Open Banking isn’t just a future concept, it’s already in use by millions. As of March 2025, nearly 13.3 million UK consumers and small businesses are actively using Open Banking services, with over 31 million payments processed through Open Banking platforms each month.

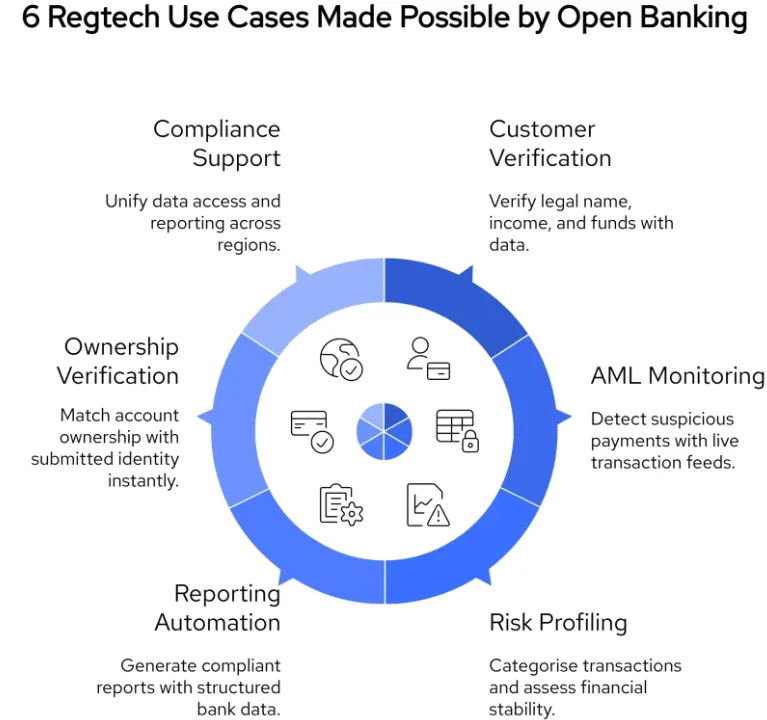

This growing adoption has had a direct impact on compliance and risk teams. Many now rely on Open Banking data to power their regtech use cases, from real-time identity checks to automated regulatory reporting.

If you’re working in compliance, risk, onboarding, or product roles within financial services, you’re in the right place. This blog outlines six practical regtech use cases that are being made possible by Open Banking in 2025. You’ll see how verified bank data is replacing manual processes in KYC, AML, audit, and more and what it means for your firm’s compliance operations.

The Regulatory Landscape Accelerating Regtech Innovation

Regulatory pressure is one of the main reasons firms are adopting regtech in financial services. As rules change more frequently and become more complex, the need for automated tools and real-time data has increased.

Key Regulatory Changes in 2025

Several regulatory updates are shaping how Open Banking and Regtech work together:

| Regulation | Region | Impact on Regtech |

|---|---|---|

| PSD3 & FIDA | EU | Expands the scope of data sharing and consent requirements |

| Open Banking 2.0 | UK | Formalises technical standards under JROC oversight |

| Data Use & Access Bill | UK | Sets the groundwork for Open Finance, beyond banking data |

These updates increase both the amount of data available and the level of control users have over how it’s shared. That creates a clear role for open banking APIs for Regtech, which must meet higher technical and compliance standards.

Rising Compliance Pressures

According to recent industry surveys:

- 77% of financial institutions expect tighter compliance rules in 2025

- 86% say better communication between departments is now a business priority

- 94% report they are prepared to invest in regtech compliance tools using Open Banking

This demand is being met by newer platforms that combine regulatory expertise with direct access to high-quality financial data, making Regtech faster, more accurate, and easier to integrate.

How Open Banking Is Enabling Practical Regtech Use Cases in 2025

Open Banking has made it much easier for Regtech platforms to access the data they need directly from a customer’s bank, with consent. This shift means compliance teams can move faster, rely less on paperwork, and make decisions based on live financial information instead of outdated files.

1. Verifying Customers and Their Source of Funds

Most financial firms are required to verify who their customers are and where their money comes from. This process, part of standard KYC and source of funds checks, is often handled manually by reviewing uploaded documents like ID cards, payslips, or PDF bank statements.

These methods are slow, hard to validate, and create extra work for both customers and compliance teams.

With Open Banking, there’s now a better way to do this, and Regtech platforms are making it easier to apply at scale. Learn how open banking facilitates faster client onboarding.

What Open Banking enables

- Confirms the customer’s legal name directly from the bank

- Shows regular income patterns (e.g. salary or pension payments)

- Provides transaction history to review account activity over time

- Helps verify that the declared source of funds matches actual behaviour

How Regtech fits in

Regtech tools connect to Open Banking APIs for Regtech and process that data in real time. Instead of asking a compliance officer to review each statement manually, the system checks ownership, income flow, and transaction consistency automatically and flags anything that needs a closer look.

Example

A lender uses a Regtech onboarding platform to assess an applicant. The platform pulls in the applicant’s last 90 days of bank data (with consent), confirms that salary is received regularly from an employer, and verifies account ownership, all without needing a single uploaded document.

Why it matters

It saves time, reduces fraud risk, and helps compliance teams meet KYC and source of funds requirements with less manual effort.

📚 Guide to Source of Funds Check API

2. Monitoring Transactions in Real Time for AML

Anti-money laundering (AML) rules don’t just apply to onboarding. Firms are expected to monitor customer activity on an ongoing basis and flag anything suspicious. But in many cases, this monitoring still relies on batch reports, delayed data, or manual reviews.

Open Banking provides a way to monitor financial behaviour as it happens, and Regtech platforms use this data to automate AML checks in real time.

What Open Banking enables

- Access to live transaction data, updated daily or in near real-time

- Full visibility into incoming and outgoing payments

- Detection of unusual patterns like sudden large transfers or frequent international payments

- Monitoring of high-risk merchant categories (e.g. gambling or crypto exchanges)

How Regtech fits in

A Regtech platform pulls Open Banking data through secure APIs and applies risk rules or machine learning models. The system flags transactions that don’t match the customer’s profile and sends alerts to the compliance team, so they can review them before it becomes a reportable incident.

Example

A fintech offering multi-currency accounts uses Open Banking to monitor customer activity across multiple accounts. When one user starts receiving large, unexpected payments from unknown sources, the Regtech system raises a flag for further review without needing a monthly data export.

Why it matters

Real-time transaction monitoring helps firms meet AML obligations more effectively. It reduces the chance of missing critical activity and lowers the operational cost of compliance reviews.

3. Profiling Customer Risk Through Transaction Categorisation

Not all customers carry the same level of risk, but many compliance teams still rely on limited data points like credit scores or income declarations to assess risk. These don’t always give a full picture, especially in lending, insurance, or high-risk onboarding scenarios.

Open Banking changes that by providing real-time visibility into a customer’s financial behaviour. Regtech platforms use this data to build more accurate risk profiles automatically.

What Open Banking enables

- Categorisation of transactions (e.g. income, rent, subscriptions, gambling)

- Identification of irregular or high-risk spending patterns

- Analysis of income stability and cash flow behaviour

- Detection of financial stress or over-indebtedness

How Regtech fits in

The Regtech tool pulls bank transaction data through Open Banking APIs, tags and categorises each line item, and builds a risk score based on behaviour. This helps teams understand not just what a customer earns, but how they spend, save, and manage risk in real life.

Example

A buy-now-pay-later (BNPL) provider uses Regtech to assess affordability in real time. Before approving a credit offer, the system checks that the applicant has stable income, manageable expenses, and no signs of high-risk activity like frequent gambling, all based on categorised Open Banking data.

Why it matters

It improves risk decisions, reduces defaults, and ensures firms are lending or onboarding responsibly without needing customers to submit additional information manually.

4. Automating Regulatory Reporting and Audit Trails

Regulatory reporting is one of those tasks that can’t be rushed but often gets delayed. Many compliance teams still pull data manually from spreadsheets, accounting systems, or customer documents, only to spend hours formatting it for the regulator.

This is where regtech compliance tools using Open Banking are making a clear difference.

What Open Banking enables

- Access to timestamped account and transaction data

- Consistent formatting across accounts and institutions

- Verified records for audit trails and reporting

- Real-time data syncing for up-to-date submissions

How Regtech fits in

This is one of the most practical regtech use cases in 2025. A Regtech platform can connect directly to Open Banking APIs for Regtech, fetch customer account data with consent, and generate structured reports that match regulatory formats. The system can also keep a full audit trail showing when data was pulled and what checks were performed.

Example

A digital bank uses its Regtech reporting tool to submit transaction volume reports to the FCA every quarter. Instead of extracting CSVs from multiple systems, the tool fetches Open Banking data in real time and outputs a clean, compliant report automatically.

Why it matters

Firms can reduce manual work, avoid formatting errors, and maintain audit-ready data with less effort, especially useful for growing teams and tighter reporting cycles.

5. Verifying Account Ownership and Identity

One of the simplest but most important compliance checks is confirming that a customer owns the bank account they’re using. It sounds basic, but when this process relies on screenshots or uploaded statements, mistakes and fraud risks go up quickly.

This is where regtech compliance tools using Open Banking step in to make the process faster, more accurate, and less dependent on manual review.

What Open Banking enables

- Pulls verified account holder details directly from the bank

- Matches account name with submitted personal details

- Confirms account status, IBAN/sort code, and ownership

- Works in real time, with no need for document uploads

How Regtech fits in

Through open banking APIs for regtech, platforms can automatically check account ownership as part of the onboarding flow. It’s a lightweight but essential step that helps teams reduce fraud, meet regulatory expectations, and avoid payment mismatches.

This is a growing part of regtech in financial services, especially in lending, payments, and professional services, where payouts or account validation are required.

Example

An accounting platform uses a Regtech integration to verify client bank accounts before sending payouts. When a new client is onboarded, the system uses Open Banking to instantly confirm account ownership, eliminating the need for a void cheque or utility bill.

Why it matters

This is one of the most efficient regtech use cases available today. It simplifies a routine check while helping firms stay compliant, reduce fraud risk, and avoid manual steps.

6. Managing Cross-Border Compliance and Regional Regulation

For businesses operating across multiple countries, regulatory compliance becomes far more complex. Each jurisdiction may have different standards for identity checks, data sharing, reporting, and consent. Trying to manage this manually or with separate systems in each region can slow everything down.

This is where regtech compliance tools using Open Banking provide a scalable advantage.

What Open Banking enables

- Access to regulated financial data from multiple regions (where supported)

- Standardised data formats for easier comparison and reporting

- Clear audit trails and consent records for each jurisdiction

- Support for local AML, KYC, and reporting requirements

How Regtech fits in

Using open banking APIs for regtech, firms can streamline how they collect and process data across different countries. The Regtech platform handles region-specific checks while keeping the process unified for internal teams. This is especially valuable for regulated businesses expanding across the UK, EU, and beyond.

It’s one of the more advanced regtech use cases, but it’s becoming increasingly common as financial services go global.

Example

A payments provider operating in the UK and Germany uses a Regtech tool to meet both FCA and BaFin reporting standards. The tool pulls Open Banking data in each region and maps it to the correct reporting framework, so the team doesn’t need separate workflows.

Why it matters

Without scalable tools, cross-border compliance becomes a bottleneck. Regtech platforms powered by Open Banking help firms stay compliant across regions, without building separate systems from scratch.

Power Your Regtech Stack with Finexer’s Open Banking Infrastructure

If your compliance team is still chasing down bank statements or waiting days for identity documents, you’re already behind. Regtech in 2025 is about precision, speed, and reducing manual overhead. That’s exactly where Finexer fits in.

It provides real-time, bank-verified data that Regtech platforms can plug into instantly, no guesswork, no delays. Whether you’re building a source of funds engine, automating affordability checks, or handling KYC with Open Banking, Finexer gives you the tools to move faster with confidence.

Here’s how Finexer stands out for critical regtech use cases:

- Instant account and identity verification using live bank data

- KYC with Open Banking: onboard clients in under 2 minutes, no PDFs needed

- Enriched transaction histories for accurate AML and source of wealth reviews

- Consent-first architecture to stay aligned with FCA requirements

- White-labelled flows to match your platform and user journey

- Flexible pricing that fits growing compliance teams, not legacy enterprise fees

- 3–5 weeks of onboarding support: real people to help you integrate and launch faster

With Finexer, you’re not just connecting to Open Banking APIs for Regtech, you’re building smarter compliance systems that scale.

Get Started

Connect today and see why Regtechs trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWrapping Up

Regtech tools are evolving quickly, but their success depends on one thing: access to clean, verified, real-time data. That’s exactly what Open Banking delivers: not just better data, but smarter ways to meet compliance requirements without slowing down operations.

For teams building Regtech in 2025, Open Banking isn’t a trend. It’s a practical foundation for better tools, faster decisions, and fewer manual checks.

If you’re looking to upgrade any part of your compliance stack this year, start with the data. Start with Open Banking.

What are the top Regtech use cases supported by Open Banking?

Top Regtech use cases powered by Open Banking include real-time KYC, source of funds verification, fraud detection, audit automation, and account ownership checks.

Why is Open Banking important for Regtech in 2025?

In 2025, Regtech solutions rely on Open Banking APIs to reduce manual processes, deliver faster decisions, and meet evolving compliance standards.

What tools can help integrate Open Banking into Regtech workflows?

Regtech platforms can use compliance tools like Finexer’s API to access real-time data for fraud checks, income verification, and audit readiness.

Can Open Banking reduce manual compliance work?

Yes, it replaces manual checks with real-time data, helping Regtech teams automate KYC, income verification, and audit workflows.

Build Faster, Smarter Regtech Workflows with Finexer’s Open Banking Infrastructure!