Insurance fraud prevention is no longer a back-office task, it’s a frontline defence. From income misrepresentation to coordinated claim scams, fraud tactics have become faster, more digital, and harder to trace.

Yet many insurers still rely on outdated methods: static bank statements, manual reviews, or self-declared financial data.

The result? Delays, blind spots, and missed risk signals.

That’s where Open Banking comes in. With access to live, consented bank data, insurers can now detect red flags at onboarding, not after a payout request. No PDFs. No delays. Just real financial behaviour, verified in real time.

The Association of British Insurers (ABI) has detected 84,400 fraudulent claims in 2023 for a total cost of 1.1 billion GBP (1.4 billion USD), up 4% over one year.

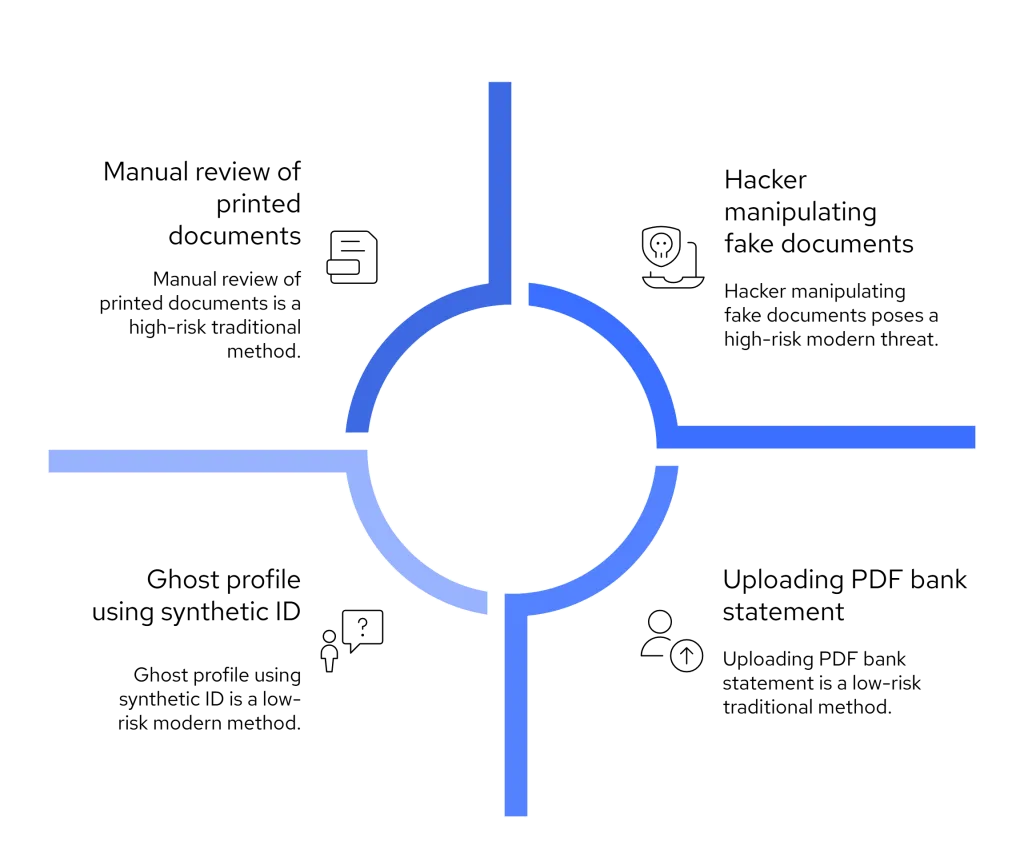

Why Traditional Insurance Fraud Prevention Falls Short

Insurers have long relied on static methods to screen policyholders: bank statements uploaded as PDFs, income declarations on forms, or one-time KYC checks. But today’s fraud networks know how to exploit these gaps.

Here’s where the current model breaks down:

- Faked or altered bank statements are easy to submit and hard to catch manually.

- One-time verification doesn’t detect behavioural red flags over time.

- Self-declared financial information often goes unchecked until a claim triggers review.

- Credit bureau data may be outdated or irrelevant to real-time financial behaviour.

- Fraudulent applicants can reuse the same fabricated documents across providers.

This creates a lag between application and fraud discovery, meaning fraud is only detected after exposure to financial risk.

In a climate where fraud sophistication is rising, relying on static checks leaves insurers vulnerable. To build a stronger insurance fraud prevention strategy, you need live, verifiable data, not just documents.

Real-Time Insurance Fraud Prevention with Open Banking

Open Banking has unlocked a new standard in fraud detection, giving insurers access to live, consented financial data directly from a customer’s bank. Instead of relying on PDFs or static documents, you can now view real-time transactions, recurring income, account balances, and spending patterns at the point of onboarding or claim.

This changes the entire model of insurance fraud prevention from reactive to proactive.

What You Can Detect Using Live Bank Data:

- False income claims: Applicant declares £3,500/month salary, but data shows inconsistent or no regular income

- Synthetic identities: No employer deposits, utilities, or tax-related transactions tied to the claimed identity

- Fabricated expenses: Bank data doesn’t align with declared assets, debts, or family obligations

- High-risk financial behaviour: Gambling patterns, sudden large deposits, or irregular withdrawals

- Duplicate fraud rings: Same account data reused under different names or emails

All of this is permissioned and FCA-regulated, ensuring compliance while improving fraud detection speed.

With Open Banking, you’re no longer guessing. You’re reviewing what’s real, verified, and ongoing.

How Live Bank Data Strengthens Insurance Fraud Prevention: Use Cases That Matter

Implementing Open Banking into your insurance fraud prevention strategy isn’t just theoretical; it produces real-world results at every stage of the policy lifecycle.

1. Detecting Income Misrepresentation at Onboarding

Problem: A customer declares an annual salary of £48,000.

Bank data reveals: No employer deposits, only sporadic income from side gigs.

Impact: Prevents underwriting based on false affordability.

2. Spotting Synthetic Identities Before Payout

Problem: Claimant provides identity documents and account details.

Bank data reveals: No transaction history, no direct debits, no utility payments, all common signs of a fabricated profile.

Impact: Flags potential fraud before funds are released.

3. Identifying High-Risk Financial Behaviour

Problem: Application appears clean on paper.

Bank data reveals: Heavy gambling, payday loans, or high cash withdrawals.

Impact: Allows dynamic fraud scoring using real spending behaviour.

4. Detecting Claim Pattern Abuse Across Policies

Problem: Same individual applies under different names or emails.

Bank data reveals: Overlapping account numbers, payment references, or recurring transactions across identities.

Impact: Identifies organised fraud rings using shared financial infrastructure.

These scenarios show that insurance fraud prevention is no longer about just detecting lies; it’s about verifying truth through behavioural proof.

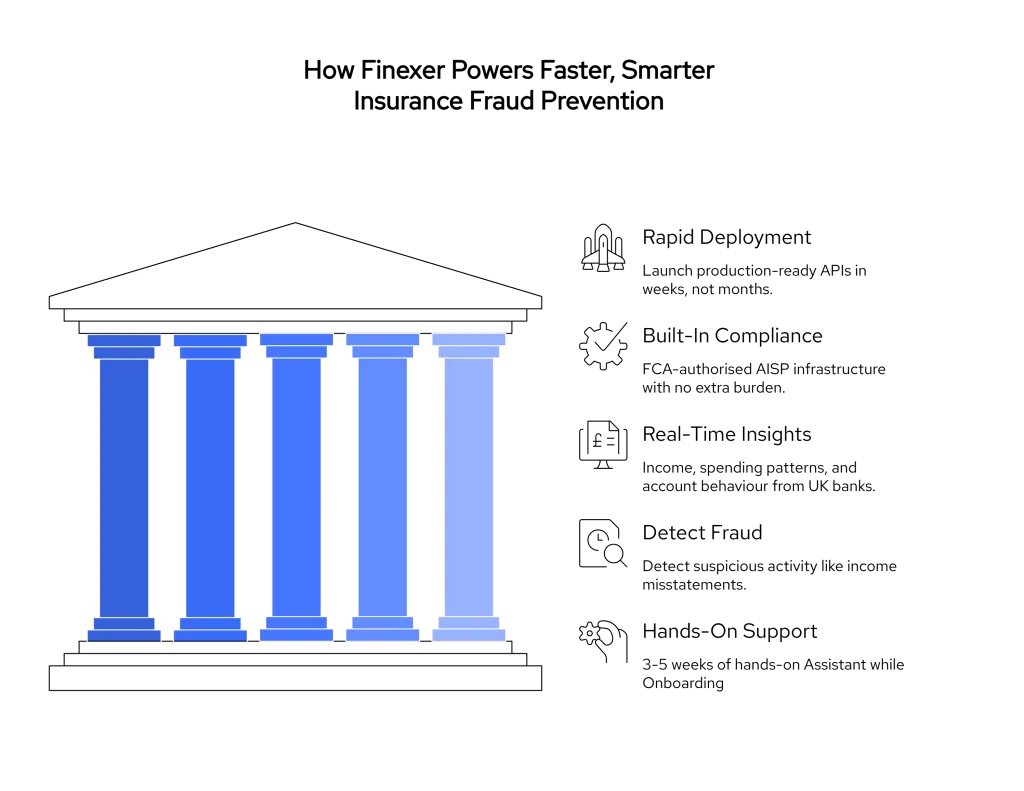

Prevent Insurance Fraud Faster with Finexer’s Open Banking API

You don’t need to build a complex fraud detection stack from scratch. Finexer makes it easy to access real-time bank data, verify policyholders, and flag suspicious behaviour, without long integration cycles or heavy compliance lift.

Why Insurers Use Finexer for Insurance Fraud Prevention

- Deploy 2–3x faster than the market average

Finexer’s developer-friendly APIs and UK-first onboarding process let your team move from testing to live usage in weeks, not months. - Built-in compliance

Finexer is FCA-authorised to access bank data under AISP permissions, so you can stay compliant without taking on regulatory overhead. - Bank-verified financial insights

Instantly access income data, transactional patterns, and account behaviours from 99% of UK banks, no PDFs or uploads required. - Custom risk signals

Configure rules to detect income inconsistencies, behavioural anomalies, or account duplication directly within your fraud prevention workflow. - Hands-on onboarding support

Finexer’s support team helps you map fraud use cases, run pilot checks, and deploy with confidence, especially if you’re integrating for the first time.

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.” – David Kern, CEO of Virtual Signature ID.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowHow does live bank data help prevent insurance fraud?

It provides real-time income and spending data, helping detect false claims and risky behaviour before approval.

Why aren’t traditional fraud checks enough?

PDF uploads and manual reviews miss red flags like fake documents and reused data, making them easy for fraudsters to exploit.

Can insurers legally use Open Banking data?

Yes, with customer consent and an FCA-authorised provider, insurers can securely access bank data to detect fraud.

Explore How Top Insurers Are Using Finexer to Spot Application Fraud with Live Bank Data & KYC