Effective law firm cost management is essential for maintaining profitability and compliance in today’s challenging legal landscape. Know Your Customer (KYC) compliance expenses typically range from £50,000 to £150,000 annually, with payment processing fees between 1% and 3% per transaction. Many UK law firms also lose over 150 staff hours per fee earner annually due to inefficient manual administrative processes, further amplifying operational strain.

These processes can be streamlined, and significant cost savings can be achieved by integrating Finexer, an open banking-based platform created for the needs of the legal sector.

Why Cost Management Matters for UK Law Firms

Here are 5 reasons why cost management is necessary for UK law firms:

- Manage Increasing Operational Costs: Manual client verification procedures and payment processing fees of 1% to 3% per transaction greatly raise overhead expenses.

- Increase Staff Productivity: Each fee earner spends more than 150 hours a year on manual reconciliation and compliance duties, which takes away from time that could be spent on billable client work.

- Assure Regulatory Compliance: Effective cost control aids in avoiding noncompliance and the fines imposed by the Solicitors Regulation Authority (SRA).

- Enhance Financial Planning: Cost control enables businesses to more effectively allocate resources, lessen their dependency on credit, and increase the stability of their cash flow.

- Boost Competitiveness: In a tightening market, cost-effective businesses can maintain profitability, satisfy customer demands for transparency, and provide more competitive pricing structures.

How Finexer Helps Reduce Payment Costs and Improve Efficiency for UK Law Firms

By enabling direct bank-to-bank payments, Finexer’s open banking platform helps legal firms avoid costly card networks. This can save up to 80% on transaction fees, which is especially advantageous for companies that deal with corporate and high-value real estate settlements.

Here are some features:

- Avoid Expensive Card Networks: Finexer allows for direct bank-to-bank payments, which can save up to 80% on transaction fees, particularly for legitimate, high-value transactions.

- Automate Reconciliation: By matching payments to invoices in real time, over 150 staff hours are saved annually, and errors are reduced.

- Instant Settlement: Quick access to money improves financial management by accelerating cash flow and lowering dependency on credit.

- Enhance the Client Payment Process: Secure payment links and QR codes simplify payments without card machines, boosting client satisfaction.

- Assure Compliance: SRA compliance and audit readiness are made easier by the automated creation of thorough payment records.

- Smooth Integration: To minimise interruption, Finexer’s API integrates seamlessly with the current law firm management software.

What are the key areas for cost management in a modern law firm?

Focus on high-volume operational areas. This includes automating client KYC verification, reducing payment processing fees, and streamlining administrative tasks that consume valuable fee-earner time.

How does automating the KYC process reduce a firm’s expenses?

Automation cuts down on manual data entry, which minimises costly human errors. It also frees up staff from administrative work, allowing them to focus on revenue-generating, billable tasks.

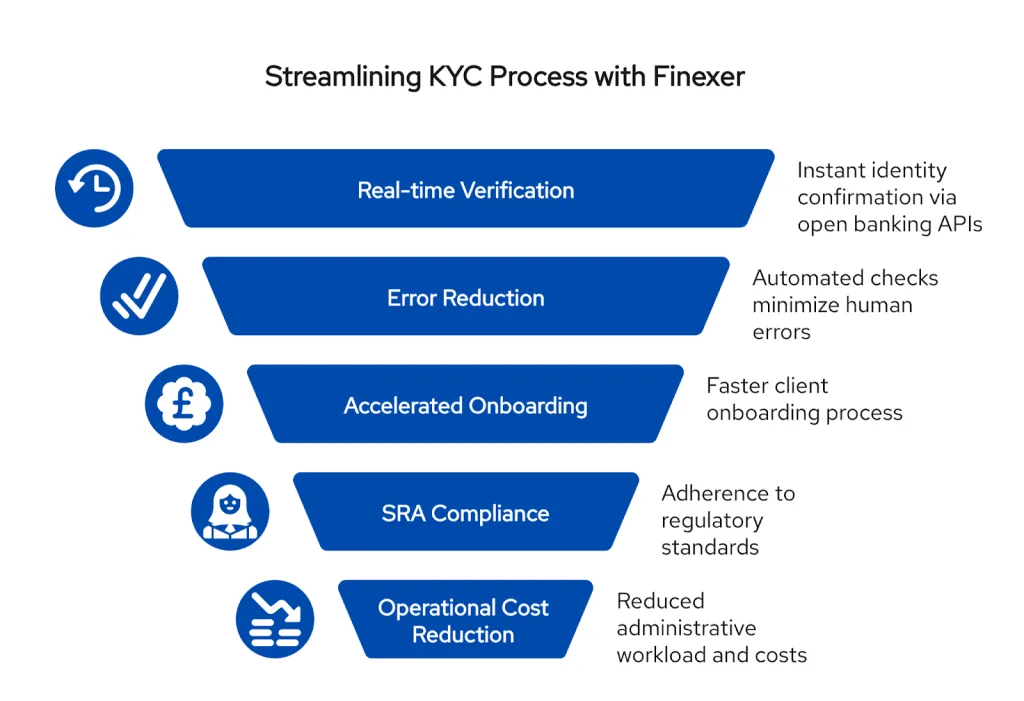

Streamlining KYC through Automation

Real-time Client Verification

Finexer instantly confirms client identities in real-time by utilising sophisticated open banking APIs. This simplifies the KYC verification procedure for legal firms, greatly cutting down on turnaround times and increasing accuracy—two critical components of efficient legal firm cost management and compliance.

Error Reduction

Finexer improves data accuracy by reducing human error by substituting automated open banking verification for manual document checks. By reducing administrative overhead and compliance risks; this improves law firm cost management by minimising expensive errors during client onboarding.

Accelerated Onboarding

By enabling quicker KYC procedures, Finexer’s platform helps legal firms onboard clients faster, increasing operational effectiveness. Enhanced client satisfaction and better cost management for law firms are supported by faster onboarding, which frees up employees for billable work.

SRA Compliance

Finexer’s automated KYC solution helps legal practices adhere strictly to the standards set forth by the Solicitors Regulation Authority (SRA). Reliable, audit-ready processes are essential to successfully managing law firm costs because they help businesses avoid fines and compliance failures.

Operational Cost Reduction

Finexer automation reduces the amount of time employees spend performing manual verifications, which leads to a considerable reduction in operational costs. Law firm cost management objectives are directly impacted by less administrative work, freeing up resources to concentrate on value-generating activities.

Comprehensive Benefits of Law Firm Cost Management with Finexer

For Managers:

Finexer provides real-time analytics and comprehensive dashboards, giving law firm managers clear visibility into cost savings, operational efficiencies, and compliance status. This data-driven insight supports smarter budgeting and strategic resource allocation, crucial for effective law firm cost management.

For Staff:

Automation of administrative tasks through Finexer reduces the tedious workload for legal professionals, freeing up their time to focus on billable client work. This increase in productivity not only enhances job satisfaction but also positively impacts the firm’s revenue.

For Clients:

Clients benefit from a transparent and accelerated payment and onboarding process. Finexer’s technology ensures real-time status updates and smooth transactions, which build trust and improve client satisfaction—key factors for client retention and referral in the legal sector.

For Compliance Teams:

With automated audit trails and sophisticated regulatory adherence tools, Finexer assists compliance teams in meeting Solicitors Regulation Authority (SRA) standards effortlessly. This reduces the risk of violations and regulatory penalties, a vital part of law firm cost management.

Practical steps to implement cost management

Examine Current Procedures

Begin by carrying out a comprehensive examination of your present Know Your Customer (KYC) verification and payment processing procedures. Make a clear plan for improvement by identifying inefficiencies, excessive expenses, and delays that affect your law firm’s cost management strategy.

Plan Integration

To link Finexer’s open banking APIs with your current practice management systems, create a thorough, phased integration plan. In order to improve overall law firm cost management, strive for minimal disruption and smooth data flow in your operational workflows.

Train Employees

Give all employees participating in payments and KYC procedures thorough training. Make sure they comprehend how to utilise Finexer’s platform, emphasising its advantages for improved law firm cost management, such as decreased manual labour and enhanced accuracy.

Client Communication

To inform clients about the new payment and verification procedures, develop clear and understandable messaging. As part of your cost management efforts, highlight the convenience and security Finexer offers, which will help your legal practice gain the trust of your clients.

Monitor KPIs

Set up key performance indicators such as client satisfaction, cost savings, verification turnaround times, and payment processing speeds. To assess how well your Finexer integration is working and improve your law firm’s cost management procedures, keep a close eye on these KPIs.

Continuous Improvement

To continuously improve your workflows, use data insights and employee/client feedback. Make sure your law firm cost management plan is sustainable and scalable over time by modifying Finexer’s features to meet evolving operational or compliance requirements.

Beyond savings, what are the benefits of a streamlined client onboarding process?

A faster, more efficient onboarding process enhances the client experience from the very first interaction. This improves client satisfaction, builds trust, and can increase retention and referrals.

How can a firm reduce high fees on client payments and settlements?

Look into modern payment solutions that enable direct bank-to-bank transfers. These systems often bypass traditional card networks, which can significantly lower the transaction fees your firm pays.

Conclusion

Effective law firm cost management is essential to maintaining profitability, improving operational efficiency, and ensuring regulatory compliance in today’s legal landscape. By adopting Finexer’s innovative open banking platform, UK law firms can significantly reduce expenses related to KYC and payment processing.

Implementing Finexer empowers firms to streamline workflows, enhance client satisfaction, and gain actionable insights for smarter budgeting and growth. This investment positions law firms for long-term financial sustainability and competitive advantage.

Cut compliance and payment costs today, integrate Finexer and give your law firm a faster, smarter, and more profitable future.