In today’s economy, speed is a baseline expectation. Yet, most UK businesses are still stuck waiting one to three working days for a bank transfer to clear. Payroll runs get delayed, supplier relationships are strained, and customers waiting on refunds grow impatient. Every extra day your money sits in transit means cash flow tied up, growth plans delayed, and goodwill lost.

If you run a business with high transaction volumes, whether it’s paying contractors, disbursing loans, settling supplier invoices, or refunding customers, those delays add up fast. Imagine running payroll on a Friday only for employees to see their money on Monday. Or issuing a customer refund that takes a week to appear. In a world where Amazon delivers products in 24 hours, waiting days for a payment feels outdated.

That’s where Finexer’s Instant Payments API steps in, enabling bold instant bank payments from one UK account to another in seconds. Built on secure Open Banking rails, it bypasses the card networks entirely, cuts costs by up to 90%, and gives you a payment experience your competitors can’t match.

💡 Ready to see instant bank payments in action? Book a free demo today and experience how Finexer moves your money in seconds, not days.

What Finexer Solves (From Pain to Value)

1. High Card Fees That Erode Your Margins → Fixed-Fee Savings

Traditional payment providers often charge a 2–3% fee per transaction, plus acquirer and gateway costs. If you’re processing £500,000 a month, that’s up to £15,000 gone, every single month. With Finexer, you move money directly between bank accounts using Open Banking. That means no interchange, no card network fees, just a predictable, low fixed fee per transaction.

The result: more margin on every sale and clear cost forecasting. Finance teams know exactly what they’ll spend, no matter the transaction size.

2. Overnight Settlement Delays → Instant Settlement

The Faster Payments network allows transfers to clear in seconds, and Finexer’s instant payment API is built to leverage it at scale. Instead of “next business day” settlements, suppliers get paid on delivery, employees see salaries immediately, and customers experience refunds that land before they even close the chat window.

The result: smoother operations, stronger relationships, and working capital that moves at the pace of your business.

3. Fraud Risk & Chargebacks → Bank-Level Security

Card payments leave merchants vulnerable to fraud, stolen credentials, and chargebacks. Finexer eliminates these headaches by using secure customer authentication via Open Banking APIs. Customers log in directly to their bank to authorise instant bank payments, and every transfer is encrypted with AES-256 and secured with TLS 1.2.

The result: reduced fraud risk, zero chargebacks, and safer transactions for both you and your customers.

4. Clunky Integrations → API-First Simplicity

Many instant payment solutions force you into rigid, pre-built checkout flows. Finexer gives you a developer-friendly instant payment API and white-label interfaces so you can offer instant banking under your own brand. You can embed payments in your mobile app, integrate them into your ERP, or add them to your e-commerce checkout without heavy dev resources.

The result: faster go-live, full brand control, and payment flows that feel native to your platform.

5. Limited Customer Choice → Versatile Payment Options

A great fast payment transfer is about flexibility along with speed. Finexer supports multiple payment channels, including in-app payments, online payments, payment links, and QR codes, so you can accept instant bank payments in whichever way works best for your customers. The intuitive design ensures a frictionless experience across all touchpoints, encouraging higher adoption rates and maximising the number of payments that move through your faster, lower-cost rails.

The result: more completed payments, happier customers, and an even greater return on your instant payment setup.

Why choose Instant Payments for your business?

Choosing instant banking means payments clear in seconds, freeing up working capital and improving liquidity. It offers transparency, better customer satisfaction, lower transaction costs, and stronger fraud protection, all critical in a competitive finance ecosystem.

Are Instant Payments secure compared to card payments?

Yes. Instant bank payments in the UK use Open Banking APIs, meaning customers authenticate directly with their bank via secure protocols. Transactions are encrypted end-to-end and can’t be completed without strong customer authentication (SCA). This removes sensitive card data from the process, reducing the risk of fraud, chargebacks, and data breaches compared to traditional card payments.

Who Uses Finexer And Why They Stay

Finexer is more than a tool, it’s a business infrastructure upgrade for organisations that move money frequently and can’t afford delays. The API powers instant bank payments that improve cash flow, cut costs, and remove friction from high-volume payment operations.

- PropTech Platforms – Tenants pay rent in seconds, landlords see funds instantly, property transactions close faster with fast payment transfers.

- Lenders – Loan payouts happen within minutes of approval, and instant bank payments improve repayment speed.

- Retail & EPOS – Faster checkout, no card fees, and happy customers who never have to “wait for it to clear.”

- Payroll & Contractor Management – Staff are paid instantly, even outside banking hours.

- Utilities & Subscriptions – Customers can pay bills in seconds via instant banking, reducing late payments and service interruptions.

📖 Want proof? CLICK HERE to read our full customer success stories.

They stay because Finexer delivers measurable ROI, better cash flow, lower transaction costs, and the kind of customer satisfaction that drives retention.

Finexer vs. Everyone Else

| Feature | Finexer Instant Payments API | Traditional Bank Transfer | Card Payments |

|---|---|---|---|

| Speed | In seconds via UK Faster Payments | Typically 1–3 business days (faster only if payer uses same bank) | 2–5 days to settle with acquirer |

| Fees | Low, fixed per transaction | Bank charges vary by volume, currency, and transfer method | 2–3% + acquirer/gateway fees |

| Fraud / Chargebacks | None, uses bank authentication and verification | Low risk, but no built-in customer verification | High – card-not-present fraud, chargebacks, and disputes common |

| Integration | API + White-label; can embed in ERP, POS, apps, or websites | Manual or semi-automated batch uploads | POS terminals, payment gateways; integration can be complex |

| Settlement Confirmation | Real-time confirmation | Confirmation often next day or later | Confirmation delayed until settlement |

| Branding | Full control with white-label UI | Bank-branded experience | Card network & acquirer-branded experience |

The bottom line is that the traditional rails, whether bank transfers or card payments weren’t designed for instant settlement at scale. Finexer brings speed, cost control, and security into one API, tailored for the operational realities of modern UK businesses.

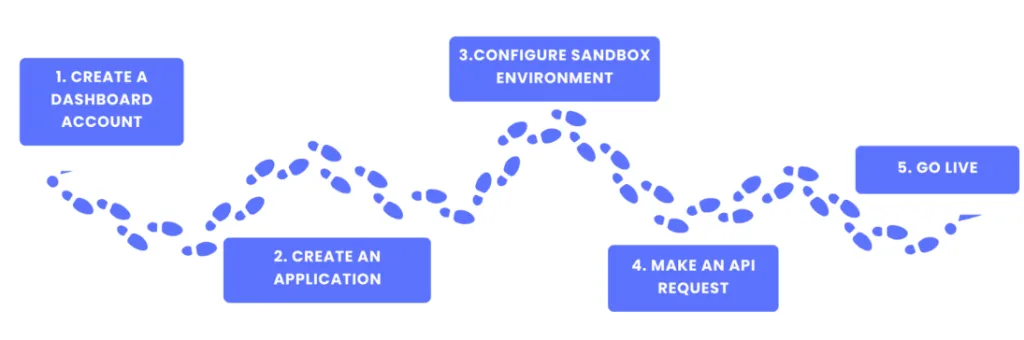

What Happens After You Sign Up

Implementing Finexer’s Instant Payments API is fast, structured, and designed to get you live with instant bank payments in days, not weeks. Here’s exactly what the onboarding journey looks like:

1. Create a Dashboard Account – Sign up on the Finexer dashboard to manage, track, and monitor all your transactions in one place. This is your central hub for reporting, analytics, and payment oversight.

2. Create an Application – Set up your application profile inside the dashboard. This defines how your platform will connect to Finexer’s instant payment API and lets you configure payment flows to match your business model.

3. Configure Sandbox Environment – Before going live, test your fast payment transfers in a dedicated sandbox. This lets your developers run transactions in a safe, simulated environment, no risk to live data or customer accounts.

4. API Integration – Plug Finexer’s APIs into your ERP, e-commerce checkout, mobile app, or POS. The integration is built to be lightweight, so you can start accepting instant banking payments without a full rebuild of your existing systems.

5. Go Live – Once testing is complete, switch to the live environment. From this point on, you can send and receive real-time payments, reduce transaction costs, and give your customers the seamless instant bank payments experience they expect.

With these five steps complete, your business is set up to move money at the speed your operations demand. No more waiting for “next business day” settlements. No more unpredictable fees. No more losing customers over slow or clunky payment experiences.

Whether you’re paying suppliers, refunding customers, funding loans, or running payroll, Finexer’s Instant Payments API puts you in control of both speed and cost. And because it’s backed by secure Open Banking rails, you get the peace of mind that every instant bank payment is authenticated, encrypted, and protected end-to-end.

What is the Instant Payments Regulation (IPR)?

The Instant Payments Regulation (IPR) is an EU law that mandates instant bank payments, requiring payment providers to support real-time credit transfers (within 10 seconds), 24/7, across Europe. It also enforces cost parity and robust fraud prevention. Banks must comply by 2025, with e-money institutions following by 2027.

Can instant payments be reversed?

No, because instant banking transfers clear within seconds, fast payment transfers typically can’t be reversed via traditional clearing systems. In rare cases (e.g. fraud), recall may be attempted, but it requires recipient consent and is not guaranteed.

What are typical fees for Instant Payments in the UK?

Fees for fast payment transfers in the UK vary by payment provider, but are generally lower than card processing costs. Many providers, including API-based solutions, offer fixed per-transaction pricing instead of a percentage fee. This can cut costs by up to 90% compared to card payments, making instant banking an attractive option for high-volume businesses.

Book a FREE DEMO or run your first 100 instant payments with us today!