Your finance team spent three hours yesterday reconciling last week’s payroll. Someone exported payment files from your payroll system, downloaded bank statements, opened Excel, and manually matched 200 transactions. Two payments didn’t match. One employee complained their salary arrived late. Another said they never received payment-but your system shows it was processed.

Payroll reconciliation automation solves this by connecting your existing payroll system to real-time bank data through Open Banking APIs. your payroll system directly to real-time bank data through open banking. Payments process, bank confirmations arrive automatically, your system matches transactions in real-time. Finance sees mismatches immediately instead of discovering them during monthly reconciliation. No Excel spreadsheets. No manual downloads. No delayed problem discovery.

This architectural difference matters because manual reconciliation doesn’t scale-adding employees means adding reconciliation hours proportionally instead of maintaining fixed operational costs.

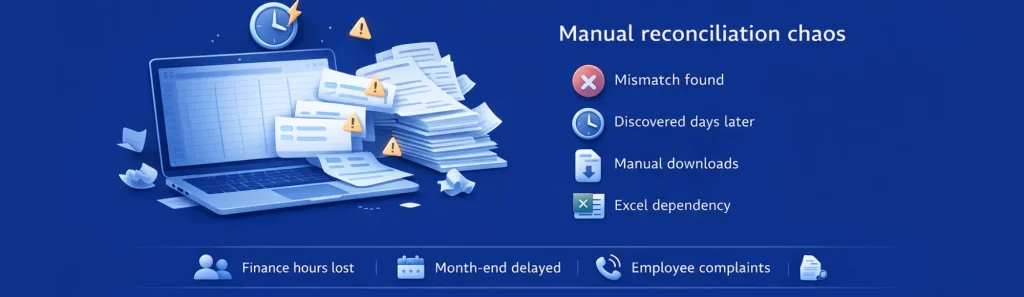

Why Your Business Still Loses Money & Time Reconciling Payroll Manually

Most businesses treat payroll reconciliation as necessary administrative burden. Payroll system generates payments, bank processes them eventually, someone manually confirms everything matched correctly days or weeks later. The problems surface during reconciliation, not payment.

What this creates operationally:

- Finance teams manually download bank statements and payroll reports for matching

- Excel becomes the reconciliation tool because systems don’t talk to each other

- Mismatches discovered days after payroll runs, requiring investigation and corrections

- Failed payments found during reconciliation instead of immediately after processing

- Employee complaints arrive before finance discovers payment issues

- Month-end close extends whilst waiting for all payroll accounts to reconcile

- Compliance audit preparation requires reconstructing payment histories manually

The fundamental issue isn’t payment processing-it’s the disconnect between payroll systems and actual bank settlement data. Without reconciliation automation, payroll account reconciliation happens retrospectively because systems lack real-time visibility into bank transactions.

What We See Happen in Manual Payroll Reconciliation

From working with finance teams, several patterns consistently create friction:

Bank feeds arrive too late. Traditional data comes through statement downloads. By the time finance receives confirmation, payroll processed hours earlier. Reconciliation always looks backward.

Two-day delays create employee anxiety. Payroll processes Friday but banks settle Monday. Employees check accounts Saturday wondering when wages arrive. Finance can’t provide confirmation.

Mismatch errors cost hours investigating. Each mismatch consumes 30-60 minutes checking multiple systems, contacting banks, reviewing records. What automated systems flag immediately requires manual investigation.

Explore payroll automation capabilities

Workflow: How Real-Time Payroll Reconciliation Actually Works

Traditional reconciliation happens after all payments complete. Automated reconciliation happens continuously as payments process. The architectural difference changes when problems surface:

1. Payroll system generates payment file – Your existing payroll software creates salary payments as normal, whether weekly, bi-weekly, or monthly schedules.

2. Open banking API pulls real-time bank data – Rather than waiting for bank statements, the system retrieves transaction confirmations directly through open banking connections as settlements occur.

3. Auto-matching engine compares payroll to bank confirmations – Software loops through payroll records matching them against actual bank transaction data using intelligent matching rules handling reference format variations.

4. Finance dashboard flags mismatches immediately – When payments don’t match or fail processing, the dashboard alerts finance teams in real-time rather than days later during manual reconciliation.

5. Exception handling allows quick resolution – Finance focuses only on genuine exceptions requiring human judgment-disputed amounts, cancelled employees, complex payment arrangements-rather than manually checking every routine transaction.

See open banking payroll implementation

This workflow treats reconciliation as continuous validation rather than periodic batch checking. Problems surface when they occur, not when someone finally reviews statements days later.

Key Benefits of Automating Payroll Payment Reconciliation

When you automate payroll payments and their reconciliation together, several operational improvements emerge:

- Immediate failure detection – Failed payments flag instantly rather than discovered during month-end reviews

- Reduced investigation time – Automated matching eliminates hours spent manually correlating payroll records with bank statements

- Continuous compliance – Audit trails generate automatically as transactions process rather than reconstructed retrospectively

- Scalable operations – Adding employees doesn’t proportionally increase reconciliation workload

- Employee satisfaction – Faster payment confirmation reduces salary-related support tickets

Why Traditional Payroll Tools Fail at Reconciliation

Most businesses reconcile payroll using tools never designed for the task. Here’s how traditional methods compare to modern reconciliation automation:

Manual vs Automated Reconciliation Approaches

| Reconciliation Aspect | Traditional Manual Process | Reconciliation Automation |

|---|---|---|

| Data Source | Downloaded bank statements (delayed) | Real-time open banking feeds |

| Matching Process | Manual Excel comparison | Automated intelligent matching |

| Error Detection | During periodic reviews (days/weeks later) | Immediate at transaction time |

| Investigation Time | 30–60 minutes per mismatch | Automatic flagging with details |

| Scaling | Linear (more staff for more payments) | Fixed infrastructure cost |

Compare this to modern reconciliation automation:

Open banking real-time feeds connect directly to bank transaction data as it occurs. No downloads, no delays, no waiting for batch processing.

Automated payroll payment confirmations return immediately after settlement. Finance sees “paid” when banks confirm, not when systems hope processing succeeded. This immediate confirmation helps automate payroll payments reconciliation end-to-end.

Auto reconciliation engines match transactions continuously using intelligent rules. Human involvement focuses on exceptions, not routine checking.

The difference impacts operational scaling fundamentally. Manual methods require adding staff as payment volumes grow. Payroll reconciliation workflows powered by real-time bank data handle increased volume without proportional cost increases.

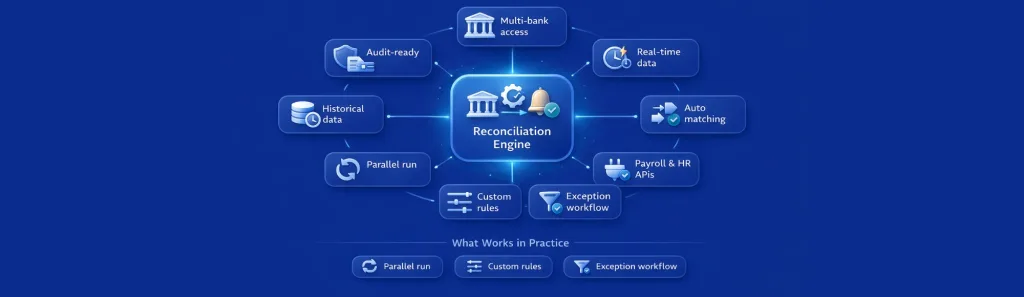

What to Look for in Payroll Reconciliation Automation Infrastructure

Not all reconciliation tools provide the same capabilities. Finance teams evaluating software should consider:

Real-time bank data access through open banking connections rather than delayed statement downloads. Reconciliation speed depends on data freshness.

Automatic matching rules handling reference format variations, timing differences, and partial payment scenarios without requiring manual configuration for each edge case.

Exception handling dashboard showing only transactions requiring human review rather than listing all payments. Focus should stay on problems, not routine confirmations.

APIs that allow payroll, accounting, and HR systems to integrate with real-time bank data for reconciliation.

Audit logs and compliance reporting capturing complete transaction history with timestamps, user actions, and system matches. Compliance requirements demand detailed records.

Compare income verification APIs

Fast onboarding with dedicated support ensuring system integration aligns with your specific payroll workflows rather than forcing generic implementation patterns.

Critical Features for Effective Payroll Account Reconciliation

When evaluating solutions to automate payroll payments and reconciliation, prioritise these capabilities:

- Multi-bank connectivity – Access transaction data from all banks employees use, not just major institutions

- Configurable matching logic – Adapt rules to your specific payment reference formats and timing patterns

- Historical data import – Load past transactions for complete reconciliation baseline before going live

- Role-based access controls – Separate viewing permissions from approval actions for proper segregation of duties

- Export and reporting – Generate reconciliation reports in formats your accounting systems accept

- Webhook notifications – Receive real-time alerts when mismatches occur rather than polling dashboards

What I’ve Seen Work in Practice

Three patterns consistently produce better outcomes:

Start with parallel processing. Run automated reconciliation alongside existing manual processes initially. Confidence builds through parallel operation proving reliability before full transition.

Customize matching rules to your patterns. Complex payroll arrangements-bonuses, deductions, multiple schedules-require tuned matching logic. Effective implementations adapt rules to actual payment patterns rather than accepting defaults.

Design exception workflows before going live. Clear processes for handling flagged mismatches prevent exceptions becoming new bottlenecks.

How Finexer Enables Automated Payroll Reconciliation

Finexer connects to 99% of UK banks through regulated open banking infrastructure. This coverage means payroll reconciliation software accesses actual bank transaction data for virtually all employee accounts without requiring specific bank relationships.

The platform provides 3-5 weeks of dedicated onboarding support. This helps reconciliation integrations align with your specific payroll systems, matching rules, and compliance requirements, matching rule requirements, and compliance reporting needs rather than forcing generic workflows.

Finance teams using reconciliation automation report significant operational improvements. Manual reconciliation time drops from hours to minutes. Mismatch discovery shifts from days to immediate. Your finance team capacity redirects from routine checking to complex payment arrangements requiring judgment.

Pricing works on actual transaction volume rather than per-employee or fixed monthly fees. This aligns costs with your payroll patterns-whether consistent monthly salaries or variable contractor payments-without penalising businesses with larger workforces.

The system integrates through standard APIs with comprehensive webhook support for real-time transaction notifications. Your engineering team gets sandbox access, detailed API documentation, and dashboard interfaces for operational monitoring.

What is payroll reconciliation automation?

Infrastructure that connects payroll systems to real-time bank transaction data through Open Banking, enabling automatic matching of payroll records against actual bank settlements.

How does reconciliation automation reduce manual reconciliation time?

Continuous automatic matching handles routine transactions, flagging only genuine exceptions requiring human review rather than requiring manual checking of every payment against bank statements.

Can automated payroll payments eliminate all manual reconciliation work?

routine matching automatically, allowing finance teams to focus on genuine exceptions-disputed payments, cancelled employees, complex arrangements-rather than verifying every standard salary payment matched correctly.

What happens when payroll account reconciliation detects mismatches?

Immediate dashboard notification with specific details about which payment failed to match, why matching failed, and relevant transaction data for investigation rather than discovering problems during month-end reviews.

How does payroll reconciliation software integrate with existing systems?

Through RESTful APIs providing real-time bank data access, automatic matching results, and exception notifications that existing payroll and accounting systems consume without requiring complete system replacements.

Ready to Automate Payroll Reconciliation?

See how Finexer enables payroll reconciliation automation using real-time bank data with real-time bank data

Book Demo Now