The pressure on UK law firms to maintain robust Anti-Money Laundering (AML) compliance has never been greater. For many, the rising costs associated with Customer Due Diligence (CDD) are shifting from a background expense to a major operational hurdle. Partners, compliance managers, and operations leads are all asking the same critical question: how can we meet our stringent SRA obligations without hurting our bottom line and creating a frustrating experience for our clients? With recent research revealing that the “fear of fraud” will cost UK businesses over £6.15 billion in lost sales in 2025, clients are more wary than ever of insecure, manual processes.

This practical guide breaks down the rising costs of client due diligence and provides a clear, technology-driven roadmap to build a more cost-efficient and effective compliance framework for 2025.

What is CDD and Why Are the Costs Spiralling?

Before diving into solutions, it’s crucial to understand the fundamentals. The CDD meaning is simple in principle: it’s the process of identifying your client and verifying their identity while also assessing the money laundering risk they present. What is CDD in practice? It’s a multi-layered process that includes everything from identity verification and risk assessments to rigorous Source of Funds (SoF) and Source of Wealth (SoW) checks.

The costs associated with this process can be broken down into two main categories:

Direct Costs

- Staff Time: Massive amounts of non-billable time are spent by lawyers and support staff manually collecting, certifying, and reviewing documents like passports, bank statements, and utility bills.

- Subscription Fees: Essential but expensive subscriptions to Politically Exposed Persons (PEP) and sanctions screening databases are a significant line item.

- Training & Audits: The cost of mandatory firm-wide AML training and commissioning independent AML audits under Regulation 21 adds up quickly.

Indirect Costs & Hidden AML Fees

- Client Friction: A slow, paper-based onboarding process creates a poor first impression. Asking clients to find, copy, and send numerous documents is inconvenient and outdated.

- Delayed Revenue: Onboarding bottlenecks postpone the start of billable work, directly harming the firm’s cash flow. Each day spent on paperwork is a day you’re not working on the case.

- High Opportunity Cost: When experienced fee earners are bogged down in forensic analysis of bank statements, they aren’t doing high-value legal work. This is one of the biggest hidden AML fees a firm can incur.

What exactly is customer due diligence (CDD)?

The process of verifying a client’s identity and assessing their money laundering risk to meet SRA regulations.

Why are our firm’s AML fees and CDD costs so high?

High costs come from non-billable hours spent on manual document checks, plus expensive software subscriptions.

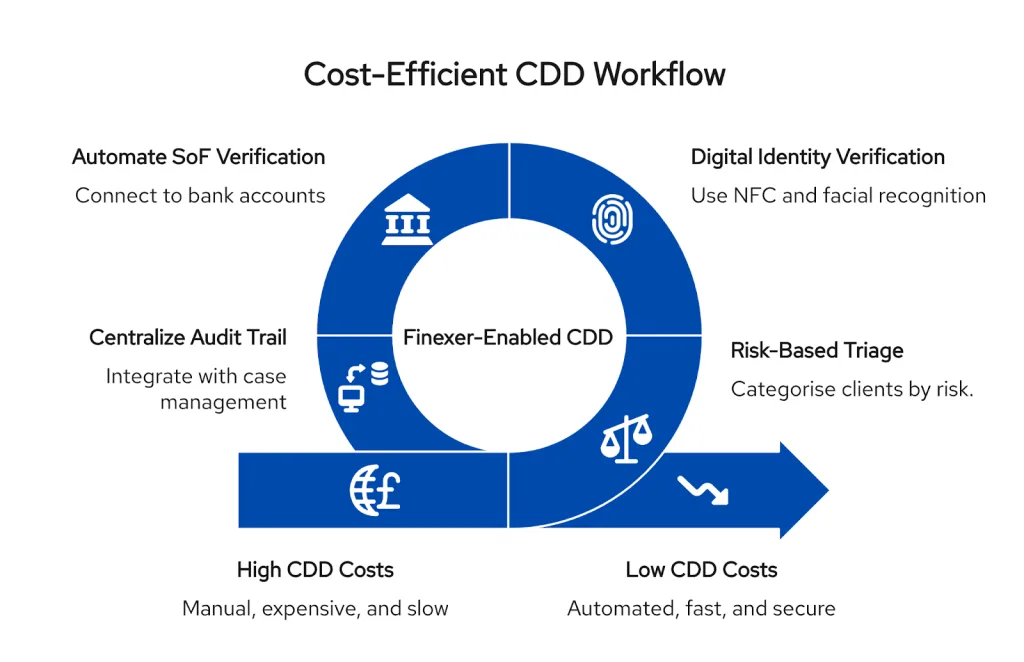

A Practical Workflow for Cost-Efficient Customer Due Diligence

Reducing costs doesn’t mean cutting corners. It means working smarter. By restructuring your workflow with a risk-based and technology-first approach, you can achieve better compliance for a lower cost.

Step 1: Risk-Based Triage at Inception

Your CMRA should be the starting point. Use it to categorise clients as low, medium, or high risk. This allows you to apply proportionate customer due diligence, focusing your most intensive (and expensive) manual efforts only where they are truly needed—on high-risk cases.

Step 2: Digital-First Identity Verification (IDV)

Move away from manually checking certified copies. Use digital IDV solutions that employ NFC technology to read biometric chips in passports and facial recognition to verify the client in seconds. This is faster, more secure, and cheaper than manual review.

Step 3: Automate Source of Funds (SoF) Verification

This is the single biggest area for cost savings. Manually reviewing months of bank statements is incredibly time-consuming. The solution is open banking. With client consent, you can connect directly to their bank account and receive fraud-proof, digitally native data in minutes. This turns a multi-hour forensic task into a quick, automated process.

Step 4: Centralise the Audit Trail

Integrate your technology solutions with your case management system. This creates a single, clean digital report for every client, containing their risk assessment, ID verification, and SoF report. When the SRA comes knocking, your audit trail is ready instantly.

Finexer Toolkit: Where Real Savings Are Made

Adopting the right technology is the key to unlocking efficiency. The comparison between traditional and modern client due diligence is stark.

| Factor | Traditional Manual Process | Open Banking-Enabled CDD (with Finexer) |

|---|---|---|

| Speed & Cost | Takes hours of expensive, non-billable lawyer time. | Takes minutes of automated work, saving time and money. |

| Client Experience | A multi-day hassle of finding and sending paper documents. | A secure, 5-minute process on their mobile device. |

| Security & Risk | High risk of being fooled by fake or edited paper statements. | Fraud-proof data comes directly from the bank, ensuring compliance. |

| Staff Focus | Lawyers are stuck doing low-value administrative work. | Lawyers are freed up to focus on high-value, billable legal work. |

| Audit Trail | Creates a messy paper trail that is difficult to manage. | Instantly generates a clean, digital report ready for regulators. |

Using a UK-focused, white-label Open Banking API provider like Finexer is the most effective strategy. It offers:

- Instant, Consent-Based Access: Get real-time, verified UK bank transaction data.

- Elimination of Manual Work: Connect directly with clients’ bank accounts, ending the need for paper statements.

- Seamless Integration: Works with your existing case management systems for streamlined workflows.

- FCA-Regulated Security: Ensures data privacy and security compliance specific to the UK market.

Hurry up and get in touch with our team to understand how your firm can leverage open banking better and save costs and time!

Our current manual process seems to work. Why should we change it?

To avoid rising SRA fines for non-compliance and stay competitive. Manual methods are now a major business risk.

What is Open Banking, and how does it help with client due diligence?

It’s a secure way to get bank data directly from a client’s bank, automating Source of Funds checks in minutes.

Checklist for Implementing a Cost-Efficient Customer Due Diligence Strategy

Ready to make a change? Follow this checklist to get started.

- Review Your Current Process: Map out every step of your existing customer due diligence workflow, from engagement to onboarding completion.

- Identify the Bottlenecks: Where is the most time and money being spent? Is it chasing documents? Is it manual SoF analysis?

- Assess Your Risk Appetite: Revisit your FWRA to ensure it accurately reflects your firm’s risk exposure and supports a risk-based customer due diligence approach.

- Evaluate Technology Solutions: Research and demo digital IDV and open banking platforms. Focus on providers with total UK bank coverage and transparent, usage-based pricing.

- Train Your Team: Technology is only effective if your staff understands its value and how to use it. Cultivate a culture of compliance efficiency.

- Measure the ROI: Track key metrics before and after implementation. Measure onboarding time, non-billable hours spent on compliance, and client feedback.

Why Opt for Finexer for Economical Customer Due Diligence?

Finexer provides UK law firms with a focused solution for reducing customer due diligence expenses. Our UK white-label Open Banking platform is designed to effectively modernise AML compliance.

- UK-Focused & Compliant: Made especially for the UK market, with complete bank coverage, guaranteeing compliance with LSAG and SRA guidelines.

- Automated SoF: Converts hours of manual bank statement analysis into a digital report that is ready for an audit in just five minutes.

- Improved Client Experience: Offers clients a safe, speedy digital verification process in place of time-consuming paperwork.

- Predictable AML Fees: Usage-based, transparent pricing helps keep AML fees under control without requiring large upfront expenditures.

Work with Finexer to create a future-proof compliance strategy, cut expenses, and expedite your clients’ due diligence.

Conclusion: Transform Compliance from a Burden to an Advantage

With SRA pressure and AML fees on the rise, manual customer due diligence is no longer sustainable for UK law firms. The future is technology.

By adopting tools like Open Banking, you can transform compliance from a costly administrative burden into a genuine competitive advantage. This strategic shift allows you to slash costs, strengthen your defence against fraud, and deliver the seamless digital experience modern clients expect. This is how you future-proof your firm.

Take the next step: don’t let compliance costs dictate your firm’s profitability.

Get in touch with our team now to find out how Finexer can help you build a better, more efficient verification process.