Open banking allows for financial data to be shared between banks and third-party service providers through the use of application programming interfaces (APIs)

What You Will Learn from This Blog

✓ Introduction to open banking and its role in financial data sharing.

✓ Case study insights from Eon and United Utilities’ open banking trials.

✓ Key objectives: debt management, personalized payment plans, and enhanced payment processing.

✓ Implementation strategies of open banking by Eon and United Utilities.

✓ Outcomes: efficiency gains, customer acceptance, and future expansion plans.

Introduction

Eon and United Utilities embarked on a pioneering trial to explore the potential of open banking in addressing affordability and debt issues among financially vulnerable customers. The primary goal of these trials was to harness real-time financial data to develop tailored payment plans, enhance operational efficiency, and boost customer acceptance. This innovative approach aimed to transform the way utility bill payments are managed, offering a more personalised and effective solution.

Objectives

- Assess the Effectiveness of Open Banking in Managing Debt: The trials sought to determine how well open banking could help in managing and reducing customer debt.

- Improve Customer Engagement through Personalised Payment Plans: By leveraging detailed financial data, the trials aimed to create payment plans that were specifically tailored to individual customer needs, thereby improving engagement and satisfaction.

- Evaluate the Potential for Reducing Transaction Costs and Enhancing Payment Processing: Another key objective was to see if open banking could streamline payment processes, reduce transaction costs, and make utility bill payments more efficient.

Implementation

- Eon: Eon focused on automating the financial assessment process. By using open banking data, they were able to create tailored payment plans that were more accurate and reflective of each customer’s financial situation. This automation aimed to reduce the time and effort required for financial assessments, making the process more efficient.

- United Utilities: United Utilities took a slightly different approach by using open banking to gain a comprehensive view of their customers’ finances. This holistic perspective allowed them to make more informed decisions regarding payment schedules, ensuring that the plans were both manageable for customers and effective in reducing debt.

Outcomes

- Efficiency Gains: Both Eon and United Utilities reported significant improvements in processing times for financial assessments and the creation of payment plans. The use of real-time financial data allowed for quicker and more accurate assessments, leading to faster implementation of tailored payment plans.

- Customer Acceptance: Customers responded positively to the personalised approach. They appreciated the tailored payment plans, which made managing their utility bill payments easier and more manageable. This positive reception indicated a high level of customer satisfaction and acceptance.

- Future Plans: Building on the success of these trials, both Eon and United Utilities plan to expand the use of open banking. Future efforts will focus on further automating processes and applying these innovations to a broader range of customer segments. The goal is to provide even more comprehensive financial support and improve the overall customer experience.

The trials conducted by Eon and United Utilities have demonstrated that open banking can be a highly effective tool in addressing debt management issues within the utility sector. The benefits observed include increased efficiency in processing financial assessments, higher levels of customer satisfaction due to personalised payment plans, and potential reductions in transaction costs. Moving forward, both companies are committed to expanding the use of open banking, with a focus on automation and broader application to more customer segments. This forward-thinking approach promises to transform the management of utility bill payments, offering a more user-friendly and efficient solution for both customers and utility providers.

For more information, visit Utility Week.

Key Benefits of Open Banking

- Enhanced Financial Management: Consumers can access a consolidated view of their financial status across various banks and accounts, leading to better financial management and planning.

- Increased Competition and Innovation: Open Banking levels the playing field for smaller providers to offer competitive services, leading to greater innovation and choice in the financial services market.

- Improved Loan and Credit Options: With access to a broader range of financial data, lenders can offer more accurately tailored loan and credit options that suit individual financial situations, potentially leading to better rates and terms.

- Efficient Payments: Open Banking simplifies the payment process, allowing direct and secure transactions between accounts without the need for intermediaries, thus reducing costs and increasing processing speed.

These benefits highlight how Open Banking can streamline financial processes, enhance the user experience, and promote a more dynamic and competitive financial services environment.

What Open Banking Can See

Data Accessible to Open Banking

Open Banking has the capability to access a wide range of financial data which is pivotal for transforming financial services into more transparent and equitable experiences. This includes detailed transaction data, account verification, income verification, and balance checks. These elements are crucial for ensuring that financial services are not only accessible but also tailored to the needs of the user.

Privacy and Security Concerns

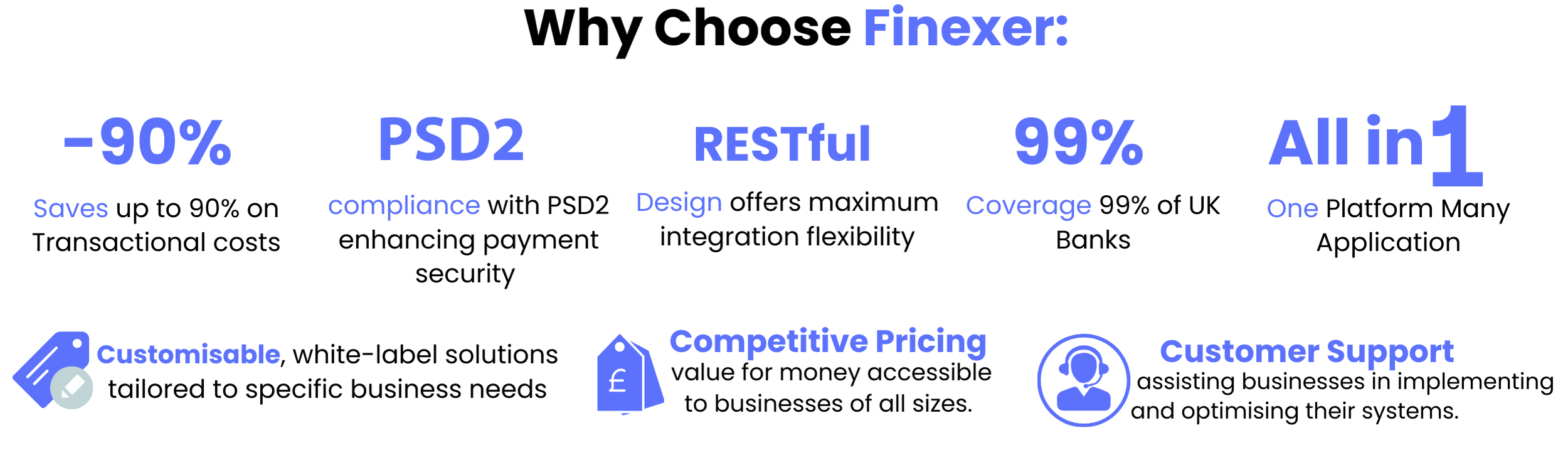

While Open Banking opens up numerous possibilities for enhanced financial management, it also brings forth concerns regarding privacy and security. It is imperative that any Open Banking platform, like Finexer, adheres to stringent security standards. These platforms must ensure that data is encrypted, access is controlled, and that they comply with regulatory standards such as PSD2 to protect user data effectively.

How Finexer enhances Utility bill payments

Finexer leverages the power of Open Banking to transform the utility bill payment process, offering a more transparent, equitable, and efficient financial service. By integrating advanced payment initiation and account aggregation features, Finexer ensures a seamless transaction experience from account-to-account payments without the need for intermediaries. This not only speeds up transactions but also reduces transaction costs significantly.

Key features of Finexer ‘s Open Banking platform include:

✓ Instant Bank-to-Bank Transfers: Enables direct transactions between bank accounts, enhancing speed and reducing costs.

✓ Seamless Checkout Experience: Provides various payment methods like QR codes and SMS, ensuring a user-friendly payment interface.

✓ Enhanced Remittance Data: Improves transparency with detailed invoice and payment data, facilitating better record-keeping.

✓ Simplified Account Mapping: Streamlines online bill payments by maintaining a database of recurring billers, reducing the need to enter account details repeatedly.

✓ Reliable Account Validation: Ensures accuracy in transactions by verifying account details prior to payment execution.

✓ Same Day Settlement: Offers faster access to funds by accelerating the settlement process.

✓ Streamlined Reconciliation Automation: Integrates with accounting systems to automate the reconciliation of invoices and payments, enhancing operational efficiency.

✓ Cloud Integration: Connects seamlessly with major accounting platforms like QuickBooks, Sage, and Xero, further simplifying the financial management process.

✓ White Labelling: Allows customization of payment interfaces to align with corporate branding, enhancing the customer experience.

By utilising these features, Finexer not only simplifies the payment process but also ensures it is secure and compliant with the latest financial regulations, providing peace of mind to both businesses and their customers.

Conclusion

The trials conducted by Eon and United Utilities have showcased the transformative potential of open banking within the utility sector. By leveraging real-time financial data, these trials successfully demonstrated improved efficiency in processing financial assessments, heightened customer satisfaction through personalized payment plans, and potential cost reductions in transaction processing. Both companies are committed to expanding their use of open banking, focusing on automation and broader customer application. This forward-thinking approach promises a significant shift in utility bill management, offering a more user-friendly and efficient solution for customers and utility providers alike. Finexer plays a crucial role in this transformation, providing the tools and technology needed to harness the full benefits of open banking.

FAQs

1. What is open banking? Open banking allows for financial data to be shared between banks and third-party service providers through the use of application programming interfaces (APIs), enabling more innovative and personalized financial services.

2. How did Eon and United Utilities use open banking in their trials? Eon and United Utilities used open banking to access real-time financial data to develop tailored payment plans, enhance operational efficiency, and improve customer engagement by offering personalized solutions for managing utility bill payments.

3. What were the main objectives of these open banking trials? The main objectives were to assess the effectiveness of open banking in managing customer debt, improve customer engagement through personalized payment plans, and evaluate the potential for reducing transaction costs and enhancing payment processing efficiency.

4. What were the outcomes of the trials? The trials led to significant improvements in processing times for financial assessments, increased customer acceptance of personalized payment plans, and demonstrated the potential for reduced transaction costs. Both companies plan to expand the use of open banking to further automate processes and serve a broader range of customers.

5. How does Finexer enhance utility bill payments with open banking? Finexer leverages open banking to provide features such as instant bank-to-bank transfers, a seamless checkout experience, enhanced remittance data, simplified account mapping, reliable account validation, same-day settlement, streamlined reconciliation automation, cloud integration with major accounting platforms, and white-labeling for customized payment interfaces.

Unlock the full potential of open banking for seamless utility bill management with Finexer today!