For decades, card payments have been the go-to payment method for retailers — simple, familiar, and widely accepted. But over the past few years, new methods have emerged that give retailers more control over how they get paid.

One of the most impactful changes has come from Open Banking, which enables secure, direct account-to-account (A2A) payments. Instead of routing transactions through card networks or waiting days for settlement, retailers can now accept payments straight from a customer’s bank account, often with lower fees and faster confirmation.

A recent survey by NatWest’s Payit™ revealed that UK businesses integrating Open Banking into their payment systems reported:

- An average annual saving of 150 hours on operational tasks such as processing invoices, handling refunds, and managing financial data.

- A reduction of £1,117 in annual card processing fees compared to businesses not using Open Banking solutions.

These findings highlight the tangible benefits of adopting bank-based payment methods, offering both time efficiency and cost savings for retailers.

This doesn’t mean card payments are obsolete — far from it. However, many UK retailers are starting to add bank-based payment options alongside cards to improve margins, reduce refund friction, and keep checkout flows moving faster.

The Main Payment Methods for Retailers in 2025

If you run a shop, manage an online store, or serve customers through both, choosing the right payment methods for retailers isn’t just about convenience — it directly affects your cash flow, operating costs, and customer satisfaction.

In 2025, there’s a wider variety of payment methods for retailers than ever before. Here’s how they stack up — and why more businesses are starting to consider bank-based alternatives.

1.Card Payments (Debit and Credit Cards)

Card payments are still one of the most used payment methods for retailers in both physical stores and online checkouts. Customers are familiar with tapping or entering card details, and most systems support cards out of the box.

But for retailers, these come with trade-offs:

- Card processing fees that eat into margins

- Payout delays of 2–3 days

- Risk of chargebacks and fraud

Cards aren’t going away — but for some businesses, they’re becoming more of a base option rather than the only one.

2.Digital Wallets (Apple Pay, Google Pay, PayPal)

Wallets are growing in popularity and are now a common part of the payment methods retailers offer, especially in mobile-first experiences. These typically connect to cards or bank accounts and are widely used in e-commerce.

However:

- Wallets still come with card-based processing fees

- Not all customers use them

- They don’t always solve core business issues like delays or fees

3.Buy Now, Pay Later (BNPL)

BNPL services have become a visible part of online payment methods for retailers, especially those in fashion or lifestyle sectors. They let customers split payments into smaller instalments and pay over time.

Retailers using BNPL should be aware:

- Merchant fees can be higher than other options

- Funds may not reach you immediately

- It’s not a fit for all industries (e.g., day-to-day retail or services)

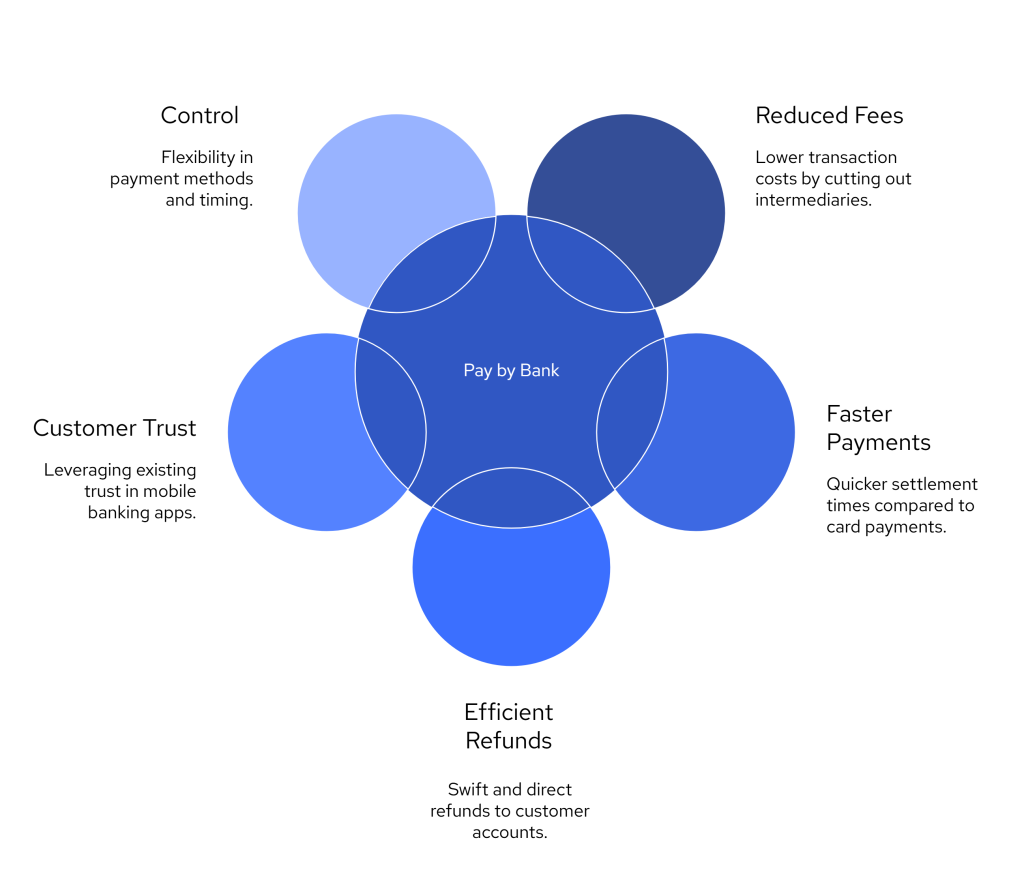

4.PaybyBank

One of the most practical and cost-aware payment methods for retailers now is direct bank transfers powered by Open Banking. These allow customers to approve payments from their bank accounts without needing cards at all.

This method offers:

- Lower fees compared to traditional card payments

- Quicker access to funds

- Better security with fewer chargebacks

- Works across online, in-store, and invoice payments

Adding this method gives retailers more flexibility, especially when aiming to reduce processing costs or speed up settlement, without removing other options like cards or wallets.

Why Retailers Are Adding PaybyBank into their Checkout Process

Retailers aren’t abandoning card payments, but they are starting to question whether relying on them alone still makes sense.

Adding bank-based payment methods for retailers has become more common across the UK, especially as businesses look for ways to save on transaction fees, reduce delays, and offer a smoother refund experience.

Here are a few reasons why retailers are choosing to add bank-to-bank transfers (via Open Banking) alongside their existing options.

1. Card Processing Fees Are Getting Harder to Ignore

Every time a customer pays with a card, a portion of that sale goes to card networks, acquirers, and processors. While this might not seem like much on a single transaction, it adds up fast, especially for businesses with lower margins or high transaction volumes.

With Open Banking, there are no card networks involved. The customer pays directly from their bank account, and that means fewer intermediaries taking a cut.

2. Faster Settlement Can Help with Cash Flow

Most card payments take 2 to 3 business days to reach your account. That might be manageable for some, but for smaller retailers or businesses that rely on daily sales to restock inventory, those delays matter.

Bank-based payments can settle much faster. In some cases, funds are confirmed and available on the same day, giving you more control over your money.

3. Fewer Refund Delays and Disputes

Card refunds can be slow and sometimes confusing for customers. Issuing a refund doesn’t always guarantee it reaches the same account quickly, and that can result in chargebacks or complaints.

Bank-to-bank payments work differently. Since each payment is tied to a verified customer account, refunds go back to the exact same source, often within hours. This reduces the back-and-forth and helps build trust with your buyers.

4. Customers Are Comfortable Using Their Banking Apps

Many UK customers now use their mobile banking apps regularly. Approving a payment through an app is secure, familiar, and takes just a few taps. In fact, some shoppers now prefer this over entering card details, especially for larger purchases or invoice payments.

5. More Control, Less Complexity

Adding a bank-based payment option doesn’t mean you have to remove cards or wallets. Instead, it gives your business more control over how you get paid. You decide when to offer it — whether it’s at checkout, for refunds, or on invoices — and only pay when it’s used.

Platforms like Finexer make this possible without technical hassle, allowing you to start small and scale at your own pace.

How Finexer Simplifies Payment Collection for Retailers

For retailers seeking to diversify their payment methods, Finexer offers a comprehensive solution that integrates seamlessly into various sales channels. Its features are designed to address common retail challenges, making it a practical choice for businesses of all sizes.

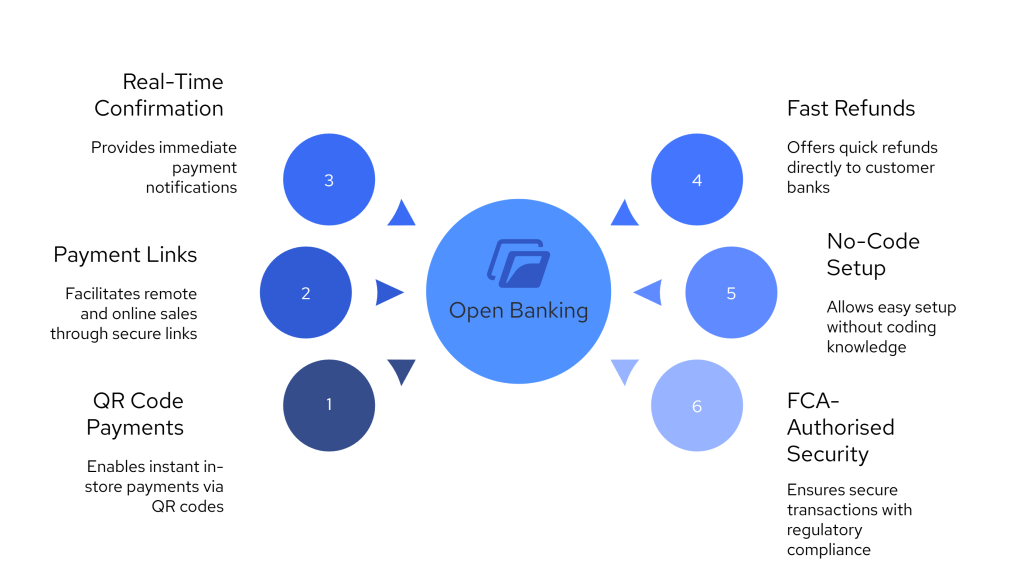

QR Code Payments for In-Store Transactions

Finexer enables retailers to accept payments through QR codes, allowing customers to complete transactions by simply scanning a code with their smartphone camera. This method eliminates the need for physical cards or cash, providing a contactless and efficient payment experience. It’s particularly beneficial for in-store purchases, pop-up shops, or any setting where quick transactions are essential.

Instant Payment Links for Online Sales

Beyond physical stores, Finexer supports online transactions by allowing retailers to generate secure payment links. These links can be shared via email, SMS, or social media, directing customers to a payment page where they can complete purchases directly from their bank accounts. This feature is ideal for online orders, remote services, or any scenario where traditional point-of-sale systems aren’t feasible.

Real-Time Transaction Confirmation

With Finexer, retailers receive immediate confirmation of payments, enabling them to process orders without delay. This real-time feedback is crucial for managing inventory, scheduling deliveries, and maintaining customer satisfaction.

Simplified Refund Process

In cases where refunds are necessary, Finexer streamlines the process by allowing funds to be returned directly to the customer’s bank account. This approach reduces the complexity often associated with card-based refunds and enhances the overall customer experience.

Secure and Compliant Transactions

Security is a top priority for Finexer. The platform employs strong customer authentication measures, including biometric verification, to ensure that each transaction is authorised by the account holder. Additionally, as an FCA-authorised provider, Finexer adheres to strict regulatory standards, giving retailers and their customers peace of mind.

Flexible Integration Options

Finexer caters to retailers with varying technical capabilities. Whether you have a dedicated IT team or prefer a plug-and-play solution, Finexer offers integration options that suit your business needs. From API access for custom setups to user-friendly dashboards for quick deployment, the platform is designed for ease of use.

By incorporating Finexer into your payment infrastructure, you can offer customers a reliable and convenient alternative to traditional payment methods, potentially reducing transaction fees and improving cash flow.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Can I still use card payments alongside bank-based payments?

Yes. You can offer both. Bank-based payments simply give your customers another secure option, especially useful for larger transactions or refunds.

Are Open Banking payments secure for retail use?

Yes. Open Banking uses secure bank authentication. Payments are authorised by the customer through their bank, reducing fraud risks.

Will customers understand or trust bank-to-bank payments?

Yes. Most UK shoppers are already familiar with mobile banking. Finexer uses their bank app, making it feel safe and straightforward.

Do I need technical help to set up Finexer?

No. Finexer provides ready-to-use dashboards and payment links. No coding is required, though API access is available for developers.

Is Open Banking one of the best payment methods for retailers?

Yes. Open Banking is now a cost-effective payment method for retailers looking to reduce fees, improve payout times, and simplify refunds.

Now Collect Payments with zero efforts, Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂