In financial services, timing and accuracy are everything. Yet many UK businesses still rely on slow, fragmented processes to access customer financial data, whether that’s asking for PDF bank statements, pulling delayed batch files, or relying on self-reported information.

These outdated methods mean credit decisions are made on stale data, fraud checks happen too late, and onboarding becomes a frustrating, high-friction experience. For lenders, insurers, PropTech platforms, fintech apps, and even large enterprises, that’s a direct hit to revenue, risk management, and customer satisfaction.

That’s where Finexer’s AIS API changes the game. As an FCA-authorised account information service provider, Finexer gives UK businesses secure, compliant, real-time access to bank transaction data via Open Banking APIs. Whether you need to assess creditworthiness, verify income, automate reconciliation, or personalise financial products, Finexer delivers the accuracy, speed, and security your operations demand.

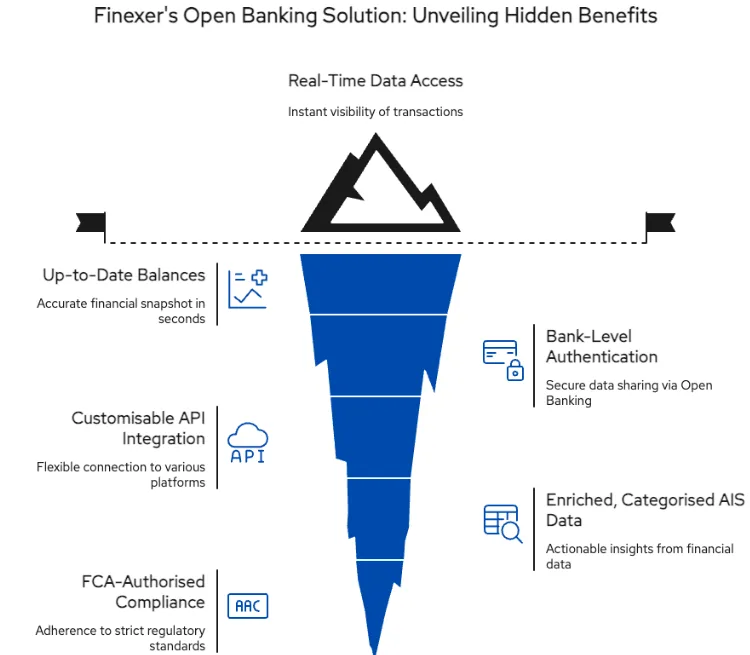

What Finexer Solves (From Pain to Value)

1. Data Delays → Real-Time Bank Transaction Access

Most businesses still rely on end-of-day batch files or manually uploaded statements to understand customer financial activity. That delay means risk models are outdated, fraud checks happen too late, and decision-making is slowed. With Finexer’s AIS Open Banking solution, you can pull real-time bank transaction data across accounts instantly. Every payment, deposit, and transfer is visible as it happens, giving your business the agility to act immediately.

2. Incomplete Financial Picture → Balance Check & Spending Insights

Traditional balance updates can lag by hours or even days, making it hard to get a true snapshot of a customer’s finances. Finexer’s open banking API UK retrieves up-to-date balances from linked accounts in seconds. Pair that with spending insights to analyse income patterns, expense categories, and cash flow trends, and you can make more accurate credit, underwriting, or investment decisions.

3. Identity & Account Risk → Bank-Level Authentication

Manual verification processes like asking for PDFs of bank statements are slow, prone to forgery, and create onboarding friction. As an account information service provider, Finexer enables direct bank authentication via secure Open Banking APIs. Customers log in to their bank to authorise data sharing, ensuring both data accuracy and user trust. This also satisfies Strong Customer Authentication (SCA) requirements in open banking UK.

4. Integration Complexity → Customisable API

Many open banking providers UK offer rigid, one-size-fits-all APIs that don’t adapt to different workflows. Finexer’s customisable API integration lets developers connect AIS data to CRMs, loan origination systems, ERP platforms, or consumer-facing open banking apps UK without heavy engineering effort. The API is fully documented, sandbox-tested, and scalable for growth.

5. Raw Data Limitations → Enriched, Categorised AIS Data

Raw transaction feeds are hard to interpret without context. Finexer enriches AIS data with merchant names, locations, and automatic categorisation, turning financial data into actionable insights. This helps businesses build personalised customer offers, identify lifestyle patterns, and improve segmentation in marketing campaigns.

6. Regulatory Risk → FCA-Authorised Security & Compliance

Handling financial data means strict compliance with GDPR, PSD2, and FCA rules. Finexer is an FCA-authorised account information service provider, ensuring every API call meets the highest security standards. Data is encrypted end-to-end, and detailed audit trails make it easy to prove compliance in reviews or inspections.

💡 Ready to see AIS in action? Book a free demo today and connect to 99% of UK banks through one integration.

What is an account information service provider?

An account information service provider (AISP) is an FCA-authorised entity that can access bank account data (with customer consent) via secure Open Banking APIs.

Is AIS part of Open Banking UK?

Yes. AIS Open Banking is one of the two regulated services under the UK’s Open Banking framework, alongside Payment Initiation Services (PIS).

Who Uses Finexer AIS API And Why They Stay

Finexer’s AIS API is a business infrastructure upgrade for organisations that need accurate, real-time financial information.

- Insurers – Price policies more accurately by assessing risk from financial behaviour. Verify claims with real-time income and expense data.

- PropTech & Rental Platforms – Verify tenant income and stability before lease agreements. Monitor rent payments automatically.

- Accounting & ERP Providers – Automate reconciliation, reduce manual data entry errors, and improve reporting accuracy.

- Fintech & Open Banking Apps UK – Deliver budgeting tools, savings recommendations, and personalised offers based on live account data.

They stay because Finexer offers a single open banking API UK connection to 99% of UK banks, with real-time data, strong compliance, and a developer-first approach that makes integration painless.

📖 Want proof? See our customer success stories and learn how UK businesses are scaling faster with Finexer HERE

Finexer vs. Everyone Else

| Feature | Finexer AIS API | Typical Open Banking Providers UK | Manual Data Gathering |

|---|---|---|---|

| Coverage | Connects to ~99% of UK retail banks and major account providers via secure API | Coverage varies, some providers only integrate with selected banks | Relies on customers supplying statements or exports |

| Speed | Real-time or near real-time data retrieval once user consents via AIS | Often near real-time, but may refresh in intervals (minutes to hours) | Days or weeks, depending on when customer provides data |

| Data Quality | Enriched, categorised transaction data with merchant/context details | Often raw, unstructured transaction lists requiring in-house processing | Varies; prone to missing or incomplete information |

| Integration | Flexible API with white-label consent screens and developer-first documentation | Fixed API flows, limited branding/customisation options | Manual review and data entry processes |

| Compliance | FCA-authorised AISP, PSD2-compliant, GDPR-aligned with audit trails | PSD2-compliant; not all are FCA-authorised for AISP services | High compliance risk without robust verification |

| Security | End-to-end encryption, Strong Customer Authentication (SCA) by default | Security varies; all PSD2 providers use SCA but implementation differs | Vulnerable to forgery, tampering, and human error |

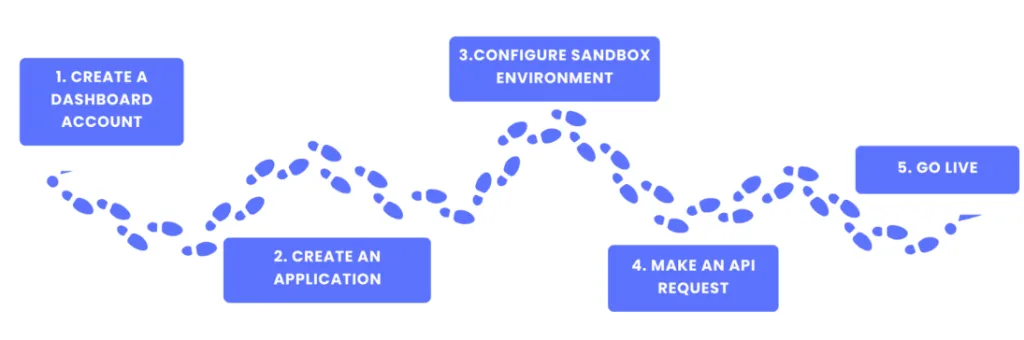

What Happens After You Sign Up

Implementing Finexer’s AIS API is straightforward, fully supported, and designed to get you live in just a few days

1. Create a Dashboard Account – Sign up through the Finexer dashboard to manage, track, and monitor all your AIS Open Banking connections in one place. From here, you’ll have access to real-time analytics, consent management tools, and audit logs to ensure compliance with Open Banking UK standards.

2. Create an Application – Within the dashboard, set up your application profile. This defines how your platform, whether it’s a lending system, open banking app UK, PropTech platform, or ERP solution will connect to the open banking API UK. You can configure connection scopes, data refresh intervals, and user consent flows to match your business needs.

3. Configure Sandbox Environment – Before touching live customer accounts, test your integration in a secure sandbox environment. The sandbox replicates live bank data structures from multiple open banking providers UK, so your developers can simulate transactions, balances, and authentication journeys without risk. This ensures your AIS workflows are tested, stable, and compliant before going live.

4. API Integration – Connect Finexer’s AIS data feed directly to your systems using our developer-first, fully documented open banking API UK. Whether you’re embedding it into a credit scoring engine, an open banking app UK, or a back-office reconciliation tool, our RESTful APIs are designed for quick adoption with minimal dev resources.

5. Go Live – Switch from sandbox to production and start accessing real-time bank transaction data securely. Once live, you’ll be able to pull up-to-date balances, categorised transactions, and verified account details from 99% of UK banks. All data is encrypted end-to-end, fully PSD2-compliant, and backed by our FCA authorisation as an account information service provider.

With these five steps complete, your business has a live, compliant connection to 99% of UK banks, no scraping, no delays, no manual uploads.

Whether you’re running risk models, verifying identities, or powering open banking apps UK, Finexer’s AIS API puts you in control of data quality, compliance, and speed.

How secure is AIS data?

Finexer uses end-to-end encryption, strong customer authentication, and FCA-approved protocols to keep all open banking UK data secure.

What businesses benefit most from AIS?

Lenders, insurers, PropTech platforms, ERP/accounting providers, and open banking apps UK that rely on accurate, real-time financial data.

How long does integration take for the open banking API UK?

With Finexer’s documented APIs and sandbox testing, most clients integrate in days, not weeks.

Book a free demo or speak to our AIS integration team today, go live in days, not weeks, with real-time bank data for your business!