Online Payment Systems are digital platforms or services that enable businesses and individuals to process online transactions. These systems facilitate the secure and efficient transfer of funds from customers to merchants or service providers.

Choosing the right online payment system is a critical decision for UK businesses. With transaction fees, ease of integration, and customer experience on the line, the choice you make can have a lasting impact on your business’s profitability and efficiency.

They lead the way, each offering unique benefits catering to different business needs. From managing recurring payments to enabling quick and secure transactions, these systems are designed to make your financial operations smoother and more cost-effective.

Merchant Demand for One-Click Checkout

Approximately 60% of UK merchants have expressed interest in implementing one-click checkout solutions to enhance the payment experience.

In this guide, we’ll explore some of the top contenders in the market, highlighting their features, pricing, and what sets them apart. Whether you’re a small startup or an established business, understanding these options will help you find the best fit for your needs.

We will guide you through:

The Need for Low-Cost Online Payment Systems

Managing costs is more important than ever in today’s competitive business landscape. For UK businesses, especially small and medium-sized enterprises (SMEs), every penny saved on transaction fees can directly contribute to the bottom line. This is where low-cost online payment systems come into play.

Transaction fees can quickly add up, eating into profits and making it harder for businesses to remain competitive. While reliable, traditional payment methods often come with hefty fees and complex pricing structures that can burden businesses with tight margins.

Low-cost online payment systems offer a solution by providing cost-effective alternatives without compromising on functionality. These systems are designed to handle transactions efficiently, often with lower fees and simpler, more transparent pricing models. This allows businesses to process payments seamlessly while keeping more of their hard-earned revenue.

For SMEs, in particular, choosing the right payment system can be a game-changer. By reducing transaction costs and offering a streamlined payment process, businesses can focus on growth, customer satisfaction, and staying ahead of the competition.

📚 What are Payment Service Providers?

Comparing Payment Systems in the UK: Top 6

| Provider | Transaction Fees | Supported Payment Methods | Best For | Key Features |

|---|---|---|---|---|

| Finexer | Up to 90% lower than traditional providers | Open Banking – Instant PayByBank | SMEs and startups looking for affordable, bank-connected payments | Seamless UK bank integration, fast deployment, transparent pricing, and strong security |

| Klarna | Merchant fees vary based on agreement | Buy Now, Pay Later (BNPL), debit/credit cards | Businesses selling high-ticket items needing BNPL options | Interest-free installment payments, higher conversion rates, and full merchant protection |

| Worldpay | From 1.5% per transaction (varies by business size) | Credit/debit cards, mobile wallets, direct debits, pay-by-link | Businesses needing multi-channel payment acceptance | Handles 40% of UK card transactions, pay-by-link for non-website businesses, and global payments |

| PayPal | 2.9% + fixed fee per transaction (higher than competitors) | PayPal balance, credit/debit cards, BNPL, digital wallets | Businesses prioritising customer trust and global reach | Instant transactions, strong buyer protection, high adoption among UK consumers |

| Revolut Business | 1.0% – 2.8% per transaction, competitive FX rates | Bank transfers, credit/debit cards, multi-currency support | Businesses handling international transactions | Low international payment fees, integrated financial tools, business accounts |

| Stripe | 1.4% + 20p for UK cards, 2.9% for non-UK cards | Credit/debit cards, digital wallets, direct debits, BNPL | Tech-savvy businesses needing custom payment solutions | Developer-friendly API, multi-currency support, transparent pay-as-you-go pricing |

1.Finexer

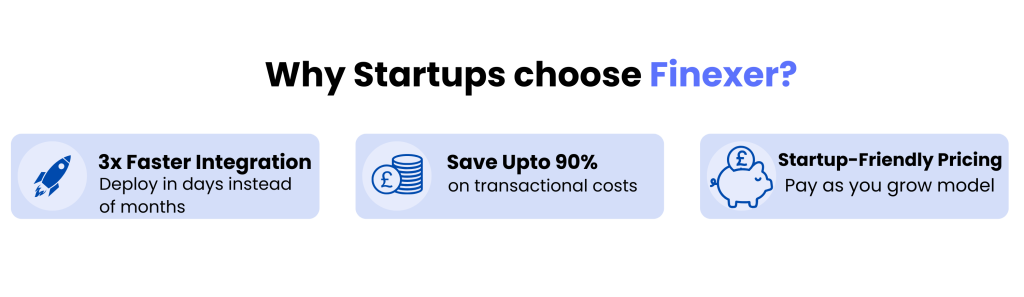

Finexer is a cost-effective payment solution tailored for UK businesses looking to reduce transaction fees. With up to 90 percent savings on transactional costs, it provides an affordable alternative to traditional payment processors. Designed for SMEs, Finexer offers a simple integration process that allows businesses to start accepting payments without complicated technical requirements.

2.Klarna

Klarna’s “buy now, pay later” model has revolutionised online shopping, especially for businesses selling high-ticket items. This service allows customers to split their payments into manageable installments, making it easier for them to commit to larger purchases. For businesses, Klarna can help boost sales and increase customer satisfaction by offering flexible payment terms without the financial risk.

3. Worldpay

As the largest payment system in the UK, Worldpay processes over 40% of all online card transactions, making it a trusted choice for businesses of all sizes. Whether you’re a startup or an established enterprise, Worldpay’s “pay by link” feature allows you to securely send payment links, even if you don’t have a complete website yet. With flexible pay-as-you-go and monthly payment options, Worldpay is a robust and versatile solution for any business looking to streamline their payment processes.

4.PayPal

PayPal is a household name, known for its ease of use and global recognition. Signing up is a breeze, and many consumers prefer using PayPal due to its strong buyer protection. However, while it’s convenient for individuals and small businesses, the higher transaction fees make it less appealing for those with a lower transaction volume. If you need a payment system that customers already trust, PayPal remains a solid choice.

5. Revolut Business

Revolut Business is designed for the modern, dynamic business that needs flexibility and integration. With a wide range of financial tools and competitive fees for international transactions, Revolut Business is perfect for companies that operate globally. The platform’s innovative features make it easier to manage finances, from accounting to customer relationship management, all in one place.

6. Stripe

Stripe is the go-to for tech-savvy businesses that require deep customisation and flexibility. Its robust API allows seamless integration into websites and mobile apps, making it a top choice for developers and larger businesses. Stripe supports various currencies and offers a transparent, pay-as-you-go pricing model. While it’s feature-rich, Stripe’s advanced tools might be overwhelming for smaller businesses that just need a straightforward payment solution.

How to Choose the Best Payment System for Your Business

Selecting the right low-cost online payment system is a crucial decision that impacts your profitability, customer experience, and scalability. Here are key factors to consider when making your choice.

1. Transaction Costs & Pricing Structure

Compare providers based on:

- Flat-rate vs. percentage-based fees – Some charge a percentage per transaction, while others offer fixed rates.

- Hidden costs – Watch for monthly fees, chargeback fees, and currency conversion charges.

- Volume discounts – If your business processes high transaction volumes, look for providers that offer lower rates at scale.

2. Payment Methods Supported

Choose a system that allows customers to pay how they prefer:

- Credit/Debit Cards – Standard for online purchases.

- Bank Transfers & Open Banking Payments – Lower-cost alternatives for UK businesses.

- Digital Wallets (Apple Pay, Google Pay, PayPal) – Essential for mobile-first consumers.

- Buy Now, Pay Later (BNPL) – If you sell high-ticket items, Klarna or similar services may help increase conversions.

3. Integration with Your Existing Systems

A payment system should seamlessly integrate with your:

- E-commerce platform (Shopify, WooCommerce, Magento, etc.).

- Point-of-sale (POS) system if you accept in-store payments.

- Accounting software to simplify financial management.

4. Security & Compliance

Ensure the provider meets PCI DSS compliance and includes:

- Fraud detection tools – AI-driven monitoring to prevent fraudulent transactions.

- Strong customer authentication (SCA) – Required under UK & EU regulations.

- Chargeback protection – Helps protect merchants from fraudulent disputes.

5. Customer Support & Reliability

Look for:

- 24/7 customer support – Especially if you handle transactions globally.

- Uptime reliability – A system with frequent downtimes can cost you sales.

- Ease of use – Both your team and customers should find it simple to use.

Why Finexer is a Smart Choice for Low-Cost Online Payments

For businesses looking for a low-cost online payment system in the UK, Finexer provides an affordable, secure, and scalable solution tailored to SMBs and fintech startups. Unlike traditional providers with high transaction fees and complex setups, Finexer simplifies payment processing while keeping costs low.

What Makes Finexer Stand Out?

- Lower Transaction Costs – Reduce fees without compromising security or reliability.

- Seamless Bank Integration – Connects with 99 percent of UK banks, enabling fast and direct payments.

- Fast Deployment – Get started quickly with a user-friendly setup that is up to three times faster than traditional providers.

- Flexible, Transparent Pricing – No hidden charges or unnecessary commitments—pay only for what you use.

- Business-Friendly Features – Supports multiple payment methods, automated compliance, and easy integration with existing platforms.

Choosing the right low-cost payment system can have a direct impact on your business’s profitability. With its affordability, efficiency, and strong UK banking connections, Finexer is a practical option for businesses looking to cut costs while improving payment flexibility.

Making the Right Choice for Your Business

Selecting a low-cost online payment system is a key decision that directly affects your revenue, customer experience, and operational efficiency. Each provider—Finexer, Klarna, Worldpay, PayPal, Revolut Business, and Stripe—offers unique advantages depending on your business needs.

Before making a decision, consider:

- Which payment methods your customers prefer.

- How transaction fees impact your margins.

- Whether the provider integrates smoothly with your existing tools.

For businesses focused on reducing costs while maintaining payment security and flexibility, Finexer provides an affordable, bank-connected solution designed for SMBs and fintech startups.

What factors should businesses consider when choosing an online payment system?

When selecting a low-cost online payment system, businesses should consider:

->Transaction fees and hidden costs

->Supported payment methods (cards, digital wallets, bank transfers)

->Integration with e-commerce platforms and accounting software

->Security and fraud protection

->Customer support and ease of use

Platforms like Finexer, Stripe, and PayPal offer various solutions tailored to different business models.

Is Open Banking a better alternative to card payments for businesses?

Yes, Open Banking payments offer a faster, more cost-effective, and secure alternative to traditional card payments. Finexer’s PayByBank feature allows businesses to receive instant payments with lower fees compared to credit/debit cards, reducing reliance on high-cost processors.

How do low-cost online payment systems reduce fees for businesses?

Low-cost payment systems reduce transaction fees by eliminating unnecessary intermediaries, using Open Banking payments, and offering transparent pricing structures. Unlike traditional providers that charge 2-3% per transaction, platforms like Finexer, Revolut, and Worldpay provide lower-cost alternatives without hidden fees.

Ready to Optimise Your Payments with Finexer? We are here to help, just a click away 🙂