Selecting the right software for Making Tax Digital is a critical decision for accountants. The wrong choice can lead to compliance risks, wasted time, and frustrated clients, while the right one can make VAT submissions faster, simpler, and fully audit-ready.

Yet with so many providers offering seemingly similar solutions, choosing MTD software isn’t just about picking the most popular brand or the cheapest plan. It requires a careful match between the software’s features and the real-world needs of your practice.

In this guide, we’ll walk you through a simple 5-step decision framework built specifically for accountants. You’ll learn how to:

- Map your existing VAT workflow

- Check for HMRC recognition and digital link compliance

- Evaluate feature fit and scalability

- Compare support options, pricing models, and contract flexibility

- Pilot the software with real returns before full adoption

By following this framework, you’ll be able to make a confident, informed decision that protects your clients, your team, and your firm’s compliance standing.

1.Map Your Core VAT Workflow

Before even looking at software features or pricing, the first step in choosing MTD software is understanding your current VAT process in detail. Without a clear map of how you manage VAT today, it’s easy to choose a tool that doesn’t fit your real needs.

Identify Each Stage of Your VAT Workflow

| Stage | Key Questions |

|---|---|

| Data Capture | Where do transactions originate—client spreadsheets, bookkeeping software, bank feeds? |

| Review & Coding | Who reviews transactions and applies VAT codes? Is this done in spreadsheets or a bookkeeping system? |

| Calculations | How are VAT totals calculated—through formulas, reports, or manual checks? |

| Approval | Is there a manager or partner who signs off returns before submission? |

| Submission | Who actually submits the return, and using what tool? |

| Record-Keeping | How and where are submitted returns and supporting documents stored? |

Document each of these stages clearly. Some firms find it helpful to sketch the process in a flowchart or create a simple checklist.

Understand Volumes and Complexity

Knowing the volume and complexity of your VAT work will influence the type of MTD software you need:

- Number of VAT-registered clients

- Filing frequencies (monthly, quarterly, annually)

- Special cases like group VAT returns or partial exemption

- Client industries (some sectors like construction or retail have more complex VAT needs)

The more complex your client base, the more important it is to choose scalable and flexible software.

List Integration Requirements

- Do you need the software to connect to Excel?

- Should it integrate with bookkeeping platforms like Xero, Sage, or QuickBooks?

- Is API access or batch submission important for your team?

Spot Manual Hand-Offs

Anywhere you rely on copying, pasting, or emailing spreadsheets is a risk point under MTD rules. Choosing MTD software that can automate or securely connect these steps helps protect your firm from compliance breaches.

2. Check HMRC Recognition and Digital-Link Compliance

Once you’ve mapped your VAT workflow, the next step in choosing MTD software is confirming that any solution you’re considering meets HMRC’s official requirements, both for software recognition and digital record-keeping standards.

Confirm HMRC Recognition

HMRC maintains a public list of recognised MTD software providers for VAT. Always check that the software you are evaluating appears on this list.

Key points to verify:

- Is the product recognised for both individual businesses and agents (if needed)?

- Are there any restrictions (e.g., specific to cloud-only users or desktop users)?

- Is the version you are planning to buy listed (some providers have separate editions)?

If a product isn’t HMRC-recognised, it cannot legally submit VAT returns through the MTD gateway — no matter how good its features look.

Understand Digital Link Compliance

Making Tax Digital rules require that VAT data flows digitally from the original source to the VAT submission without manual intervention like copy-pasting.

When choosing MTD software, check that it:

- Supports direct data flows from spreadsheets, ledgers, or accounting software

- Maintains audit trails showing the link between the transaction source and VAT return

- Can handle imported bank feeds, invoices, or Excel files without breaking digital links

Good signs:

- Excel cell mapping

- Ledger integrations via API

- Full audit trail download options

Red flags:

- Manual retyping needed between data and VAT return

- Export to CSV with manual entry into filing screens

- Lack of clear digital link documentation

Keep a Simple Comparison Table

As you shortlist vendors, create a quick table like this:

| Software | HMRC Recognised | Digital Link Supported | Notes |

|---|---|---|---|

| Product A | ✅ | ✅ | Full Excel + API support |

| Product B | ✅ | ❌ | Requires manual data entry |

| Product C | ❌ | ❌ | Not suitable |

Only software that ticks both boxes — recognition and digital links — should move to your next evaluation steps.

3. Evaluate Feature Fit and Scalability

Once you have confirmed HMRC recognition and digital link compliance, the next step in choosing MTD software is to assess how well the product fits your current needs — and whether it can scale with your firm as you grow.

Not all MTD software is built the same. Some tools are perfect for small practices with simple client portfolios, while others are designed to handle hundreds of VAT submissions across multiple sectors and tax complexities.

Here’s what to check:

Multi-Client Management

If you manage VAT for several clients, look for software that offers:

- A central dashboard to view and track all client filings

- Easy switching between client accounts

- Clear status indicators (e.g., drafted, filed, awaiting approval)

Managing clients individually through separate logins or workspaces will slow your team down significantly over time.

Group VAT and Special Schemes Support

Not every software solution supports:

- Group VAT returns (where multiple entities file under a single VAT number)

- Partial exemption calculations

- Flat rate scheme or margin scheme adjustments

If any of your clients fall under these categories, check the software’s capabilities carefully before committing.

Excel Bridging and Data Import Options

Many practices still use Excel for record-keeping.

When choosing MTD software, ensure it can:

- Map fields directly from Excel spreadsheets

- Maintain digital links without manual workarounds

- Validate data before submission

Bonus if the tool supports batch uploads for speed.

User Access and Permission Controls

If multiple staff members will be involved, the software should allow:

- Setting different permission levels (e.g., preparer, reviewer, approver)

- Audit logs that record who made changes or submissions

This is essential for maintaining accountability and compliance, especially in larger firms.

Scalability for Future Needs

- Can you add more users without high extra costs?

- Can the platform handle growth if your client base doubles?

- Are regular updates included, especially when MTD for Income Tax Self-Assessment (ITSA) rolls out?

Choosing MTD software that can adapt to your growth will save you from costly platform switches later.

4. Compare Support, Pricing, and Contracts

After confirming features and scalability, the next step in choosing MTD software is to carefully compare the practical terms of using the product, how it’s priced, what support you get, and whether you’re locked into rigid contracts.

Many firms make the mistake of only comparing feature lists, but ignoring service terms can cause bigger problems once you’re live.

Here’s what to check:

Understand the Pricing Structure

Different MTD software providers offer different pricing models:

| Model | What It Means |

|---|---|

| Per Submission | Pay a fee each time you file a VAT return — good for low-volume firms. |

| Monthly/Annual Licence | Flat fee for unlimited submissions — better for firms with lots of VAT clients. |

| Client-Based Pricing | Charges based on number of clients, regardless of submissions. |

When choosing MTD software, pick a pricing model that aligns with your client portfolio size and filing frequency.

Always ask:

- Are updates and new feature releases included in the price?

- Is there a minimum contract length or notice period?

- Are there hidden costs (e.g., for onboarding, support, extra users)?

Assess Support Levels

Support becomes critical the moment you face a filing issue close to a VAT deadline.

Ask potential providers:

- Is support UK-based and available during working hours?

- Do they offer live chat, phone, or just email ticketing?

- What’s the average response and resolution time?

A cheaper software with slow or poor support can cost far more in stress and lost time during busy periods.

Look Out for Contract Flexibility

Especially if you’re trialling MTD software for the first time, flexibility matters.

Prefer software that:

- Offers a free trial or sandbox environment

- Allows monthly billing instead of forcing long contracts

- Doesn’t tie you into a multi-year deal unless you choose it voluntarily

In choosing MTD software, flexibility protects you from being stuck with a system that doesn’t fit as your practice evolves.

5. Run a Pilot and Gather Feedback

Even after checking features, pricing, and support, the final step in choosing MTD software is to test it in real-world conditions before fully committing. A pilot run helps you spot issues that brochures and demos often miss.

Here’s how to run a smart pilot:

Select a Small Pilot Group

Choose a handful of VAT-registered clients that represent different scenarios:

- A simple, straightforward VAT return

- A more complex case (group VAT, partial exemption, high transaction volume)

This way, you can test how the software handles both easy and challenging cases.

Use the Software End-to-End

During the pilot, go through every key task you would in live operation:

- Import client data (from Excel, bookkeeping software, or bank feeds)

- Map VAT fields and check digital links

- Review VAT calculations

- Submit the VAT return via the software to HMRC (if in a live environment)

- Generate and archive audit trails

Avoid “half pilots” where you only simulate parts of the process — real submissions reveal real strengths and weaknesses.

Involve the Real Users

Get feedback not just from partners, but from:

- The preparers who input and review VAT data

- The reviewers or approvers

- The admin or accounts staff responsible for client communications

Choosing MTD software isn’t just about ticking technical boxes — it must also work for the team that uses it daily.

Document Pilot Findings

For each software tested, create a simple record:

| Area | Questions to Answer |

|---|---|

| User Experience | Was it easy to navigate and complete tasks? |

| Filing Accuracy | Were returns submitted correctly without rework? |

| Support Experience | How quickly and helpfully did support respond to questions? |

| Client Communication | Were submission receipts and confirmations easy to generate? |

This documentation makes final decision-making evidence-based rather than based on opinions.

How Finexer Fits into Your MTD Software Strategy

While most MTD software focuses on filing, many accountants still struggle with what happens before submission — collecting accurate, up-to-date financial data from clients. This is where Finexer supports firms using spreadsheet workflows, bridging tools, or accounting software that lacks direct bank connectivity.

Finexer complements your MTD setup by offering:

| Feature | How It Supports Your Practice |

|---|---|

| 99% UK bank coverage | Pull bank data directly into Excel, ledgers, or MTD software — no chasing clients for PDFs |

| Real-time transaction feeds | Keep VAT records current and error-free throughout the quarter |

| Usage-based pricing | No bundles or subscriptions — ideal for firms with varied client volumes |

| Quick client onboarding | Authorise and activate feeds within days, not weeks |

| FCA-regulated, UK-hosted | Fully compliant and secure for accounting workflows |

| White-label dashboard | Give clients access to their live data under your own branding |

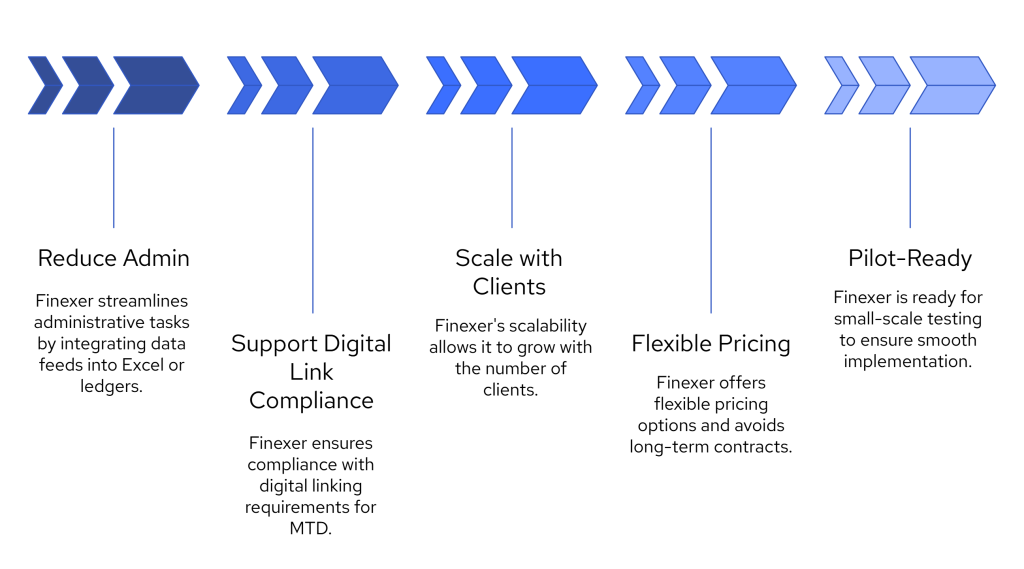

How Finexer Helps in the Process

- Step 1 – Map your workflow: Finexer reduces admin by feeding transactions into the tools you already use — Excel, ledgers, or cloud software.

- Step 2 – Digital link compliance: Finexer helps preserve compliant digital flows by syncing live data directly, without manual re-entry.

- Step 3 – Scalability: Whether you manage 5 clients or 500, Finexer scales with your portfolio and lets you add new bank feeds as needed.

- Step 4 – Pricing & contracts: With no setup fees or long-term lock-ins, Finexer gives you flexibility when evaluating software combinations.

- Step 5 – Pilot-ready: You can connect one client to test Finexer’s real-time feeds before rolling it out to the wider practice.

By pairing Finexer with your chosen MTD software, your firm can close the data gap between clients’ bank activity and your final VAT return, reducing delays, errors, and manual effort while staying fully MTD-compliant.

Wrapping Up

Choosing MTD software isn’t just a one-time purchase decision — it’s about selecting a tool that will directly affect how efficiently, accurately, and compliantly your practice manages VAT obligations for years to come.

By following this 5-step decision framework:

- Mapping your VAT workflow ensures the software fits your real operational needs, not just surface-level features.

- Checking HMRC recognition and digital link compliance protects you from future filing errors and penalties.

- Evaluating feature fit and scalability ensures the software can support both your current clients and your firm’s future growth.

- Comparing support, pricing, and contracts helps you avoid hidden costs and service bottlenecks down the line.

- Running a live pilot gives you real-world proof that the solution works, not just for the partners, but for the day-to-day team that keeps filings on track.

Taking the time to work through each of these steps will allow you to make a confident, evidence-based decision.

Instead of feeling overwhelmed by the crowded market, you’ll have clear criteria, practical insights, and a strong foundation for selecting a solution that supports your practice and your clients, far beyond just compliance.

What should I look for when choosing MTD software?

When choosing MTD software, focus on HMRC recognition, digital link compliance, multi-client management features, scalability, support quality, and flexible pricing. Always test the software with real VAT returns before committing.

Is HMRC recognition enough when selecting MTD software?

No. While HMRC recognition is essential, it’s only the starting point. The software must also maintain digital links, fit your firm’s VAT workflow, handle the complexity of your client portfolio, and offer reliable support.

Can I use Excel spreadsheets with MTD software?

Yes, but only if the software supports Excel bridging while maintaining compliant digital links. If spreadsheets are central to your workflow, make sure that choosing MTD software includes checking for robust Excel integration.

How important is pilot testing before choosing MTD software?

Pilot testing is critical. It helps you verify that the software works with your real client data, reveals usability issues, and gives your team confidence before rolling out the system across your practice.

What’s the biggest mistake firms make when choosing MTD software?

The most common mistake is focusing only on price or basic features, without considering scalability, user experience, or support responsiveness. Poor support or rigid software can cause major issues at VAT deadlines.

Get Instant Bank Data with Finexer! Schedule your free demo and get a 14-day Free Trial 🙂