Wealth management covers a wide range of financial services to address a client’s diverse needs, including investment advice, estate planning, accounting, retirement planning, and tax services.

Introduction

Open banking is changing wealth management by allowing secure data sharing between banks and fintech firms. With regulations like PSD2 and the use of open APIs, financial services are becoming more accessible and transparent. This allows investors to manage their money more effectively and make informed decisions.

This article explores how open banking improves wealth management, with a case study on Sarwa and Lean Technologies showing its real-world impact. From better access to financial services to more personalised investment options, open banking is shaping a more open and efficient financial landscape.

we will guide you through:

Overview of Open Banking in Wealth Management

Definition and Importance of Open Banking

Open banking represents a transformative shift in financial services, enabling the seamless exchange of financial data between institutions through the use of open APIs. This innovation is particularly significant in wealth management, where it facilitates enhanced service offerings and improved client experiences. By leveraging open banking, wealth management firms can offer more personalised and efficient solutions, thereby fostering greater transparency and trust with their clients.

Growth of Open Banking in WealthTech

By 2025, 14% of digitally active banking customers and 18% of small businesses are expected to adopt open banking services. The global open banking market is projected to reach $11.7 billion by 2028, growing at a 16% CAGR, contributing to more personalized and efficient WealthTech solutions.

Revolutionising Wealth Management

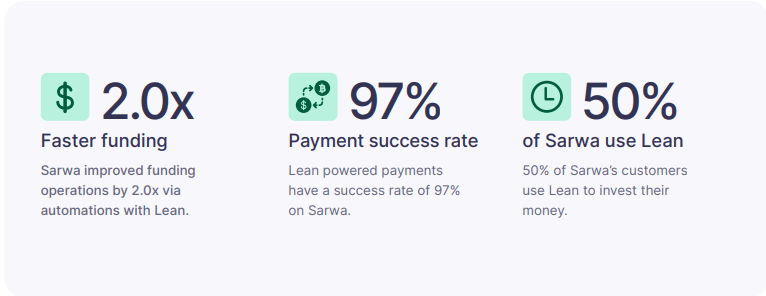

In the context of wealth management, open banking has been instrumental in streamlining operations and enhancing customer satisfaction. For instance, Lean Technologies, a leader in open banking solutions, provides access to 98% of the UAE retail banking industry, allowing wealth management firms to offer rapid and secure financial transactions. This capability is crucial for companies like Sarwa, which utilises Lean’s Payments API to improve funding operations, doubling the efficiency of account top-ups and achieving a 97% success rate in transaction processing. This integration not only simplifies the investment process but also ensures a superior user experience by minimising the need for manual data entry and reducing transaction times.

Case Study: Sarwa and Lean Partnership

Background of Sarwa

Sarwa, a pioneering digital wealth management platform, recognised the need for a seamless and secure method to fund investment accounts, aiming to democratise investing within the UAE. Early on, Sarwa sought a partner to facilitate this experience, leading to the partnership with Lean Technologies. Lean’s Open Banking technology, particularly its Payments API, was identified as the ideal solution to enhance the funding process.

Integration of Lean’s API

Lean’s Payments API has been instrumental in transforming Sarwa’s account funding operations. By integrating this API, Sarwa enabled its users to fund their accounts directly, bypassing the need for manual data entry and reducing transaction times. This integration allowed for instant funding of accounts, a critical advantage in the fast-paced investment environment.

Results Achieved

The partnership between Sarwa and Lean has led to significant improvements in operational efficiency and customer satisfaction. Account funding operations have doubled in efficiency, with 50% of Sarwa’s customers utilising Lean to invest their money. Moreover, Lean-powered payments boast a 97% success rate, underscoring the reliability and effectiveness of the integrated solution. This case study highlights how Open Banking can streamline and enhance financial operations, ultimately benefiting end-users with faster and more reliable financial services.

📚Open banking use cases in wealthtech

How Finexer Can Enhance UK’s Wealthtechs

✓ Unified Financial Data Access:

- Provides real-time access to financial data across multiple banks via robust APIs.

- Wealth Management Benefit: Enables wealth management platforms to offer comprehensive financial planning and personalized investment advice.

✓ Secure and Compliant Transactions:

- Ensures top-tier encryption and fraud detection.

- Compliant with PSD2 and other regulatory standards.

- Wealth Management Benefit: Enhances user trust and secures financial transactions, crucial for managing client assets securely.

✓ Seamless Integration:

- Supports quick customizations and integrations.

- Reduces cost and complexity of integrating new technologies with existing systems.

- Wealth Management Benefit: Simplifies the integration of advanced financial tools, enhancing operational efficiency and service delivery.

✓ Enhanced Customer Experience:

- Offers instant payment solutions and real-time data access.

- Provides user-friendly interfaces for smoother financial transactions.

- Wealth Management Benefit: Improves client satisfaction by making financial management more intuitive and efficient.

✓ Instant Payment Solutions:

- Secure A2A payments reduce transaction costs and provide instant settlement.

- Real-time withdrawals and multiple vendor payments streamline operations.

- Wealth Management Benefit: Facilitates quicker and more cost-effective financial transactions, enhancing liquidity and client service.

✓ Recurring Payments (Beta):

- Automates recurring transactions, optimising cash flow and reducing costs and fraud.

- Wealth Management Benefit: Supports regular investment contributions and withdrawals, enhancing portfolio management.

✓ Verification API (KYC/KYB):

- Advanced tools for customer and business verification processes.

- Enhances security and compliance.

- Wealth Management Benefit: Streamlines onboarding processes and ensures regulatory compliance, vital for managing client relationships.

✓ White-Label Solutions:

- Customisable payment interfaces ensure a consistent brand experience.

- Wealth Management Benefit: Allows wealth management firms to maintain brand integrity while providing advanced financial services.

✓ Rapid Customisation and Deployment:

- Tailored payment solutions fit specific business needs.

- Wealth Management Benefit: Enables wealth management firms to quickly adapt to changing market demands and client needs.

✓ Advanced Security and Compliance:

- Ensures highest security standards and regulatory compliance.

- Wealth Management Benefit: Protects sensitive financial data and ensures adherence to industry regulations, critical for trust and legal compliance in wealth management.

Benefits of Open Banking for Wealth Management

Open banking significantly enhances the wealth management experience by offering a range of benefits that streamline financial processes and improve client satisfaction. These advantages are evident in several key areas:

1.Enhanced User Experience

Open banking facilitates a more intuitive and efficient user interface in wealth management platforms. Clients benefit from simplified access to their financial data, which is now integrated seamlessly across banking and investment platforms. This integration allows for a more personalised user experience, where clients can view and manage their financial portfolios with greater ease and precision.

2.Faster and Secure Transactions

The utilisation of open APIs ensures that transactions are not only faster but also more secure. Open banking provides an infrastructure that supports real-time data transfer, which is crucial for timely investment decisions and management. Moreover, the enhanced security protocols inherent in open APIs help in safeguarding sensitive financial information, thereby boosting client confidence in using digital wealth management services.

3.Increased Investment Success Rate

By enabling more accurate and timely access to financial data, open banking aids investors in making informed decisions that potentially lead to higher success rates in investments. The ability to quickly adapt to market changes and access a wide range of financial products and services allows for a more dynamic and responsive investment strategy. This agility is a critical factor in enhancing the overall performance of investment portfolios.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Future of Wealth Management with Open Banking

Predicted Trends

The trajectory of wealth management is increasingly intertwined with open banking, projecting a future where financial data flows seamlessly between institutions and clients. This integration is expected to catalyse a shift towards more personalised financial advice and investment strategies, tailored to individual profiles and real-time financial situations. The use of open APIs will likely expand, enabling wealth management firms to offer a broader range of services efficiently and securely, thus enhancing client engagement and satisfaction.

Innovations and Opportunities

Open banking is set to revolutionise the wealth management sector by introducing innovations that simplify the investment process. For instance, technologies like Lean’s Payments API, which has demonstrated significant improvements in funding operations for platforms like Sarwa, highlight the potential for more streamlined, secure, and rapid financial transactions. This not only improves the user experience but also provides wealth management firms with the tools to offer customised financial products that can adapt to market changes swiftly, thereby potentially increasing investment success rates and client trust.

Conclusion

Open banking is playing a key role in reshaping wealth management by making financial services more accessible and tailored to individual needs. By enabling secure data sharing, it removes traditional barriers, allowing both consumers and financial institutions to benefit from a more competitive market. The partnership between Sarwa and Lean Technologies highlights how open banking can improve financial services, leading to better customer experiences and smoother transactions.

Looking ahead, open banking will continue to shape wealth management by improving personalisation and accessibility. The ability to securely share and analyse financial data will drive better investment decisions and financial planning. For firms in the financial sector, integrating solutions like Finexer’s Open Banking is a step toward creating a more responsive and customer-focused wealth management experience.

What is WealthTech, and how is it shaping investment management in 2025?

WealthTech, short for Wealth Technology, applies technology to investment management, financial planning, and advisory services. In 2025, financial firms are using artificial intelligence, big data, and open banking to improve how individuals and businesses manage their money. These tools help provide tailored advice, automate processes, and create better access to financial services.

How does open banking affect wealth management?

Open banking allows secure financial data sharing between banks and third-party providers through application programming interfaces (APIs). For wealth management, this means better access to client information, making it easier to provide informed investment advice, offer automated portfolio adjustments, and simplify financial planning.

What are the key benefits of open banking for investors?

->Faster Transactions – Funds move more quickly between accounts, reducing delays in deposits and withdrawals.

->Better Investment Strategies – Access to real-time financial data helps investors make informed decisions.

->Stronger Security – Strict authentication measures keep transactions safe.

->Simplified Account Management – Investors can track multiple accounts in one place.

What are some key trends in WealthTech for 2025?

->Embedded Finance – Financial services are being integrated into everyday platforms, such as e-commerce and social media.

->AI-Driven Investment Tools – Automated systems are helping investors manage portfolios with less manual effort.

->Regulatory Technology (RegTech) Adoption – Firms are using software to keep up with changing financial regulations.

->Blockchain for Secure Transactions – Some investment platforms are exploring decentralised finance (DeFi) to provide more control over assets.

How does Finexer contribute to WealthTech through open banking?

Finexer provides tools that allow financial institutions to access real-time account data, process payments securely, and connect different financial platforms. Their open banking framework helps wealth management firms offer better financial planning and account management services.

For more information on how Finexer can help your WealthTech firm thrive, We are here to help lets chat 🙂