In the UK, the financial landscape for small and medium-sized enterprises (SMEs) is changing rapidly. New pressures such as rising operating costs, delayed invoices and tighter working-capital margins are pushing business owners to modernise how they manage money. In this context, open banking for SMEs is emerging as one of the most practical ways to gain better control, transparency and competitiveness.

Recent data underlines the momentum behind the shift: as of March 2025, there are 13.3 million active users of open banking services in the UK, including both consumers and small businesses representing roughly one in five of people and firms in digitally-enabled banking.

In the same period, 31 million open-banking payments were made in that month alone, equivalent to about 7.9% of all Faster Payments.

For SMEs, these numbers translate into real opportunity. Open banking gives businesses direct access to live banking data and payment-flows, enabling clearer cash-flow visibility and faster decision-making. A recent survey of 500 UK SMEs found that 47% cited faster funds settlement, and 46% lower transaction fees, as major benefits of adopting open banking payments.

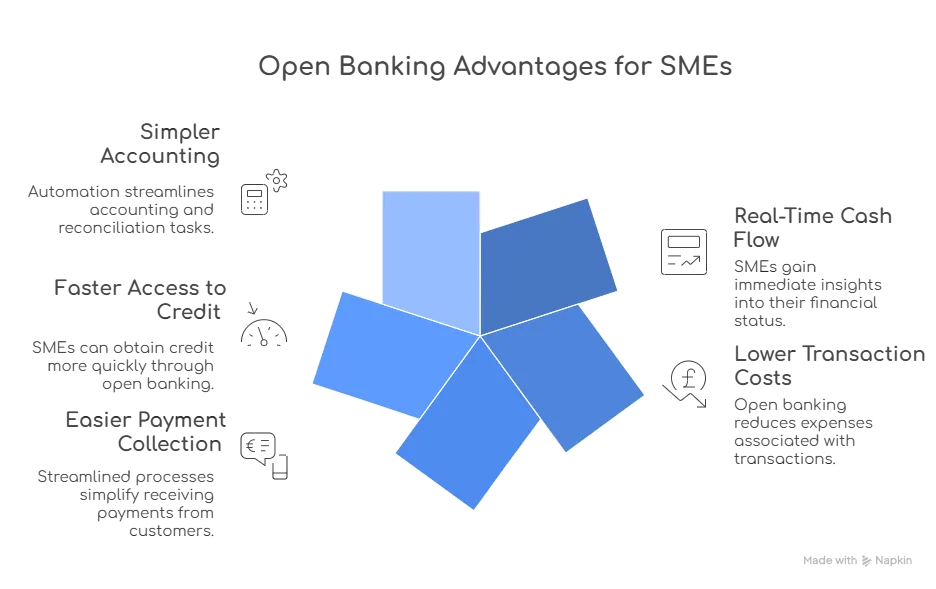

Key Advantages of Open Banking for SMEs in 2025

The real strength of open banking for SMEs lies in its ability to simplify day-to-day financial management. Beyond faster payments and easier integrations, it directly impacts how efficiently a business can operate, forecast, and grow.

1. Real-Time Cash Flow Visibility

Open banking gives SMEs instant access to live account balances and transactions across multiple banks. Instead of waiting for statements or reconciling spreadsheets, business owners can view their company’s entire cash position in one dashboard. This real-time visibility helps identify cash gaps earlier and make timely financial decisions.

2. Lower Transaction Costs

By connecting directly to the Faster Payments network, open banking eliminates the need for costly card networks or intermediaries. SMEs can save up to 90% in transaction costs compared to traditional card processing, especially in industries with frequent or high-volume payments.

3. Easier Payment Collection

Open banking payments allow customers to pay directly from their bank accounts without entering card details. This reduces payment failures, improves trust, and ensures funds reach the business instantly — ideal for SMEs that rely on steady cash inflows.

4. Faster Access to Credit

With direct access to verified transaction data, lenders can make quicker credit decisions for SMEs. This transparency helps small businesses secure funding faster, based on real-time bank data rather than outdated financial statements.

5. Simpler Accounting and Reconciliation

Accounting platforms connected to open banking APIs automatically fetch and categorise transactions, removing the need for manual uploads or data entry. For SMEs, this means fewer errors, less admin time, and more focus on growth.

Practical Use Cases of Open Banking for SMEs

While the benefits of open banking for SMEs are clear in theory, their real value is best seen in day-to-day business operations. From payments to accounting and credit assessment, open banking touches nearly every financial process that small and medium-sized enterprises manage.

1. Automated Accounting and Bookkeeping

By linking accounting platforms directly to bank accounts, SMEs can import transactions automatically, match invoices in real time, and generate accurate financial reports. This reduces manual reconciliation and helps business owners keep books up to date without extra effort.

2. Instant Customer Payments

Open banking enables Pay by Bank transfers, allowing customers to pay directly from their banking app. This removes card processing fees, improves cash flow, and ensures funds reach the business instantly—ideal for service-based SMEs and e-commerce businesses.

3. Payroll and Supplier Payments

Instead of uploading bulk payment files or waiting days for BACS transfers, SMEs can use open banking APIs to make batch payments instantly through the Faster Payments network. This helps maintain punctual payroll runs and strengthens supplier relationships.

4. Faster Loan and Credit Approvals

Lenders can use open banking data to verify SME income, expenses, and transaction patterns within seconds. This means small businesses no longer need to share documents manually or wait weeks for funding decisions.

5. Compliance and Verification

Open banking also supports identity and account verification. By securely accessing bank-verified data, SMEs can validate customer information or proof of funds without collecting sensitive documents—improving compliance while reducing fraud risk.

How to Get Started with Open Banking APIs for SMEs

Adopting open banking for SMEs may sound technical, but the process is far more straightforward than most business owners expect. Modern API providers now handle the compliance, bank connectivity, and data security layers—allowing SMEs to focus on using the data rather than building the infrastructure.

1. Choose a Regulated Open Banking Provider

Start by selecting a provider authorised by the Financial Conduct Authority (FCA). These platforms ensure that all data sharing follows strict consent-based frameworks. Providers like Finexer, Modulr, or TrueLayer are examples of UK-regulated providers that connect with nearly all major banks.

2. Define Your Use Cases

Before integrating, identify what you want to achieve. For instance:

- Automate transaction syncing into your accounting software

- Enable instant Pay-by-Bank collections

- Speed up customer verification using bank-verified data

Clear goals help you choose the right endpoints and pricing plans.

3. Integrate Securely via API

Most open banking providers offer developer-friendly APIs with ready documentation and SDKs. Integration can be completed within days and usually involves connecting your internal system to the provider’s authentication and data endpoints.

4. Test in a Sandbox Environment

Run tests using the provider’s sandbox setup to simulate real data connections before going live. This step ensures your internal systems handle transaction data accurately and securely.

5. Go Live and Monitor Usage

Once integrated, monitor API activity, track transaction volumes, and ensure permissions are renewed regularly. Good providers offer dashboards that simplify monitoring and ongoing compliance.

Finexer’s Role in Helping UK SMEs Adopt Open Banking

Finexer makes open banking for SMEs accessible, affordable, and fast to deploy. It’s built for UK businesses that want to modernise their payments, accounting, or compliance processes without the complexity of managing multiple banking integrations.

Built for UK SMEs

Finexer connects with 99% of UK banks through a single FCA-authorised API. This gives SMEs instant access to verified account data, real-time balances, and transaction insights — all within one secure platform.

Affordable and Scalable

Unlike traditional providers that charge high setup fees, Finexer offers usage-based pricing designed to grow with your business. Whether you process a few hundred transactions a month or several thousand, you only pay for what you use — making it ideal for small and medium-sized enterprises.

Fast Deployment

Finexer’s infrastructure is designed to deploy 2–3x faster than the market average, helping SMEs integrate open banking into their existing systems quickly. The platform also provides 3–5 weeks of onboarding support, ensuring smooth implementation and minimal downtime.

White-Label Ready

For accounting firms, fintechs, or SaaS platforms serving SMEs, Finexer offers white-label APIs that allow you to present open banking functionality under your own brand. This helps you create client-facing experiences powered by secure, regulated data access.

End-to-End Coverage

From instant Pay-by-Bank payments to account information access, Finexer supports both AIS and PIS capabilities giving SMEs full visibility and control across data, payments, and reconciliation in one place.

Conclusion: Open Banking for SMEs in 2025

Open banking is now a necessity for UK SMEs aiming to save time, lower costs, and make faster financial decisions. By connecting directly to UK banks through secure APIs, small businesses gain real-time visibility, instant payments, and simpler compliance — all from one platform.

With providers like Finexer, SMEs can adopt open banking quickly and affordably, gaining access to 99% of UK banks and deployment up to 3x faster than the market. For growing businesses, this isn’t just an upgrade, it’s the smarter way to operate in 2025.

What is open banking for SMEs?

It’s a secure way for UK small businesses to connect directly with banks via APIs. This lets them access real-time financial data, accept instant payments, and manage accounts more efficiently.

How does open banking improve SME cash flow?

It provides instant visibility into income and expenses across all accounts, helping SMEs predict cash gaps, track payments, and make faster financial decisions.

Is open banking safe for small businesses?

Yes. It’s regulated by the Financial Conduct Authority (FCA). Data is shared only with user consent and protected through strong encryption and authentication.

See how Finexer helps UK SMEs save time and costs through instant bank connectivity.