Traditional recurring payment systems weren’t built for today’s UK businesses. Whether you’re handling loan repayments, donation billing, or subscription renewals, chances are you’re stuck with rigid, outdated tools, think standing orders, direct debits, or even card-on-file setups. They’re slow, fixed, prone to failures, and full of hidden fees.

But here’s the truth: your customers expect flexibility. And your finance team demands control.

That’s exactly where Variable Recurring Payments (VRPs) step in. And not just any VRP setup, Finexer’s VRP API, built with Open Banking at its core.

With Finexer’s variable recurring payments open banking infrastructure:

- You initiate and automate dynamic payments directly from a user’s bank account

- Your customer gives one-time consent, and you charge them flexibly going forward

- You move money without touching a card network or waiting on a direct debit cycle

Whether you’re a fintech startup scaling usage-based pricing or a utility provider collecting seasonal bills, VRP payments deliver a better experience on both sides, business and customer.

Finexer powers this with a UK-specific API, live dashboards, and full bank connectivity giving you infrastructure, not another dashboard to manage.

How Finexer’s VRP API Works (Without Breaking Your Existing Stack)

Finexer’s VRP API is built to integrate, not interrupt. You don’t need to replace your billing software, payment stack, or user flows. Just plug in our variable recurring payments open banking layer and start charging flexibly, without chasing approvals or failed transactions.

Here’s how it works:

- One-time user consent: Your customer authenticates once via their bank using secure VRP open banking protocols.

- You control the logic: You set the amount range, frequency, and context (e.g. usage-based, subscription-level, tiered).

- Bank-to-bank payments: No cards. No intermediaries. Just fast, direct payments using Open Banking rails.

- Real-time visibility: Monitor payment status, errors, and logs via your dashboard or API events.

It’s what variable recurring payments should’ve been from the start: flexible, compliant, developer-friendly, and future-ready. You get all this with Finexer’s UK-only data hosting, GDPR-aligned security, and enterprise-grade uptime.

What Use Cases Are a Perfect Fit for Variable Recurring Payments?

Not every recurring payment should be fixed. That’s where variable recurring payments (VRP) shine, offering flexibility where traditional direct debits or card mandates fail. Here’s where businesses are already using Finexer’s VRP API to streamline operations and improve customer experience:

1. Subscription Platforms with Tiered or Usage-Based Billing

Forget fixed-price subscriptions. VRP enables dynamic pricing based on user behavior, perfect for SaaS, media, or cloud services. Charge users only for what they use, when they use it.

Example: A cloud hosting startup uses VRP payments to automatically bill customers based on server usage and add-ons, without sending new mandates every month.

2. Lending Platforms for Flexible Loan Repayments

Whether it’s interest fluctuations or partial repayments, lenders need flexibility. Finexer’s VRP open banking flow enables real-time repayment adjustments without re-authentication.

Example: A UK-based P2P lender automates thousands of loan repayments monthly with Finexer’s variable recurring payments, ensuring timely collection and less borrower friction.

3. Insurance, Utilities, and Education

Industries with seasonal or adjustable billing models benefit most from variable recurring payments open banking setups. Billing can respond to real-world usage, energy consumed, tuition periods, insurance riders, without breaking compliance.

Example: An energy provider adjusts billing every month based on meter readings. Customers give one consent and never have to manually approve variable charges again.

4. Donations and Memberships

Donors and members value flexibility. VRPs allow them to increase, pause, or decrease contributions without re-entering card info or logging in again.

What is the difference between Direct Debit and VRP?

Direct Debits are fixed, pre-authorised payment instructions set up through banks. They’re rigid, often take days to settle, and require re-approval for changes.

VRP (Variable Recurring Payments), on the other hand, allows businesses to pull variable amounts directly from a customer’s bank account using Open Banking without needing re-consent every time. They’re faster, more flexible, and offer real-time control and visibility.

What is an example of a VRP?

An example of a VRP is a cloud service provider that charges customers based on their monthly data usage. Instead of billing a fixed amount, it uses a VRP to automatically pull different amounts each month based on actual usage, without needing fresh approval. This provides a seamless, usage-based billing experience for both the business and customer.

Why Finexer’s VRP API Is Built Different

Most APIs say they’re plug-and-play, until your dev team spends weeks debugging vague documentation and dealing with flaky authentication. That’s not how Finexer does things. Our VRP API is designed for engineers and approved by CFOs. Here’s what makes it stand out:

✅ Built for Open Banking From Day 1

While other solutions try to retrofit direct debits or card flows, Finexer’s variable recurring payments open banking infrastructure is native to UK regulations. That means faster go-lives, cleaner compliance, and smoother user authentication.

✅ Pre-Consent, Not Pre-Pain

Unlike cards or standing orders, your customer gives one consent, and you can pull variable amounts within a preset limit and time window. No re-authentication. No broken flows. It’s what VRP payments should’ve always been.

✅ Granular Controls, Real-Time Visibility

Need to pause a recurring payment? Adjust a limit? Flag a fraudulent request? Finexer gives you real-time controls and monitoring right from your dashboard or API.

✅ Designed to Be Invisible

Your users never leave your ecosystem. No confusing redirects. No janky white-label flows. Just seamless integration into your platform exactly how embedded finance should feel.

With Finexer, VRP is more than just a feature. It’s programmable trust between your business and your customer.

Finexer vs. Everyone Else

Variable recurring payments are still new in the UK, and most providers are either banks moving slowly with limited flexibility, APIs that bolt VRP onto legacy systems or platforms that force you into their UI.

Finexer built its VRP open banking stack from scratch with zero legacy debt, full API control, and obsessively fast setup.

| Features | Finexer | Big Banks | Legacy Payment Platforms |

|---|---|---|---|

| API-first VRP setup | Quicker go live date than market | Several Weeks | Complex integration |

| Flexible variable amounts | Native support | Limited or fixed | Workarounds needed |

| Pre-approved consent flow | Frictionless UX | Manual triggers | Redirects required |

| Open banking compliance | Full PSD2-ready | But rigid | Partial or retrofitted |

| Live tracking + controls | Built-in | Batch-based | Limited visibility |

| Pricing model | Simple + transparent | High + opaque | Hidden fees |

Switch to Finexer VRP API, built for developers, trusted by finance teams.

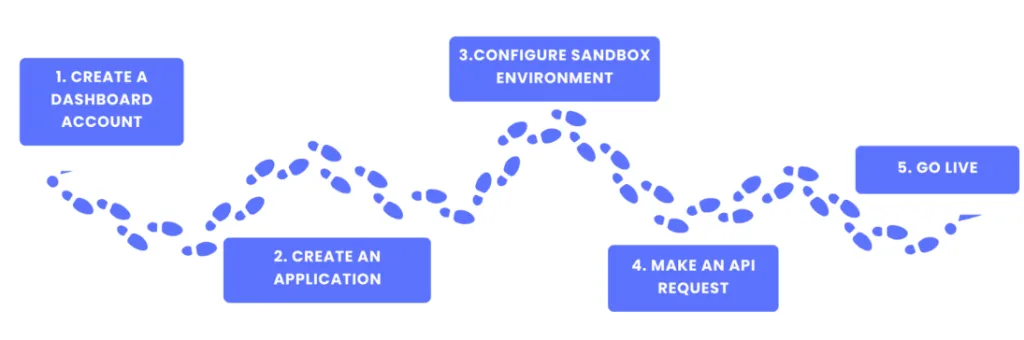

What Happens After You Sign Up

Setting up variable recurring payments with Finexer VRP API doesn’t require a long onboarding or a separate dev team. It’s built for speed, clarity, and real-time execution, whether you’re a fintech, utility provider, or a subscription platform scaling across the UK.

Here’s how to get started:

Step 1: Create Your Dashboard Account

Start by signing up on the Finexer dashboard, this will become your command center to configure payment consents, monitor transaction statuses, and manage all your VRP payments in one place.

Step 2: Register Your Application

Once inside the dashboard, create your application. This is where your VRP API credentials live and where you define rules around consent types, amount limits, frequency, and failover handling.

Step 3: Configure Your Sandbox Environment

Before going live, test everything in a fully functional sandbox. This lets your team run variable recurring payments open banking flows using real APIs, without touching live data. Simulate edge cases like failed mandates, capped amounts, and early cancellations to bulletproof your payment logic.

Step 4: Integrate the VRP API

Plug into our VRP open banking infrastructure with minimal engineering time. Whether you’re embedding it in a mobile app, CRM, or billing engine, the Finexer team is available to co-pilot your integration, ensuring your system is compliant, secure, and scalable from Day 1.

Step 5: Go Live with Confidence

With testing complete and your workflows in place, it’s time to launch. Your variable recurring payments start running in real time, backed by Finexer’s consent dashboards, live logs, fraud detection, and real-time alerts. You get full control and zero manual intervention.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored VRP solutions.

Try NowWant to learn more about Variable Recurring Payments? Read these additional blogs by Finexer

- What are Variable Recurring Payments? Guide to VRP in 2025. Read HERE

How do VRPs work?

VRPs work through Open Banking. A customer gives one-time secure consent via their bank, setting limits on how much and how often a business can charge them. After that, the business can collect variable payments directly from the customer’s bank account, using an API like Finexer’s, without requiring re-approval, cards, or delays.

What does VRP stand for?

VRP stands for Variable Recurring Payments. It refers to a modern payment method where a business can collect recurring payments of different amounts from a customer’s bank account based on a one-time consent. VRPs are powered by Open Banking and are more flexible and secure than traditional recurring payment methods.

What is the VRP payment method?

The VRP payment method allows businesses to charge customers variable amounts on a recurring basis, directly from their bank accounts. Unlike card or direct debit systems, VRPs are powered by Open Banking and use a one-time customer consent to authorise future payments. This method is ideal for flexible billing models like subscriptions, lending, utilities, and donations.

Want us to walk you through it? Request a 1:1 integration session and we’ll help you go live in no time !