WealthTech -The words “wealth” and “tech” have come together to give rise to a new generation of financial technology companies that create digital solutions to transform the investment and asset management industry.

Introduction

In the rapidly progressing landscape of financial technology, or FinTech, the wealthtech sector in the UK is making significant strides, establishing itself as a pillar of financial innovation and transformation. This sector, a blend of wealth management and technology, redefines financial planning, portfolio management, and investment strategies for individuals and financial institutions. With its commitment to regulatory compliance and leveraging digital platforms for automated investing, wealthtech is not just a buzzword but a crucial advancement in making top wealth management firms more accessible and efficient for a broader range of clients. By integrating financial innovation into everyday financial planning and management, these wealth tech startups are paving the way for a more inclusive and financially empowered society.

This article spotlights top wealthtech startups in the UK, delving into their unique offerings, from Nutmeg’s pioneering approach in automated investing to Moneyfarm’s tailored financial planning solutions, Wealthify’s user-friendly digital investment service, Tickr’s focus on impact investing, and Evestor’s commitment to low-cost, accessible wealth management. These firms exemplify the forward-thinking and innovative spirit of the UK’s wealthtech sector, offering insights into how they are not only navigating but also setting the benchmarks for success in the realms of portfolio management, financial technology, and regulatory compliance. In exploring these key players, the article will provide a comprehensive overview of how wealthtech is transforming the landscape of financial services in the UK.

1.Nutmeg

Nutmeg is a pioneering wealth management company based in the UK, known for its innovative approach to automated investing. Established to democratize investing, Nutmeg offers a user-friendly platform that allows individuals to access high-quality portfolio management services without the traditional cost barriers.

Nutmeg Overview

Nutmeg stands out in the wealthtech landscape for its straightforward, transparent approach to investment. It was one of the first in the UK to provide robo-advisory services, making professional investment advice more accessible to the general public. Nutmeg’s platform is designed with a focus on simplicity and user experience, enabling customers to set up, manage, and review their investments easily online.

Nutmeg Key Features

- Automated Portfolio Management: Uses advanced algorithms to manage portfolios, tailored to the individual’s risk appetite.

- Transparent Fees: Clear, straightforward pricing with no hidden costs.

- Ethical Investing Options: Offers socially responsible portfolios that align with personal values.

Nutmeg Pricing

Nutmeg’s pricing structure is designed to be transparent and competitive, offering various tiers based on the amount invested. Fees decrease as the investment amount increases, making it cost-effective for larger portfolios. This tiered pricing structure ensures that investors can access wealth management solutions that are both affordable and effective, aligning with Nutmeg’s mission to make quality investment opportunities accessible.

How Finexer Can Enhance Wealthify’s Capabilities:

- Instant Payments: Finexer’s instant payment solution streamlines Nutmeg’s transaction processes, ensuring clients can fund their accounts and withdraw funds quickly and securely.

- Open Banking Data: Leveraging Finexer’s enriched data provides deeper insights into client financial behavior, enhancing Nutmeg’s portfolio management strategies.

- Verification Services: Finexer’s robust verification system ensures the accuracy and security of client information, minimizing fraud risk and improving trust.

📚Open banking use cases in wealthtech

2.Moneyfarm

Moneyfarm Overview

Moneyfarm operates as a distinguished player in the UK’s wealthtech landscape, offering a blend of technology-driven financial planning and investment management services. It caters primarily to individuals seeking streamlined and effective strategies for managing their investments. With a strong focus on user experience, Moneyfarm integrates advanced technology to personalise financial solutions, thereby aligning with clients’ specific financial goals and risk profiles.

Moneyfarm Key Features

- Personalised Asset Allocation: Tailors investment strategies to individual risk tolerance and financial goals.

- Direct Financial Advice: Provides clients with access to expert financial advisors.

- User-Friendly Digital Platform: Simplifies the investment process through an intuitive online platform.

Moneyfarm Pricing

Moneyfarm’s pricing model is designed to be transparent and competitive, offering tiered pricing based on the amount invested. This structure ensures affordability and accessibility, making professional financial management available to a broader audience.

How Finexer Can Enhance Wealthify’s Capabilities:

- Personalised Asset Allocation: Finexer’s enriched data provides detailed insights into client finances, allowing Moneyfarm to offer more personalized and effective asset allocation strategies.

- Instant Payments: Facilitate quick and secure transactions, enhancing the user experience.

- Custom Notifications: Finexer’s custom notifications keep clients informed about their account status and investment performance in real-time.

3.Wealthify

Wealthify Overview

Wealthify is a standout wealthtech firm based in the UK, renowned for its innovative approach to digital investment services. It simplifies the investment process, making it accessible to a wider audience without the need for extensive financial knowledge. This approach demystifies investing, offering a straightforward platform for users to engage with their financial growth.

Wealthify Key Features

- Automated Investment Strategies: Utilises advanced algorithms to craft personalised investment portfolios.

- User-Friendly Interface: Designed to ensure ease of use for all, regardless of investment experience.

- Ethical Investment Choices: Provides options for socially responsible investing, aligning with personal values.

Wealthify Pricing

Wealthify maintains a transparent pricing model, ensuring users understand exactly what they are paying for. It offers a tiered fee structure, which is designed to be cost-effective, encouraging more individuals to invest by keeping expenses low. This approach supports Wealthify’s mission to make investing accessible to everyone.

How Finexer Can Enhance Wealthify’s Capabilities

- Automated Investment Strategies: Finexer’s APIs integrate seamlessly with Wealthify’s platform, enhancing automated investment capabilities.

- Open Banking Data: Provide comprehensive financial insights, aiding in the creation of tailored investment portfolios.

- Secure Transactions: Finexer’s secure payment solutions protect client funds and data, building trust and reliability.

4.Tickr

Tickr Overview

Tickr stands out as a forward-thinking wealthtech firm in the UK, focusing on impact investing. It enables users to invest in companies and projects that align with their values concerning social and environmental impact. This approach not only appeals to ethically conscious investors but also aims to generate positive social change alongside financial returns.

Tickr Key Features

- Impact Investing: Allows investments in portfolios that have a positive environmental and social impact.

- Transparent Reporting: Provides clear reports on the tangible impact of investments.

- User-Centric Platform: Offers an intuitive and accessible interface designed for ease of use by all, regardless of their investing experience.

Tickr Pricing

Tickr adopts a transparent pricing model with no hidden fees, making it accessible for individuals who are new to investing. The platform encourages low entry thresholds, which democratizes access to impact investing.

Tickr is best suited for investors who wish to align their investment choices with their ethical values, offering a straightforward platform to contribute positively to societal and environmental challenges.

How Finexer Can Enhance Tickr’s Capabilities

- Impact Investing: Finexer’s enriched data helps identify and verify socially responsible investments, ensuring alignment with client values within a WealthTech.

- Transparent Reporting: Utilize Finexer’s real-time data to provide detailed reports on the impact of investments.

- User-Centric Platform: Enhance the user experience with Finexer’s secure and intuitive payment solutions.

5.Evestor

Evestor Overview

Evestor is a prominent wealthtech firm in the UK, offering innovative financial solutions designed to simplify wealth management. The company provides a user-friendly platform that caters to individuals seeking straightforward and accessible investment opportunities, without requiring extensive financial knowledge.

Evestor Key Features

- Automated Investment Strategies: Evestor utilises advanced algorithms to develop customised investment portfolios, ensuring that clients’ investments align with their financial goals and risk tolerance.

- User-Friendly Interface: The platform is crafted to be intuitive, making it easy for anyone to manage their investments efficiently.

- Ethical Investment Options: Evestor offers a selection of socially responsible investment choices, allowing clients to invest in ways that reflect their personal values.

Evestor Pricing

Evestor maintains a transparent pricing model, which is structured to be straightforward and affordable, encouraging a broad spectrum of investors to engage with the market confidently. This approach is in line with Evestor’s commitment to making investment opportunities accessible to all.

Evestor is best suited for individuals looking for a simple, effective way to manage their investments, with a strong emphasis on ethical and socially responsible options.

How Finexer Can Enhance Evestor’s Capabilities

- Automated Investment Strategies: Finexer’s secure APIs enhance Evestor’s automated investment processes, ensuring efficient and accurate portfolio management.

- User-Friendly Interface: Improve the user experience with Finexer’s customizable white-label solutions.

- Ethical Investment Options: Leverage Finexer’s verification services to ensure the integrity and alignment of socially responsible investments.

📚 Yapily vs Truelayer vs Finexer

Conclusion

In navigating the evolution and impact of the UK’s WealthTech sector, this article has illuminated the groundbreaking work of various startups, including Nutmega, Moneyfarm, Wealthify, Tickr, and Evestor. These companies, through their innovative approaches to automated investing, personalised financial planning, ethical investment options, and user-friendly digital platforms, are not just redefining wealth management for individuals and institutions alike but are also underlining the UK’s burgeoning reputation as a global fintech hub. Each of these firms showcases the potential of technology to democratise access to financial services, ensuring that high-quality wealth management solutions are no longer the preserve of the affluent but are accessible to a broader demographic, thus fostering a more inclusive financial ecosystem.

Reflecting on the broader implications of these advancements, it’s evident that the WealthTech sector’s trajectory within the UK harbours far-reaching ramifications for the global financial services landscape. By prioritising accessibility, transparency, and ethical investing, these startups are not only catering to the growing demand for personalised and inclusive financial services but are also setting new benchmarks for responsible and sustainable investing. In doing so, they lay down the gauntlet for future innovation in the WealthTech space, inviting further research into how technology can continue to break down barriers in wealth management. As the sector evolves, it will be intriguing to observe how these trends develop and which new players emerge, underpinning the UK’s position at the forefront of financial innovation.

FAQs

1. What is WealthTech?

WealthTech is a combination of wealth management and technology, aimed at redefining financial planning, portfolio management, and investment strategies for both individuals and financial institutions.

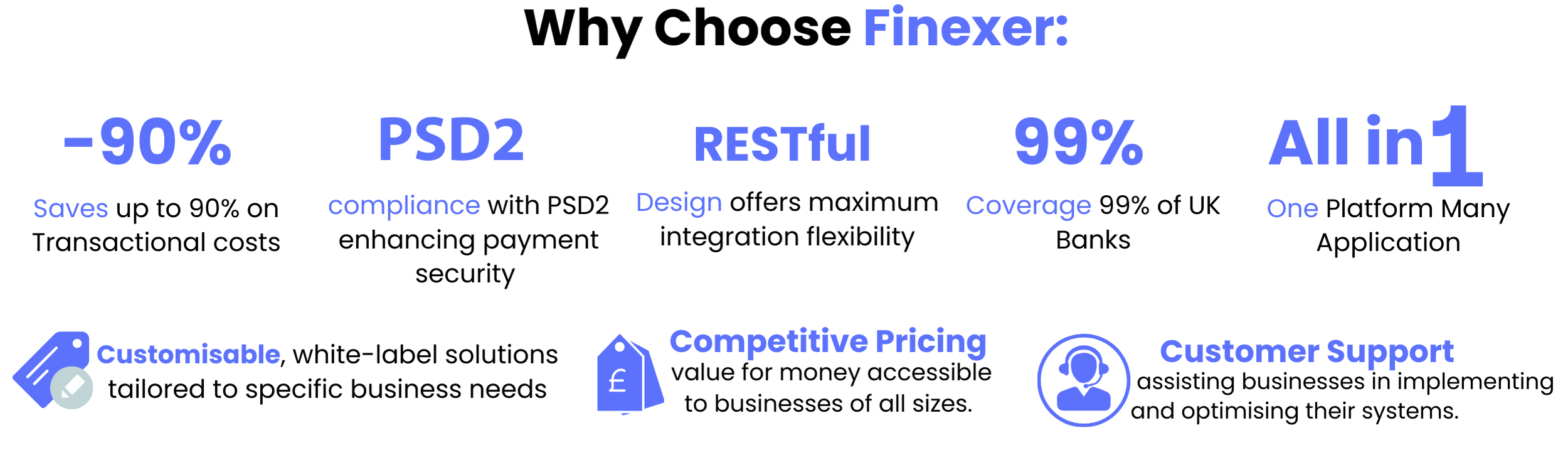

2. How can Finexer help WealthTech firms?

Finexer helps WealthTech firms by providing instant payment solutions, enriched data for better financial insights, secure transactions, and robust verification services, enhancing overall financial services and user experience.

3. What specific benefits does Finexer offer to Nutmeg?

Finexer offers Nutmeg instant payment solutions for quick transactions, enriched data for better portfolio management, and robust verification services to ensure security and trust.

4. How does Finexer enhance Moneyfarm’s services?

Finexer enhances Moneyfarm’s services by providing personalized asset allocation through enriched data, facilitating quick and secure transactions, and offering custom notifications to keep clients informed.

5. What advantages does Wealthify gain from Finexer ’s solutions?

Wealthify benefits from Finexer’s automated investment strategies, comprehensive financial insights, and secure transaction solutions, improving the reliability and efficiency of their digital investment services.

6. How does Finexer support Tickr’s impact investing approach?

Finexer supports Tickr’s impact investing by providing enriched data to identify and verify socially responsible investments, offering transparent reporting, and enhancing the user experience with secure payment solutions.

7. In what ways does Finexer simplify wealth management for Evestor?

Finexer simplifies wealth management for Evestor by enhancing automated investment processes with secure APIs, improving user experience with customizable solutions, and ensuring the integrity of ethical investments through verification services.

For more information on how Finexer can help your WealthTech firm thrive, We are here to help lets chat 🙂