VRP Payments with Finexer Cut churn, improve payment success & deploy faster with 99% UK bank coverage Contact Now Subscription businesses in the UK lose customers not because they want to leave, but because their payments fail. Card declines, expired details, and failed Direct Debits create friction that pushes customers away. Variable recurring payments…

Proof of Funds: Fast Verification Without Manual Bank Statements

Verify proof of funds in seconds without bank statements. Discover how direct bank verification speeds onboarding and removes document fraud risk.

Bulk Payments: How Businesses Send High-Volume Bank Payments Efficiently in the UK

Learn how UK businesses handle bulk payments at scale, including key use cases, bulk vs batch differences, and modern payment infrastructure.

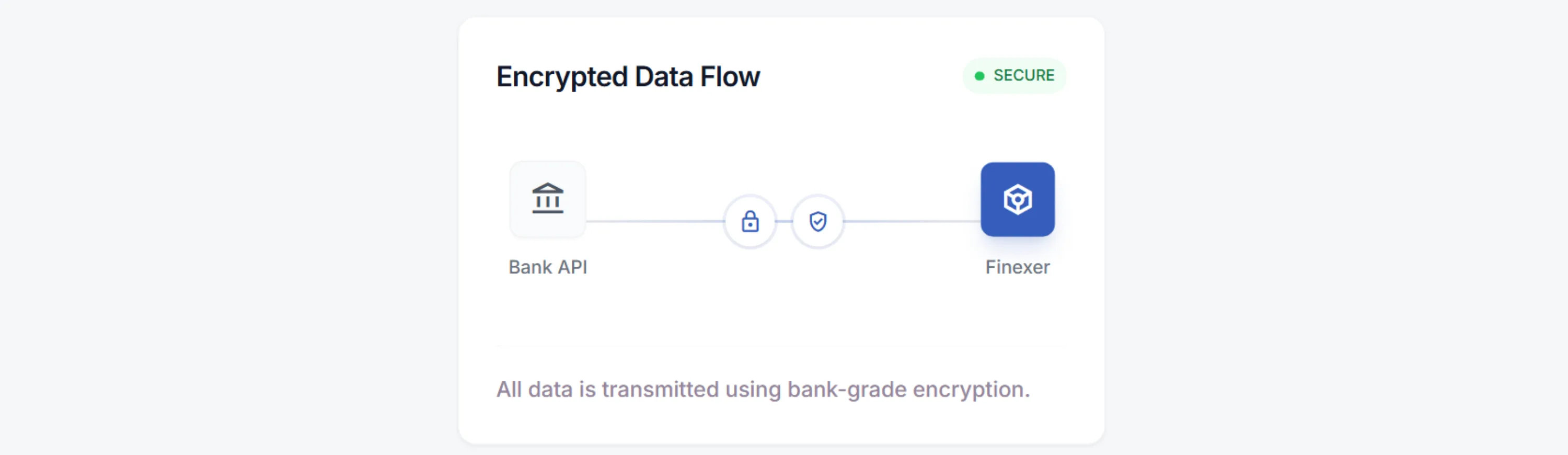

Why Open Banking API Security Is Under Regulatory Pressure in 2026

Get Secure Open banking API with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open Banking API Security in the UK has reached a scale where security failures now pose systemic risk, not isolated product issues. Active users grew from 12.1 million (Dec 2024) to 13.3 million…

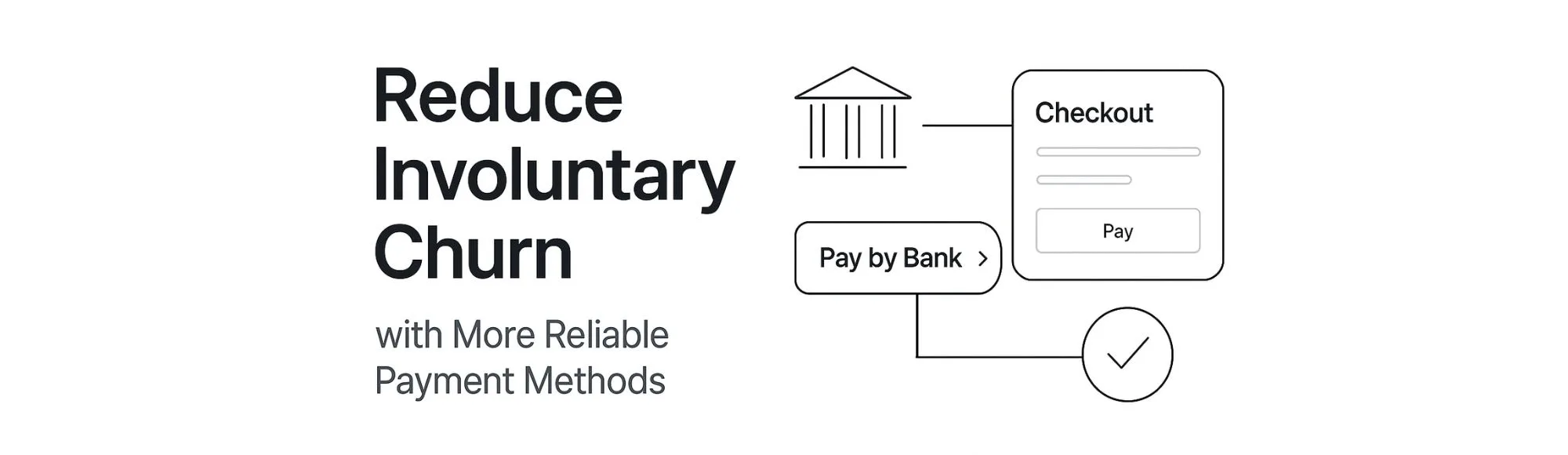

How SaaS Companies Can Reduce Involuntary Churn With Better Payment Flows

Want fewer failed renewals and steadier revenue? See how a more reliable payment method keeps customers subscribed Try Now A lot of churn in SaaS doesn’t happen because customers decide to leave. It happens because their payments fail. Card expiries, random declines, and SCA drop-offs quietly interrupt renewals — making it harder for teams to…

Building Behavioural Insights from Open Banking Data (Without Breaching Consent)

Learn how lenders can build behavioural insights from consent-led Open Banking Data. Clear guidance on affordability, patterns, and compliant data use.

Historical Financial Data Aggregation: How It Works and Key Insights

Learn how historical financial data aggregation helps UK businesses access up to 5 years of bank data via regulated APIs for compliance, credit, and accounting.

Transfer Funds Instantly: Fast, Secure Money Transfers in the UK

Learn how to transfer funds instantly in the UK with Faster Payments. Explore instant bank transfers, instant payouts, security, and key use cases.

Best Bank Data Aggregation Tools for 2025 to Streamline Your Workflow

The information in this comparison table was sourced from publicly available material on each provider’s website and official documentation as of 10th October 2025 Bank data aggregation has moved from being a back-office function to a core operational requirement for regulated businesses in the UK and Europe. With open banking adoption now exceeding 63 million…

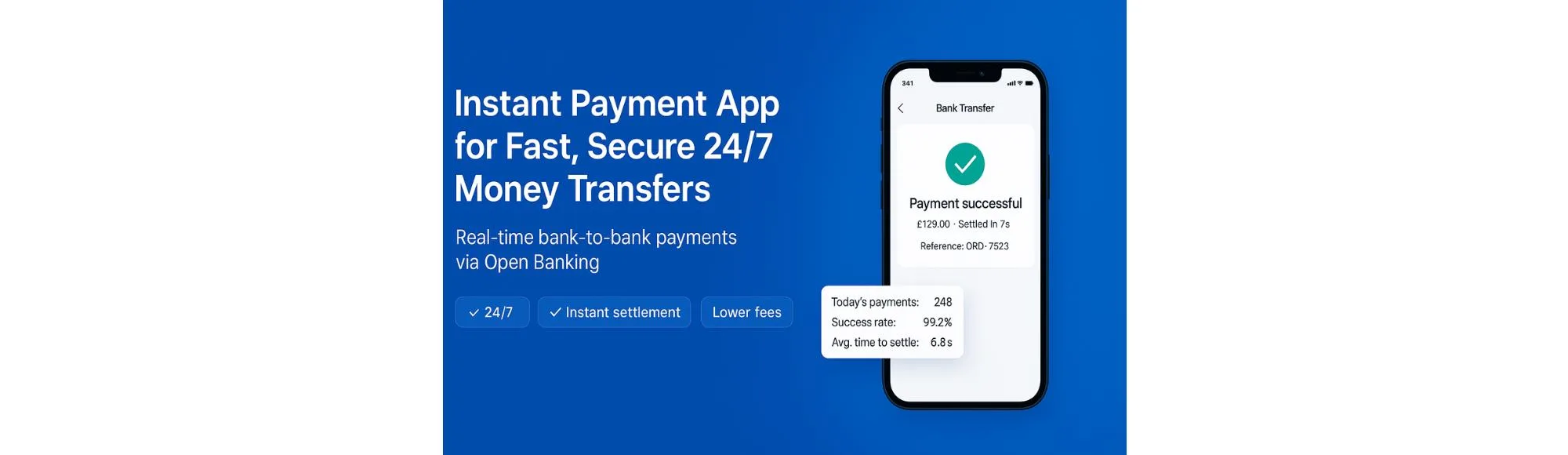

Instant Payment App for Fast, Secure 24/7 Money Transfers

Instant payment app for UK businesses: real-time bank transfers, 24/7 availability, lower fees than cards, and Open Banking Payment Initiation by Finexer.

Consent-Driven Financial Data Aggregation: Secure Account Access Explained

Learn how financial data aggregation works, from consent to secure APIs. Benefits, challenges, regulations, and future trends explained clearly.

Instant P2P Money Transfer Guide for UK Businesses

Learn how instant P2P money transfer works, key methods, security tips, and how to build P2P platforms in the UK using Finexer’s API.

Understanding Commercial VRPs: The future of Variable Recurring Payments for UK businesses

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Imagine a better and smarter way of handling multiple recurring payments, without losing control. Let me introduce you to the world of Commercial VRPs, the next major development in the world of open banking. Growing…

Insurance Payment Methods in 2025: Top Solutions for UK Businesses

Start Collecting & Paying Instantly Cut costs and delays in insurance payments. Use Finexer to connect with 99% of UK banks for instant premium collections and claim payouts. Try Now The way customers pay for insurance is undergoing a major shift. For UK insurers, brokers, and online merchants selling insurance products such as travel, car…

How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms

Get Instant Withdrawals with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms If your platform moves money daily, whether it’s paying contractors, refunding customers, or releasing commissions, you already know that traditional payout methods are painfully slow. Bank transfers…

Finexer Instant Payments API for UK Businesses

Pay Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In today’s economy, speed is a baseline expectation. Yet, most UK businesses are still stuck waiting one to three working days for a bank transfer to clear. Payroll runs get delayed, supplier relationships are strained, and…

Finexer AIS API: Access Real-Time Bank Data in the UK

Get Instant Bank Data with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In financial services, timing and accuracy are everything. Yet many UK businesses still rely on slow, fragmented processes to access customer financial data, whether that’s asking for PDF bank statements, pulling delayed batch files,…

Finexer VRP API: Set Up Variable Recurring Payments in the UK

Get Paid Faster with Finexer’s VRP Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Traditional recurring payment systems weren’t built for today’s UK businesses. Whether you’re handling loan repayments, donation billing, or subscription renewals, chances are you’re stuck with rigid, outdated tools, think standing orders, direct debits, or…

How Finexer Powers Bulk Payments for UK Businesses

Now Pay Faster with Finexer! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the world of business finance, few functions are as routine or as risky, as bulk payments. Whether you’re disbursing salaries, paying out investor returns, settling refunds, or managing contractor invoices, bulk payment processing is…

7 Business Functions Made Easier with an Account Information API

Get Instant Bank Data with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Manual document uploads. Delayed verifications. Incomplete financial data. For years, these have been the bottlenecks slowing down business operations across industries, from onboarding and credit checks to payouts and compliance reviews. But a better…

Choosing a Pay by Bank API: What Actually Matters for Your Dev Team

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Integrating a pay by bank API isn’t a usual decision; it’s a technical one. Your dev team is the first to see how well an API performs, and often the last to clean up when…

5 Best Source of Funds Check APIs That Meet UK Compliance in 2025

Get Compliant with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Source of funds checks play a vital role in fighting money laundering. The Financial Action Task Force (FATF) emphasises that these checks help track money to its original source and verify its legal acquisition. This is a…

![Source of Funds Check API: UK Pricing Guide & Implementation Roadmap [2026] 23 Source of Funds Check API: UK Pricing Guide & Implementation Roadmap [2026]](/wp-content/uploads/2025/05/Sof-2026-jpg.webp)

Source of Funds Check API: UK Pricing Guide & Implementation Roadmap [2026]

Get Instant Bank Data with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now In 2024, the Financial Conduct Authority (FCA) issued over £176 million in fines, much of it tied to inadequate anti-money laundering (AML) controls. Starling Bank alone faced a penalty of £29 million for weaknesses in…

Identity Verification for UK Contractors: Avoid Payment Delays and Compliance Risks

Get Verified with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now If you’re in charge of paying contractors, you already know how often identity verification slows things down. The payment is ready, but the contractor hasn’t submitted the right details.. The payment is ready, but the contractor hasn’t…

KYC Processing Delays Holding You Back? Here’s How to Fix Them

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now KYC verification doesn’t always fail because of bad data. Sometimes it fails because nothing happens at all. Your applicant clicks “verify,” consents to share their details, and then… silence. No confirmation. No next step. Just a stalled…

Still Manually Reviewing Docs? Improve KYC Verification Speed with Open Banking

Get Verified with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now If you’re still asking users to upload multiple documents, chances are you’re slowing down your KYC verification speed and losing a lot of them before they ever complete onboarding. According to the Signicat “Battle to Onboard” report…

Customer KYC Process: Reduce Friction in Verification

Get Verified with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now For many clients, the customer KYC process feels intrusive. They’re often unsure why personal documents are being requested, especially when the service they’re signing up for doesn’t seem like it needs them. This disconnect can create hesitation,…

KYB UK Guide: Best Tools for Quick Business Verification in 2025

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Financial crime drains £290 billion from the UK economy each year, while global losses have reached £1.8 trillion. KYB UK regulations have grown stricter, especially after high-risk money laundering countries increased by 116% between 2019-2021. Businesses must…

Faster Refunds & Withdrawals for Retailers in 2025: What to Know

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now For most retailers, getting paid is the priority. But what happens when the money has to go the other way? Refunds and withdrawals aren’t just a backend task—they directly impact customer satisfaction, operational efficiency, and how trustworthy…

Guide to Transaction Enrichment API in 2025

Get Bank data with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now If you’ve ever worked with raw bank transaction data, you’ll know how messy and unhelpful it can be. Descriptions often look like random codes, merchant names are inconsistent, and there’s no easy way to tell if…