Traditional energy payment methods have reached their limit due to the volatility of the UK energy market and the fluctuating Ofgem price cap. Variable bills and rigid direct debits conflict, leading to a spike in unsuccessful payments that annoys clients and generates large administrative expenses. Now over 11 million consumers and small businesses in the UK regularly use Open Banking. Open Banking for energy suppliers provides a contemporary solution as they look for efficient Direct Debit substitutes to lower payment failures. Variable Recurring Payments in the UK allow businesses to finally implement an adaptable, effective system designed to meet the demands of the modern world.

What is open banking?

Launched in 2016, Open Banking is a UK initiative aimed at giving you more options and upending the banking sector.

This is what makes Open Banking strong and secure:

- You have control over data sharing because it only occurs with express consent, which can be withdrawn at any time.

- No password sharing—built on secure APIs. Banks and regulated apps are directly connected via APIs.

- Improved financial visibility: Consolidate all of your accounts in one location to make planning and budgeting simpler.

However, its influence extends beyond personal finance; Open Banking is currently being used by sectors like energy to enhance customer satisfaction and streamline operations.

But how is the UK energy market making use of it?

An excellent illustration of Open Banking’s practical effects is the energy industry in the United Kingdom. Suppliers usually collaborate with fintech platforms that offer the required infrastructures (like Finexer) to link to the open banking ecosystem in order to implement this technological change. Utility companies using Open Banking can see a transaction cost reduction of up to 90% compared to conventional card payments and Direct Debit solutions, while automation reduces administrative overhead.

Energy providers have a special problem because traditional direct debits are inflexible and bills change each month. Payment failures, increased churn, and additional administrative work are caused by this discrepancy. Moreover, over 22 million open banking-enabled payments are processed monthly in the UK, representing a 67% year-on-year growth in transaction volume, which means it is time for the UK energy sector to adopt open banking.

The Power of VRPs in Open Banking for Energy Suppliers

One of Open Banking’s primary features, Variable Recurring Payments (VRPs), provides suppliers with the flexibility they’ve long required in a volatile market. VRPs enable companies to automatically collect the precise amount owed each month, in contrast to strict direct debits, and can adjust to changing price caps and energy usage.

Instant settlement, where real-time payment clearing enhances cash flow and removes delays brought on by conventional payment cycles, also benefits suppliers. Additionally, VRPs greatly lower failure rates, no more expired cards, out-of-date mandates, or missed payment, because they run on secure bank-to-bank transfers.

How to collect flexible payments without increasing admin work?

Use Variable Recurring Payments (VRPs) through Open Banking to collect flexible payments without additional administration. You can automatically pull variable amounts every billing cycle once the customer has given their one-time approval. By automating reconciliation and almost completely eliminating unsuccessful payments, this saves a great deal of time and lowers operating expenses.

How do VRPs help cut costs for energy companies?

By automating manual administrative tasks, reducing the risk of fraud, and significantly reducing payment failures, variable recurring payments, or VRPs, save energy companies money. Cash flow increases, and operational overhead is significantly reduced as a result.

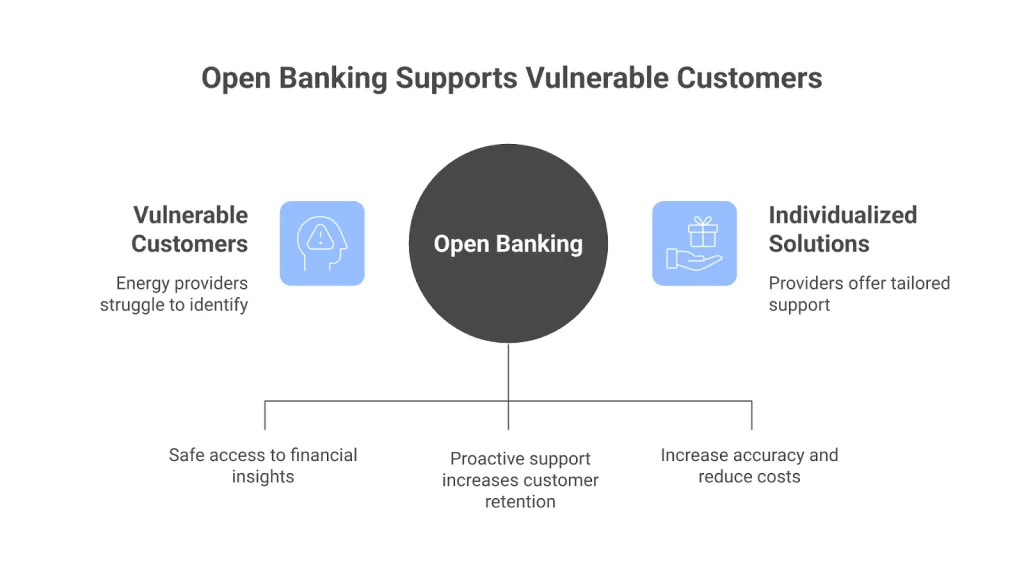

Supporting Vulnerable Customers

In order to comply with regulations and preserve trust, energy providers must identify financially vulnerable customers early on. This is made possible by Open Banking, which helps providers provide individualised solutions by granting safe, consent-based access to financial insights.

- By offering flexible payment plans, proactive support increases customer retention and lowers attrition.

- By replacing manual procedures, automated checks increase accuracy and reduce costs.

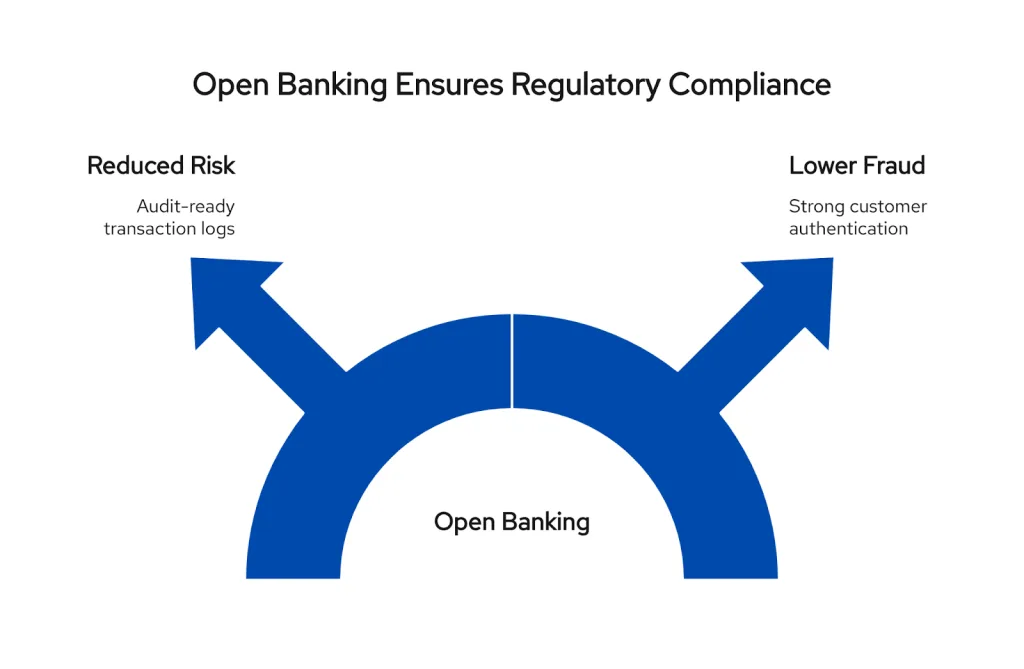

Increasing security through compliance

The FCA, PSD2 impose stringent regulations on energy providers. Heavy fines and harm to one’s reputation may result from noncompliance. This is resolved by Open Banking, which offers safe, controlled payment flows that comply with EU and UK regulations.

- Strong Customer Authentication (SCA) lowers fraud and guarantees that payments adhere to PSD2 regulations.

- Operational and legal risk is decreased by audit-ready transaction logs and automated compliance checks.

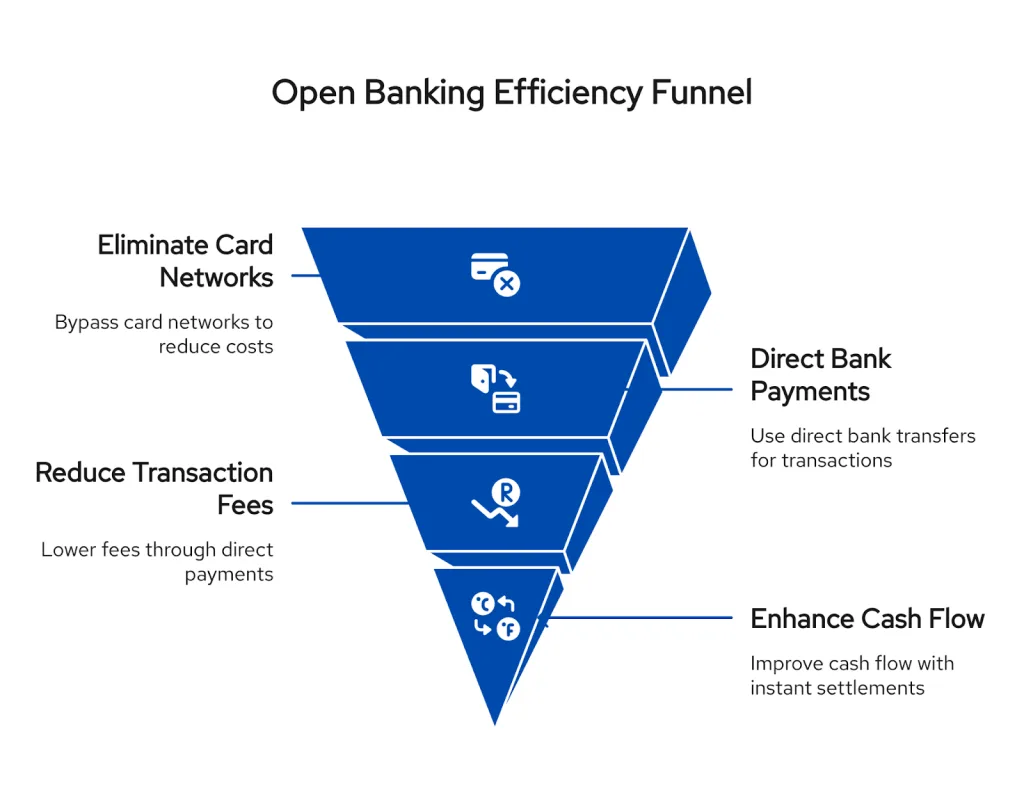

Cutting Out Card Fees

Supplier margins are eroded by hidden fees and card processing fees. By completely avoiding card networks, Open Banking offers a more affordable option.

- Transaction fees and operating costs are decreased by direct bank payments.

- Unlike delayed card payment cycles, instant settlement enhances cash flow.

- Energy companies can use Finexer’s API-driven infrastructure to swap out expensive legacy systems for more contemporary, effective ones.

Hence, the UK energy market is under immense pressure to reduce costs, improve payment success rates, and enhance customer satisfaction. Traditional methods like Direct Debit and card payments are no longer efficient in a landscape where flexibility and security matter most. Open Banking, powered by Variable Recurring Payments (VRPs), offers energy suppliers the ability to create adaptive billing systems, achieve instant settlements, and minimise operational inefficiencies—all while staying fully compliant with FCA and PSD2 regulations.

How can we help?

At Finexer, we offer open banking solutions that are API-driven and focused on the UK, especially for energy providers. The following explains why energy companies pick us:

- Blazingly quick onboarding with committed assistance at every stage.

- Complete compliance management: we take care of the FCA, PSD2, and GDPR regulations to keep you safe.

- Transaction costs can be reduced by up to 90% when compared to direct debit and conventional card payments.

How does Open Banking improve customer experience?

Consumers benefit from secure consent-driven data sharing, quick and easy payments, and flexible VRPs for adaptive billing, which reduces disputes and improves customer satisfaction.w

How can Open Banking help identify vulnerable customers?

Suppliers can safely confirm a customer’s financial stability (with consent) and provide customised payment plans without keeping sensitive data by utilising Account Information Services (AIS).

Is Open Banking secure for energy companies?

Indeed. It is safer than cards or Direct Debit because it makes use of bank-level encryption, Strong Customer Authentication (SCA), and FCA-regulated APIs.

See how Open Banking can change your billing strategy by scheduling a free consultation right now.