If you’re in the business of lending money, offering credit, or managing financial approvals, verifying a person’s income is a big deal. It’s how you make sure that someone can actually afford what they’re applying for—whether it’s a loan, a mortgage, or a new rental agreement. But let’s be honest—traditional income verification is a hassle.

The Problems with Traditional Income Verification

- It’s slow – Waiting for payslips, bank statements, or tax documents to be submitted and reviewed can take days (or even weeks).

- It’s not always accurate – Paper documents can be forged, altered, or just outdated, making them unreliable.

- It’s not built for modern work life – Many people in the UK earn income from multiple sources (freelancing, gig work, side businesses), and old-school verification methods struggle to assess this properly.

- It’s a compliance headache – Financial institutions have to meet strict FCA and GDPR regulations when handling customer data, and manual processes leave too much room for mistakes.

The Solution is Automated income verification software, It connects directly to financial data sources such as banks, payroll providers, and tax systems to confirm an applicant’s income instantly. Instead of requesting documents and manually reviewing them, lenders receive verified financial information within seconds.

Comparing Top Income Verification Software

| Software | Verification Method | Best For | Key Features | API Integration | Data Sources Used |

|---|---|---|---|---|---|

| Finexer | Open Banking (99% UK banks) | Lenders, Fintech, Accounting & ERP | Real-time bank integration, ERP compatibility, AI-driven fraud detection | Yes | Bank Transactions (Open Banking) |

| Plaid | Bank & Payroll Data Access | UK & International Lenders, Fintechs | Multi-source income validation, cross-border verification, secure API | Yes | Bank & Payroll Data |

| Tink’s Income Check | Bank Transaction Analysis | Mortgage Lenders, BNPL Providers | 12+ months income trend analysis, affordability scoring, FCA-compliant | Yes | Bank Transaction Analysis |

| Equifax Income Verification | Payroll & Credit Data | Banks & Financial Institutions | Payroll & credit-linked risk assessment, real-time verification | Yes | Payroll & Credit Data |

| Konfir | Employer-backed Verification | HR, Mortgage Lenders, Employment Screening | Employer API for tamper-proof verification, seamless HR integration | Yes | Employer & Payroll API |

| Sikoia | AI-Powered Multi-Source Verification | High-Risk Lending & Credit Assessment | AI-driven financial data validation, fraud detection, affordability checks | Yes | Bank, Payroll & Alternative Data |

| Experian Verify | Credit & Payroll-linked Verification | Lenders, Mortgage Providers, Auto Finance | Credit-linked income validation, real-time affordability insights | Yes | Credit Reports & Payroll Data |

| TrueLayer | Instant Bank Data Retrieval | Lenders, Fintech, Open Banking Services | Open banking-based real-time income verification, fraud-proof authentication | Yes | Bank Transactions (Open Banking) |

| MicroBilt | Bank & Alternative Data Access | Credit Unions, Microloan Providers | Predictive analytics, alternative financial data, microloan risk assessment | Yes | Bank & Alternative Credit Data |

| Docsumo | AI-driven Document Processing | Mortgage Providers, Document-Based Verification | AI-powered OCR document verification, automated affordability checks | Yes | Payslips, Tax Records, Bank Statements |

📚 Open banking Income Verification Explained

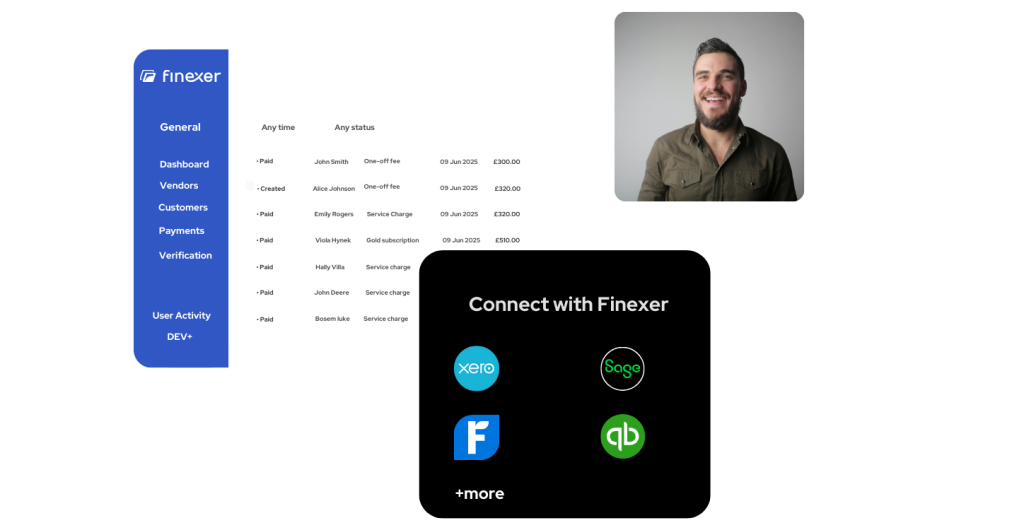

1. Finexer

Overview

Finexer is a UK-based income verification software that leverages open banking to provide real-time, secure access to financial data. By connecting with 99% of UK banks, Finexer ensures instant income verification without requiring manual document submission. This allows lenders and financial institutions to speed up approvals, reduce fraud risks, and make more informed lending decisions.

How Finexer Uses Open Banking for Income Verification

- Direct Bank Integration – Finexer connects with a borrower’s bank, retrieving income details in real time through open banking APIs.

- Automated Income Analysis – AI-driven algorithms categorise income sources (salaries, freelance payments, rental income, etc.) and provide detailed financial insights.

- Fraud Prevention – Since data is fetched directly from banks, it is tamper-proof, eliminating risks of falsified payslips or bank statements.

- Regulatory Compliance – Finexer is FCA and GDPR compliant, ensuring secure data handling.

Key Features

- Instant access to verified financial data from UK banks..

- Quick Income verification for salaried workers, freelancers, and gig economy earners.

- Seamless API integration for lending platforms and payroll systems.

- Reduces approval times by up to 80 percent, improving customer experience.

- Affordable pricing model designed for UK businesses looking to reduce costs while ensuring compliance.

Who Should Use Finexer?

- Lenders and mortgage providers looking for real-time, fraud-proof income verification software.

- Fintech companies integrating income verification into their platforms.

- Property rental agencies and employers needing a fast, reliable way to confirm applicant income.

- Accounting & ERP firms that need to verify client or supplier income for financial reporting and credit assessments.

2.Plaid

Overview

Plaid is a widely recognised income verification software that connects businesses with real-time financial data from bank accounts, payroll providers, and tax systems. While widely used in the US and Europe, Plaid has expanded its open banking integrations in the UK, making it a strong choice for lenders requiring global income verification capabilities.

How Plaid Works for Income Verification

- Bank & Payroll Data Access – Plaid retrieves real-time income details from bank transactions and employer payroll records.

- Global Coverage – Works across the UK, US, and Europe, making it ideal for lenders with international customers.

- AI-Powered Categorisation – Automatically classifies income from salaries, benefits, and freelance earnings.

- Secure & Compliant – Fully FCA, GDPR, and PSD2 compliant, ensuring secure data handling.

Key Features

- Instant income verification from multiple financial sources.

- Multi-country support, making it ideal for lenders working across different regions.

- Open banking APIs for easy integration with financial platforms.

- Strong fraud protection by verifying income directly from financial institutions.

- Works with multiple income streams, including full-time employment, self-employment, and government benefits.

Who Should Use Plaid?

- UK lenders & fintechs needing real-time access to verified bank and payroll data.

- International lenders & financial institutions looking for cross-border income verification.

- Companies offering BNPL (Buy Now, Pay Later) and credit services requiring fast income validation.

3. Tink’s Income Check

Overview

Tink’s Income Check is a secure, open banking-powered verification tool that provides real-time financial insights by analysing bank transaction data. It helps lenders verify income sources instantly without requiring manual document submissions.

How Tink’s Income Check Works for Income Verification

- Real-Time Bank Data Access – Fetches direct income data from UK banks using open banking.

- Advanced Income Categorisation – Identifies and classifies salary payments, pension deposits, and benefits.

- Historical Income Analysis – Analyses 12+ months of income trends to assess financial stability.

- FCA-Regulated Security – Complies with UK financial laws and ensures consumer consent-driven data sharing.

Key Features

- Instant income verification using secure open banking APIs.

- Detailed affordability checks with income trend analysis.

- Works with mortgage lenders, credit providers, and financial institutions.

- Prevents fraud by eliminating reliance on self-reported data.

- Easily integrates with existing lending and underwriting platforms.

Who Should Use Tink’s Income Check?

- UK lenders & mortgage providers needing real-time bank-verified income data.

- BNPL & credit service providers requiring automated affordability assessments.

- Financial institutions integrating open banking for faster loan approvals.

4. Equifax Income Verification

Overview

Equifax Income Verification is an automated income verification solution designed to provide businesses with accurate and secure access to payroll and credit-linked income data. It helps financial institutions, lenders, and mortgage providers streamline income verification while ensuring compliance with UK regulations.

How Equifax Income Verification Works for Income Verification

- Direct Payroll & Bank Integration – Retrieves real-time income data from payroll providers and bank transactions.

- Automated Affordability Assessments – Uses credit file data and spending behavior analysis to assess loan eligibility.

- Fraud Prevention & Compliance – Reduces the risk of altered income documents by verifying directly from financial sources.

- Secure API Integration – Allows lenders to automate income verification within their existing systems.

Key Features

- Instant access to verified payroll & banking data.

- Uses credit-linked data to enhance affordability assessments.

- Minimises manual documentation and reduces processing times.

- Fully FCA & GDPR compliant, ensuring secure data handling.

- Works with mortgage lenders, banks, and financial institutions.

Who Should Use Equifax Income Verification?

- Lenders & mortgage providers requiring secure payroll-based income verification.

- Financial institutions conducting affordability & risk assessments.

- Businesses automating income verification to reduce fraud risk.

5. Konfir

Overview

Konfir is a specialised employment & income verification platform that provides instant verification for businesses, lenders, and employers. It eliminates manual back-and-forth processes, ensuring faster decision-making and reduced administrative burden.

How Konfir Works for Income Verification

- API-Based Verification – Instantly retrieves income & employment history using employer and payroll connections.

- Multi-Source Income Validation – Cross-checks salary, benefits, and financial history to ensure accurate verification.

- Secure Data Sharing & Compliance – Uses consumer-consented data sharing while ensuring GDPR compliance.

Key Features

- Instant employment & income verification through API or file upload.

- Eliminates manual verification delays, reducing time spent on approvals.

- Provides a clear overview of income stability & employment history.

- Fully FCA & GDPR compliant, ensuring secure data transfers.

- Integrates with lending platforms, mortgage providers, and payroll systems.

Who Should Use Konfir?

- Lenders & financial institutions conducting instant income verification.

- Employers & HR teams verifying employment & income history.

- Mortgage providers & banks automating applicant verification processes.

6. Sikoia

Overview

Sikoia is an AI-driven financial data aggregator that helps lenders verify income, employment, and financial health by leveraging bank transactions, payroll data, and alternative financial sources. It is widely used in the UK for lending, affordability checks, and risk assessment.

How Sikoia Works for Income Verification

- Bank Transaction Analysis – Uses open banking to verify income from salaries, freelancing, rental income, and gig work.

- Payroll & Employer Data Integration – Connects with payroll providers to cross-check employer-reported income.

- AI-Based Risk Scoring – Detects irregular financial patterns and fraudulent claims.

- Customisable API for Lenders – Allows financial platforms to automate affordability assessments.

Key Features

- Multi-source income verification from banks, payroll, and alternative finance records.

- Automated affordability checks & risk scoring to improve lending decisions.

- Detects irregularities & fraud using AI-driven analytics.

- Custom API integration for financial institutions & lenders.

- Fully FCA & GDPR compliant, ensuring secure income validation.

Who Should Use Sikoia?

- Lenders & credit providers needing AI-powered affordability checks.

- Financial institutions verifying income & employment records with accuracy.

- Mortgage providers assessing financial stability & borrower risk.

7. Experian Verify

Overview

Experian Verify is a trusted income verification software that combines credit history with income data to provide a comprehensive financial profile of applicants. It is widely used by lenders, mortgage providers, and financial institutions in the UK to streamline decision-making.

How Experian Verify Works for Income Verification

- Credit-Linked Income Verification – Uses credit file data alongside open banking insights to verify income.

- Seamless Payroll Integration – Connects directly with employer payroll systems for accurate income assessment.

- Historical Income Analysis – Assesses up to 12 months of income transactions to determine financial stability.

- AI-Powered Affordability Checks – Evaluates disposable income and spending habits to assist in lending decisions.

- Secure API for Lenders – Easily integrates into loan approval processes and credit risk models.

Key Features

- Combines credit report data with verified income records.

- Access to real-time payroll and banking data for more precise assessments.

- Helps lenders assess affordability by analysing spending patterns.

- FCA-compliant and meets UK financial regulations for data security.

- Works with mortgage providers, auto lenders, and personal finance platforms.

Who Should Use Experian Verify?

- Mortgage lenders & banks looking for credit-linked income verification.

- Financial institutions needing affordability assessments based on income and credit history.

- Auto finance & BNPL providers requiring secure income validation.

8. Truelayer

Overview

Truelayer is a leading income verification software in the UK that specialises in real-time financial data retrieval through open banking APIs. It allows lenders and fintech companies to access verified income data directly from customer bank accounts, ensuring high accuracy and fraud prevention.

How Truelayer Works for Income Verification

- Instant Bank Connection – Users authenticate their bank accounts, and Truelayer retrieves verified income data in real time.

- AI-Based Categorisation – Automatically detects salary payments, self-employment income, and government benefits.

- Fraud Prevention & Security – Eliminates the risk of altered payslips or bank statements by accessing direct financial data.

- Customisable APIs for Fintech & Lenders – Allows financial platforms to integrate income verification into their systems.

- FCA-Regulated Open Banking Platform – Ensures compliance with UK data protection and privacy laws.

Key Features

- Real-time income verification through open banking.

- Fraud-proof authentication by retrieving direct bank data.

- Supports multiple income sources, including freelance and self-employed earnings.

- Customisable API for easy integration with lending platforms.

- Fully FCA and GDPR compliant.

Who Should Use Truelayer?

- Lenders and financial institutions that need instant bank-verified income data.

- Credit providers and BNPL companies requiring fast and accurate affordability assessments.

- Fintech companies integrating open banking for enhanced financial services.

9. MicroBilt

Overview

MicroBilt is a specialised income verification software designed for small lenders, credit unions, and alternative financial institutions. It provides a wider range of income verification tools, including traditional bank data and alternative credit data sources, helping lenders assess non-traditional borrowers more accurately.

How MicroBilt Works for Income Verification

- Bank & Alternative Data Access – Retrieves income details from bank transactions, payroll records, and public financial data sources.

- Credit Bureau Integration – Combines income verification with alternative credit data for a complete financial profile.

- Automated Income Categorisation – Uses machine learning to identify salary, gig economy earnings, and government benefits.

- Risk Scoring & Predictive Analytics – Evaluates income patterns and financial stability to assist with credit decisions.

- Secure API for Seamless Integration – Works with lending platforms and financial risk assessment systems.

Key Features

- Income verification using traditional and alternative financial data.

- Predictive analytics and credit scoring to assess financial stability.

- Multi-source data collection, including payroll records and public financial data.

- Designed for small lenders, credit unions, and alternative finance providers.

- FCA and GDPR compliant for secure data processing.

Who Should Use MicroBilt?

- Credit unions & small lenders needing alternative data for income verification.

- Subprime lenders & microloan providers assessing borrowers with thin or no credit files.

- BNPL & payday loan providers looking for real-time financial history tracking.

10. Docsumo

Overview

Docsumo is an AI-powered document processing software that automates income verification by extracting data from payslips, bank statements, and tax records. It is widely used by financial institutions, lenders, and mortgage providers looking to speed up manual verification processes.

How Docsumo Works for Income Verification

- AI-Driven OCR (Optical Character Recognition) – Automatically extracts income details from payslips, invoices, and tax returns.

- Automated Income Categorisation – Classifies salary payments, rental income, business earnings, and self-employment income.

- Fraud Detection & Compliance Checks – Identifies forged or altered financial documents.

- Seamless API Integration – Connects with lending platforms and financial services.

- Multi-Document Support – Processes bank statements, employment records, and financial forms.

Key Features

- Extracts and verifies income details from financial documents.

- AI-powered fraud detection to prevent forged documents.

- Supports multiple document formats, including PDFs, images, and scanned files.

- Seamless integration with financial services & lending platforms.

- Reduces manual processing time and improves verification accuracy.

Who Should Use Docsumo?

- Mortgage providers & lenders needing AI-powered document-based income verification.

- Financial institutions handling large volumes of income verification requests.

- Companies still relying on document uploads for income validation.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why UK Businesses Choose Finexer’s Income Verification

For UK-based lenders, fintech companies, and financial institutions looking for a fast, reliable, and cost-effective solution, Finexer stands out as an excellent choice.

- Connects to 99% of UK banks for instant income verification.

- Seamlessly integrates with ERP & accounting systems for business financial management.

- Uses open banking to eliminate manual documentation and reduce processing time by up to 80%.

- AI-powered fraud detection ensures accurate and tamper-proof financial data.

- Lower costs compared to traditional income verification providers, making it a budget-friendly option.

As digital transformation continues to shape financial services, adopting an efficient and automated income verification solution is essential. Whether you’re looking for bank-based verification, payroll integration, AI-driven insights, or document-based scanning, there’s a solution tailored to your needs in this list.

What is income verification software, and why is it important?

Income verification software is a tool used by lenders, financial institutions, and businesses to validate a person’s income through bank transactions, payroll data, or alternative sources. It helps in loan approvals, rental agreements, and financial risk assessments by ensuring the applicant has a stable source of income.

How does open banking help with income verification?

Open banking-based income verification software connects directly to a user’s bank account (with their consent) to fetch real-time income data. Solutions like Finexer and Tink eliminate the need for manual document uploads, ensuring faster, more secure, and fraud-resistant verification.

What is the most secure method for income verification?

The most secure income verification methods include:

->Open banking (e.g., Finexer, Tink) – Direct bank data prevents document fraud.

->Employer-backed payroll verification (e.g., Experian, Equifax, Konfir) – Ensures authentic employment records.

->AI-driven fraud detection (e.g., Sikoia) – Identifies inconsistencies in reported income.

All FCA-regulated software solutions in this list comply with UK data protection laws, ensuring secure and consent-driven verification.

How do lenders use income verification software?

Lenders use income verification software to:

✅ Verify employment and salary information before approving loans.

✅ Assess affordability by analysing income trends and spending habits.

✅ Detect fraud by ensuring data comes directly from bank accounts or payroll providers.

✅ Speed up approvals by automating the verification process instead of relying on manual bank statements and payslips.

How does income verification software prevent fraud?

Fraud prevention in income verification software includes:

->Direct bank connections (e.g., Finexer, Tink) → Eliminates fake payslips & tampered documents.

->Payroll-based verification (e.g., Experian, Equifax, Konfir) → Confirms employer-reported salary data.

->AI-driven risk detection (e.g., Sikoia) → Flags inconsistencies in income patterns.

By automating verification, these tools reduce human error and detect suspicious financial activity.

Which UK regulations apply to income verification software?

All income verification solutions must comply with UK financial regulations, including:

->Financial Conduct Authority (FCA) guidelines – Ensuring secure financial data processing.

->GDPR (General Data Protection Regulation) – Protecting consumer data privacy.

->Strong Customer Authentication (SCA) – Requiring user consent for data sharing.

Can businesses integrate income verification software into their systems?

Yes. Most income verification solutions offer API integrations, allowing businesses to embed verification tools into:

->Lending platforms – Automating affordability checks for banks and credit providers.

->ERP & accounting software (e.g., Finexer) – Automating financial assessments for businesses.

->Payroll & HR systems – Helping employers verify staff income and employment history.

Stay Compliant with Finexer! Schedule your free demo and get a 14 days Trial by Finexer 🙂