How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms

If your platform moves money daily, whether it’s paying contractors, refunding customers, or releasing commissions, you already know that traditional payout methods are painfully slow. Bank transfers take days, card withdrawals are expensive, and the manual steps in between create friction for both your team and your end users.

Finexer changes that. Powered by open banking payouts, our payout API delivers instant withdrawals in real-time funds and lands in the recipient’s account in seconds, 24/7. This is more than a speed upgrade; it’s an operational shift that reduces costs, improves cash flow, and gives your customers the experience they expect in 2025.

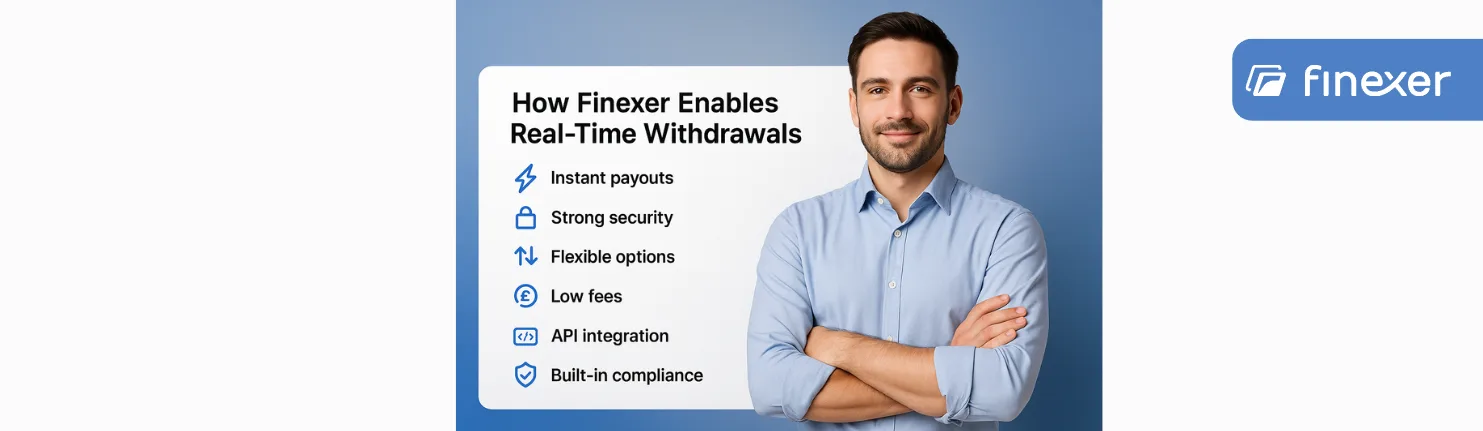

What Finexer Solves

1. Immediate Access to Funds

With Finexer’s real-time payouts in UK, money moves from your account to your user’s account in seconds. This removes the standard 1-3 day wait that frustrates customers and slows business operations. Both sender and recipient get real-time payout confirmation that the payout has landed.

2. Cost Efficiency

By leveraging open banking payouts, Finexer cuts out card networks and intermediaries. That means lower transaction fees and no percentage-based card costs, just predictable, transparent pricing you can scale with.

3. Enhanced Security

Every transaction is protected by AES-256 encryption, TLS 1.2, and strong customer authentication (SCA). Real-time fraud monitoring flags anomalies instantly, safeguarding both your platform and your users.

4. Seamless Integration

Our payout API plugs directly into your existing systems. Whether you’re building a new payout feature or replacing legacy rails, integration is fast, developer-friendly, and supported by white-label consent screens for a fully branded user journey.

5. Versatile Payment Options

From single instant withdrawals to real-time bulk payout system UK operations, Finexer covers every scenario. We support in-app withdrawals, payment links, and bulk batch payouts, all within the same API framework.

6. Compliance Built-In

Finexer is FCA-authorised, PSD2-compliant, and GDPR-ready. You stay compliant by default, without adding another layer of legal and technical overhead.

👉 Talk to our team and discover how to automate your payouts with Finexer.

What is a real-time withdrawal?

A real-time withdrawal is a bank-to-bank transfer where funds reach the recipient’s account in seconds, 24/7. It works through instant payment rails, such as the UK’s Faster Payments system or open banking APIs, so there are no batch delays or cut-off times.

How is it different from Faster Payments or BACS?

Faster Payments is quick but still has bank-dependent cut-off times, and some transfers can take hours. BACS takes 2-3 business days. Real-time withdrawals settle instantly at any time of day, including weekends and public holidays.

Who Uses Finexer And Why They Stay

- PropTech Platforms – Tenants get security deposits back instantly; agents get commission payouts within seconds.

- Lenders – Approved loans are disbursed instantly, repayments hit accounts in real time.

- Retail & EPOS – End-of-day takings are available instantly, bypassing card settlement delays.

- Payroll & Contractor Management – Pay staff instantly, even on weekends and bank holidays.

- Utilities & Subscriptions – Customers can pay bills in seconds, reducing arrears and service interruptions.

📖 Want proof? CLICK HERE to read our full customer success stories.

They stay because Finexer delivers measurable ROI, faster settlements, lower costs, and user experiences that drive loyalty.

Finexer vs. Everyone Else

| Feature | Finexer Instant Withdrawal API (Open Banking) | Traditional Bank Transfer | Card Withdrawal |

|---|---|---|---|

| Speed | Near Instant | 1–3 business days (BACS) or up to 2 hours (Faster Payments, bank cut-off times apply) | 1–3 business days for card-issuer settlement |

| Fees | Low, fixed per transaction | Varies by bank (may include flat + % fees) | 1–3% + fixed fees (scheme & acquirer costs) |

| Fraud / Chargebacks | No chargebacks; strong customer authentication | Low; possible recalls for incorrect payments | High risk for card-not-present; chargeback liability |

| Integration | API + white-label flows for instant withdrawals | Manual setup, CSV/BACS file uploads | Complex integration via card network APIs |

| Settlement Confirmation | Real-time API confirmation | Confirmation after processing (can be delayed) | Confirmation after acquirer settles |

| Branding Control | Full UI/UX branding | Limited (bank statement shows sender name) | Limited (card scheme branding) |

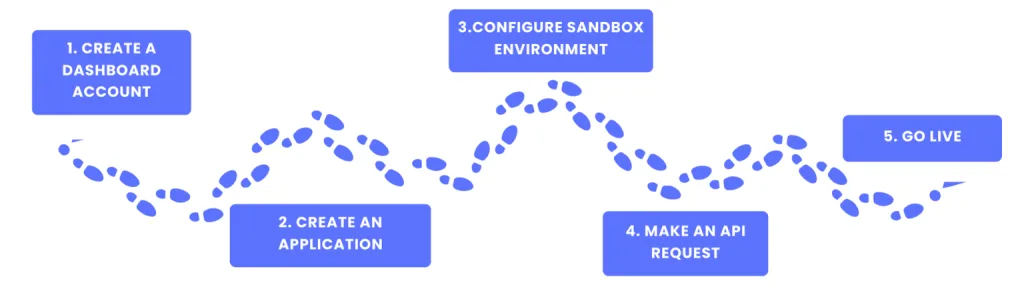

Getting Started in 5 Steps

1. Create a Dashboard Account – Sign up for Finexer’s web-based dashboard, which acts as your control centre for all payout activity. From here, you can manage, track, and monitor transactions in real time, view settlement reports, and configure access permissions for your team. This is where your real-time bulk payout system UK begins.

2. Create an Application – Within the dashboard, set up an “application” profile that defines how your platform connects to the instant withdrawal payout API. You can specify payout workflows, bank coverage, and authentication methods, ensuring your integration is tailored to your operational needs.

3. Configure Sandbox Environment – Before touching live accounts, you get access to a full sandbox, our safe, simulated environment that mirrors UK banking connections. Here, you can run test real-time withdrawal, validate response times, and fine-tune error handling without any financial risk.

4. API Integration – Connect your systems directly to Finexer’s instant withdrawal engine using our developer-friendly payout API. Integration includes white-label consent screens, webhook notifications, and built-in security protocols, so you can launch with confidence and compliance from day one.

5. Go Live – Once tested, switch from sandbox to live mode and start sending real-time payouts in UK. Funds reach recipients in seconds, backed by FCA-authorised, PSD2-compliant rails, so your customers get speed without compromising on safety.

Whether you’re running a lending platform or a large-scale enterprise, Finexer’s payout API and real-time bulk payout system UK make instant withdrawals a reality.

By replacing outdated bank transfers with open banking payouts, you cut costs, improve customer satisfaction, and stay ahead of your competition. From setup to go-live, the process is quick, compliant, and backed by enterprise-grade security.

How secure are real-time withdrawals?

Transactions are typically secured with bank-level encryption and strong customer authentication (SCA). Because they run through regulated payment initiation services in the UK, they’re also covered by FCA and PSD2 compliance standards.

Are there limits on the amount you can send instantly?

Yes, each bank sets its own limits for real time transfers, often between £25,000 and £1 million for business accounts. Open banking and Faster Payments limits may also apply.

How do I integrate real-time withdrawals into my platform?

Integration is usually done via an API from a payment provider. This lets your platform trigger payouts programmatically, track them in real time, and present a fully branded withdrawal flow to your users.

👉 Book a Demo Today and see how Finexer can power your payouts in real time.