Table of Contents

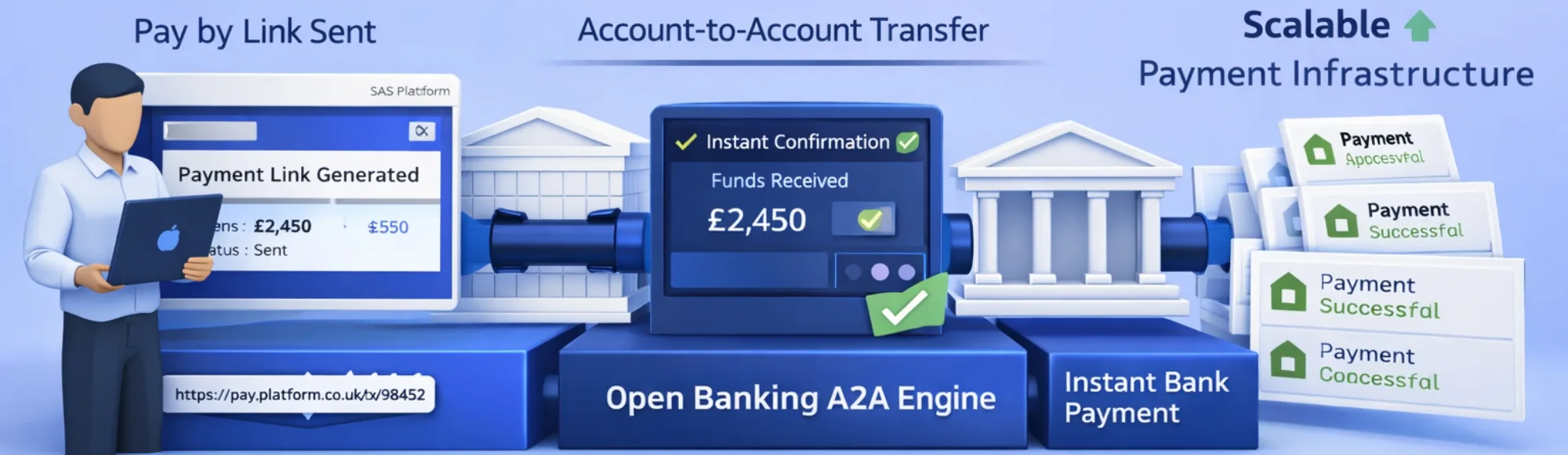

Pay by Link Service Built on Open Banking, Not Card Rails

Pay by link service providers charging 2-3% per transaction are built on card networks. That means settlement delays, chargeback disputes, and reconciliation complexity for every payment.

Account-to-account payments eliminate these problems. Through FCA-authorised Open Banking infrastructure, UK platforms collect payments directly from customer bank accounts with instant confirmation.

After working with SaaS and fintech platforms evaluating pay by link service provider options, we’ve seen the pattern. Teams choose card-based solutions for quick integration. Then operational costs compound. Chargeback volumes increase support load. Settlement delays slow cash flow. Reconciliation requires manual intervention.

The Real Cost of Card-Based Pay by Link Services

Most pay by link UK solutions are built on card networks. That creates inherent operational friction:

- 2-3% processing fees on every transaction eating profit margins

- T+1 or T+2 settlement delays affecting cash flow forecasting

- Chargeback disputes requiring manual investigation and evidence submission

- Card authentication failures causing payment drop-off and abandoned transactions

- PCI compliance requirements adding technical and operational complexity

- Reconciliation complexity across multiple payment methods and CSV exports

For UK platforms processing high volumes or low-margin transactions, these costs compound quickly. Card rails were built for consumer protection scenarios, not platform efficiency.

When collecting from trusted business relationships or verified customers, card infrastructure creates unnecessary friction.

What Modern Pay by Link Service Infrastructure Requires

Pay by link service evaluation goes beyond “can it process payments?” Decision-stage buyers need to understand infrastructure capabilities:

- Account-to-Account (A2A) Payments

Direct bank transfers without card intermediaries. Eliminates processing fees and settlement delays entirely.

- Instant Payment Confirmation

Real-time notification when funds are received. Enables immediate service provisioning without waiting for settlement.

- 99% UK Bank Coverage

Access to virtually all UK financial institutions through single integration. Reduces user drop-off from limited bank support.

- Real-Time Webhooks

Event notifications for payment status changes, refunds, and failures. No polling required for status checks.

- Consent-Based Authentication

Strong Customer Authentication (SCA) compliant flows using Open Banking standards. Meets UK regulatory requirements.

- Refund and Payout Capabilities

Bidirectional payment flows for returns, disbursements, and marketplace settlements. Not just collection-only infrastructure.

- Usage-Based Pricing

Transaction-based fees without fixed monthly commitments, volume minimums, or long-term contracts. Scales with platform growth.

The critical question isn’t whether a pay by link service provider can accept payments. It’s whether they can do it instantly, reliably, and cost-effectively at scale without card network dependencies.

Understanding how payment links work with Open Banking helps technical teams see the infrastructure architecture enabling instant account-to-account transfers.

What We See in Practice

After working with platforms implementing pay by link service infrastructure, patterns emerge consistently:

Platforms choose card-only providers with attractive initial pricing. Integration completes successfully. Payment volumes start growing. Then operational problems become visible.

Reconciliation gaps between payment processor data and internal accounting systems. Finance teams manually match transactions across multiple CSV exports.

Chargeback rates increase as transaction volumes scale. Support teams spend hours investigating disputed payments and gathering evidence.

Cash flow forecasting becomes unreliable due to T+1/T+2 settlement delays. Treasury teams can’t predict available funds accurately.

Engineering teams build custom polling logic because webhook coverage doesn’t include all payment states. API request volumes increase unnecessarily.

Product teams can’t launch instant provisioning features because payment confirmation takes 24 hours minimum.

Card infrastructure wasn’t designed for platform-to-platform or B2B payment flows where both parties are verified entities. The operational overhead becomes visible at scale.

This is where infrastructure choice matters more than initial pricing.

Common Mistakes When Evaluating Pay by Link Service Providers

| Mistake | Why It Fails | What to Look For |

|---|---|---|

| Choosing card-only providers | High fees, chargebacks, settlement delays | Open Banking A2A payment support |

| Ignoring webhook support | Polling introduces delays, missed events | Comprehensive real-time webhook coverage |

| Limited bank coverage | User drop-off, poor conversion rates | 99% UK bank coverage minimum |

| Fixed pricing contracts | Growth friction, unpredictable costs | Usage-based pricing with no minimums |

| No refund infrastructure | Manual processes, poor user experience | Automated refund and payout APIs |

| Integration timeline focus only | Ignores long-term operational costs | Total cost of ownership evaluation |

Platforms often optimize for integration speed without evaluating long-term operational costs. A pay by link service that integrates in one day but costs 2.5% per transaction becomes expensive quickly compared to one taking three weeks to integrate with lower transaction costs.

Where Finexer Fits

Finexer provides Pay by Bank infrastructure for UK platforms. We don’t operate as a consumer payment app or payment gateway. We provide the Open Banking connectivity layer enabling platforms to build reliable pay by link service workflows.

This distinction matters for technical teams evaluating infrastructure:

FCA-Authorised Open Banking Provider

Regulated connectivity to UK banks ensuring compliance with financial regulations. Not a card processor offering Open Banking as a secondary option.

99% UK Bank Coverage

Access transactions and initiate payments across virtually all UK financial institutions through single integration. No user drop-off from limited bank support.

Usage-Based Pricing

Transaction-based fees without fixed monthly commitments, minimum volumes, or long-term contracts. Scales naturally with platform growth.

3-5 Week Onboarding Support

Technical integration assistance from the engineering team during implementation. Not self-service documentation only.

Real-Time Webhooks

Event notifications for payment status, refunds, consent changes without polling. Reduces API request volumes and latency.

No Transaction Caps

Infrastructure scales with your platform without artificial volume limits or tier changes affecting pricing.

UK-Focused Infrastructure

Purpose-built for the UK banking ecosystem. Not generic European coverage adapted for the UK market.

Finexer’s payment infrastructure enables instant collections across multiple sectors. Platforms use the same Open Banking connectivity for utility billing workflows requiring recurring payments and payroll and invoicing systems needing bank verification.

Finexer does not perform payment processing decisions or hold funds. We provide verified bank connectivity that pay by link service provider platforms integrate to build payment workflows matching their business logic.

How We’d Evaluate a Pay by Link Service Today

When comparing pay by link uk infrastructure options, platforms should ask these specific questions:

Does it support A2A payments or just card rails?

Card rails introduce fees and delays. Open Banking enables instant bank transfers with lower costs.

Does it provide instant payment confirmation?

Settlement delays affect service provisioning timing and cash flow forecasting accuracy.

Is pricing usage-based or contract-based?

Fixed contracts create friction during growth phases. Usage-based pricing scales naturally.

Does it handle consent lifecycle management?

Open Banking requires ongoing consent tracking, renewal, and expiry handling. Not one-time authentication.

Does it support refunds and payouts?

Bidirectional payment flows are essential for marketplace, subscription, and SaaS platforms. Not just collection-only.

What’s the realistic integration timeline?

Quick integration often means limited functionality. 3-5 weeks with proper testing provides production-ready implementation.

What webhook events are available?

Polling introduces latency and complexity. Real-time webhooks enable instant workflow automation.

What percentage of UK banks are covered?

Limited coverage creates user drop-off and support tickets. 99% coverage ensures most users can connect successfully.

What ongoing technical support is provided?

Self-service documentation differs from dedicated engineering support during integration and production operation.

Most pay by link service providers optimize for quick integration demos. Few optimize for long-term operational efficiency at scale.

What I Feel About Payment Infrastructure

Payment infrastructure appears commoditized on the surface. Every provider claims instant setup and low fees. The operational differences become visible at scale.

Infrastructure matters more than initial pricing. A pay by link service provider with instant settlement provides better unit economics than a provider with 48-hour settlement and manual reconciliation requirements.

The UK market is moving towards account-to-account payments. Card networks won’t disappear, but their dominance in platform-to-platform payments will decrease. Platforms building on Open Banking infrastructure now will have competitive advantage when card network fees increase and regulatory pressure around instant payments intensifies.

Engineering teams understand this intuitively. Finance teams see it in monthly processing costs. Product teams experience it in feature limitations caused by settlement delays.

Who This Infrastructure Serves

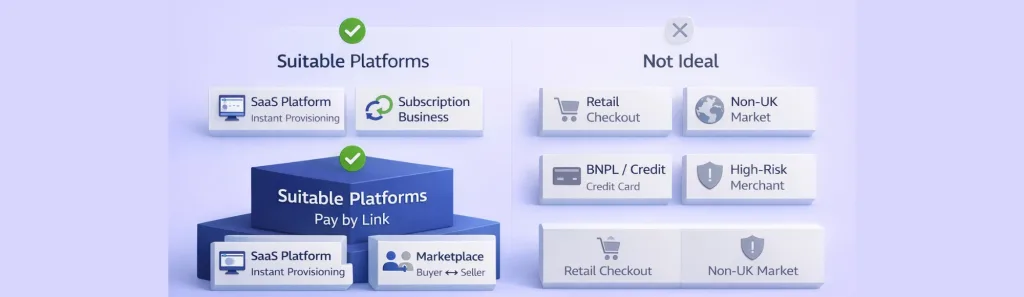

Pay by link service infrastructure built on Open Banking works for specific platform types:

Suitable For:

- SaaS platforms requiring instant payment confirmation for service provisioning

- Subscription businesses eliminating card decline rates affecting recurring revenue

- Marketplace operators handling bidirectional payment flows between buyers and sellers

- Utility and billing platforms collecting recurring payments from verified customers

- Invoicing and payroll systems requiring bank verification for compliance

- B2B payment platforms serving business customers with established relationships

Not Suitable For:

- Consumer-facing retail with no existing customer relationship or account

- Platforms serving markets outside UK without UK bank account holders

- Applications requiring credit, buy-now-pay-later, or deferred payment options

- High-risk merchant categories where chargebacks provide necessary protection

The infrastructure choice depends on your platform’s payment characteristics and customer relationships.

Implementation Considerations

When evaluating pay by link service infrastructure, UK platforms should ask:

- Does the provider hold FCA authorisation specifically for Open Banking?

- What percentage of UK banks can customers connect through the infrastructure?

- How are payment confirmations delivered (polling vs real-time webhooks)?

- What refund and payout capabilities are supported beyond collection?

- What ongoing technical support is provided during integration and production?

- Is pricing usage-based or does it require fixed contract commitments?

- What transaction volume or value limits apply to the infrastructure?

- How does pricing change as platform payment volumes scale?

Finexer covers 99% of UK banks, provides usage-based pricing with no volume minimums, and typically deploys 2-3 times faster than alternative infrastructure options. Integration support runs 3-5 weeks depending on your existing payment systems and technical requirements.

The technology works. The question is whether your platform is ready to shift from card rails to bank-to-bank infrastructure.

What is a pay by link service?

A pay by link service enables businesses to send payment requests via URL that customers click to complete payment. Modern solutions use Open Banking for instant account-to-account transfers instead of card networks.

How do pay by link services work with Open Banking?

Pay by link uk services using Open Banking connect directly to customer bank accounts for instant account-to-account payments. Customers authenticate through their bank, authorise payment, and funds transfer instantly without card intermediaries.

What’s the difference between card and bank-based pay by link?

Card-based pay by link service solutions charge 2-3% fees with 1-2 day settlement and chargeback risk. Bank-based solutions using Open Banking enable instant transfers with lower transaction costs and no chargeback disputes.

Do pay by link service providers need FCA authorisation?

Pay by link service provider companies using Open Banking for account-to-account payments require FCA authorisation as Payment Initiation Service Providers (PISP). Card-only providers need different authorisation.

How long does pay by link service integration take?

Pay by link service integration using Open Banking infrastructure typically takes 3-5 weeks including technical implementation, webhook testing, and compliance review depending on existing payment systems.

Ready to Eliminate Card Processing Fees?

See how Finexer enables UK platforms to collect instant bank payments without card network fees, settlement delays, or chargeback disputes.

Book Demo Now