Financial disclosure in divorce isn’t just a formality; it’s a legal requirement. Yet the process of collecting income, spending, and account data from both parties is often the first hurdle that causes costly delays.

Family lawyers routinely face missing PDFs, conflicting figures, or clients unwilling to cooperate. In fact, financial evidence disputes are among the top reasons divorce cases get delayed or adjourned.

Open Banking offers a faster, more reliable solution. Instead of waiting days for clients to send over statements from multiple accounts, solicitors can now access bank-verified transaction data with consent in minutes. It’s fully traceable, categorised, and up to five years deep.

In this guide, we’ll walk through:

- Why financial disclosure still stalls so many divorce cases

- How Open Banking makes gathering evidence easier for solicitors

- What tools law firms are using to verify assets and income in under an hour

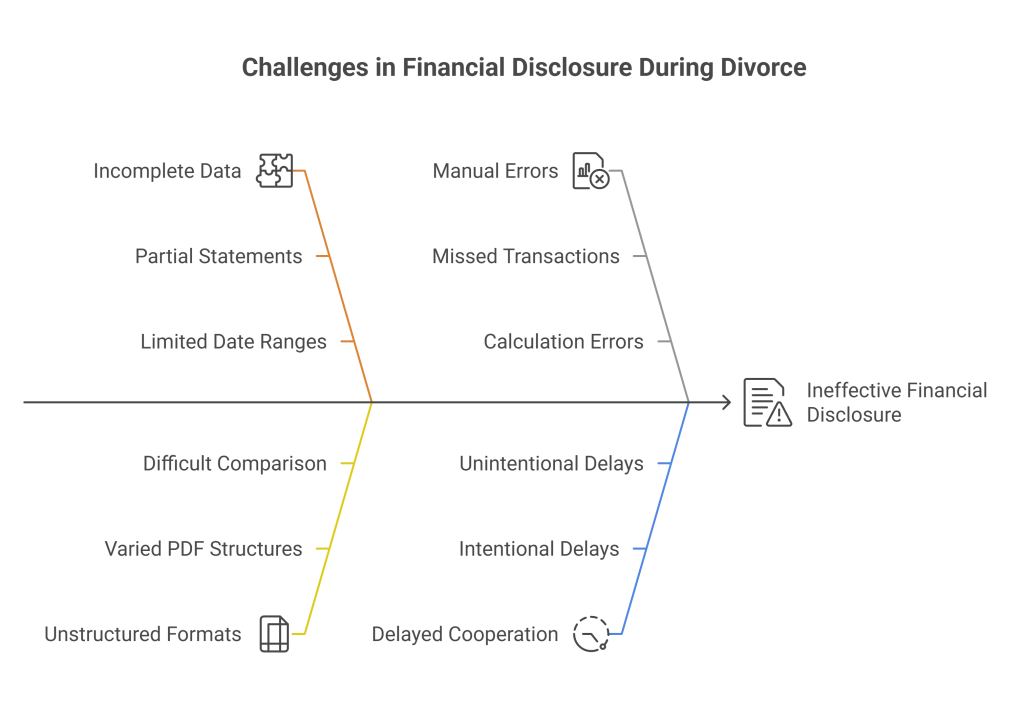

Why Traditional Disclosure Fails

Despite being a standard part of the divorce process, financial disclosure often unravels due to one simple issue: the data is incomplete, unstructured, or delayed.

Family solicitors regularly encounter the following problems:

- Partial statements: Clients provide only some accounts or limited date ranges.

- Unclear formats: PDFs from different banks vary in structure, making side-by-side comparison difficult.

- Manual spreadsheets: Manually compiled figures often miss transactions or contain errors.

- Delayed cooperation: One party may drag out the process, intentionally or unintentionally, risking mediation deadlines or hearing dates.

These issues not only increase legal costs but also create uncertainty during asset division and financial remedy negotiations. According to family law practitioners, reviewing disorganised disclosures can consume days of prep time per case.

When emotions run high and time is tight, traditional methods fall short of what solicitors and clients need: speed, completeness, and clarity.

📚 Guide to Open Banking for Law Firms

Client Scenario: Racing the Mediation Clock

A family solicitor is preparing for a financial remedy mediation scheduled in less than a week. To comply with disclosure requirements, the client must submit three years of bank statements across all personal and joint accounts.

What the solicitor receives instead:

- A handful of PDFs from four different banks

- Missing months in a joint current account

- A savings account export with no transaction detail

- A credit card statement that cuts off midway through the year

The legal team spends three full days reviewing, reformatting, and piecing together the data manually. Still, there are gaps. Some recurring income sources are unverified. A questionable outgoing transfer raises red flags, but there’s no clear trail to assess it.

With the hearing at risk and the client growing anxious, the solicitor is forced to request a delay, adding time, cost, and friction to an already stressful case.

How Open Banking Transforms Financial Disclosure in Divorce Cases

Open Banking gives family solicitors a faster, more complete way to handle financial disclosure in divorce proceedings. Instead of relying on slow, manual document sharing, solicitors can access verified transaction data directly from the client’s bank, with full consent and without delay.

Here’s how this improves the financial evidence process in divorce cases:

1. Real-Time Access to Bank Data for Financial Disclosure

Clients authorise access to their accounts through a secure Open Banking link. Within minutes, solicitors can retrieve up to five years of transaction history across all personal and joint accounts critical for financial disclosure in divorce mediation or litigation.

2 . Categorised and Timestamped Transactions for Legal Use

Every transaction is auto-categorised (e.g. salary, mortgage, transfers) and timestamped. This ensures lawyers can:

- Track income trends across multiple sources

- Identify undeclared liabilities or outgoing transfers

- Avoid relying on manually edited spreadsheets during financial disclosure reviews

3. Eliminating Bias in Divorce Financial Disputes

Unlike client-supplied documents, Open Banking data is unbiased and difficult to alter. This ensures financial disclosure in divorce is based on facts, not selective reporting. Both parties work from the same source of truth, which can reduce conflict and speed up resolution.

In short, Open Banking removes uncertainty from the disclosure process and helps solicitors meet legal standards with less administrative strain.

Benefits for Family Law Firms Handling Financial Disclosure in Divorce

Using Open Banking to manage financial disclosure in divorce isn’t just faster, it improves accuracy, reduces costs, and strengthens legal preparation. Here’s what law firms gain:

| Benefit | Impact on Divorce Disclosure Workflows |

|---|---|

| Faster preparation | Cut client data gathering time from days to under an hour |

| Full account visibility | Access complete financial history across all accounts—personal, joint, credit, and savings |

| Clearer financial disclosure | Auto-categorised transactions reduce interpretation errors during divorce negotiations |

| Fewer disputes | Objective, timestamped data makes it harder to hide or misrepresent income and spending |

| Lower legal costs | Less time spent chasing documents frees up fee-earners for higher-value tasks |

| Court-ready output | Data is exportable in formats suitable for court bundles and mediation files |

For family law solicitors working through complex or high-stakes financial disclosure in divorce cases, this approach means fewer delays and better outcomes for clients.

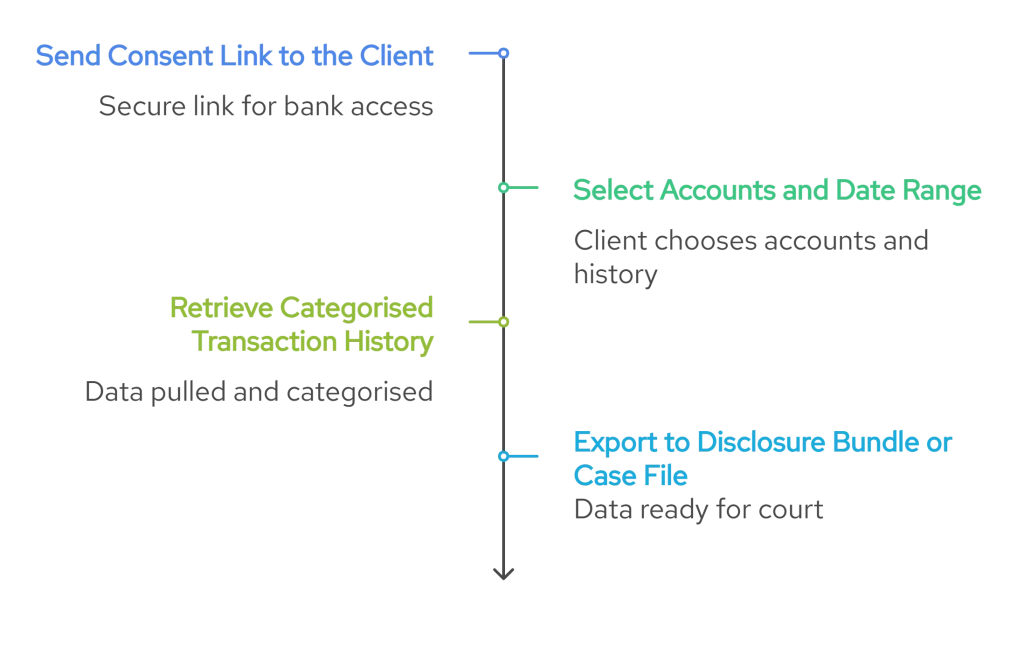

Practical Implementation: How to Collect Bank Data for Financial Disclosure in Divorce Cases

Adopting Open Banking in your firm’s divorce workflows doesn’t require complex IT setups or long onboarding cycles. In most cases, financial data can be retrieved and reviewed within an hour using just a few steps:

Step 1: Send Consent Link to the Client

The solicitor shares a secure, FCA-compliant link that allows the client to authorise access to their bank accounts. Consent is limited, read-only, and can be revoked at any time.

Step 2: Select Accounts and Date Range

The client chooses which accounts to connect and how far back to go, typically three to five years for financial disclosure in divorce proceedings.

Step 3: Retrieve Categorised Transaction History

Once authorised, all data is pulled directly from the bank. Transactions are automatically categorised by type (e.g. salary, mortgage, transfers), helping lawyers quickly identify income, liabilities, and spending patterns.

Step 4: Export to Disclosure Bundle or Case File

The data can be downloaded as a CSV or PDF and added to a digital case file or court bundle, making it courtroom-ready. This ensures faster preparation for mediation, settlement, or litigation.

By integrating this process into your practice, you reduce administrative friction and bring greater accuracy and speed to financial disclosure in divorce cases.

Why This Matters in Divorce and Financial Disclosure Cases

In emotionally charged legal disputes, the ability to move quickly and fairly through financial evidence can make or break a case. Yet in many divorce and financial disclosure processes, administrative delays, incomplete data, or intentional non-cooperation often derail progress.

When solicitors rely on outdated or selective documents, the negotiation becomes unbalanced. One side may attempt to hide assets, misreport income, or stall the process entirely. This is where Open Banking plays a pivotal role.

With bank-verified transaction data pulled directly from the source, law firms can build a complete, accurate picture of each party’s finances, without weeks of back-and-forth. From verifying hidden accounts to validating recurring income, Open Banking supports divorce financial disclosure that’s faster, fairer, and more difficult to dispute.

For legal professionals, this means less time reconciling spreadsheets and more time focused on mediation, asset division, and achieving a timely resolution for both parties.

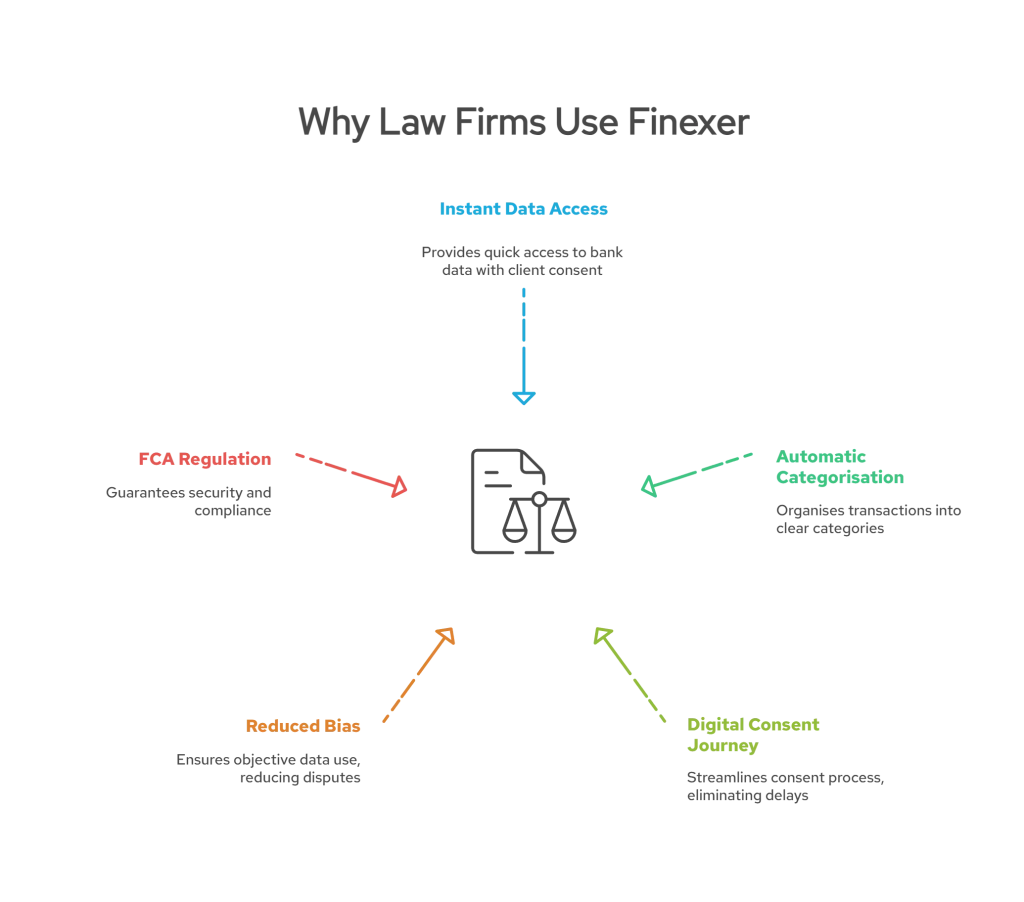

How Finexer Supports Divorce Financial Disclosure for Law Firms

Finexer enables UK family law firms to collect complete, bank-verified financial data across all client accounts within minutes. Built for legal use cases like divorce and financial disclosure, our platform simplifies evidence gathering, reduces manual review time, and ensures every case begins with the full financial picture.

Why Finexer Is a Fit for Divorce & Family Law Firms

- Pull up to 5 years of bank data instantly

Access historic and live transactions from 99% of UK banks with client consent. - Automatically categorised and court-ready

All income, transfers, and liabilities are clearly labelled, ready for use in mediation or financial remedy bundles. - No more delays from missing PDFs

Replace weeks of back-and-forth with a single digital consent journey. - Reduces bias in contested financial disclosure

Lawyers work with objective data, not selective documents, reducing disputes and improving transparency. - FCA-regulated, white-labelled, and secure

Finexer is authorised by the FCA and can be embedded directly into your firm’s client onboarding or case workflows.

Whether you handle straightforward separations or complex asset disputes, Finexer equips your firm with the tools to deliver full financial disclosure in divorce faster, more accurately, and without admin headaches.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat is financial disclosure in divorce?

Financial disclosure in divorce involves both parties sharing full details of income, assets, liabilities, and spending to support fair settlement or court decisions.

How can Open Banking improve divorce financial disclosure?

It allows solicitors to access up to 5 years of verified bank data from all accounts, reducing manual delays, missing statements, and disputes over accuracy.

Is Open Banking compliant for legal use in the UK?

Yes. Finexer’s solution is FCA-regulated, read-only, and fully GDPR-compliant, ensuring safe, lawful access to client bank data.

Can Open Banking help detect hidden assets in divorce?

Yes. Categorised data helps uncover irregular transfers, recurring income, and financial behaviour that may indicate undisclosed assets.

Ready to Simplify Divorce Financial Disclosure? Book a demo to see how Finexer supports fast, compliant financial disclosure in divorce cases 🙂