If you’re a landlord earning over £50,000 in rental income, Making Tax Digital for landlords is going to change how you manage and report your finances. From April 2026, you’ll need to keep digital records and submit quarterly updates to HMRC as part of the new MTD for landlords rules.

This move is part of the wider MTD for ITSA (Income Tax Self Assessment) rollout, and while the deadline may seem far off, preparing early can save you time, stress, and avoid penalties. The transition isn’t just about switching to software. It’s about adopting a system that keeps your property income and expenses properly recorded throughout the year.

This blog provides a simple, step-by-step checklist to help landlords prepare for the changes. Whether you manage one rental or several, following this guide will ensure you’re ready to comply with the new landlord tax return rules before they take effect.

Who Needs to Follow MTD for Landlords?

Not all landlords are affected right away, but many will need to comply within the next one to two years. The MTD for landlords rules apply based on how much income you earn from your rental properties, not your overall income.

Here’s how it breaks down:

- April 2026: Landlords earning more than £50,000 per year from property income will be required to follow MTD for ITSA rules.

- Expected 2027: Landlords earning between £30,000 and £50,000 will be brought into the system in a second phase, though the final date has yet to be confirmed.

- If you earn below £30,000 from rental income, MTD will not apply to you yet — but HMRC may expand the scheme in the future.

These rules apply whether you own residential, commercial, or furnished holiday lets. As long as the income is reported under property income in your Self-Assessment tax return, it counts toward the threshold.

Limited companies and incorporated landlords are not yet included in MTD for Income Tax. However, individual landlords, including those with multiple properties, will need to comply once their rental income crosses the threshold.

Complete MTD Preparation Checklist for Landlords

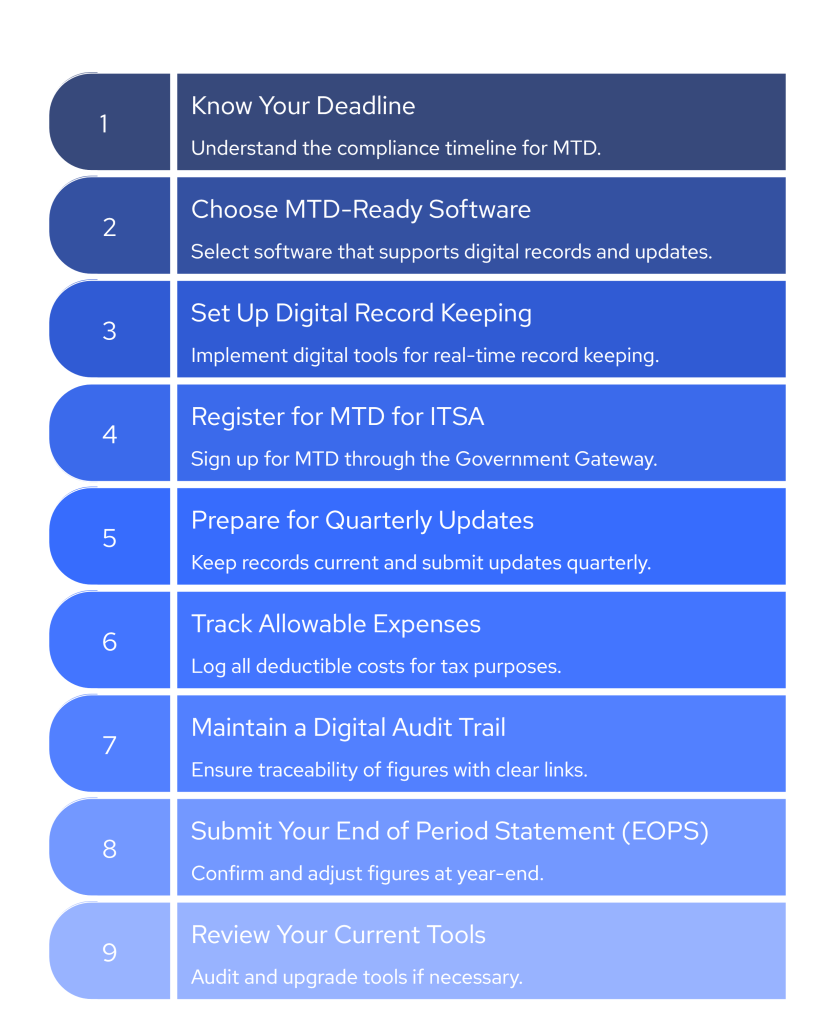

Getting ready for MTD for landlords is easier when you break it down into manageable steps. Use this checklist to make sure you’re fully prepared before the April 2026 deadline.

✅1. Know your deadline

Landlords earning over £50,000 from property income must follow Making Tax Digital for landlords starting April 2026. Those earning between £30,000 and £50,000 will follow in a later phase, expected from April 2027.

✅ 2. Choose MTD-ready software

You’ll need to use MTD-ready software for landlords that’s recognised by HMRC. It must support digital record keeping, allow quarterly tax updates, and handle the end of period statement (EOPS) submission.

✅ 3. Set up digital record keeping

Spreadsheets or handwritten notes will no longer be accepted unless they’re digitally linked. You must start using a system that allows digital record keeping for landlords, with income and expenses recorded as they occur.

✅ 4. Register for MTD for ITSA

Even if you already file Self Assessment returns, you must register separately for MTD. This is done through your Government Gateway account, and you should complete it before your first quarterly update is due.

✅ 5. Prepare for quarterly updates

Instead of filing once a year, you’ll need to submit quarterly tax updates for landlords. Your MTD software will remind you and guide you through each update, but it’s still important to keep your records updated throughout the year.

✅ 6. Track allowable expenses properly

Start categorising and recording deductible costs like maintenance, letting agent fees, utilities, council tax, mortgage interest, and insurance. Good records can reduce your tax bill and ensure your updates are accurate.

✅ 7. Maintain a digital audit trail

If HMRC checks your compliance, you’ll need to show how records were kept and submitted. Make sure your system maintains a clear MTD audit trail linking each figure back to its original entry.

✅ 8. Finalise with your End of Period Statement (EOPS)

At the end of the tax year, you’ll need to submit an EOPS to confirm all your figures and apply any adjustments. This replaces the traditional Self Assessment tax return for property income under MTD.

✅ 9. Review your current tools

“If you’re still using paper records or unlinked spreadsheets, now is the time to upgrade. The right MTD software will make compliance easier and help you avoid mistakes later on.

How Finexer Can Support Landlords with MTD Compliance

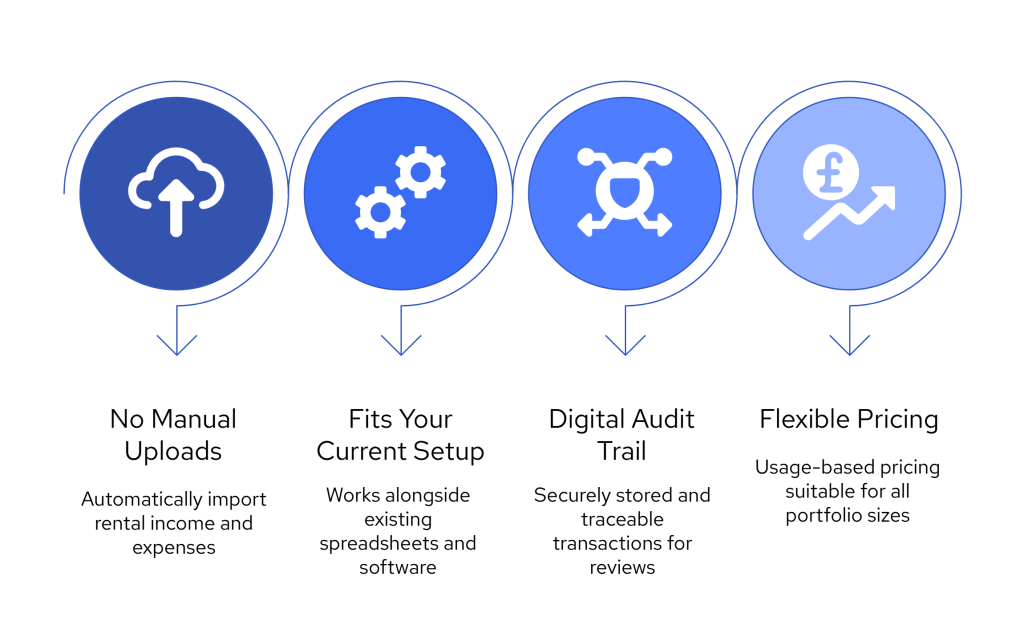

For many landlords, the main challenge with MTD for landlords is not the tax submission itself, but keeping reliable, digital records across the year. Finexer helps simplify this part of the process without requiring you to replace your current software.

Finexer connects to 99 percent of UK bank accounts, allowing you to automatically import real-time transaction records linked to your rental income and property-related expenses. This eliminates the need to upload CSV files or wait for clients to send statements. The result is consistent, accurate financial data that supports full MTD compliance.

Here is how Finexer helps landlords prepare:

- No manual uploads

You can automatically pull rental income and expense data from your bank accounts, reducing human error and saving time. - Fits into your current workflow

Finexer works alongside Excel-based bridging tools or MTD-compatible software, helping you keep your current setup while adding digital capabilities. - Maintains a clear audit trail

Each transaction is securely stored and traceable back to its source, making it easier to respond to any HMRC compliance checks. - Flexible pricing for all portfolio sizes

Whether you own one property or manage several, Finexer uses a pricing model that adjusts to your needs. There are no fixed bundles or unnecessary costs.

Finexer does not replace your MTD software. It supports the part of your workflow that HMRC often reviews most closely — how your records were captured and kept in a digital format.

Conclusion

The shift to MTD for landlords is more than just a tax filing update. It changes how rental income and expenses must be recorded, stored, and submitted throughout the year. Landlords who start preparing early will find the transition far easier than those who wait until the last minute.

Using the checklist above, you can make sure your records are accurate, your software is compliant, and your process is ready for quarterly submissions and year-end statements. Even if you currently rely on spreadsheets or manual logs, taking small steps now, such as connecting your bank feeds or reviewing your current workflow, can prevent bigger problems later.

With tools like Finexer, you can start collecting reliable financial data in real time and build a digital audit trail that meets HMRC’s expectations without overcomplicating your setup.

Getting ready for MTD does not need to be difficult. It just needs to be done properly.

What is MTD for landlords?

MTD for landlords refers to HMRC’s digital tax reporting requirement for landlords earning over £50,000 in property income, starting from April 2026.

Who needs to follow MTD for ITSA?

From April 2026, individual landlords with annual property income over £50,000 must follow MTD for ITSA rules. Landlords earning £30,000 to £50,000 will follow later.

What records must landlords keep under MTD?

Landlords must keep digital records of rental income and allowable expenses using HMRC-recognised software that maintains digital links.

How often do landlords need to report under MTD?

Under MTD for landlords, you must submit quarterly updates and a year-end End of Period Statement (EOPS) through compatible software.

Try Finexer free for 14 days and simplify your tax prep with real-time bank feeds, digital records, and zero setup fees for Startups!