Running payroll shouldn’t feel like a deadline-driven jigsaw puzzle. Yet, for many UK businesses, the process involves too many disconnected tools: time trackers that don’t speak to payroll, HR records that are always slightly outdated, and payment systems that require manual uploads.

The result? Errors, delays, and frustrated employees.

If you’re still reconciling data manually across multiple platforms, the issue isn’t just inefficiency; it’s risk. From regulatory exposure to underpayments, fragmented payroll operations can cause long-term damage to employee trust and compliance efforts.

This guide highlights 5 payroll software integrations that help eliminate those risks. These aren’t just “nice-to-have” tools, they’re essential building blocks for a reliable, future-ready payroll system. Whether you manage payroll in-house or through an outsourced provider, these integrations will help you automate workflows, ensure data accuracy, and maintain control over every payout.

Keep reading or Jump to the section you’re looking for:

1. Time & Attendance Integration: Preventing Input Errors at the Source

Why it matters:

Payroll errors often begin with incomplete or inconsistent time records. When work hours are logged in one system and processed in another, mismatches are inevitable, especially during overtime, holidays, or last-minute shift swaps.

What this payroll software integration does:

By integrating your time-tracking system directly with your payroll software, you create a seamless flow of verified work hours into your payroll engine. This payroll software integration eliminates the need for manual data transfers, spreadsheets, or import-export routines. As a result, payment disputes are reduced and accuracy improves.

Popular Integration Tools:

- Deputy – Shift scheduling with payroll-ready exports

- RotaCloud – UK-based rota and attendance platform

- TSheets by QuickBooks – Ideal for small and mid-sized teams

Impact on Payroll Operations:

- Immediate access to approved attendance and absences

- Accurate overtime calculations aligned with policies

- Less stress at payroll cut-off and fewer corrections post-run

Who needs it most:

Businesses with hourly staff, shift-based scheduling, or multiple worksites, especially in sectors like retail, hospitality, and logistics.

📚 Batch Payment Processing for Accounting Software Users

2. HR & Payroll Sync: Aligning Staff Data with Pay Runs

Why it matters:

Disconnected systems between HR and payroll often result in outdated or inconsistent employee records. This leads to issues like missed salary adjustments, incorrect tax codes, and delayed leaver processing, all of which directly impact employee payment accuracy and payroll compliance.

What this payroll software integration does:

By connecting your HR platform with your payroll system, all key data points, including salary bands, start and end dates, National Insurance information, leave status, and job role changes, flow automatically between systems. This payroll software integration ensures you’re always working with current employee data, reducing manual errors and improving audit readiness.

Popular Integration Tools:

- BambooHR – Offers native payroll sync and role-based permissions

- Personio – HRMS platform tailored to UK compliance needs

- HiBob – Ideal for scale-ups managing multi-country payroll

Impact on Payroll Operations:

- Automatic updates for joiners, leavers, and internal transfers

- Accurate salary and tax data without manual re-entry

- Full audit trail for internal controls or HMRC reporting

Who needs it most:

Mid-sized businesses and fast-scaling teams that manage a diverse workforce or have frequent role changes across departments.

3. Accounting Software Sync: Keeping Your Ledgers Clean

Why this integration matters

Once payroll is processed, accounting still needs to record every salary, tax deduction, pension contribution, and NI payment. When payroll and accounting tools are disconnected, finance teams end up manually entering journals, correcting codes, and reconciling mismatches — often under time pressure.

What this payroll software integration does

This integration connects your payroll system directly to your accounting platform, so all payroll-related transactions are automatically recorded. Salary journals are broken down by category and department, reducing the risk of errors and making reporting much faster.

Popular Integration Tools

- Xero Payroll + Accounting – Native integration for small to mid-sized UK businesses

- QuickBooks Payroll (UK) – Offers smart mapping between payroll and chart of accounts

- Sage Payroll with Sage Business Cloud Accounting – Trusted for compliance-heavy firms

Impact on Payroll Operations

- Automatically post payroll journals to your ledger

- Improve reconciliation accuracy at month-end

- Enable clean audit trails and faster financial reporting

Who needs it most

Businesses that prepare internal financial reports, operate across cost centres, or must meet strict reporting standards. Also ideal for any team still manually transferring payroll data to accounting software.

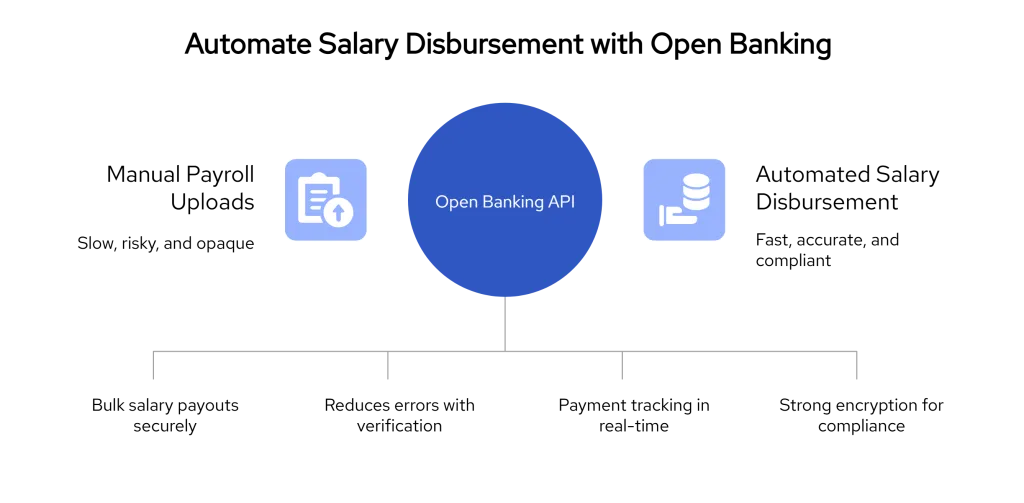

4. Real-Time Salary Disbursement via Open Banking

Why this integration matters

Most payroll systems still require teams to generate BACS or CSV files and manually upload them to a banking portal. This process is slow, increases the risk of duplicate or failed payments, and leaves little visibility after funds are sent. For teams managing large pay runs or handling last-minute changes, this creates avoidable delays and stress.

What this payroll software integration does

Finexer offers a fully embedded Open Banking API designed to automate salary disbursement directly from your payroll or ERP system.

There’s no need to log into your bank or export files — salary payments can be triggered, verified, and tracked in real time. This reduces administrative overhead, speeds up payouts, and gives you complete visibility over your payroll transactions.

Key Benefits of Using Finexer for Payroll

✅ Bulk Salary Payments

Send thousands of salary payouts with one secure API request. Ideal for payroll teams managing contractors, remote workers, or multiple entities.

✅ Account Verification Before Payment

Validate the account holder’s name and details before releasing any funds. This helps eliminate rejections, payment reversals, and misdirected wages.

✅ Real-Time Payment Tracking

Monitor every salary disbursement from initiation to confirmation. You’ll know the exact status of each payment without relying on BACS delays or bank-side reporting.

✅ Secure and FCA-Compliant

Finexer is fully authorised and regulated in the UK. It uses enterprise-grade encryption (AES-256, TLS 1.2) and enforces role-based access to separate payment approval from initiation.

✅ Transparent Pricing

No percentage-based fees. Finexer charges a flat, usage-based rate, so you know exactly what you’re paying each month, with no surprises or hidden markups.

Who should use this integration?

- Payroll teams handling high-volume or time-sensitive salary runs

- Businesses looking to eliminate manual payment uploads

- Companies that require audit-ready payroll operations with real-time control

“Our clients in the legal and accountancy sectors expect the highest standards of efficiency and security, and Finexer’s solutions help us deliver on those expectations every day,”David Kern, CEO of VirtualSignature-ID.

Get Started

Connect today and see why businesses trust Finexer for real-time Salary Disbursement.

Try Now5. Payslip Distribution & Compliance Portals: Closing the Payroll Loop

Why this integration matters

Even after salaries are paid, the job isn’t done. Employees need timely access to their payslips, and finance teams need proof that every payment aligns with tax and compliance obligations. When payslips are emailed manually or stored in outdated systems, it creates risks, from missed communications to audit failures.

What this payroll software integration does

By integrating your payroll software with a secure payslip distribution platform or compliance portal, payslips can be automatically generated, distributed, and logged. This ensures that every employee receives accurate documentation, and your team maintains a digital record of each pay run for audit readiness.

Popular Integration Tools

- PayDashboard – Enables secure online payslip access and employee communication

- Moorepay – Offers payroll compliance tools with payslip auto-generation

- BrightPay Connect – Cloud extension for automated payslip delivery and logs

Impact on Payroll Operations

- Instant, secure delivery of payslips to employees

- Centralised portal for compliance tracking and audit support

- Reduced admin for HR and payroll teams post-payment

Who needs it most

Firms that handle payroll in-house and want to maintain compliance logs

Businesses undergoing audits or subject to regular financial reporting

Organisations with remote or hybrid employees needing digital access to payslips

What is a payroll software integration?

A payroll software integration connects your payroll system with other tools like HR, banking, or accounting to automate data syncing and reduce errors.

How can Open Banking improve payroll processing?

Open Banking allows real-time salary payments without manual bank uploads, improving speed, visibility, and payment accuracy.

Which integrations are essential for accurate payroll?

Time tracking, HR sync, accounting journals, payment APIs, and payslip automation are key integrations for reliable payroll operations.

Tired of payment files, late bank logins, and payout errors?

Finexer gives you a direct payroll integration that’s faster, safer, and stress-free.