As HMRC continues to expand the Making Tax Digital for VAT initiative, a growing number of VAT registered businesses and accountants are facing stricter MTD compliance expectations. But what many don’t realise is that filing your VAT MTD return on time is no longer enough — how you maintain digital records before submission is now under scrutiny.

In 2025, HMRC is stepping up its use of MTD compliance checks to ensure that businesses are not just submitting digital tax returns electronically, but also storing and linking their financial data in line with regulatory standards. These checks aren’t always triggered by obvious mistakes; they often begin with subtle inconsistencies, missing digital links, or outdated processes that fall short of the compliance threshold.

This blog breaks down exactly what can trigger an HMRC compliance check, what to expect during the review process, and how you can stay fully prepared even if you’re still using VAT spreadsheets or bridging tools. If you’re unsure whether your current workflow meets MTD requirements for digital record-keeping, now is the time to tighten up.

Keep reading or Jump to the section you’re looking for:

- What Is an MTD Compliance Check Really About?

- Common Triggers That Raise HMRC Red Flags

- What Does HMRC Actually Ask For?

- How to Prepare (Without Changing Your Entire Workflow)

- Minimising Risk with Proactive Systems

- How Finexer Helps You Stay Ready for MTD Compliance Checks

- Conclusion

What Is an MTD Compliance Check Really About?

An MTD compliance check is not the same as a full tax investigation. It focuses specifically on how you store and transfer VAT-related data, especially whether your processes meet HMRC’s digital record-keeping rules under Making Tax Digital for VAT.

Instead of reviewing the figures submitted in your MTD VAT return, HMRC looks at the methods used to prepare those figures. For example, if data was copied manually from a VAT spreadsheet or if CSV files were uploaded instead of maintaining digital links, this can raise concerns.

The main objective is to confirm that your data moves digitally from its original source, such as a bank or sales platform, through to the VAT submission. Manual edits, copy-pasting, or disconnected workflows are viewed as signs of weak compliance. To meet expectations, every step from VAT transaction to tax return should be traceable and stored securely using approved systems that support digital record keeping for MTD.

These checks are becoming more frequent, especially for businesses still relying on spreadsheets or outdated software. They are not designed to punish mistakes but to ensure that digital standards are being followed. If issues are found and not addressed, there is a higher risk of further review or VAT penalties.

Common Triggers That Raise HMRC Red Flags

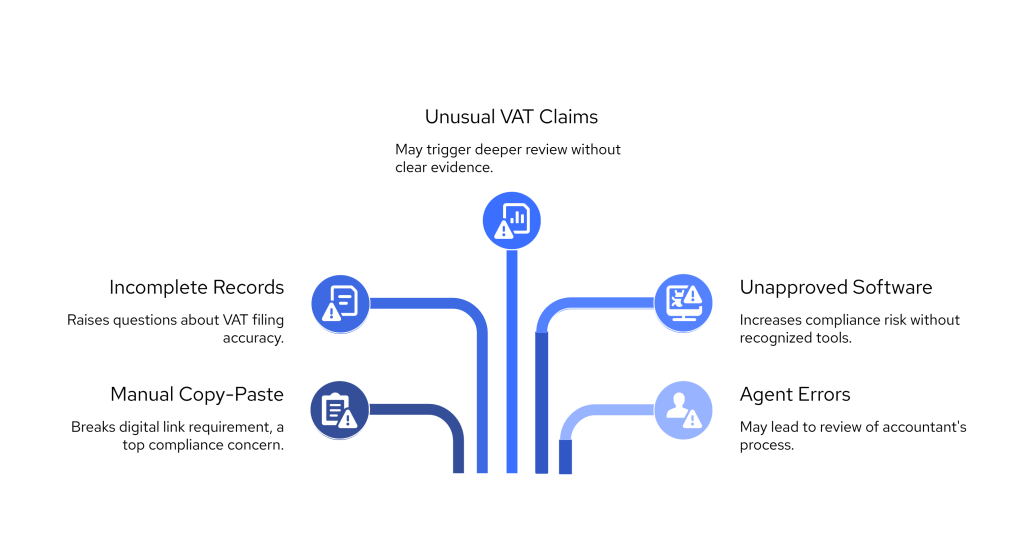

HMRC doesn’t select businesses at random for MTD compliance checks. Most reviews are prompted by signals that suggest something isn’t quite right with how VAT data is managed and submitted.

Below are some of the most common triggers that increase the chances of being flagged:

1. Manual retyping or copy-pasting between systems

When figures are manually entered from one system to another, especially between VAT spreadsheets and MTD compatible software, it breaks the digital link requirement. This is one of the clearest indicators that a business is not meeting MTD digital links criteria.

2. Inconsistent or incomplete transaction records

If the numbers submitted in your MTD VAT return don’t match what HMRC systems see from connected platforms, such as bank feeds or previous filings, this could prompt a review. Missing entries or unbalanced totals often raise questions.

3. Sudden changes in VAT claim patterns

Large or unexpected changes in input VAT or claim frequency can look suspicious, especially if they are not supported by a clear explanation in your record trail.

4. Use of outdated or unrecognised software

Submitting returns using software that is not on HMRC’s approved list of functional compatible software, or that does not support digital links, increases the likelihood of an investigation. Even spreadsheet-based workflows need to be linked through a compliant bridging tool.

5. Agent-level issues across multiple clients

If an accounting firm files for several VAT registered businesses and a pattern of errors appears across those submissions, HMRC may look more closely at the firm’s processes, not just individual returns.

These triggers are not automatic penalties, but they do serve as early warnings. A review can often be avoided by tightening VAT record keeping systems and making sure all data flows through digital channels without manual intervention.

What Does HMRC Actually Ask For?

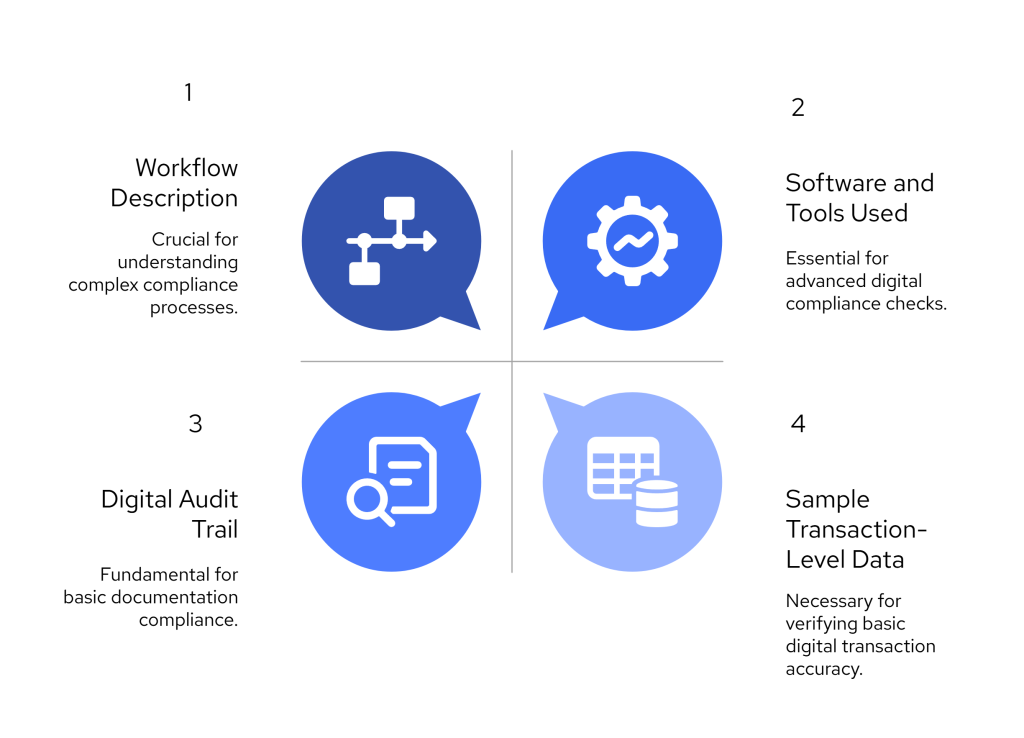

When HMRC initiates an MTD compliance check, they are not just interested in the numbers submitted in your VAT MTD return. They want to see how those numbers were prepared and whether the process followed the digital record-keeping rules under Making Tax Digital for VAT.

Here’s what you may be asked to provide:

1. Digital audit trail

HMRC may request evidence showing how figures were derived. This could include screenshots or exports from your MTD compatible software, VAT spreadsheets with formulas, or logs showing when data was pulled from a bank feed. The goal is to confirm that each figure can be traced back to its source without manual edits.

2. Sample transaction-level data

You might be asked to provide a set of raw VAT transactions from a recent VAT period. HMRC will review whether these records were stored digitally and whether they match what was submitted.

3. Details of software and tools used

HMRC may ask for the names of any platforms, bridging tools, or spreadsheets used in your VAT workflow. They want to check if these tools are compatible with MTD and whether digital links were maintained throughout the process.

4. Description of your workflow

Sometimes HMRC will ask for a short explanation of how your MTD VAT return was prepared. This includes how data was moved, how calculations were done, and where records were stored.

The review is designed to assess whether your system supports proper digital record keeping for MTD, not just whether the final VAT submission was accurate. If you can show that your processes are consistent and traceable, the check is more likely to close without further action.

How to Prepare (Without Changing Your Entire Workflow)

Getting ready for an MTD compliance check doesn’t mean you need to scrap your current tools or adopt a whole new system. HMRC isn’t demanding perfection — it’s looking for evidence that your digital records are complete, consistent, and properly linked.

Here are practical ways to prepare without overhauling your entire setup:

1. Keep an audit folder for each VAT period

Create a simple folder structure that stores key files for every MTD VAT return. This should include the original transaction data, a copy of the VAT return, and any working files used to calculate totals. Consistency matters more than complexity.

2. Maintain a clear digital link between records

Whether you use VAT spreadsheets or MTD compatible software, ensure that figures are linked using formulas, references, or automated imports. Avoid manual copying and pasting at all costs. HMRC views this as breaking the rules for MTD digital links.

3. Document how data moves across systems

Even if you’re using a simple process, write down how it works. Include which tools you use, how data is pulled in, and where it’s stored. This shows HMRC you have control over your workflow and understand your VAT compliance obligations.

4. Run your own quarterly check

Before each VAT MTD return, take five minutes to review your process. Confirm that your links are working, your data is complete, and that any spreadsheet formulas are intact. This habit can help you catch problems before HMRC does.

5. Don’t edit the linked spreadsheet after the return is submitted

If you use a bridging tool or Excel workflow, always save a version of the file as it was at the time of submission. Editing it afterward can make it hard to prove how the final figures were calculated.

These simple habits can make the difference between a smooth review and a prolonged investigation. The goal is to build a workflow that holds up under scrutiny, even if it’s built around tools you’re already using.

Minimising Risk with Proactive Systems

HMRC does not require specific tools for compliance, but the systems you rely on can significantly affect how prepared you are for an MTD compliance check. Businesses that use manual entry, copy data between files, or rely on downloaded CSVs often run into problems when records are reviewed.

To reduce this risk, it’s helpful to work with systems that keep your financial data connected and consistent from the start. One effective approach is using tools that provide real-time transaction records pulled directly from bank accounts. This removes the need to chase clients for statements or manually upload spreadsheets.

Finexer supports this type of setup by giving firms access to live bank feeds from nearly all UK banks. Instead of waiting for clients to send files, you get timely data that is already in a digital format. This makes it easier to maintain accurate records and comply with MTD digital links requirements.

For accountants still using Excel or bridging tools, adding this layer of automated bank connectivity can reduce human error, improve accuracy, and help keep a clean digital trail. When records are automatically updated from the source, you spend less time correcting mistakes and more time focusing on the VAT submission itself.

The more your systems work together without manual steps, the lower your chance of triggering a compliance review. If you are ever selected, your records will already show how the data was collected and processed.

How Finexer Helps You Stay Ready for MTD Compliance Checks

Many firms rely on VAT spreadsheets or bridging tools for VAT returns, but that alone isn’t always enough to meet HMRC’s expectations. What matters most during a compliance check is how your financial data is captured, linked, and stored. That’s where Finexer adds real value.

Finexer provides real-time transaction feeds from 99 percent of UK banks, which means your records are always current and traceable. Instead of manually uploading CSVs or collecting statements from clients, you can pull bank data directly into your VAT workflow, with a clear, secure digital trail.

Here’s how Finexer supports MTD compliance preparation:

- No need for manual uploads: VAT transactions are imported automatically, reducing the risk of broken links or data entry errors.

- Digital links maintained throughout: All bank data is connected from source to submission, supporting HMRC’s requirement for uninterrupted digital flow.

- Compatible with Excel and bridging workflows: Whether your clients use spreadsheets, cloud software, or a mix of both, Finexer fits into your process without disruption.

- White-label dashboard options: Provide clients with their own branded view of their transaction history, while keeping your own audit records intact.

- FCA-regulated infrastructure: Your data remains secure, compliant, and stored within the UK — a key concern in any compliance review.

Finexer doesn’t replace your MTD software. It strengthens the part that often causes problems during an investigation: how data gets into the system in the first place. For firms handling high volumes of clients or those working with legacy tools, this makes it easier to prove compliance without changing everything overnight.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Conclusion

An MTD compliance check is no longer a rare occurrence. As HMRC tightens its focus on digital record-keeping, VAT registered businesses and accounting firms need to be ready to show not just what was submitted, but how those figures were produced.

Avoiding common triggers, maintaining clear digital links, and documenting your workflow can go a long way in preventing unnecessary scrutiny. Even if you’re still using VAT spreadsheets or a mix of systems, preparation is possible without a full software overhaul.

Tools like Finexer can help reduce the manual steps that often lead to problems. With live bank feeds and proper digital links in place, your records stay consistent, your audit trail remains intact, and your firm stays prepared for any review.

The most effective way to handle an HMRC compliance check is to never be caught off guard. A few proactive changes today can save you from a much longer investigation tomorrow.

What is an MTD compliance check?

An MTD compliance check is a review by HMRC to confirm that your VAT submission process meets digital record-keeping requirements under Making Tax Digital.

What triggers an HMRC compliance check for MTD?

Common triggers include manual data entry, missing digital links, inconsistent records, and use of outdated or unrecognised VAT software.

What does HMRC look for during an MTD check?

HMRC checks how your financial data is stored, linked, and submitted. They may request audit trails, transaction samples, and a description of your VAT workflow.

How can I prepare for an MTD compliance check?

Keep an organised audit folder, ensure digital links are maintained, document your process, and avoid manual copying of data between systems.

How does Finexer help with MTD compliance?

Finexer provides real-time bank feeds with secure, traceable digital records, helping firms avoid manual uploads and maintain proper digital links.

Ease your MTD Compliance Process! Schedule your free demo and get a 14-day Free Trial 🙂