Tag: Finexer

-

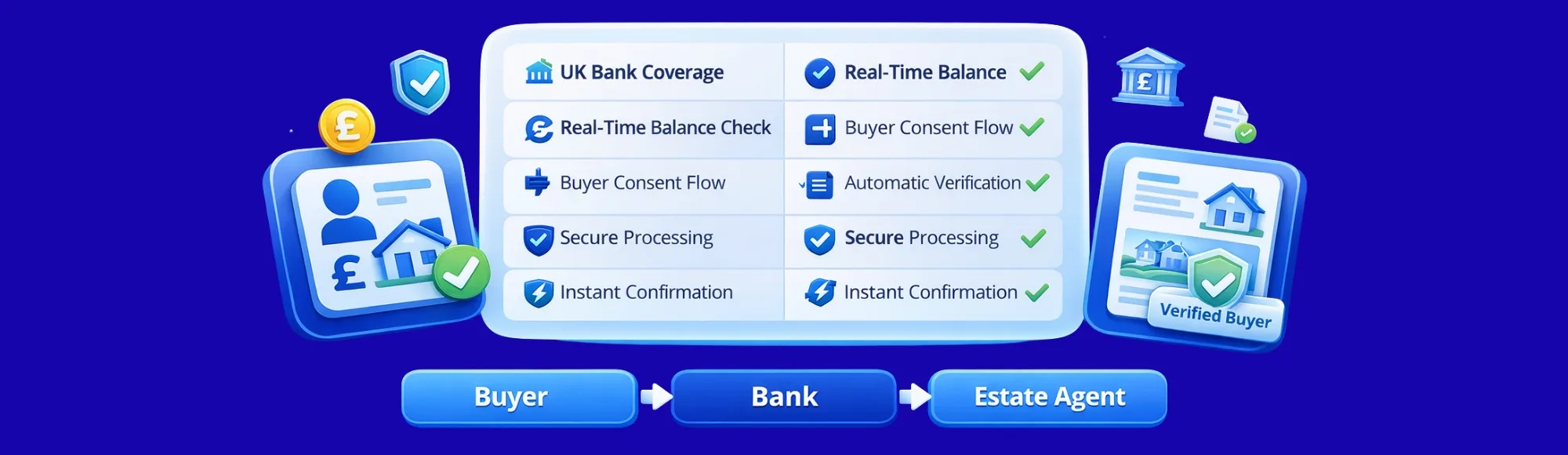

Real Estate Bank Verification: How Estate Agents Instantly Verify Proof of Funds & Bank Accounts Using Open Banking

Real estate bank verification for UK estate agents. Verify buyer funds instantly, eliminate statement delays & close deals faster with open banking technology.

-

Law Firm Payment Automation for UK Firms: Automating Client Payments End-to-End

Law firm payment automation for UK firms. Automate client payments end-to-end, reduce admin by 90% & eliminate delays with 99% UK bank coverage from Finexer.

-

Looking for a Noda Open Banking Alternative? Compare UK Providers for Payment Initiation & Account Information Services

Looking for a Noda open banking alternative? Switch to Finexer for 99% UK bank coverage, faster deployment, and usage-based payments.

-

Top 10 Open Banking API Examples That Power Real AIS Products in the UK

Discover 10 open banking API examples powering real UK businesses. Compare providers, bank coverage & integration times. Reduce costs by 90% with Finexer.

-

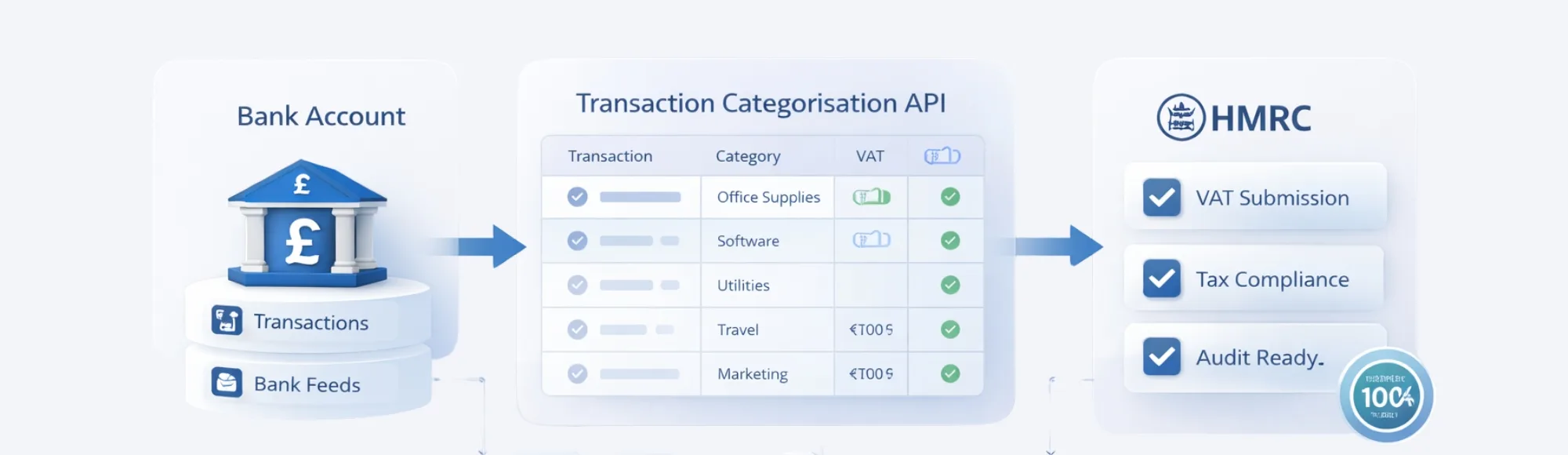

Transaction Categorisation API for Audit-Ready Bookkeeping: How UK Firms Reduce VAT Errors

See why transaction categorisation APIs outperform manual processing with faster setup, lower VAT errors, and automated audit trails.

-

Free MTD Software for Landlords: What’s Actually Free and What Can Cost You Penalties

Free MTD software for landlords often misses key features. Discover what’s truly free, what triggers penalties, and how to stay compliant.

-

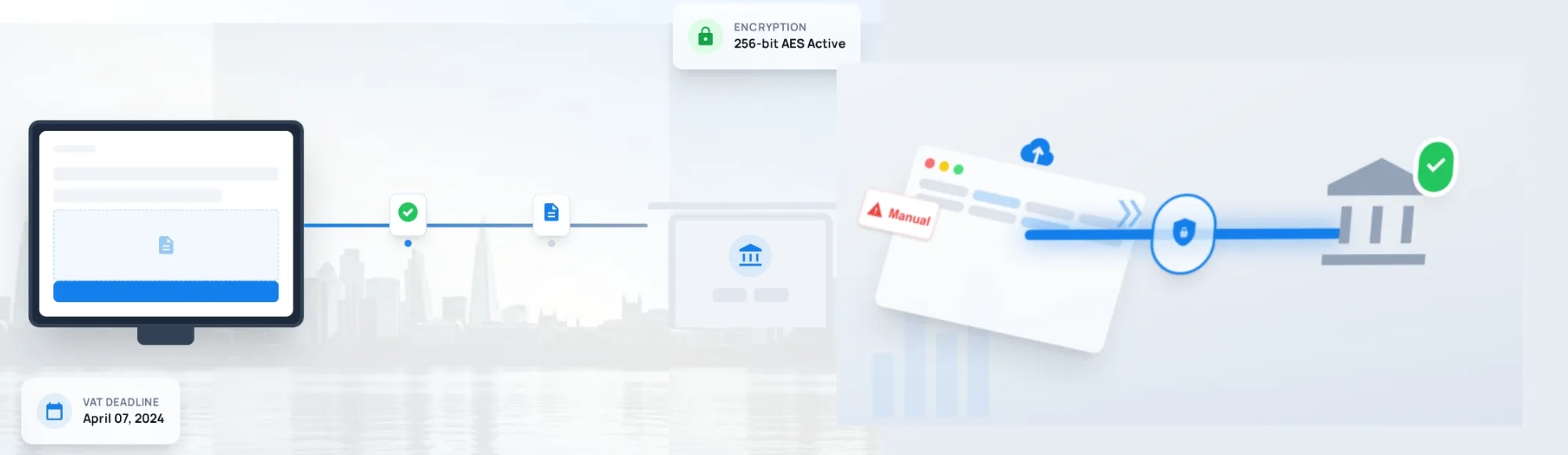

MTD Bridging Software: What UK Businesses Must Check Before Choosing One

Struggling with HMRC VAT submissions? Learn how to choose the right MTD bridging software to avoid errors, ensure compliance, and submit VAT smoothly.

-

Why Open Banking API Security Is Under Regulatory Pressure in 2026

Get Secure Open banking API with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open Banking API Security in the UK has reached a scale where security failures now pose systemic risk, not isolated product issues. Active users grew from 12.1 million (Dec 2024) to 13.3 million…

-

How Enterprises Should Evaluate Bank Data Quality: A 12-Point Checklist

A practical, enterprise-friendly framework for evaluating Bank Data Quality, accuracy, enrichment, and compliance for real-time financial operations.

-

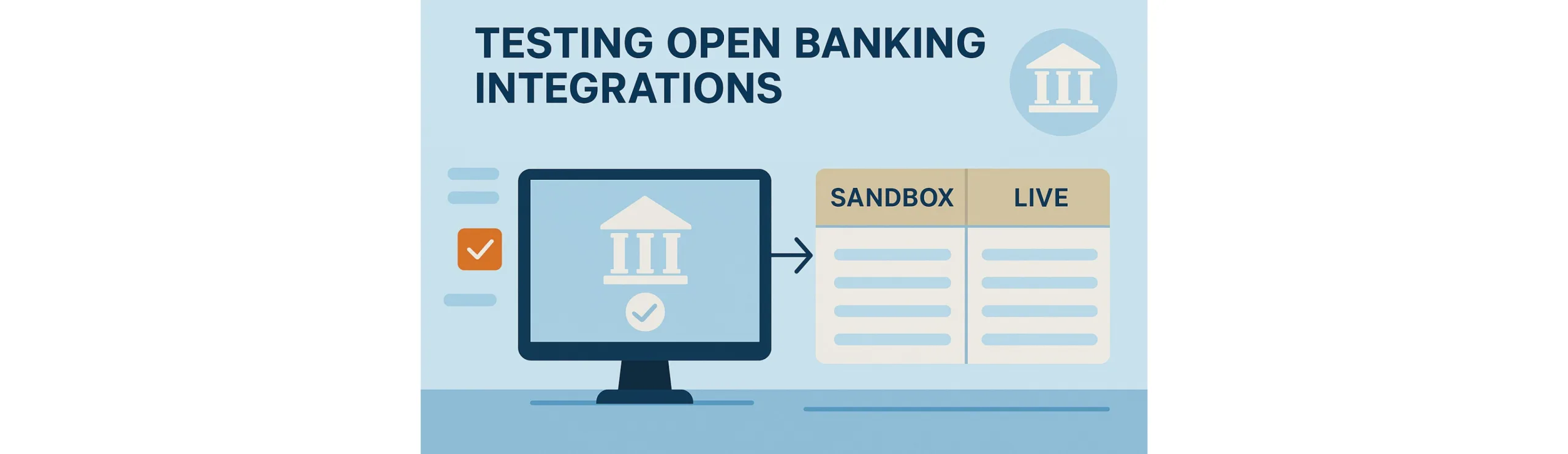

Testing Open Banking Integrations: Sandbox vs Live Data Scenarios

Learn about testing Open Banking integrations using sandbox and live data. Understand real bank behaviour, authentication friction, and safe rollout steps.

-

Finexer Joins FinTech Wales to expand Open Banking Innovation

Finexer is proud to announce its membership with FinTech Wales, the leading organisation championing the growth of Wales’ fintech ecosystem. As an FCA-regulated Open Banking platform, Finexer provides secure, API-led access to real-time banking data and Pay-by-Bank payments. By joining FinTech Wales, Finexer becomes part of a collaborative community spanning fintech, payments, AI, financial services,…

-

How Bank-Data Verification Is Redefining Digital KYC for UK Insurers

Learn how UK insurers use bank-data verification to improve digital KYC, reduce fraud, and meet FCA expectations with faster, verified financial checks.

-

Screen Scraping vs Open Banking: Why UK Businesses Are Making the Switch in 2025

Learn why UK businesses are replacing screen scraping with secure, PSD2-compliant Open Banking APIs. Discover safer, faster data access with Finexer.

-

Open Banking in Practice: Real-World Examples Transforming Accounting Workflows

Learn how accountants use open banking in practice for faster reconciliation, cleaner audits, and real-time financial accuracy across UK firms.

-

Guide to Scalable Customer Retention with Open Banking UK

Discover how open banking boosts customer retention, guide to building lasting customer loyalty.

-

White-Label Payment API: A Buyer’s Guide for PSPs

Choosing a white-label payment API? This buyer’s guide helps PSPs compare open banking vs. cards, PISP/AISP, and B2B features.

-

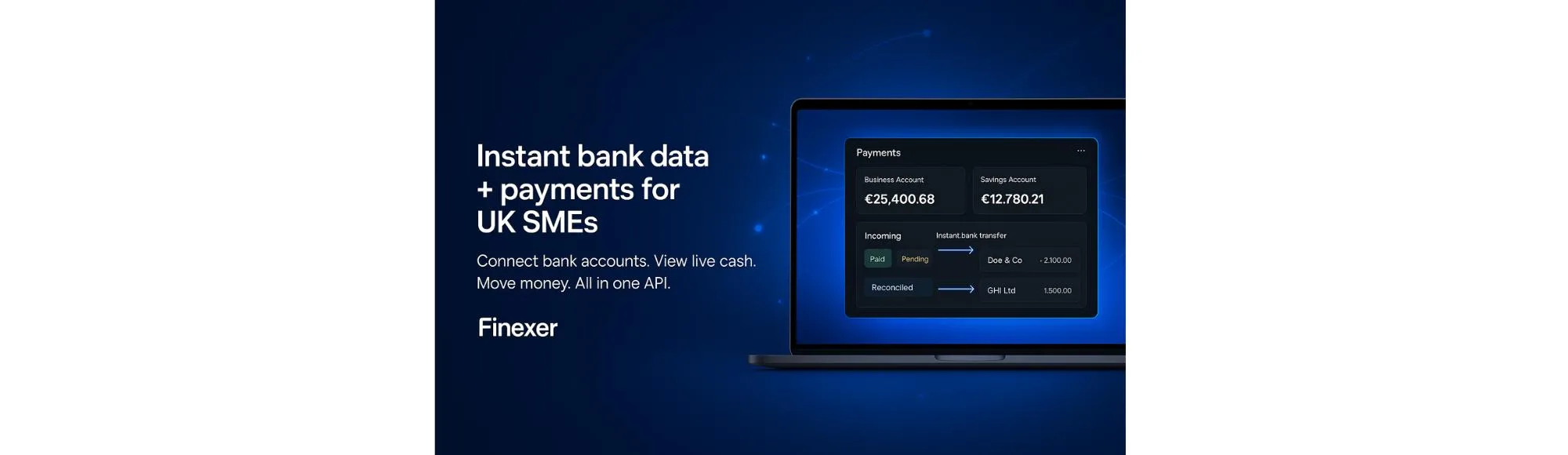

Integrated Digital Banking for UK SME’s

Learn how integrated digital banking helps UK SMEs manage payments, data, and cashflow in one place. Find how Finexer connects it all securely!

-

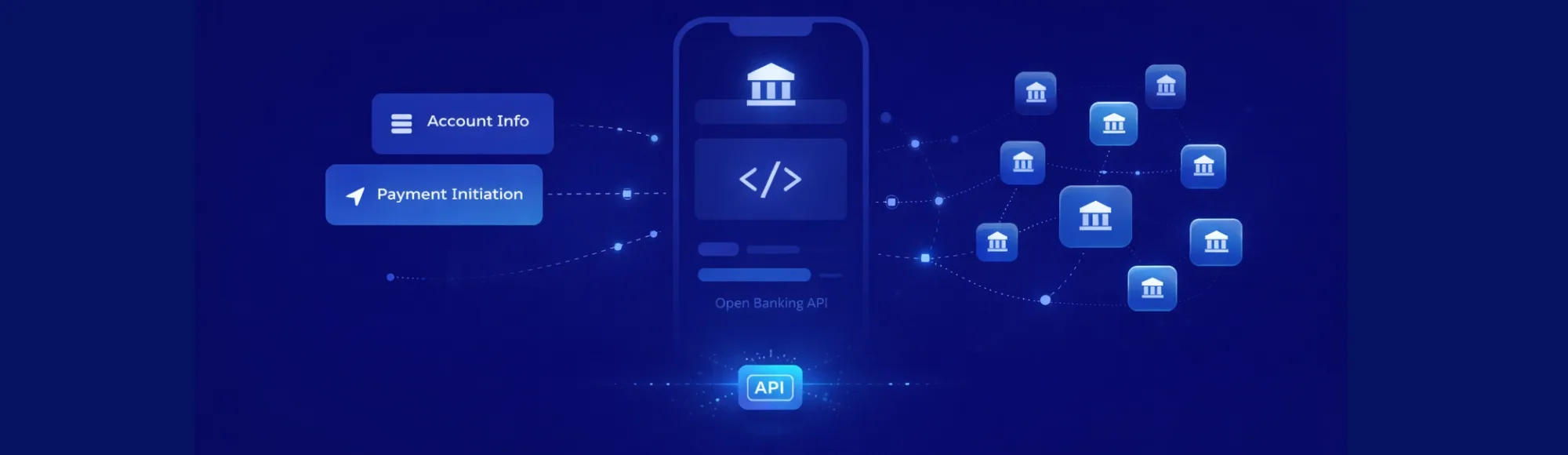

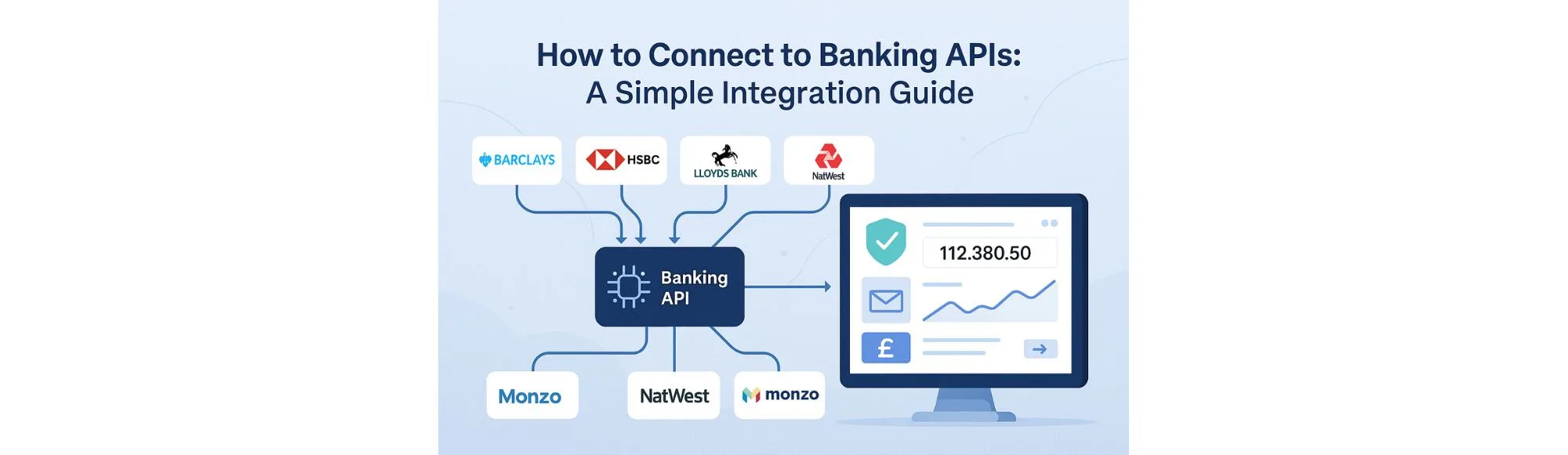

How to Connect to Banking APIs: Open Banking Integration Guide

Learn how to connect to a banking API using secure Open Banking integration and see how Finexer helps UK businesses access real-time financial data.

-

Ecospend Review: Features, Pros & Cons, and the Best Alternative for UK Businesses

Read our Ecospend review and find out why Finexer is the faster, transparent Open Banking choice for UK businesses.

-

Open Banking Security: 5 Myths Every UK Business Owner Still Believes

Discover the truth about open banking security in the UK. Learn how FCA rules, consent-based access, and Finexer’s APIs keep business data safe.

-

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms. Explroe pricing, coverage, and deployment insights

-

5 Real-World Examples of Successful TPPs in Open Banking

Discover how leading TPPs are transforming UK Open Banking. Learn from real examples of secure, compliant, and data-driven financial innovation.

-

In-House vs Outsourced Open Banking Integration: Costs, Security, and Speed

Learn how to plan open banking integration in the UK. Compare build vs buy, timelines, licensing, security, and cost with a step-by-step process.

-

7 Questions to Ask Before Choosing a Bank Data API

Setup Bank Data API Instantly with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now UK businesses are increasingly turning to direct bank connections to reduce payment costs and improve customer experience. With over 5 billion real-time transactions processed last year, the demand for reliable banking infrastructure has…

-

Transfer Funds Instantly: Fast, Secure Money Transfers in the UK

Learn how to transfer funds instantly in the UK with Faster Payments. Explore instant bank transfers, instant payouts, security, and key use cases.

-

Securing the Open Banking Ecosystem: Technical Implementation Guide

Setup Open banking infrastructure 2-3x faster with finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open banking APIs processed $57 billion in global transactions during 2023. APIs now handle 31% of all web traffic, but financial services ranks as the third-most targeted sector for web application attacks. This creates…

-

Best Bank Data Aggregation Tools for 2025 to Streamline Your Workflow

The information in this comparison table was sourced from publicly available material on each provider’s website and official documentation as of 10th October 2025 Bank data aggregation has moved from being a back-office function to a core operational requirement for regulated businesses in the UK and Europe. With open banking adoption now exceeding 63 million…

-

Consent-Driven Financial Data Aggregation: Secure Account Access Explained

Learn how financial data aggregation works, from consent to secure APIs. Benefits, challenges, regulations, and future trends explained clearly.

-

Best Practices for Reducing Compliance Cost for UK Lenders

Learn how Open Banking reduces the compliance cost for lenders in the UK by automating checks, improving accuracy, and cutting manual effort

-

Yapily vs Plaid: Which AIS Provider Fits Your Business in 2025?

Compare Yapily and Plaid for AIS in the UK. See how they differ on bank coverage, business account access, and pricing