In the world of business finance, few functions are as routine or as risky, as bulk payments. Whether you’re disbursing salaries, paying out investor returns, settling refunds, or managing contractor invoices, bulk payment processing is the invisible engine keeping your operations moving.

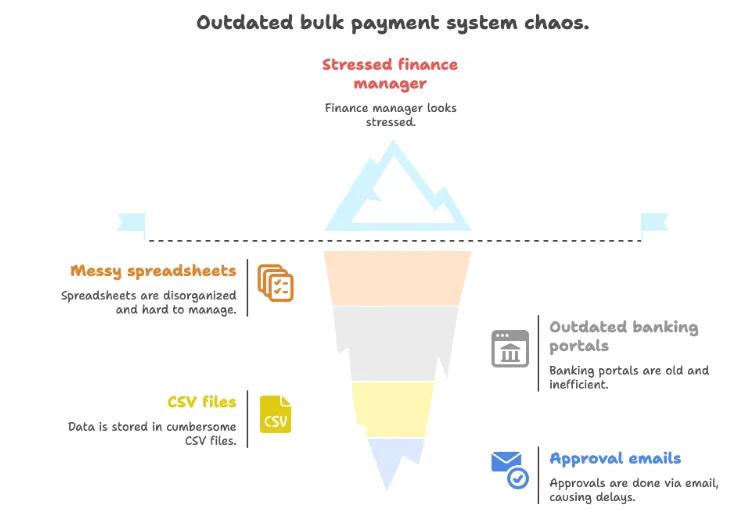

But behind the scenes, the bulk payment systems many finance teams rely on are inefficient, fragmented, and quietly expensive. You’re exporting CSVs from your accounting software, logging into legacy banking portals, emailing around approvals, and dealing with inconsistent transaction confirmations. Every bulk payment transfer becomes a race against time, and a magnet for errors.

We built Finexer because too many UK businesses are still depending on systems that weren’t built for scale. What we’ve learned is this: bulk payments don’t just need automation, they need a purpose-built bulk payment solution that’s fast, compliant, and actually pleasant to use.

In this article, you’ll learn:

- Where bulk payments workflows (payroll, refunds, investor returns) break down

- How Finexer’s bulk payment system works, via API or dashboard

- Features built for finance: live tracking, audit logs, UK-only data hosting

- Why UK finance teams are switching from Plaid, Yapily, and Tink

- What to expect in week 1- (2-3x faster deployment) than the market, no dev required

- How to get started: We’ll run your first 100 payouts with you

Let’s get into it.

You’re Already Spending Too Much on Bulk Payments (You Just Don’t See It)

Across UK finance teams, bulk payment transfers are still executed with a patchwork of tools that were never designed to work together. According to AutoRek’s 2024 survey, 84% of payment firms rely on spreadsheets and manual reconciliation workflows, and 63% report operational costs rising in tandem with payment volumes

These inefficiencies slow you down and affect cash flow predictability, team bandwidth, and trust with vendors, contractors, and employees. And then there’s the hidden cost. Every time your team gets a “Just checking if my payment went through?” email, it adds unnecessary pressure.

Common Bulk Payment Use Cases (Where Finexer Replaces Friction with Flow)

Bulk payouts don’t just happen once a month on payroll day. For most businesses, they show up everywhere, across finance, operations, investor relations, and customer support. And while the contexts may differ, the underlying pain is the same: manual work, delays, and uncertainty.

Let’s look at four of the most common use cases where businesses rely on bulk payment services and how Finexer helps in achieving a streamlined workflow.

- PropTech & Real Estate – Bulk Contractor Payouts Made Effortless

- Challenge: Property management teams juggle multiple vendor payments weekly. CSVs, portals, and failed transfers cost them time and trust.

- Finexer Approach: The bulk payout feature enables simultaneous disbursements to contractors or service providers with just a single upload. Read more about Finexer’s bulk payment automation for PropTech HERE

- Benefit: Instantly settle multiple payments, dramatically reducing admin errors and turnaround time.

2. Accounting, Payroll & ERP Platforms – Automate Supplier Returns & Payroll

- Challenge: Many platforms require users to navigate legacy banking systems or build custom layers just to make routine payments.

- Finexer Approach: Use our ready-to-use dashboard or API to review, approve, and release bulk payment directly via Open Banking. Built for automation day one, even before integrations are complete.

- Benefit: Teams can launch automated supplier pays, payroll, or refund workflows without IT overhead.

3. Digital Finance & Lending Companies – Scale Bulk Disbursements with Zero Headaches

- Challenge: Splitting borrower and investor payouts across thousands of accounts is manually tedious and error-prone.

- Finexer Approach: Finexer’s Open Banking engine handles bulk payouts with real-time verification and tracking. Even at scale, up to 100,000 transactions per month. Read more HERE

- Benefit: Finance teams get full visibility into status and failures automatically, no spreadsheet juggling.

How Finexer’s Bulk Payment System Works

So, what actually happens under the hood when you run your payouts through Finexer?

It’s a clean, API-first bulk payment system that mirrors the way your team already works, but without the hours lost to formatting, back-and-forths, or reconciliation surprises. Whether you’re a startup scaling fast or an enterprise trying to tighten operations, Finexer removes the manual steps and gives you control.

Let’s walk through the process.

Step 1: Create Your Payout Batch

Start by uploading a CSV file or pushing data directly via API. Whether you’re paying 10 or 10,000 recipients, Finexer’s bulk payment system doesn’t flinch. In the dashboard, you can:

- Upload payout files manually or pull from your internal tool (like a contractor dashboard or CRM)

- Tag each batch with internal notes, metadata, or invoice IDs

- Set a preferred processing window. Open banking payments runs on faster payment rails making it near instant settlement

For tech teams, the API lets you skip the UI entirely, making Finexer a fully embedded part of your stack.

Step 2: Real-Time Verification (Before Money Moves)

Once a batch is created, Finexer runs real-time verification checks on every entry, validating sort codes, account numbers, and payment readiness before funds are triggered.

This step catches:

- Closed or invalid bank accounts

- Duplicated payments

- Threshold exceptions

- Suspicious patterns

Step 3: Execute and Track Live Payouts

Once everything’s verified, execute the payout with one click (or automatically via API). From there, each transaction moves through Finexer’s secure rails and updates in real time. You’ll see:

- Timestamped status per recipient

- Flagged errors or exceptions

- Confirmation of successful disbursements

All in a single dashboard view. No more logging into bank portals, exporting status reports, or asking, “Did that payment actually go through?”

Step 4: Reconcile with No Guesswork

After payout, Finexer auto-generates a reconciliation file you can export or sync into your accounting software. Every transaction is traceable with a unique reference ID, audit log, and status history, so there’s no ambiguity at month-end close.

If you’re handling multiple batches a week, this can reduce reconciliation time by up to 80%. That’s not a small win, it’s how finance teams claw back days of productivity without adding more hands.

Want to see this workflow in action? Book a live demo with our product team and test how Finexer handles your real payout data, no development required.

How do I make a bulk payment?

To make a bulk payment, you typically upload a file (like a CSV) containing details of multiple recipients and their payment amounts. Platforms like Finexer let you process these payouts via dashboard or API in one go, eliminating manual bank uploads or spreadsheet juggling. You can approve and release all payments in a batch with live tracking and real-time verification, reducing errors and saving time.

How can I pay multiple people online at once?

You can pay multiple people online using bulk payment software like Finexer. Just prepare a payout file with names, bank account details, and amounts, then upload it to the platform. Finexer verifies the data, executes payments instantly through Open Banking, and gives you live updates for each transaction, all without logging into your bank manually for every recipient.

Key Features Built for Finance Teams

Finexer is a tool built by people who understand what finance teams actually need – reliability, compliance, traceability, and control. Let’s dig into the core features that make that possible.

✅ One-click bulk payout upload (CSV + API)

Whether your workflow is no-code or fully automated, Finexer fits right in. You can upload payout batches manually via CSV or trigger them programmatically through a developer-friendly API. This means:

- No toggling between banking portals and spreadsheets

- No formatting nightmares every time you send a new file

No developer bottlenecks to get started

It’s flexible enough for operations leads and structured enough for product teams who want embedded finance capabilities.

✅ Live status per transaction

The most common frustration in bulk payments? Not knowing where the money is. Finexer eliminates that blind spot with real-time updates on each transaction. From “initiated” to “settled,” you get full visibility down to the recipient level. And if a payout fails or bounces? You know exactly why, when, and what to do next.

✅ White-label dashboard

If you’re making payouts to customers, vendors, or investors, presentation matters. With Finexer’s white-label dashboard, your recipients interact with a payout interface that reflects your brand, not your provider’s. This adds trust, reduces support tickets (“Did this come from you?”), and makes the experience feel native.

You control the colours, logos, and messaging, Finexer handles the infrastructure.

✅ Audit trails and smart compliance logs

Audits aren’t optional. Whether you’re subject to FCA regulations, client reviews, or internal board scrutiny, Finexer helps you stay ready. Every payout includes:

- Timestamped logs of approvals and triggers

- Bank account verification records

- IP-based session tracking

Clear version history of uploaded data

✅ UK-only data hosting

If you’re operating in the UK and need to comply with local data residency laws or just want to avoid GDPR complexity, Finexer is built for you.

All customer data is stored in UK-based, ISO-compliant infrastructure. Nothing leaves the region, and nothing is routed through third-country servers. This is especially critical for regulated businesses handling PII, payroll data, or investor records.

✅ Real-time bank account verification

Before a single pound moves, Finexer runs real-time checks to ensure that account numbers, sort codes, and payment details are valid.

This cuts down:

- Failed payments

- Manual rework

- Customer frustration

- Fraud risks

Who Uses Finexer (and Why They Stick)

Finexer is purpose-built for UK businesses navigating scale, compliance, and cost efficiency. Whether you’re a startup CFO, a product lead embedding financial services, or an ops manager drowning in spreadsheets, Finexer fits seamlessly into your world. Here’s how real users benefit:

📖 Want proof? CLICK HERE to read our full customer success stories.

1. Ellie – The Startup CFO – “I needed to automate payouts without hiring a full finance team.”

Ellie manages finance at a 30-person SaaS company operating across multiple client accounts and service providers. With limited headcount, she was spending too much time on manual bank uploads, approvals, and reconciliations.

With Open banking:

- She automated 90% of recurring payouts using the CSV upload feature.

- Cut approval-to-settlement time from 2 days to 30 minutes.

- Now tracks payment statuses live without chasing her ops team.

Why she sticks: Finexer became her finance assistant without needing to hire one. Every transaction is traceable, auditable, and off her to-do list.

2. James, the Product Lead – “We wanted embedded payouts, not another UI to manage.”

James builds a lending platform where both borrowers and investors need to get paid fast. He didn’t want another platform cluttering his team’s dashboard. What he needed was infrastructure.

With Open Banking:

- His dev team integrated payouts via API and had 2-3x faster deployment than the market

- Now triggers 1,000+ investor payouts monthly without touching a bank file.

Eliminated back-and-forth between product, finance, and ops.

Why he sticks: The API is clean, well-documented, and doesn’t require UI design or custom support flows. It’s invisible infrastructure doing visible work.

3. Sonia, the Operations Manager – “I used to spend hours chasing payout mismatches.”

Sonia oversees payments for a mid-size agency managing freelancers, consultants, and project-based teams. Her workflow was a mess of approval chains, banking rules, and tracking errors.

With Open Banking:

- She uses the white-label dashboard to manage and brand payouts.

- Reconciliation that used to take 2 hours per run now takes 15 minutes.

- Clients receive funds faster, and vendors stop emailing for payment updates.

Why she sticks: Live tracking, audit logs, and error-handling built-in. She controls everything without needing tech support.

Finance teams using Finexer save up to 70% on admin time in the first 30 days. Start your Payment journey HERE and we’ll guide your first 100 payouts personally.

Finexer vs. The Rest: A Clearer, Faster Bulk Payment Engine

The UK bulk payment landscape is crowded with providers claiming to simplify payouts. But when you strip away the buzzwords and look at what CFOs and finance teams actually need, real-time performance, UK-first compliance, white-label interfaces, and fast onboarding the difference is clear.

Let’s break it down

| Feature | Finexer | Plaid | Yapily | Tink |

|---|---|---|---|---|

| UK‑first focus | Focused on UK | Global-first, includes UK | UK + Europe infrastructure | EU/Nordic focus, includes UK (~95%+ UK coverage) |

| Real‑time bulk payouts | Available (built-in support) | Payment Initiation API exists, but bulk payouts not ideal | Offers bulk payments (infrastructure) | Not primarily known for bulk payouts (focus on data services) |

| UI + API combo | Fully customisable white‑label frontend + API | API only; no white‑label UI | Offers both white‑label infrastructure and hosted flows | Offers white‑label functionality, typically with additional cost |

| UK Bank Coverage | 99% coverage of UK banks | Over 95% of UK banks | Major UK Banks | 95% UK Coverage |

| White-label dashboard | Fully customised white‑label dashboard available | Limited or not offered | Limited customisation options available | Limited white‑labelling, typically add-on or enterprise only |

Why Finexer’s Bulk Payment Service Wins for UK Payouts

- Local Compliance: Built for UK regulations and expectations, not retrofitted from US systems.

- Speed to Value: Finexer customers typically go live within a couple of days, no development sprint needed.

- Built-In Trust: Full visibility, traceability, and audit logs by default, not as a premium add-on.

Finexer is focused on doing one thing exceptionally well: streamlining bulk payment processing for UK businesses that need speed, transparency, and reliability.

What Happens After You Sign Up?

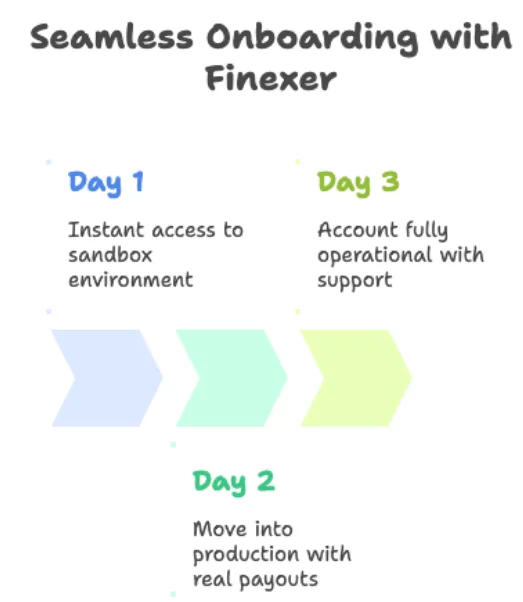

We’ve made onboarding with Finexer feel more like plugging into a modern productivity app than deploying a clunky payments tool. There are no weeks of scoping, no developer bottlenecks, and no enterprise-style ticketing systems to get started.

Here’s exactly what to expect when you sign up:

Day 1: Right after you sign up, you get instant access to our sandbox environment. This is a safe, zero-risk playground where you can upload mock payouts, test different scenarios, and explore the UI or API at your own pace. Our team is available for a 1:1 walkthrough if you want a guided run, but most finance or ops teams find the setup intuitive from the start.

Day 2: Move into production. Upload your first real payout batch via CSV or API. Track every transaction live. If something fails (wrong IFSC, mismatched name, missing approval), the error will surface immediately, and we’ll guide you through fixing it. Most first-time users report saving 2-3 hours just on reconciliation alone during this test phase.

Day 3: Go live. Your account is fully operational, with audit logs, user permissions, and support on standby. No onboarding fees. No multi-week implementation plans. Most teams are up and running in few days without needing to hire, code, or overhaul legacy systems.

What is the difference between batch payment and bulk payment?

The terms are often used interchangeably, but here’s the difference:

Bulk payment refers to sending multiple payments in one go, usually to different recipients.

Batch payment is a method of grouping those payments into one processing cycle or file. In practice, a batch is how you execute a bulk payment. Finexer supports both concepts: you create a batch to trigger your bulk payout.

What is an example of a bulk payment?

An example of a bulk payment is when a company pays 50 freelancers at the end of the month in one go. Instead of initiating 50 separate transfers, the finance team uploads a single file or uses an API to trigger all 50 payments simultaneously. Platforms like Finexer handle this process securely, with real-time status tracking for each recipient

What is considered bulk cash?

Bulk cash” usually refers to large volumes of physical currency, often above standard deposit or withdrawal thresholds (e.g., £10,000 or more in the UK). It’s a term more relevant in banking compliance and cash-handling contexts, not digital payouts. For digital payments, “bulk payments” means transferring funds to multiple accounts electronically, not handling large cash sums.

Ready to simplify your bulk payment processing? Let’s run your first 100 payouts together, no implementation headaches, no extra hires.