Businesses invest heavily in attracting customers—through paid advertising, content marketing, and personalised promotions. But even after all that effort, a staggering 70% of online shoppers abandon their carts before completing a purchase.

Why? Because the checkout process is often frustrating. Customers encounter:

- Long or complicated forms that take too much time to complete

- Limited payment options that don’t match their preferred methods

- Unexpected fees that only appear at the last step

- Slow load times that make them reconsider their purchase

- Security concerns that create hesitation before entering payment details

Each of these issues disrupts the buying experience, leading to lost revenue and wasted marketing spend. Businesses spend money acquiring traffic, only to see potential buyers drop off at the final stage.

We will guide you through:

Checkout Abandonment in the UK

A recent study found that 69% of UK consumers have abandoned an online purchase because the payment process was too complex. Additionally, 64% would stop their purchase if their preferred payment method wasn’t available. Source

7 Reasons for Checkout Abandonment

Without a structured approach to refining payment experiences, businesses lose customers at the last moment, directly impacting revenue and retention. Below are the most common reasons why checkout abandonment occurs and why businesses must focus on improving the payment experience.

1. Checkout Takes Too Long

Speed is one of the most important factors in Checkout Process Optimisation. Customers expect quick and hassle-free transactions, yet many checkout flows are too slow, leading to abandonment.

What slows down checkout?

- Too many form fields requiring excessive customer details.

- Multiple pages instead of a single, streamlined checkout experience.

- Repeated entry of information, such as billing and shipping details.

- Slow loading times between each checkout step.

Customers today demand efficiency. If Checkout Process Optimisation is neglected, the longer a transaction takes, the higher the chance a customer will abandon their cart.

2. Mandatory Account Creation Before Payment

One of the biggest checkout barriers is forcing customers to create an account before they can make a purchase. While businesses often encourage sign-ups for future marketing, this practice disrupts the Checkout Process Optimisation strategy by adding unnecessary friction.

Common issues with required account creation:

- Customers don’t want to spend extra time registering just to make a one-time purchase.

- Many users prefer guest checkout and abandon their cart if no such option exists.

- The additional step extends the checkout process, leading to frustration.

A well-structured Checkout Process Optimisation approach ensures customers can complete their purchase without unnecessary roadblocks.

3. Limited Payment Options

A critical part of Checkout Process Optimisation is ensuring customers can pay using their preferred method. Many businesses fail in this area, leading to avoidable drop-offs.

Common payment limitations that drive abandonment:

- Offering only credit or debit card payments, ignoring digital wallets or bank transfers.

- Lack of alternative payment options, such as open banking payments or Buy Now, Pay Later (BNPL) services.

- Excluding regional payment methods, making it difficult for international customers to pay.

A fully optimised checkout process accommodates different payment preferences, ensuring that all customers have a convenient and reliable way to complete their transaction.

4. Unexpected Costs at Checkout

Hidden fees remain one of the biggest checkout deterrents. Customers expect full transparency in pricing, and when unexpected costs appear at the final step, it damages trust and causes drop-offs.

How unexpected costs impact Checkout Process Optimisation:

- Shipping fees, service charges, and taxes added at the last moment create frustration.

- Customers feel misled when the final amount is higher than expected.

- Many buyers will compare prices elsewhere instead of proceeding with payment.

One of the fundamental rules of Checkout Process Optimisation is to ensure cost transparency upfront so that customers are not surprised at the final payment stage.

5. Security Concerns and Lack of Trust

A lack of security signals at checkout causes hesitation, even for customers who intend to complete their purchase. A well-executed Checkout Process Optimisation strategy ensures that customers feel safe when entering payment details.

What makes customers abandon checkout due to security concerns?

- No visible security badges (SSL encryption, PCI compliance, or trusted payment logos).

- Inconsistent checkout page design, which makes the payment step feel separate from the main website.

- Unclear refund or chargeback policies, leaving customers uncertain about their purchase protection.

Customers will not proceed if they lack confidence in the security of their payment information. A business that prioritises Checkout Process Optimisation must display clear security assurances throughout the payment experience.

6. Poor Mobile Checkout Experience

With mobile shopping continuing to grow, mobile Checkout Process Optimisation has become essential. Yet, many businesses still struggle to provide a smooth mobile payment experience.

Common mobile checkout issues include:

- Small buttons and form fields that are difficult to use on a mobile screen.

- Checkout pages that are not mobile-responsive, requiring excessive zooming and scrolling.

- Lack of one-tap payment options, such as Apple Pay or Google Pay.

A strong focus on mobile Checkout Process Optimisation is necessary to retain customers who prefer fast, on-the-go transactions.

7. Payment Failures and Processing Errors

Even customers who are fully committed to making a purchase may face payment declines or checkout errors, leading to frustration and lost revenue. A key component of Checkout Process Optimisation is ensuring a smooth payment processing experience.

Why payments fail during checkout:

- Credit card declines due to fraud prevention rules (even when the transaction is legitimate).

- Checkout errors caused by unstable payment gateways or system failures.

- No alternative payment method offered, forcing customers to start over if their first attempt fails.

An effective Checkout Process Optimisation approach includes reliable payment processing, reducing failed transactions and keeping customers on track to complete their purchase.

8 Practical Solutions for Checkout Process Optimisation

Now that we’ve identified the key reasons why customers abandon checkout, the next step is to implement solutions that directly address these issues. Checkout Process Optimisation is about removing unnecessary friction, improving payment reliability, and creating a clear, efficient flow that encourages customers to complete their purchase.

Below are practical ways to optimise the checkout experience, ensuring fewer abandoned transactions and higher conversions.

1. Reduce the Number of Steps in Checkout

The more steps a customer must go through, the higher the likelihood they will abandon the process. A long and complicated checkout discourages buyers, especially those who expect a quick and simple experience.

How to shorten checkout:

- Use single-page checkout instead of multiple steps across different pages.

- Minimise required form fields by removing unnecessary data collection.

- Enable auto-fill so returning customers don’t have to re-enter their details.

- Use progress indicators to show how many steps remain.

Businesses that refine their checkout flow through Checkout Process Optimisation consistently see higher conversion rates and lower cart abandonment.

2. Allow Guest Checkout Without Forcing Account Creation

One of the biggest mistakes businesses make is forcing users to create an account before making a purchase. Many first-time buyers prefer a quick checkout without commitments.

How to improve guest checkout:

- Allow purchases without account creation but offer an option to register after checkout.

- Use social logins (Google, Apple, Facebook) for a faster sign-in experience.

- Give customers the option to save their details for future purchases, rather than requiring it upfront.

Prioritising guest checkout within Checkout Process Optimisation ensures that customers can complete their transaction quickly, reducing frustration and increasing sales.

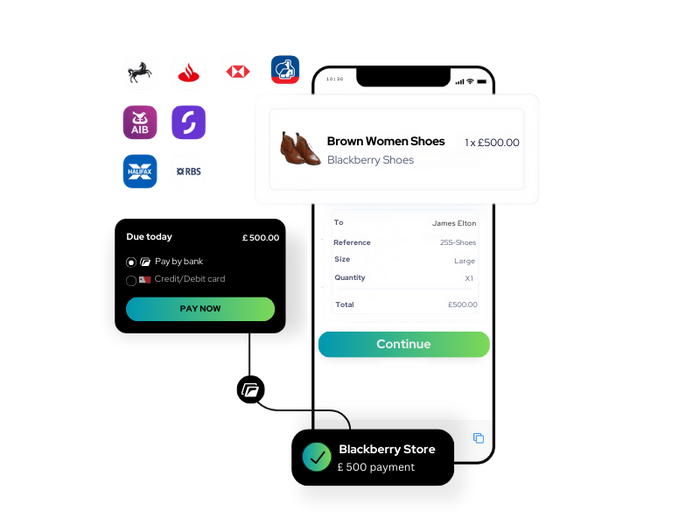

3. Expand Payment Options to Match Customer Preferences

A flexible checkout process should accommodate a variety of payment methods. Limiting customers to only credit or debit card payments creates an unnecessary barrier.

How to improve payment flexibility:

- Accept digital wallets like Apple Pay, Google Pay, and PayPal.

- Support open banking payments, allowing direct bank transfers.

- Offer Buy Now, Pay Later (BNPL) services to provide more purchasing flexibility.

- Ensure compatibility with local payment methods for international customers.

Checkout Process Optimisation means giving customers the freedom to pay the way they want, reducing drop-offs caused by limited payment choices.

4. Be Transparent About Costs Early in the Process

Hidden fees are one of the biggest reasons for last-minute checkout abandonment. Customers should know exactly what they will pay before they reach the final step.

How to improve cost transparency:

- Display taxes, shipping fees, and service charges upfront on product pages.

- Offer free shipping thresholds to encourage higher spending.

- Provide a detailed breakdown of costs on the checkout page before customers enter payment details.

By integrating clear pricing into Checkout Process Optimisation, businesses build trust and reduce abandonment caused by unexpected charges.

5. Build Customer Trust with Security and Reliability

A secure and trustworthy checkout process encourages customers to complete their purchase without hesitation. If a checkout page lacks credibility, customers are more likely to abandon the process.

How to improve checkout security:

- Use SSL encryption and display security badges to reassure customers.

- Keep branding consistent across checkout pages to avoid suspicion.

- Ensure PCI compliance when handling payment details.

- Use fraud detection tools that do not disrupt legitimate transactions.

A well-executed Checkout Process Optimisation strategy builds confidence, making customers feel safe when entering their payment information.

6. Improve Mobile Checkout for Faster Transactions

Since mobile purchases now make up a significant percentage of online transactions, checkout processes must be fully optimised for mobile users.

How to create a mobile-friendly checkout:

- Ensure checkout pages are fully responsive, adapting to different screen sizes.

- Use large buttons and easy-to-tap fields to simplify navigation.

- Allow one-click payments via Apple Pay, Google Pay, or stored card details.

- Minimise text input by using dropdown menus and pre-filled data.

Checkout Process Optimisation for mobile ensures that customers can complete transactions without struggling with poor design or usability issues.

7. Reduce Payment Failures with Smart Processing

Even customers who fully intend to complete their purchase may face payment failures due to issues beyond their control. If a transaction is declined without explanation, many customers will simply leave instead of trying again.

How to reduce payment failures:

- Use smart payment routing to automatically retry failed transactions.

- Allow customers to save multiple payment methods for backup.

- Provide clear error messages when a payment fails, with steps to resolve the issue.

An optimised payment processing system within Checkout Process Optimisation keeps customers on track to complete their transaction, even if an initial attempt fails.

8. Improve Checkout Page Load Times

Slow checkout pages frustrate customers and increase abandonment rates. Even a small delay can push users to leave before completing payment.

How to speed up checkout:

- Reduce unnecessary scripts and large images that slow down the page.

- Use browser caching to load checkout pages faster.

- Test checkout performance on different devices and networks.

Faster checkout times are a fundamental part of Checkout Process Optimisation, ensuring that customers don’t leave simply because of unnecessary delays.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How Finexer helps businesses optimise checkout process

1. Reduce Transaction Costs by Up to 90%

Traditional payment methods, such as card processing and direct debits, come with high transaction fees due to intermediary banks and payment networks. These costs add up quickly, cutting into profit margins—especially for businesses with high transaction volumes.

How Finexer Solves This:

- Eliminates card processing fees by enabling direct account-to-account payments.

- Removes third-party intermediaries, reducing costs significantly.

- Lower operational expenses compared to traditional card networks and payment gateways.

By integrating Finexer’s PayByBank API, businesses can drastically cut transaction costs while ensuring a seamless and secure payment experience for customers.

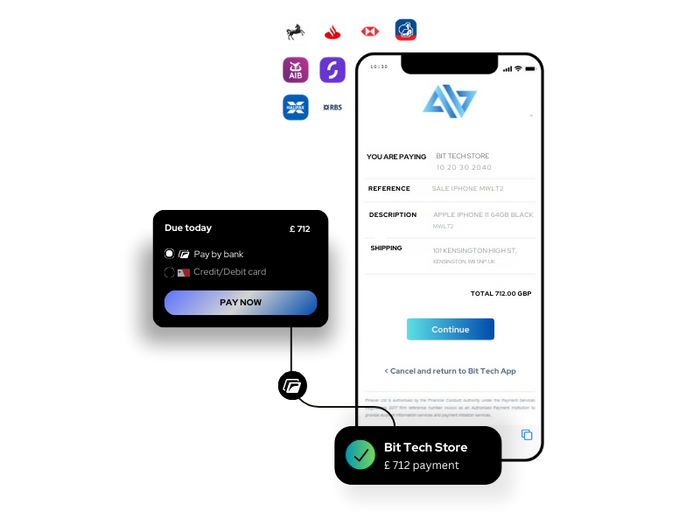

2. Faster Payments with Instant Bank Transfers

Card payments and standard bank transfers can take hours or even days to settle, delaying access to funds. Finexer’s PayByBank feature enables instant payments, ensuring businesses receive funds within minutes, improving cash flow and reducing waiting times.

How Finexer Improves Speed:

- Funds are settled in near real-time, without requiring additional clearing or processing delays.

- No dependency on card networks, reducing wait times compared to traditional payments.

- Secure authentication via open banking, ensuring transactions are approved instantly by the customer’s bank.

With instant bank payments, businesses can improve cash flow, reduce reliance on slow payment methods, and create a better checkout experience for customers.

3. Customisable, White-Label Checkout for Full Brand Control

Unlike third-party payment processors that redirect customers away from a business’s website, Finexer’s PayByBank solution is fully customisable and white-label. This means businesses can integrate secure, direct bank payments while maintaining full control over their branding and user experience.

How Finexer Enhances Checkout Process Optimisation:

- Fully customisable checkout UI, allowing businesses to match their brand identity.

- Seamless API integration that works within existing payment systems.

- Secure and compliant infrastructure, removing the need for businesses to handle sensitive financial data directly.

By using Finexer’s white-label PayByBank API, businesses can retain full ownership of their payment experience, improving trust and consistency for their customers.

What is Checkout Process Optimisation, and why does it matter?

Checkout Process Optimisation is the process of improving the final steps of an online purchase to reduce cart abandonment and increase successful transactions. It involves simplifying payment flows, offering multiple payment options, ensuring security, and reducing unnecessary steps that slow down the checkout experience.

How does a slow checkout process impact online sales?

A slow checkout process leads to frustration and higher cart abandonment rates. Studies show that 69% of UK consumers abandon their purchase when the checkout is too complex, and slow-loading pages or lengthy forms can cause customers to leave before completing payment.

What are the biggest reasons customers abandon checkout?

The most common reasons customers abandon their purchase at checkout include:

->Long or complicated forms requiring excessive details

->Limited payment options that don’t match their preferences

->Hidden fees or unexpected costs appearing at the last step

->Slow page load times that make customers reconsider

->Security concerns that create hesitation before entering payment details

How can businesses speed up the checkout process?

Businesses can improve checkout speed by:

->Using single-page checkout instead of multi-step processes

->Reducing form fields to only the necessary details

->Implementing auto-fill and saved payment methods

->Ensuring fast load times by optimising scripts and images

Why is offering multiple payment options important?

64% of UK shoppers abandon their cart if their preferred payment method is unavailable. Businesses that support credit/debit cards, digital wallets (Apple Pay, Google Pay), PayByBank, and Buy Now, Pay Later (BNPL) options reduce checkout abandonment and increase conversion rates.

How does PayByBank improve checkout process optimisation?

PayByBank allows customers to pay directly from their bank account without using card networks. This eliminates transaction fees, speeds up payments, and reduces fraud risks, making it a secure and cost-effective alternative to traditional payment methods.

What security measures improve customer trust at checkout?

To build trust and reduce abandonment, businesses should:

->Display SSL certificates and security badges (PCI compliance, verified payment providers)

->Offer biometric authentication for faster and safer payments

->Use fraud detection tools to prevent unauthorised transactions

How do real-time payment insights help improve checkout success?

Real-time payment analytics allow businesses to track customer behavior at checkout. With Finexer’s payment insights, businesses can:

->Identify where customers drop off and make improvements

->Monitor payment success rates and fraud detection trends

->Optimise checkout flows based on real-time customer interactions

Faster, Cost-Effective Checkout Experience with Finexer, Book a Demo now and Get 14 days Free Trial 🙂