Payroll and invoicing still break at the worst moments. Last year, 40% of UK employees found an error in their payslip, and many had to wait for a correction. At the other end of the cash-flow pipe, small businesses are now waiting about 47 days for the average invoice to be paid.

Open banking for payroll and invoicing removes those headaches in three simple moves. It lets you send instant payroll payouts, run a bank account verification API before every transfer, and add invoice payment links so customers can pay by bank for invoices in a couple of taps.

In this article, we’ll walk through the most useful ways to apply open banking for payroll and invoicing. From sending instant payroll payouts, to checking if bank account details are correct before sending money, to collecting invoices with request to Pay links each section focuses on a real-world use case. You’ll also see how these tools compare to older systems and how to get started, whether you prefer no-code options or developer APIs.

Top 10 Use Cases of Open Banking for Payroll and Invoicing

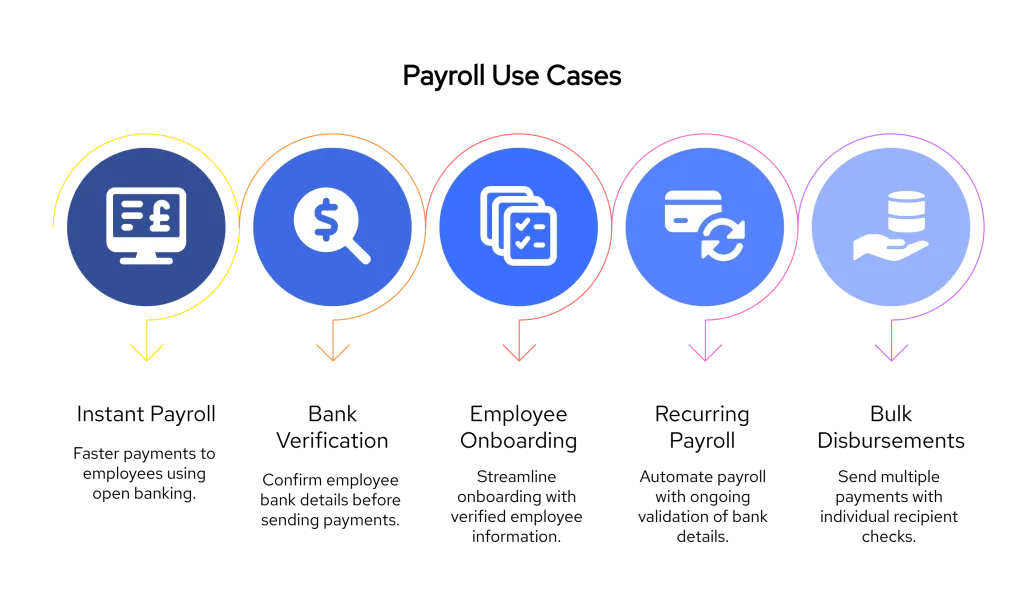

Key Open Banking Use Cases for Payroll

| # | Use Case | What it is | How it works | Why it matters |

|---|---|---|---|---|

| 1 | Instant payroll payouts | Pay salaries in seconds instead of days | API fires a Faster Payments transfer straight from your business account | Keeps staff happy, avoids late-pay complaints |

| 2 | Bank-account verification before payout | Name-on-account check right before money leaves | Verification API pings the employee’s bank and matches name + sort code + account | Stops bounce-backs and fraud, reduces admin |

| 3 | Employee onboarding with verified details | Collect bank info without manual forms | New hire clicks a secure link → connects bank → details auto-populate | Zero typos, faster first-pay setup |

| 4 | Recurring payroll with auto-validation | Schedule weekly/monthly runs with pre-checks | Each cycle, the API re-verifies stored accounts before sending | Catches closed or changed accounts early |

| 5 | Bulk disbursements with per-recipient checks | One file, hundreds of verified payouts | Upload CSV/JSON → API validates every line → executes batch | Scales to high-volume teams without risk |

1. Instant Payroll Payouts

What it solves:

Waiting 2–3 business days for salary transfers can lead to missed paydays, complaints, and stress on payroll teams.

How it works:

Open Banking payout APIs use the UK’s Faster Payments infrastructure to send salary payments instantly. Once payroll is approved, funds can be transferred and confirmed within seconds, even outside standard Bacs windows.

Why it matters:

- Employees get paid on time, every time

- No more cutoff panic or overnight delays

- Ideal for same-day wages, gig platforms, or temp staff

Example:

A shift-based employer uses instant payouts at the end of each day. Workers receive payment within minutes, improving retention and reducing support queries.

📚Guide to best invoice processing tools

2. Bank Account Verification Before Payout

What it solves:

Manual errors in sort codes or account numbers cause bounce-backs, delays, and potential fraud risk.

How it works:

A bank account verification API checks the account holder’s name directly with the bank before payment is made. This ensures the account is valid and matches the intended recipient.

Why it matters:

- Prevents failed or misdirected payments

- Reduces fraud and identity mismatches

- Avoids last-minute payment-day corrections

Example:

A payroll platform auto-verifies every payee during onboarding. As a result, their failed payment rate dropped by over 90%.

3. Employee Onboarding with Verified Details

What it solves:

Collecting bank details via spreadsheets, PDFs, or forms leads to manual errors and security risks.

How it works:

New hires are sent a secure link to connect their bank account using Open Banking. Their name, account number, and sort code are pulled directly from the bank, no manual entry required.

Why it matters:

- Speeds up payroll setup for new joiners

- Minimises onboarding back-and-forth

- Ensures data accuracy from day one

Example:

An HR team replaces bank forms with Open Banking connections during onboarding, cutting setup time in half.

4. Recurring Payroll with Auto-Validation

What it solves:

Stored bank details may become outdated, especially for contractors or seasonal staff, but most systems don’t recheck them.

How it works:

Each time a payroll run is scheduled, the system re-verifies saved account details via Open Banking. If an account is closed, mismatched, or flagged, finance is alerted before the payment is made.

Why it matters:

- Adds a safety net to automated payroll

- Avoids batch failures due to outdated info

- Increases confidence in recurring runs

Example:

A large cleaning agency with weekly payroll uses auto-validation to check 500 accounts before each run. Payment failures dropped to zero.

5. Bulk Disbursements with Per-Recipient Checks

What it solves:

When making dozens or hundreds of payments at once, it’s risky to assume every payee’s details are correct.

How it works:

Open Banking APIs can process a full payment batch (CSV or JSON) and automatically verify each line before executing the disbursement. Invalid accounts are flagged, and valid ones proceed.

Why it matters:

- Reduces admin on bulk payroll days

- Catches issues early without slowing the process

- Scales well for platforms and larger teams

Example:

An accounting firm handling payroll for multiple clients runs bulk payouts through an Open Banking tool. It flags issues in seconds and prevents hundreds of potential failures across accounts.

Invoicing Use Cases That Eliminate Friction and Payment Delays

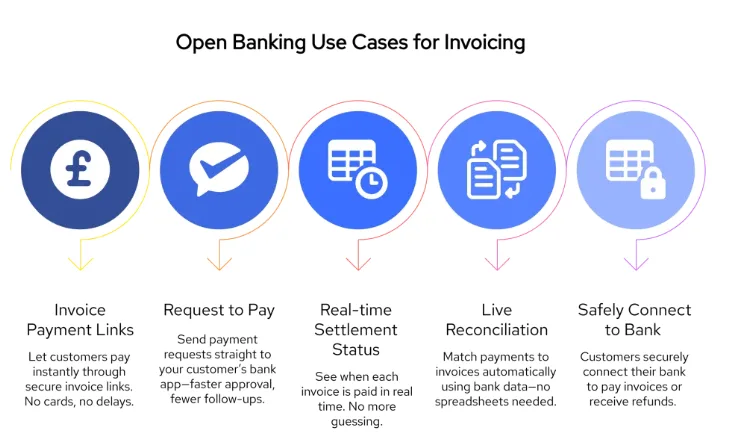

| # | Use Case | What it is | How it works | Why it matters |

|---|---|---|---|---|

| 6 | Invoice payment links (Pay by Bank) | “Pay Now” link tied to an invoice | Link opens customer’s banking app; they approve in two taps | Faster payments, no card fees |

| 7 | Request to Pay (RTP) for invoices | Push a payment request inside the buyer’s bank app | Seller sends RTP; buyer reviews and authorises instantly | Reduces email chasing, clear audit trail |

| 8 | Real-time invoice settlement status | Know the second an invoice clears | AIS feed pings your system when funds arrive | Speeds up cash-flow forecasting |

| 9 | Live reconciliation with bank data | Auto-match payments to invoices & payroll runs | Unique references + AIS feed mark items “paid” | Cuts manual spreadsheet work |

| 10 | Secure customer bank-detail capture | Collect payers’ details via Open Banking instead of forms | Customer connects their bank once; details flow through API | Removes data-entry errors, boosts security |

6. Invoice Payment Links (Pay by Bank)

What it solves

Late payments are caused by card friction, forgotten logins, or manual bank transfers.

How it works

Your invoicing system generates a unique invoice payment link. When the customer clicks, their banking app opens with the payment pre-filled; they approve in two taps. Funds move via Open Banking rails, no cards, no interchange fees.

Why it matters

- Speeds up settlement and cuts Days Sales Outstanding

- Eliminates card fees and chargebacks

- Gives customers a mobile-first, one-click experience

Example

A B2B design studio added pay-by-bank links to every invoice email and saw average payment time drop from 30 days to 18 days.

7. Request to Pay (RTP) for Invoices

What it solves

Endless “invoice reminder” emails and uncertain payment dates.

How it works

Instead of sending a static invoice, you push a Request to Pay directly to the client’s banking app. They review the details and accept (or schedule) the payment. Once approved, money clears instantly, and the invoice is auto-marked “paid.”

Why it matters

- Places the payment prompt where clients already trust—inside their bank

- Clear audit trail of acceptance, reducing disputes

- Lets payers split, defer, or part-pay if needed

Example

A wholesaler switched high-value accounts to RTP requests and recovered 20% of overdue balances within the first month.

8. Real-Time Invoice Settlement Status

What it solves

Waiting for next-day bank files to confirm if money has arrived.

How it works

Open Banking AIS (Account Information Services) streams transaction data back into your system. As soon as the invoice amount hits your account, the status updates automatically, with no manual checking.

Why it matters

- Finance knows the exact moment cash lands

- Enables up-to-the-minute cash-flow forecasting

- Reduces gaps between payment and service delivery

Example

A SaaS provider links its billing system to AIS feeds; customer subscriptions activate the instant funds are received, eliminating false “non-payment” suspensions.

9. Live Reconciliation with Bank Data

What it solves

Manual spreadsheet matching between invoice IDs and bank statement lines.

How it works

Each invoice carries a unique reference. When the payment arrives, the AIS feed matches that reference automatically and marks the invoice as reconciled. No CSV imports or late-night matching sessions.

Why it matters

- Saves hours of end-of-month admin

- Cuts reconciliation errors to near-zero

- Produces audit-ready records without extra effort

Example

An accounting firm managing 300 monthly client invoices reduced reconciliation time from five hours to 20 minutes.

10. Secure Customer Bank-Detail Capture

What it solves

Risky practices like emailing bank details or relying on PDF forms.

How it works

At invoice creation or when setting up recurring payments, you send the customer a secure Open Banking link. They connect their bank once; the verified account data flows straight into your system.

Why it matters

- Removes manual data entry and typos

- Protects sensitive information with bank-grade security

- Ensures future refunds or payouts go to the verified account

Example

A logistics company onboarding new vendors switched to secure bank-detail capture and slashed setup errors by 85%.

Why Finance Teams Choose Finexer for Payroll & Invoicing

Finexer is purpose-built for companies that need faster payments and accurate data without the usual integration burden.

Below are the core strengths that set it apart from generic payment aggregators and legacy payroll add-ons.

| Finexer Capability | Practical Benefit |

|---|---|

| Single Open Banking API covering payouts, account verification, and incoming payments | One integration instead of stitching multiple tools together |

| Instant Faster Payments rail | Salaries and invoice collections clear in seconds, not days |

| Real-time bank-owner match (name, sort code, account) | Stops bounce-backs and reduces fraud before money leaves your account |

| Branded payment links and optional QR codes | Let clients or customers pay directly from their bank—no cards, no hidden fees |

| Batch payouts with per-recipient validation | Upload one file; Finexer verifies every line and handles the disbursement |

| White-label option | Keep your brand front-and-centre while Finexer handles the regulated plumbing |

| Usage-based pricing | Pay only for what you process; no fixed licence fees or surprise mark-ups |

| Deployment in days, not months | Pre-built workflows for non-technical teams; clean REST API and clear docs for developers |

| Regulatory coverage | Finexer manages AIS/PIS compliance so your team doesn’t have to build it in-house |

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

Penny Phillips, Chief Commercial Officer at Sysynkt.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowFewer Delays, Fewer Errors — One Platform

Payroll and invoicing shouldn’t be held back by outdated rails or unreliable data. With Open Banking, businesses can now send instant payouts, verify account details before funds leave the business, and collect invoice payments without friction or fees.

The result isn’t just faster processing, it’s better control, cleaner data, and fewer financial surprises across your payment workflows.

If you’re managing payroll or chasing invoices, now is the time to switch to a system built for speed, accuracy, and transparency. Finexer brings these capabilities into one API-driven platform, designed for finance teams who need results without complexity.

How does Open Banking speed up UK payroll payouts?

It replaces Bacs with Faster Payments, so salaries clear in seconds instead of 2–3 working days.

What is a Bank Account Verification API for payroll?

An API that confirms the payee’s name, sort code and account number with their bank before money is sent.

Can I collect invoices using Pay-by-Bank links?

Yes. A secure invoice payment link lets customers approve the transfer in their banking app, no cards, no fees.

Is Open Banking secure for payroll and invoicing?

UK Open Banking is FCA-regulated, uses encrypted consent, and meets PSD2 strong customer-authentication rules.

Do I need developers to use Finexer’s Open Banking tools?

No. Finance teams can start with no-code dashboards, while developers can embed the same features via REST APIs.

Faster Payroll. Smarter Invoicing. Zero Fuss.

Finexer connects your business to Open Banking with easy integration and full compliance handled for you 🙂