Open Banking is quietly reshaping how payments work in retail. Instead of relying on expensive card networks or long refund timelines, merchants can now offer instant bank transfers at checkout, enable real-time refunds, and power QR-based payments using secure, regulated APIs.

According to the Impact Report, Open Banking payments exceeded 14.5 million transactions in a single month in 2024, a 69%% year-on-year increase, driven largely by retail and e-commerce use cases. From independent stores to high-volume chains, retailers are under pressure to cut processing costs, reduce fraud exposure, and speed up settlement.

Open Banking delivers on all three, without adding friction to your EPOS stack.

In this guide, we’ll walk through how Open Banking is being used across retail, from Pay by Bank checkout and mobile QR payments to instant refunds and bank-side customer validation. You’ll see where it fits into the retail workflow, how it compares to cards, and how to integrate it with your existing systems.

If you’re looking to improve margins, speed up settlements, and modernise your customer experience, Open Banking may be the simplest upgrade you haven’t made yet.

Keep Reading or Jump to the Section You’re looking for:

Why Retailers Are Turning to Open Banking

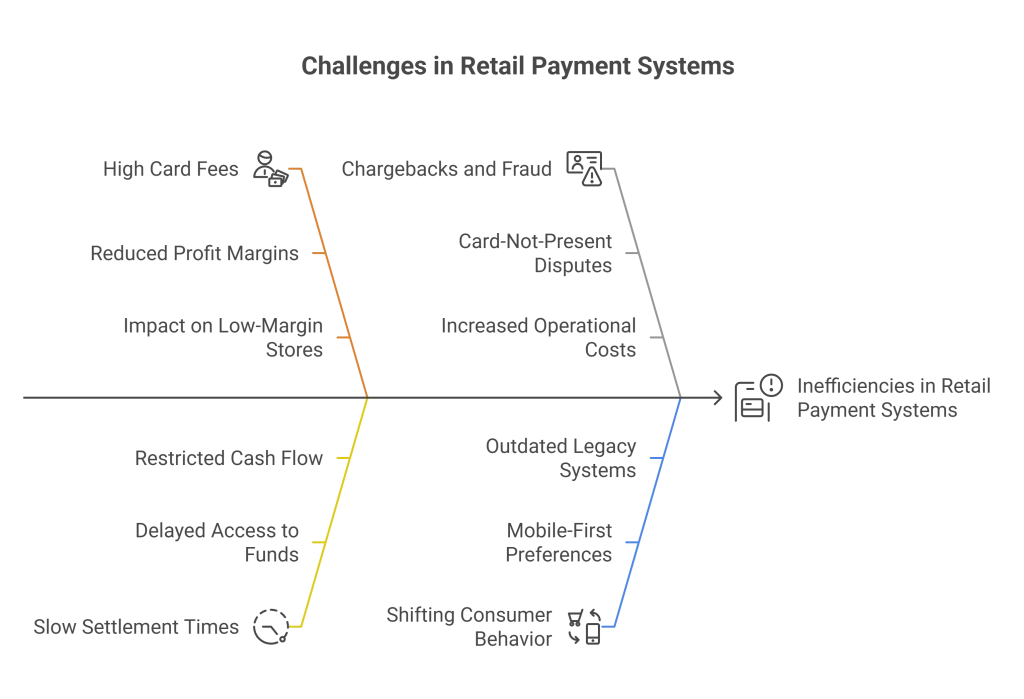

Retailers are moving fast to modernise how they accept and manage payments, and Open Banking is becoming a key part of that shift. From rising card fees to long settlement delays, traditional payment systems are no longer fit for purpose in many retail environments, especially those running on modern EPOS systems.

1. High Card Fees Are Eating Into Margins

For retailers processing high transaction volumes, every basis point matters. Card fees from major schemes can cut deeply into profit margins, particularly for smaller stores or those operating across tight inventory cycles. With Open Banking for retail payments, merchants can accept direct bank transfers at a fraction of the cost, without needing to rely on acquirers or card processors.

2. Slow Settlement Hurts Cash Flow

Card-based payments often take two to five business days to settle into a retailer’s account, depending on the provider and batch processing windows. This lag impacts cash flow, especially when managing daily stock orders or reconciling high-volume weekend sales. By contrast, Pay by Bank through Open Banking offers instant settlement, allowing EPOS-based retailers to access funds in real time.

3. Chargebacks and Fraud Are Still a Problem

Chargeback fraud remains a hidden cost in many retail payment systems, often tied to card-not-present transactions or customer disputes. Because Open Banking transactions are initiated and approved by the customer via their banking app, they cannot be reversed by third parties, removing the risk of chargebacks altogether.

4. Consumer Behaviour Is Changing

UK shoppers are becoming more comfortable with bank-initiated payments, especially those tied to secure, mobile-first checkout flows. Whether it’s scanning a QR code at the EPOS or completing a one-click bank payment online, Open Banking aligns with how modern consumers already manage their finances.

Pay by Bank: Frictionless Checkout Without Cards

Open Banking has introduced a new way for retailers to accept payments, Pay by Bank. Unlike cards, this method enables customers to pay directly from their bank accounts through a secure, real-time transfer initiated via their banking app. No card numbers, no third-party wallets, no middlemen.

What Is Pay by Bank in Retail?

Pay by Bank is an account-to-account payment method built on Open Banking rails. At checkout, the customer selects their bank, approves the payment through their mobile banking app, and the money is instantly transferred to the retailer. This applies to both in-store EPOS checkouts and online retail payment flows.

How It Works with EPOS and Online Checkouts

Whether you run a physical store or an online shop, Pay by Bank can integrate directly with your EPOS system or checkout page. Here’s how a typical transaction works at the point of sale:

- The customer selects “Pay by Bank” at checkout.

- A dynamic QR code or button triggers a bank selection screen.

- The customer is redirected to their banking app.

- They authenticate using Face ID, biometrics, or a passcode.

- The payment is authorised and funds settle instantly.

This experience is consistent across mobile, desktop, and in-store EPOS devices.

Benefits of Open Banking for Retailers

| Benefit | What It Means for Retailers |

|---|---|

| Lower transaction costs | Open Banking eliminates the use of card networks and acquirers, cutting per-transaction fees . |

| Real-time settlement | Payments settle instantly into your bank account—no more waiting 2–5 business days for funds. |

| No chargebacks or card fraud | Payments are bank-authorised and irreversible, eliminating chargeback risk and fraud disputes. |

| Improved payment transparency | Retailers receive full payer details with each transaction, making reconciliation faster and clearer. |

| Faster checkout experience | Customers complete payments in their banking app—no card entry, PINs, or delays at the till. |

📚 Guide to Checkout Process Optimisation

QR Code Payments: Turn Physical Stores into Smart Checkouts

For in-person retail, Open Banking-enabled QR code payments are changing how checkout works, especially in environments where speed, simplicity, or staff-free setups are priorities. From pop-up stores to self-checkout kiosks, dynamic QR codes now let customers complete secure retail payments using just their phone and banking app.

Static vs. Dynamic QR Codes

There are two main types of QR codes used in EPOS systems:

- Static QR codes: Fixed codes that link to a general payment page. Best for low-volume or one-off use cases.

- Dynamic QR codes: Automatically generated for each transaction. These include transaction details like amount, reference, and expiry time, offering better traceability and automation.

Dynamic codes are ideal for integrated Open Banking for EPOS, where every payment needs to be tracked, reconciled, and settled quickly.

Where QR Pay Works Best

QR code checkouts are especially useful in:

- Self-service areas (cafés, food courts, vending machines)

- Events and pop-up locations

- Retail chains with mobile-first customers

- Queue-reduction strategies at peak hours

Instead of queuing at a terminal, customers scan a QR code on a screen, shelf-edge label, or receipt, then complete the payment through their bank app.

Why Customers Prefer QR + Bank Checkout

- No app downloads required

- Trusted user experience via their own bank

- Instant confirmation and transparent receipts

- More privacy, as card details are never shared

For retailers already using EPOS systems, adding QR support for Open Banking is often as simple as embedding a link into existing display flows or receipts.

Open Banking Refunds: Real-Time Reversals without Cards

Refunds are a critical part of the retail experience, but for most merchants, they’re still painfully slow. Card-based refunds can take 3–5 business days to appear in the customer’s account, creating unnecessary friction, support queries, and reputational risk. With Open Banking for EPOS and retail systems, refunds can now be processed instantly, with no card processors or delays.

Why Refunds Are Slower with Cards

Traditional card refunds require multi-step processing across acquiring banks, card schemes, and issuers. This creates delays and inconsistencies, especially when cards are expired, lost, or blocked.

It’s also costly. Many acquirers charge a fee for processing refunds or reverse authorisations, especially when done in bulk.

How Open Banking Refunds Work

With Open Banking, refunds are initiated via API directly to the customer’s bank account. The original transaction details (name, account number, reference) are already known, making the refund process fast, traceable, and fully automated.

- Funds return to the customer’s account in seconds

- No manual entry, no card rails involved

- Refund confirmation is available in real time

- Works across all UK-supported banks

This is particularly useful for retailers offering Pay by Bank checkout or integrating Open Banking into their EPOS systems.

| Use Case | How Open Banking Helps |

|---|---|

| Retail Returns (Online & In-Store) | Instantly refunds customers for returned goods, removing card processing delays and improving customer satisfaction. |

| Failed Payments or Partial Transactions | Quickly reverses failed or incomplete transactions, with real-time confirmation and no manual handling. |

| Loyalty Redemptions & Promo Balances | Sends refunded promotional or loyalty balances directly back to the customer’s bank account, avoiding voucher misuse. |

| Customer Service Escalations | Resolves complaints faster by issuing refunds in seconds—reducing friction, call volume, and churn risk. |

EPOS Integration: Connecting Open Banking with Retail Systems

For Open Banking to deliver real value in retail, it needs to work seamlessly with your EPOS system. That means more than just enabling Pay by Bank—it’s about integrating payment flows, refunds, settlement data, and customer details into your existing tools.

Whether you’re running a large retail chain or a growing independent store, Open Banking can slot directly into your stack.

API vs. Plugin vs. Hosted Checkout

Retailers have three main ways to integrate Open Banking into their EPOS workflows:

- API integration: Offers full control and flexibility. Ideal for custom EPOS systems or larger operations needing tailored workflows.

- Pre-built plugins: Many providers offer plugins for popular POS platforms like Shopify, Lightspeed, or Square.

- Hosted checkout links: Best for smaller merchants. QR codes or payment links can be embedded without touching your backend.

Each method supports retail payments through direct bank transfer, and most options include real-time payment confirmation, reconciliation fields, and refund support.

Data You Get with Open Banking

Unlike card schemes, Open Banking gives retailers more than just a transaction ID. You also receive:

- Payer name and account reference

- Bank timestamp for payment confirmation

- Transaction metadata (such as invoice numbers or customer IDs)

- Clear visibility into failed or abandoned payments

This is especially helpful for reconciliation, loyalty mapping, and post-payment engagement.

Common Retail Tech Stacks and Compatibility

Open Banking works well with:

- Cloud-based EPOS platforms (Shopify POS, Vend, Square)

- Custom retail software used by large stores or franchises

- Mobile checkout systems running on tablets or handhelds

- Inventory and returns systems needing instant refund triggers

You don’t need to replace your existing EPOS setup. Most Open Banking platforms are designed to run alongside cards and wallets, giving customers more choice at checkout.

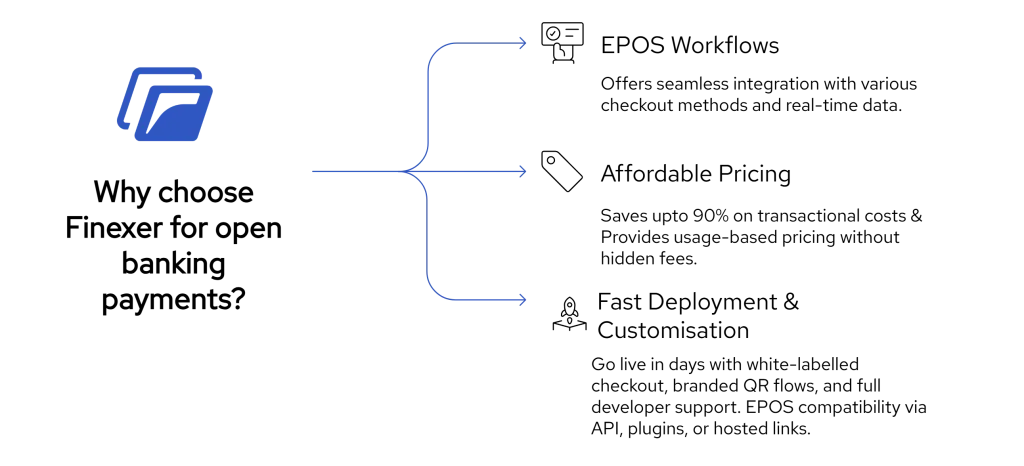

Why Retailers Choose Finexer for Open Banking Payments

If you’re looking to integrate Open Banking into your retail or EPOS systems, Finexer offers the fastest route from planning to production, without high fees or complex technical setup.

Built for EPOS and Retail Workflows

Finexer’s Open Banking APIs are designed to fit into the real-world workflows of modern retailers:

- Pay by Bank APIs that work across online, in-store, kiosk, and mobile checkouts

- QR code payments with dynamic transaction-level tracking

- Instant refund capabilities for smoother returns and faster resolution

- Real-time payment confirmation with full customer and reference data

- Lightweight integration options, including hosted pages, plugins, and direct API access

Affordable, Usage-Based Pricing

Finexer’s pricing is designed for scale without upfront risk. You only pay for what you use with no card scheme fees, no minimums, and no per-terminal costs.

Whether you’re an independent store or a multi-site chain, Finexer lets you modernise your retail payment infrastructure without overhauling your stack.

Fast Deployment and Support

Finexer gets you live in days, not months, with white-labelled checkout options, branded QR flows, and full developer support throughout onboarding, along with 3-5 weeks of hands-on assistance.

If your EPOS system already supports webhooks or RESTful API endpoints, you’re likely already compatible.

Get Started

Add QR Pay, instant refunds, and Open Banking checkout to your store without rebuilding your EPOS.

Try NowRegulatory and Customer Considerations

Integrating Open Banking into your EPOS or retail payment system comes with fewer regulatory hurdles than many retailers expect. However, it’s still important to understand how the model works from both a compliance and customer experience perspective.

Do You Need FCA Approval?

In most cases, retailers using Open Banking via a regulated provider do not need direct authorisation from the FCA. Here’s why:

- The Open Banking provider (e.g. Finexer) is already FCA-regulated as a Payment Initiation Service Provider (PISP) or Account Information Service Provider (AISP).

- As a retailer, you’re simply using that provider’s infrastructure to initiate payments or process refunds.

- You are not handling customer banking credentials or operating as a financial service.

This setup makes it easier to adopt Open Banking without a heavy regulatory lift.

Wrapping Up

Retailers across the UK are already benefiting from Open Banking—reducing fees, speeding up refunds, and transforming how customers pay at checkout. Whether you operate a single store or manage thousands of transactions daily, the opportunity to upgrade your retail payment system is clear.

By enabling Pay by Bank, QR code checkout, and real-time refunds, Open Banking helps you modernise payments without disrupting your existing EPOS setup.

And with providers like Finexer, integration is no longer a barrier.

If you’re ready to cut processing costs, improve your refund experience, and offer secure, instant payment options, Open Banking isn’t just a future investment. It’s a competitive advantage today.

What is Open Banking for EPOS systems?

It lets any EPOS take Pay by Bank transfers, QR payments and instant refunds directly between customer and merchant bank accounts.

Can Open Banking cut card fees for retailers?

Yes. Bank-to-bank payments avoid scheme fees and acquirer mark-ups, lowering every transaction’s cost.

Is Pay by Bank secure for shoppers?

Yes. Customers approve each transfer inside their banking app using Strong Customer Authentication, so no card data is shared.

How do QR code payments work in-store?

The till shows a dynamic QR code. Shoppers scan, choose their bank, confirm, and funds settle instantly. No app download needed.

Can refunds be instant with Open Banking?

Yes. An API call pushes the money straight back to the shopper’s bank account in seconds, removing card-refund delays.

Save Up to 90% on Transaction Costs with Finexer. Cut card fees, process refunds instantly, and offer Pay by Bank checkout fully integrated into your EPOS.