Wealthtech platforms are under increasing pressure to deliver seamless, digital-first experiences, and traditional onboarding and data aggregation methods are increasingly out of step. According to a 2024 report by LSEG, 68% of investors expect their digital interactions with wealth management firms to match the quality of top tech brands. At the same time, manual compliance processes are a major bottleneck; nearly one-third of wealth managers report that onboarding UHNW clients takes 3 months or more, while only 13% achieve under one-week turnaround times.

These gaps matter: inefficient onboarding leads to lost revenue and client attrition, while poor data infrastructure limits real-time insights and personalisation. Open Banking provides consented, live access to bank accounts, bridges these divides: automating KYC and AML workflows, enabling portfolio updates in real time, and reducing onboarding friction all under full regulatory oversight.

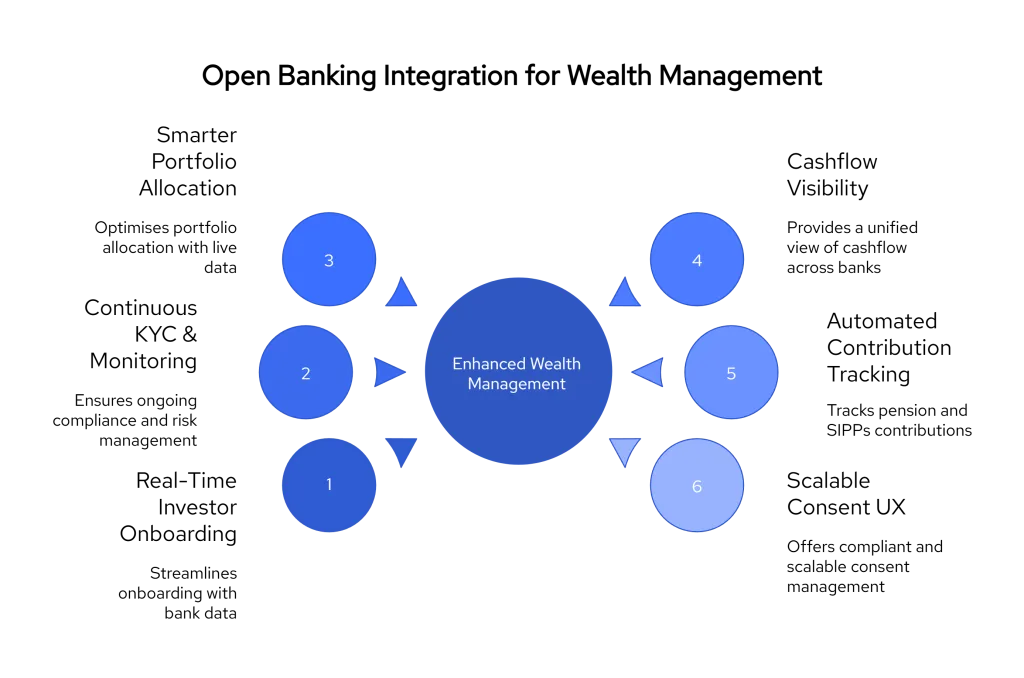

In this blog, we’ll explore 6 practical use cases where Open Banking is transforming the wealthtech stack for UK-based platforms. From onboarding automation to dynamic portfolio management, these are the applications that are making the investor experience faster, smarter, and more compliant.

1. Real-Time Investor Onboarding with Bank Data

Onboarding is often the first serious test of your platform’s experience, and for many wealthtech firms, it’s still painfully slow. Manual form-fills, document uploads, and back-and-forths with compliance teams stretch onboarding timelines and increase drop-offs, especially among high-net-worth clients.

Open Banking helps modernise this process.

By using Account Information Services (AIS), wealthtech firms can securely access a prospective investor’s verified bank data with full consent and use that to pre-fill KYC information, validate identity, and assess financial behaviour in real time.

How Open Banking speeds up onboarding

- Instant Source of Funds Verification

Identify where incoming wealth originates based on categorised transaction history. - Pre-Filled Financial Profiles

Use income patterns, account balances, and spending habits to build dynamic investor profiles. - Shorter Time to Approval

No more waiting on PDFs or bank letters, investors can be reviewed and onboarded in hours, not weeks. - Improved Compliance Efficiency

Reduce manual checks and maintain a secure audit trail aligned with FCA requirements.

2. Continuous KYC & Transaction Monitoring

Most wealthtech firms treat KYC as a one-time event, typically during onboarding. But that’s no longer enough. Investors’ financial behaviour changes over time, and relying solely on static documents or initial declarations leaves gaps in compliance, especially when managing large portfolios or recurring investments.

Open Banking enables ongoing visibility into a client’s financial activity with their explicit consent. Instead of waiting for annual updates or manual refreshes, platforms can re-authenticate bank connections every 90 or 180 days and continuously monitor changes in income, spending, and account activity.

What this Enables

- Ongoing AML and Risk Checks

Monitor transactions for unusual flows, high-risk merchants, or inconsistent sources of wealth over time. - Dynamic Investor Risk Profiling

Adjust internal risk flags and suitability scoring as financial behaviour evolves. - Faster Response to Red Flags

Detect anomalies in near real time and alert compliance teams before they escalate. - Better Audit Preparedness

Maintain a digital record of all consented data access and monitoring activity, reducing audit friction.

By integrating continuous monitoring into the platform, compliance becomes an embedded process, not a disruptive one. This approach strengthens oversight while improving the experience for investors who no longer need to submit repeated documentation.

What is the role of Open Banking in wealth management?

Open Banking allows platforms to access verified bank data with client consent. This enables faster onboarding, better portfolio visibility, and ongoing compliance, all within a secure, FCA-authorised framework.

How can wealthtech platforms monitor client risk in real time?

By integrating Open Banking, platforms can track financial activity across client accounts and spot unusual spending patterns or red flags, enabling proactive risk management.

Is Open Banking secure for wealth management use?

Yes. All data access is consent-based and managed through FCA-authorised providers using encrypted APIs. Clients can revoke access at any time.

3. Smarter Portfolio Allocation & Risk Profiling

A wealth platform is only as good as the insights it can offer. Yet many portfolio decisions are still made based on outdated or incomplete data, annual reviews, static income declarations, or limited access to spending patterns. This disconnect creates blind spots in suitability, risk exposure, and asset allocation.

Open Banking enables wealthtech platforms to access real-time data on income inflows, account balances, and spending trends. When this live data is fed into your portfolio engine, it opens up a new level of precision in how client portfolios are managed and adjusted.

What Real-Time Data Means for Portfolios

- Real-Time Liquidity Assessment

Understand how much cash an investor actually has available across accounts at any moment. - Timely Portfolio Rebalancing

Detect major inflows (e.g., bonuses, dividends, property sales) and suggest reallocation or top-ups without delay. - Behaviour-Based Suitability Scoring

Align investment strategies with live financial behaviour, not static assumptions. - Reduced Manual Intervention

Remove the need for advisors to request updated financial snapshots or wait on self-declared changes.

4. Cashflow Visibility for HNW Clients

For high-net-worth (HNW) clients, static reports and quarterly reviews no longer provide the clarity they expect. These clients often hold multiple accounts across banks and investment vehicles, making it difficult for advisers to assess real-time liquidity or cash availability for reallocation or drawdowns.

With Open Banking integrations, wealth management platforms can access up-to-date account balances and transaction activity across multiple institutions, directly and securely, with client consent. This gives advisers a live view of available cash, income sources, and spending trends, enabling smarter, more timely financial decisions.

How to See a Client’s Full Cash Picture

- Live Cash Positioning

See the total accessible cash across current, savings, and linked investment accounts, all in one view. - Better Preparedness for Large Transactions

Anticipate cash calls, property purchases, or charitable donations with real-time data. - Streamlined Advisor Review Cycles

Reduce the need for clients to upload statements or explain liquidity events manually. - Improved Client Confidence

Provide visibility that matches what clients see in their banking apps, but within your wealth management environment.

This level of real-time cashflow insight enhances the advisory experience and positions your platform as a trusted partner for managing wealth with speed, context, and confidence.

5. Automated Contribution Tracking for Pensions & SIPPs

Tracking regular contributions to pensions, ISAs, or SIPPs is critical for both advisers and investors, but many wealth management platforms still depend on manual updates or outdated feeds. This not only creates visibility gaps but also increases the risk of missed contributions, compliance errors, and poor client communication.

Open Banking provides direct access to live transaction data, allowing platforms to automatically detect standing orders, direct debits, and other regular payments linked to investment products. Instead of waiting for quarterly summaries or asking clients to confirm deposits, the system can flag missed contributions or irregular patterns in real time.

Tracking Contributions Without the Paperwork

- Accurate Monitoring of Client Commitments

Ensure that planned pension or SIPP contributions are occurring as expected, and trigger alerts when they aren’t. - Streamlined Communication Between Client and Adviser

Reduce back-and-forth by equipping advisers with real-time updates during reviews. - Improved Long-Term Planning

Use consistent data feeds to generate more accurate forecasts for retirement or goal-based investing. - Greater Efficiency Across the Wealth Management Stack

Automate manual reconciliation tasks and reduce dependency on outdated data sources.

For firms managing long-term wealth strategies, this use case strengthens operational reliability while improving transparency across the client journey.

Can Open Banking help automate pension and SIPP tracking?

Yes. Platforms can detect recurring payments, flag missed contributions, and keep forecasts up to date using live bank data feeds

How does Open Banking support scalable wealth management?

It removes friction in onboarding, data collection, and re-authentication. With developer-ready APIs, platforms can scale investor access without expanding admin overhead.

6. Scalable, Compliant Consent UX for Wealth Platforms

In a regulated industry like wealth management, client trust is built on transparency and control. Whether accessing account data or initiating payments, platforms must present clear, compliant consent experiences, especially when dealing with high-net-worth individuals who expect privacy and professionalism.

Open Banking enables firms to implement fully customisable consent journeys that align with FCA requirements. From initial data access to re-authentication flows, every interaction can be branded, auditable, and designed to feel native to your platform, without compromising security or control.

Making Consent Clear and Compliant

- Fully White-Labelled Consent Interfaces

Align data permissions and access requests with your platform’s user experience. - Consent Management at Scale

Handle thousands of investor connections with secure re-authentication and opt-out options built-in. - Built-In Regulatory Alignment

Ensure every data request, connection, and refresh is logged in line with Open Banking and data privacy regulations. - Improved User Confidence and Retention

Give clients visibility into what’s being accessed, why, and for how long critical for long-term trust in digital wealth management.

As client expectations rise and compliance becomes more complex, having a scalable, audit-ready consent infrastructure is no longer optional. It’s foundational to delivering a modern, trustworthy wealthtech experience.

Implementing These Use Cases with Finexer

All six use cases highlighted in this guide rely on one thing: fast, compliant, and secure access to live financial data. That’s exactly what Finexer delivers.

Built for regulated platforms, Finexer’s Open Banking infrastructure gives wealth management firms the tools they need to modernise investor experiences from onboarding and verification to portfolio monitoring and long-term financial planning.

What Finexer offers:

- Live Access to 99% of UK Banks

Authorised under FCA permissions for both AIS and PIS, Finexer provides reliable, consent-based access to account data across the UK banking ecosystem. - Transaction Categorisation & Enrichment

Go beyond raw data with categorised transactions that support better investor profiling, AML checks, and suitability scoring. - White-Labelled Consent Flows

Integrate fully branded, FCA-compliant consent journeys into your wealth management platform with minimal engineering effort. - Flexible, Usage-Based Pricing

Scale up as your investor base grows without heavy fixed costs or lock-in contracts. - Developer-First Onboarding Support

Finexer deploys 2–3x faster than the market average, with 3-5 weeks of dedicated technical support to get you live quickly.

Whether you’re launching a new digital wealth platform or upgrading an existing investment advisory system, Finexer provides the Open Banking layer that powers secure, real-time investor insight at scale.

Get Started

From onboarding automation to real-time portfolio insights, Finexer powers the financial data layer trusted by UK wealthtech firms.

Try NowHow do wealthtech platforms access bank data?

Using secure APIs from Open Banking providers like Finexer, platforms can connect to 99% of UK banks and retrieve account and transaction data with user consent.

Is Open Banking compliant with KYC and AML regulations?

Yes. It supports compliance by providing verified, audit-ready data, reducing reliance on static documents, and maintaining a full consent trail.

What are the benefits of Open Banking for investor onboarding?

It speeds up KYC checks, pre-fills investor profiles, and verifies source of funds instantly, reducing onboarding time from weeks to hours.

Ready to launch faster, smarter wealth management experiences?

Connect to 99% of UK banks and scale your business with Finexer!