Tag: Open Banking

Open Banking API Integration for Enterprise Treasury Management Systems

See how UK enterprises enhance treasury management systems with real-time bank data via Open Banking APIs. Finexer provides fast, clean connectivity

Testing Open Banking Integrations: Sandbox vs Live Data Scenarios

Learn about testing Open Banking integrations using sandbox and live data. Understand real bank behaviour, authentication friction, and safe rollout steps.

Finexer Joins FinTech Wales to expand Open Banking Innovation

Finexer is proud to announce its membership with FinTech Wales, the leading organisation championing the growth of Wales’ fintech ecosystem. As an FCA-regulated Open Banking platform, Finexer provides secure, API-led access to real-time banking data and Pay-by-Bank payments. By joining FinTech Wales, Finexer becomes part of a collaborative community spanning fintech, payments, AI, financial services,…

How SaaS Companies Can Reduce Involuntary Churn With Better Payment Flows

Want fewer failed renewals and steadier revenue? See how a more reliable payment method keeps customers subscribed Try Now A lot of churn in SaaS doesn’t happen because customers decide to leave. It happens because their payments fail. Card expiries, random declines, and SCA drop-offs quietly interrupt renewals — making it harder for teams to…

Evaluating an Open Banking Partner: 10 Red Flags to Watch For

Before choosing an Open Banking partner, review the 10 red flags that affect bank coverage, data quality, uptime, and compliance for UK businesses.

How UK Businesses Use Open Banking APIs for Account Aggregation

Find how UK businesses use account aggregation to access real-time balances and transactions through Open Banking APIs, with practical use cases

Building Behavioural Insights from Open Banking Data (Without Breaching Consent)

Learn how lenders can build behavioural insights from consent-led Open Banking Data. Clear guidance on affordability, patterns, and compliant data use.

UK Open Banking Governance 2025–26: Key Standards Every Provider Must Track

A clear guide to UK open banking governance for 2025–26. Learn the standards, reporting rules, consent requirements, and how Finexer supports compliant usage.

How Bank-Data Verification Is Redefining Digital KYC for UK Insurers

Learn how UK insurers use bank-data verification to improve digital KYC, reduce fraud, and meet FCA expectations with faster, verified financial checks.

Faster client onboarding with Open banking for law firms

Find how Open Banking helps UK law firms speed up client onboarding. Reduce onboarding friction, simplify AML/SoF compliance, and improve client experience.

Confirm Buyer Funds Instantly: An Estate Agent’s Guide to Open Banking

learn how Open Banking provides an instant, fraud-proof, and AML-compliant way to confirm buyer funds.

Open Banking for UK Banks: Practical Use Cases for 2026

Discover how UK banks are using the open banking API. We explore 3 practical use cases for risk, revenue, and customer retention.

Screen Scraping vs Open Banking: Why UK Businesses Are Making the Switch in 2026

Learn why UK businesses are replacing screen scraping with secure, PSD2-compliant Open Banking APIs. Discover safer, faster data access with Finexer.

Most popular banking API examples

Explore the most popular banking APIs in 2025 — Plaid, Tink, Finexer and Yapily. Compare coverage, features, and compliance for UK fintech success.

Top Scalable Banking Data Aggregation Solutions for UK Businesses in 2026

Find the top scalable banking data aggregation platforms in the UK. Compare features, coverage, and performance to choose the right provider for your business.

Open Banking in Practice: Real-World Examples Transforming Accounting Workflows

Learn how accountants use open banking in practice for faster reconciliation, cleaner audits, and real-time financial accuracy across UK firms.

Guide to Scalable Customer Retention with Open Banking UK

Discover how open banking boosts customer retention, guide to building lasting customer loyalty.

White-Label Payment API: A Buyer’s Guide for PSPs

Choosing a white-label payment API? This buyer’s guide helps PSPs compare open banking vs. cards, PISP/AISP, and B2B features.

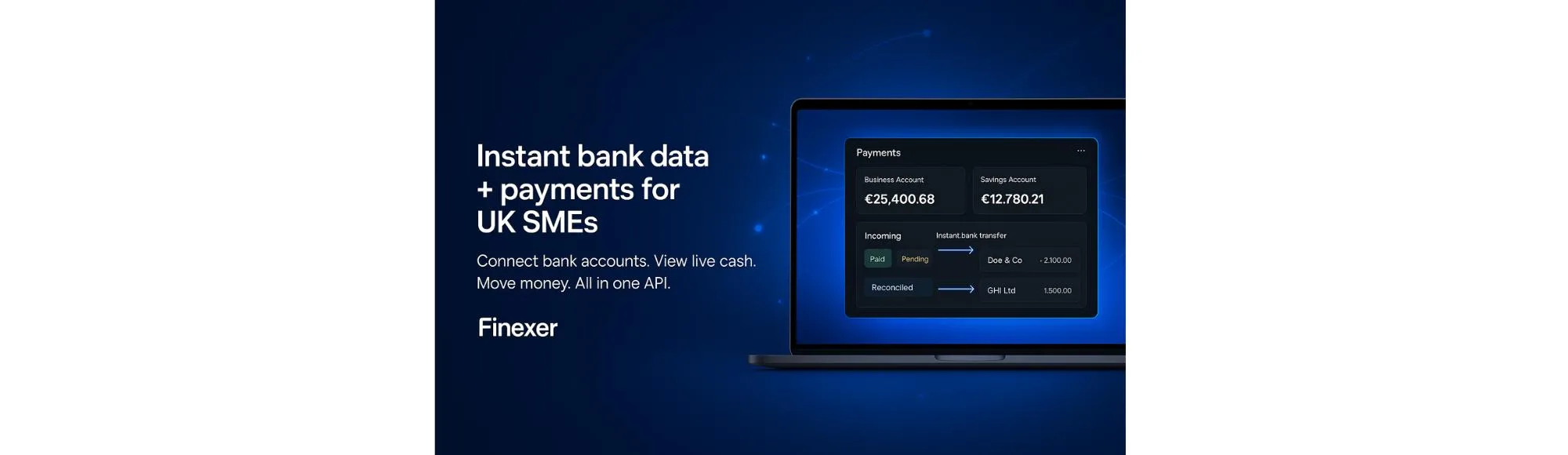

Integrated Digital Banking for UK SME’s

Learn how integrated digital banking helps UK SMEs manage payments, data, and cashflow in one place. Find how Finexer connects it all securely!

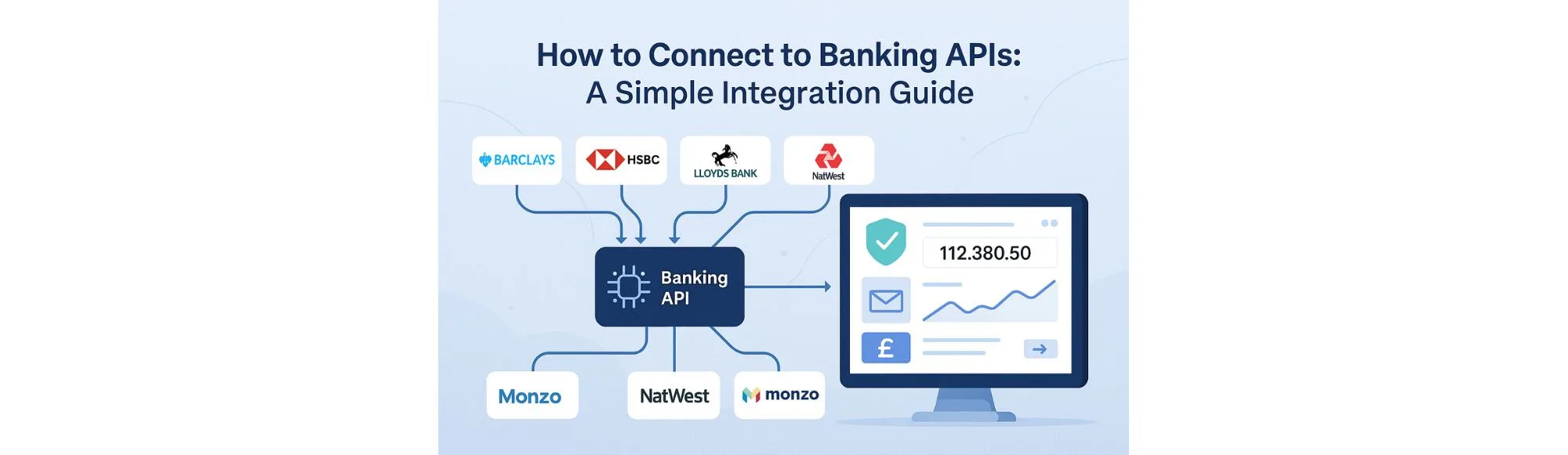

How to Connect to Banking APIs: Open Banking Integration Guide

Learn how to connect to a banking API using secure Open Banking integration and see how Finexer helps UK businesses access real-time financial data.

7 Best Banking API Providers in the UK (2026 Guide)

Find the top UK banking API providers. See how Finexer, Salt Edge, Yapily, Plaid, Tink and TrueLayer stack up on coverage, pricing and integration speed.

Planky Review for Data Aggregation and Alternatives in the UK (2025 Guide)

Find the best UK alternatives to Planky for Open Banking data aggregation — built for faster deployment, wider coverage, and flexible pricing.

NorthRow Review: Pricing & Competitors for KYB/KYC in the UK

NorthRow review 2025: features, pricing model, strengths, and KYB/KYC competitors to compare before choosing your compliance platform.

Ecospend Review: Features, Pros & Cons, and the Best Alternative for UK Businesses

Read our Ecospend review and find out why Finexer is the faster, transparent Open Banking choice for UK businesses.

Open Banking Security: 5 Myths Every UK Business Owner Still Believes

Discover the truth about open banking security in the UK. Learn how FCA rules, consent-based access, and Finexer’s APIs keep business data safe.

10 Hidden Bank Charges You Can Eliminate with Open Banking

Explore 10 common bank charges your business can cut instantly using Open Banking. Learn how direct payments reduce fees, save time, and improve cash flow.

Open Banking for SMEs: Why UK Small Businesses Should Adopt It in 2025

Explore how open banking for SMEs helps UK businesses cut costs, speed up payments, and gain real-time financial visibility in 2025.

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms. Explroe pricing, coverage, and deployment insights

5 Real-World Examples of Successful TPPs in Open Banking

Discover how leading TPPs are transforming UK Open Banking. Learn from real examples of secure, compliant, and data-driven financial innovation.

In-House vs Outsourced Open Banking Integration: Costs, Security, and Speed

Learn how to plan open banking integration in the UK. Compare build vs buy, timelines, licensing, security, and cost with a step-by-step process.