If you’re VAT-registered and filing returns in the UK, MTD record keeping isn’t just an admin task; it’s a legal requirement. Under Making Tax Digital (MTD) rules, HMRC expects businesses and agents to store VAT data digitally and submit returns using compatible software.

But there’s a common misconception: “digital” doesn’t just mean switching from paper to spreadsheets. It’s about maintaining digital links across your entire VAT process from sales and purchase logs to final submission.

What HMRC defines as MTD-compliant record keeping

To meet the MTD record keeping rules, you need to:

- Maintain digital records of key VAT information like supply dates, amounts, and tax rates.

- Use MTD-compatible software to store this data.

- Ensure all tools in your VAT workflow are digitally linked, meaning data flows between systems without copying and pasting.

In short: if your VAT numbers pass through multiple tools, they must remain digitally connected the whole way through.

Common Pitfall: Thinking Spreadsheets Are Enough

Many firms still rely on Excel or Google Sheets to track VAT. While HMRC doesn’t ban spreadsheets, they must be paired with an approved bridging tool that can submit data directly to HMRC via an API.

Manually typing values from a spreadsheet into an online VAT form or another system? That breaks compliance.

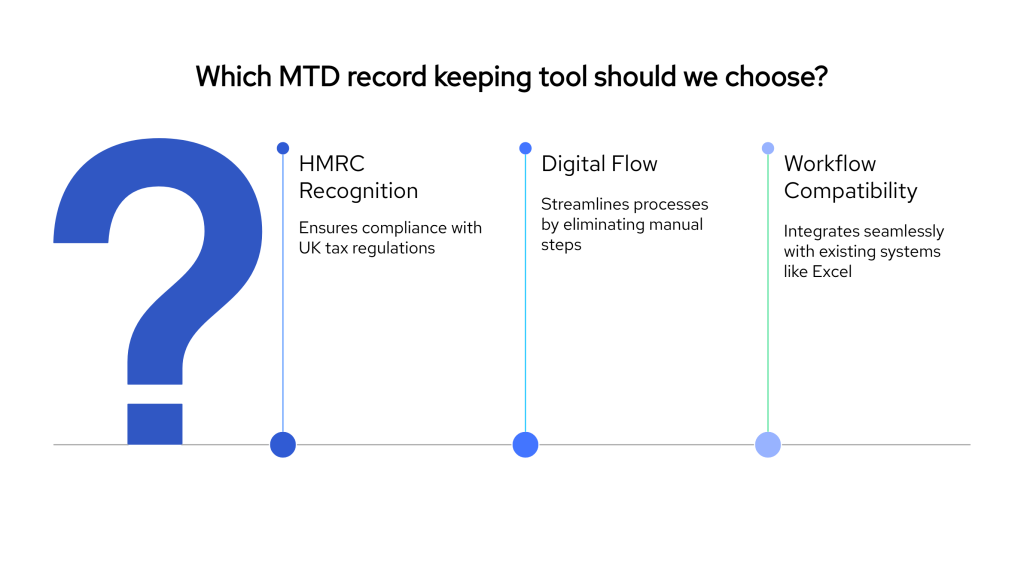

Choosing the Right Tools for MTD Record Keeping

Once you understand what counts as compliant digital record keeping under Making Tax Digital, the next step is choosing the right tools to support your process, especially if you work with spreadsheets, legacy systems, or multiple clients.

Key Considerations When Choosing MTD Record Keeping Tools

1. HMRC Recognition

Always check that the software is on HMRC’s list of approved tools for MTD VAT. This applies to both full accounting platforms and bridging tools.

2. End-to-End Digital Flow

Ensure your tools connect without manual data handling. If you’re using separate tools for invoicing, payments, or reconciliation, they should be able to pass data digitally to your VAT submission software.

3. Compatibility with Your Workflow

Spreadsheets are still widely used, especially by small firms and agents. If you’re not ready to switch to cloud accounting entirely, choose a solution that works with Excel, not against it.

Where Finexer Fits into Your MTD Record-Keeping Setup

Many firms still depend on spreadsheets, emailed bank statements, or manual CSV uploads to prepare VAT returns. While this may appear manageable, it introduces major compliance risks under MTD, from broken digital links to out-of-date transaction data.

Finexer closes those gaps without requiring a full system overhaul. Whether you use cloud accounting, bridging tools, or Excel-based workflows, Finexer ensures the bank data behind your VAT records is reliable, real-time, and digitally connected.

Why Accountants Choose Finexer for MTD Record Keeping

| Feature | Without Finexer | With Finexer |

|---|---|---|

| Bank Data Access | Manual CSVs, delayed statements | Real-time feeds from 99% of UK banks |

| Data Completeness | Risk of missing transactions or duplicates | All transactions automatically captured and updated |

| MTD Spreadsheet Compatibility | Risk of broken digital links | Supports bridging tools and Excel workflows with clean digital links |

| Client Collaboration | Disconnected emails and PDFs | White-label dashboard for client access and approvals |

| Pricing Model | Fixed subscriptions or bundled tools | Pay-as-you-go, no minimums, no setup fees |

| Compliance Confidence | Manual workflows leave room for error | Fully FCA-regulated with UK-based data handling |

With Finexer, you’re not replacing your current workflow, you’re upgrading it where it matters most: at the data source.

Built for Accountants, Not Just Developers

Trusted by firms that want flexibility without sacrificing compliance and ready for MTD VAT submission, without needing a full system overhaul.

No dev work required — start with one client, expand when ready

Secure, encrypted connections to 99% of UK bank accounts

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Final Thoughts

Staying compliant with MTD record keeping requirements is not just about meeting regulatory obligations. It is about building a more efficient, reliable, and scalable way to handle VAT submissions. HMRC’s Making Tax Digital initiative aims to eliminate manual errors and ensure that businesses and their accountants maintain accurate records at every stage of the process.

For many firms, the challenge is not a lack of tools but the lack of integration between them. Whether you use spreadsheets, multiple apps, or legacy systems, the key is ensuring that data flows digitally from one point to another without any manual re-entry or disconnection.

This is where Finexer plays a crucial role. By offering secure, real-time access to bank transactions from nearly every UK bank, Finexer makes it easier to maintain fully compliant digital records without changing your entire tech stack. Whether you’re using bridging tools or managing multiple client workflows, Finexer fits into your process without disruption and supports your record keeping responsibilities from the ground up.

If you’re still copying and pasting figures or relying on emailed bank statements, it may be time to reassess. Moving toward a connected, digital-first approach helps reduce errors, improve client service, and keep your firm fully aligned with HMRC’s expectations for MTD.

What is MTD record keeping?

MTD record keeping refers to maintaining digital records of your VAT-related financial data in a way that complies with HMRC’s Making Tax Digital rules. This includes digitally storing details such as transaction dates, amounts, VAT rates, and submitting returns using MTD-compatible software.

Can I still use spreadsheets for MTD VAT submissions?

Yes, spreadsheets are allowed but only when paired with HMRC-approved bridging software. The spreadsheet must be digitally linked to the bridging tool without manual retyping or copying and pasting of figures.

What counts as a digital link under MTD?

A digital link is an automated connection between two pieces of software where data is transferred without human intervention. This can include cell references in spreadsheets, API connections between platforms, or linked accounting tools.

Is using PDFs or emailed bank statements still compliant?

No. Storing financial records in PDFs or relying on emailed bank statements breaks the digital record keeping requirement. MTD requires records to be stored and processed in a digitally linked system from start to finish.

How does Finexer help with MTD record keeping?

Finexer provides real-time access to transaction data from 99% of UK banks, helping accounting firms eliminate manual entry, maintain digital links, and stay MTD-compliant. It supports spreadsheet workflows, bridging tools, and offers a usage-based pricing model with no minimums.

Make Record Keeping Easier with Finexer! Schedule your free demo and get a 14-day Free Trial 🙂

![MTD record keeping: What Counts as Compliant and What Doesn’t 1 MTD Record Keeping: What's Compliant and What's Not[2025]](/wp-content/uploads/2025/04/MTD-Record-Keeping.png)