Over 55% of UK tenants now expect digital-first interactions with letting agents from affordability checks to payment tracking. But most agencies still rely on emails, PDFs, and manual document reviews to verify income, deposits, or spending risk.

That gap is costing time and trust.

With tenant consent, letting agents can now use Open Banking to view verified financial data straight from the tenant’s bank no uploads, no edits, no follow-ups. This doesn’t just speed up referencing. It unlocks faster move-ins, better fraud prevention, and simpler compliance.

In this post, we break down 3 specific things letting agents can do with Open Banking data in 2025, and how it’s reshaping client service in the rental market.

📚 Guide to Open Banking for Proptech

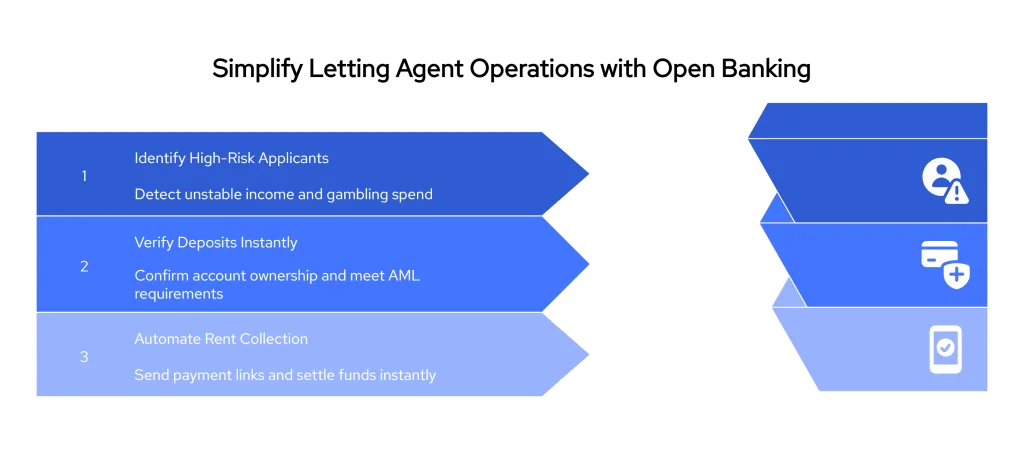

1. Flag High-Risk Applicants in Seconds

Why Traditional Document Checks Fall Short

Manual reviews rely on PDFs, scans, or photographs of payslips and bank statements. These files:

- can be edited with basic software

- rarely cover the full date range you need

- hide indicators such as frequent overdrafts or payday loan use

The result is a slower process with blind spots that only become clear after a tenant has moved in.

What Open Banking Reveals Instantly

When a tenant consents to share account data, the platform receives a machine-readable feed covering up to 90 days of transactions. Within moments, letting agents can see:

| Signal | Why It Matters | Typical Thresholds |

|---|---|---|

| Net income stability | Confirms regular earnings and employment continuity | ≥ 3 consecutive monthly salary credits |

| Overdraft frequency | Highlights cash-flow strain before rent day | ≤ 1 overdraft use per month is generally low risk |

| High-risk spending patterns | Gambling, payday loans, or persistent overdraft fees may signal future arrears | Flag any gambling > £100 or payday-loan repayments |

| Existing rental or mortgage payments | Shows current housing cost burden | Current rent ≤ 40% of net income is common cut-off |

| Regular missed payments | Late utilities or loan defaults predict payment issues | More than 2 missed direct debits in 3 months |

Using these signals, a platform can assign a risk score automatically, letting teams sort applicants into approve, review, or decline queues without manual number-crunching.

How to Interpret the Data Responsibly

- Set clear thresholds – Decide in advance what level of overdraft use or gambling spend is acceptable for your portfolio.

- Combine multiple factors – A single overdraft isn’t a deal-breaker, but frequent overdrafts plus high unsecured debt might be.

- Document the logic – Record your scoring rules so you can defend decisions under the Tenant Fees Act and FCA guidance.

Business Impact in Practice

Agencies that replace manual document checks with real-time Open Banking data typically report:

- 60 % faster application turnaround (from days to hours)

- Up to 30 % drop in post-move-in arrears thanks to early risk detection

- Improved tenant experience because applicants don’t have to gather PDFs or bank screenshots

By turning opaque statements into structured signals, letting agents gain the confidence to approve good tenants quickly while filtering out high-risk applicants before a tenancy agreement is signed.

2. Verify Deposits Without Asking for Documents

Most letting agents still rely on email threads, screenshot attachments, or in-person meetings to verify large deposits. But this process is slow, inconsistent, and vulnerable to error, especially in high-value or overseas tenancies.

The Problem with Manual Deposit Checks

When tenants transfer a deposit or months of rent upfront, agents are expected to confirm the source of funds to comply with Anti-Money Laundering (AML) rules. But verifying this manually introduces several issues:

- Tenants send redacted or incomplete files

- Documents don’t show the full financial trail

- Agents must interpret a mix of foreign currencies, transfers, and irregular income

- Verbal claims (e.g. “it’s from family”) aren’t backed by evidence

This slows down onboarding and introduces risk, especially in regions flagged for enhanced due diligence.

What Open Banking Solves

With Open Banking, letting agents can trigger a consent-based check that securely connects to the tenant’s account and provides:

| Verified Insight | What It Confirms |

|---|---|

| Deposit origin | Whether funds came from salary, savings, loan, or third-party gift |

| Account ownership | Matches name on the bank account with tenancy applicant |

| Hold duration | How long the funds were present before being sent |

| Financial context | Ongoing income and spending that supports or contradicts the deposit |

This audit-ready data is structured, timestamped, and categorised, meaning teams no longer need to interpret line items manually.

AML Compliance Without Chasing Documents

These real-time checks can satisfy due diligence requirements under:

- HMRC AML supervision for lettings (for rents over £10,000/month)

- Right to Rent & Right to Let guidelines

- Internal risk-based AML policies

By shifting from document collection to verified bank data, letting agents reduce back-and-forth, avoid subjective judgement, and deliver a faster, safer onboarding experience even in complex tenancies.

3. Automate Monthly Rent Collection Without Risky Direct Debits

Even after a tenant passes screening and moves in, letting agents often face a bigger operational challenge: collecting rent reliably.

Why Traditional Rent Collection Breaks

Most agents still depend on Direct Debit, standing orders, or manual bank transfers. But each method has its issues:

- Direct Debit can bounce if there are insufficient funds

- Standing orders require tenant setup and often fail during changes

- Manual transfers rely on reminders and perfect timing

Late or missed rent creates admin, tension, and impacts landlord relationships, especially when reconciliation becomes a manual chore.

How Open Banking Changes Rent Collection

With Request to Pay, a new Open Banking-based flow, letting agents can send a secure, branded payment request link to tenants via:

- Email or SMS

- Tenant portal login

- In-app notification

The tenant taps the link, approves the rent amount via their mobile banking app, and the funds move instantly into the agent’s or landlord’s account.

Key Benefits for Letting Agents

| Feature | What It Solves |

|---|---|

| Instant settlement | No waiting days for payment to clear — rent arrives in real time |

| No card failures | Unlike card payments, there’s no expiry, fraud blocks, or CVV mismatch |

| Lower transaction costs | No card network or interchange fees |

| Built-in reconciliation | Every payment includes a unique ID or reference, auto-matched to tenant |

| Recurring reminders | Monthly requests can be automated without holding funds like Direct Debit |

A Better Experience for Tenants Too

Rent payments are frictionless, no need to:

- Enter card details

- Remember bank account numbers

- Log in to third-party systems

They simply approve a trusted request from their mobile banking app, on their own schedule.

How Finexer Makes Open Banking Simple for Letting Agents

Finexer turns what sounds technical, “Open Banking APIs”, into a three-step process any lettings team can run without extra head-count or new licences.

1. Send a Link, Not a Spreadsheet

You drop a Finexer’s consent link into your application form or rent reminder. The tenant clicks once to open their mobile-bank app and approves access.

2. Finexer Does the Heavy Lifting

- For affordability: Finexer pulls 90 days of income and spending, then returns a clean JSON summary (net pay, overdraft use, stability score).

- For deposits: Finexer traces where the money came from and how long it sat in the account, ready for AML export.

- For rent payments: Finexer sends a secure “Request to Pay” prompt; funds move account-to-account in seconds.

All consent, encryption, and data-storage rules are handled under Finexer’s FCA-regulated umbrella, so you never touch raw credentials.

3. Act on Real-Time Results

The data lands in your CRM or property-management system via webhook. Approve the tenant, log the deposit, or mark the rent as paid, no PDFs, no reconciliation headaches.

Finexer’s Key Advantages for Letting Agents

| Finexer Provides | Why It Matters |

|---|---|

| Zero setup fees, zero cancellation fees | Try the service with no upfront cost or long-term lock-in. |

| Up to 90% lower payment costs | Account-to-account transfers bypass card schemes and interchange. |

| Go live in days, not months | Drop-in widget or straight REST API—no AISP/PISP licence needed. |

| Full audit trail for AML | Every consent, check, and payment is timestamped and exportable. |

| White-label tenant journey | Keep your own branding while Finexer handles the regulated rails. |

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowFinal Thoughts: Letting Agents Have More Control Than Ever

Open Banking is no longer just for banks or fintechs. It’s becoming a practical tool for letting agents who want to work smarter, cut admin, and reduce risk.

From identifying high-risk tenants early to collecting rent instantly and verifying deposits without the paper trail, Open Banking gives you faster decisions, cleaner processes, and a better experience for both landlords and renters.

Solutions like Finexer make it easy to adopt with no licensing, no setup delays, and no steep costs. If you’re still chasing payslips, scanning PDFs, or managing missed payments, now’s the time to move to a system built for speed and security.

Letting agents don’t need more documents. They need better data, and Open Banking delivers it!

Do letting agents need a licence to use Open Banking tools?

No. Letting agents can work with regulated third-party providers who handle compliance. You can embed Open Banking into your tenant workflows without becoming an AISP or PISP.

Is Open Banking safe for letting agents to use?

Yes. When used via a regulated provider, Open Banking follows strict FCA rules. Letting agents only receive consented, read-only data, without needing to store or process sensitive login information.

What can letting agents do with Open Banking data?

Letting agents can use Open Banking data to verify a tenant’s income, assess affordability, collect rent through secure account-to-account payments, and perform source of funds checks for compliance.

Ready to move beyond PDFs and spreadsheets?

Finexer helps letting agents collect verified data, instantly 🙂