Tag: RequestToPay

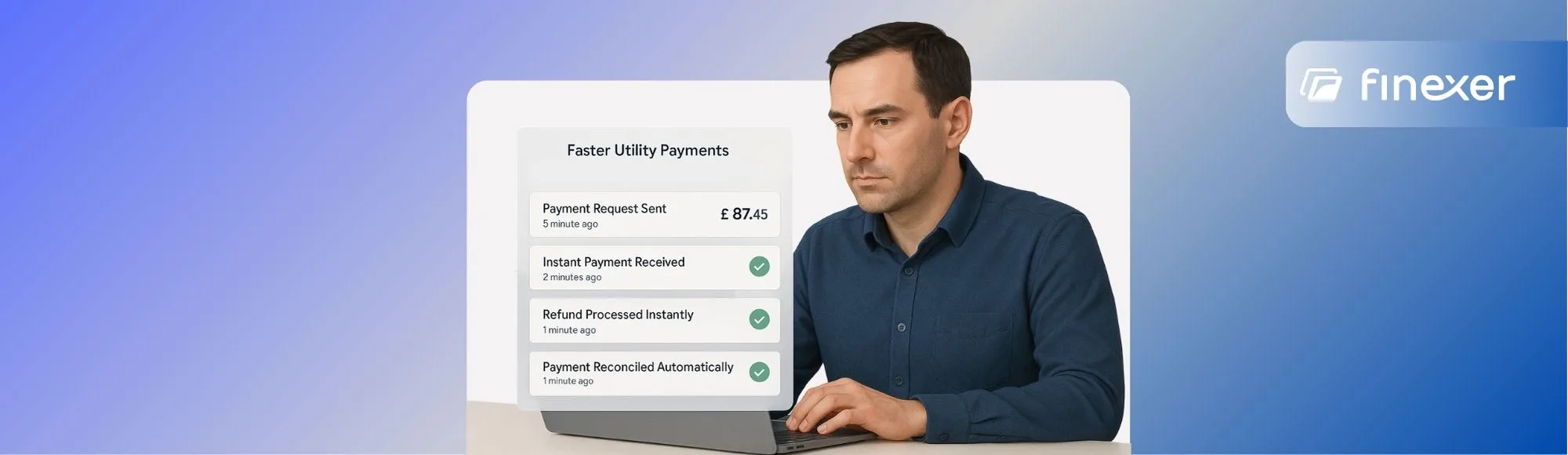

Open Banking for Utilities: Instant Payments, Refunds, and Reconciliation

Find how Open Banking for utilities helps UK providers get paid faster, issue real-time refunds, and reconcile automatically — all through secure, account-to-account transfers.

Open Banking for Payroll and Invoicing: One API for Salary Runs, Invoice Links, and Payee Checks

This blog covers 10 practical use cases of Open Banking for payroll and invoicing—like instant payouts, account verification, pay-by-bank links, live reconciliation, and more to help you reduce delays, errors, and admin.

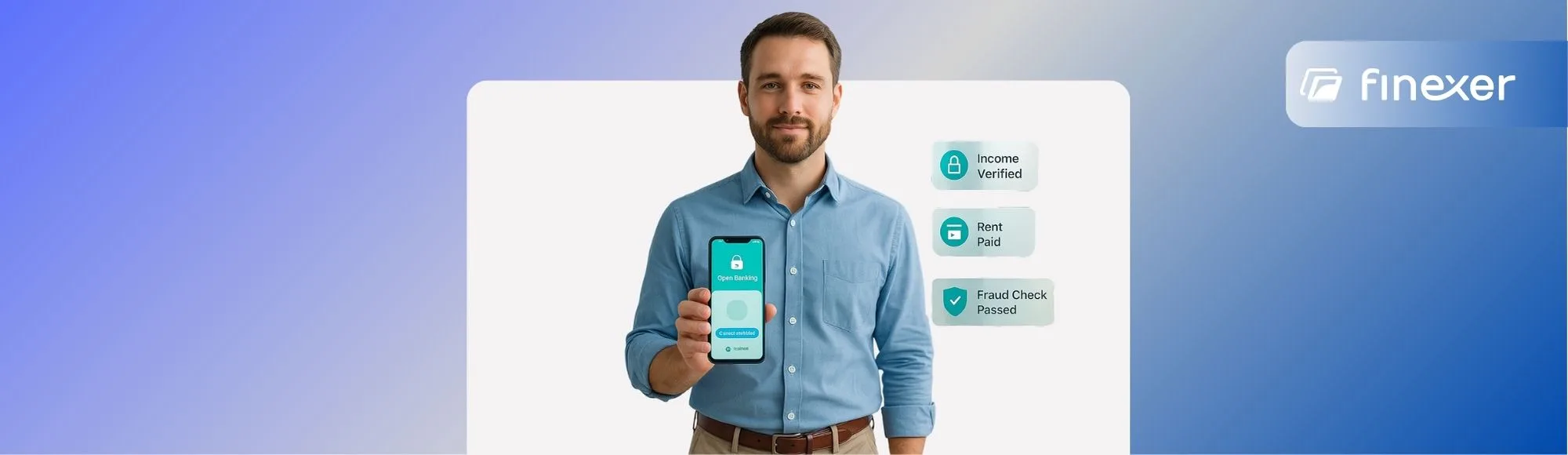

Case Study: The 5 Most Trusted Proptech Apps Using Open Banking in the UK Today

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now 13.3 million people in the UK already use Open Banking every month, a 40 % jump year-on-year. That momentum isn’t just sitting inside fintech; it’s powering a new wave of proptech apps that verify tenants…

Batch Payment Processing for Accounting Software Users: A 2025 Guide

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now You’ve done the work. Invoices are approved, and suppliers are waiting. Your accounting system can generate the payment list, but now comes the part no one talks about: getting those payments actually out the door. This is…

![Detailed Guide: 6 Best Payment collection platforms for Law Firms [2025 Guide] 5 Detailed Guide: 6 Best Payment collection platforms for Law Firms [2025 Guide]](/wp-content/uploads/2025/04/Payment-collection-platforms-for-law-firms.png)

Detailed Guide: 6 Best Payment collection platforms for Law Firms [2025 Guide]

Collect Payments with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now For most law firms, getting paid still involves chasing invoices, handling card terminals, or waiting days for bank transfers to clear. These outdated methods often result in unnecessary admin, missed follow-ups, compliance risk, and slower cash flow.…

7 Best Accounting Workflow Software in 2025 for Growth

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Keeping track of recurring deadlines, team responsibilities, and client deliverables is one of the biggest challenges accounting firms face, especially as they grow. Spreadsheets, sticky notes, and email threads can only take you so far. Eventually, things…

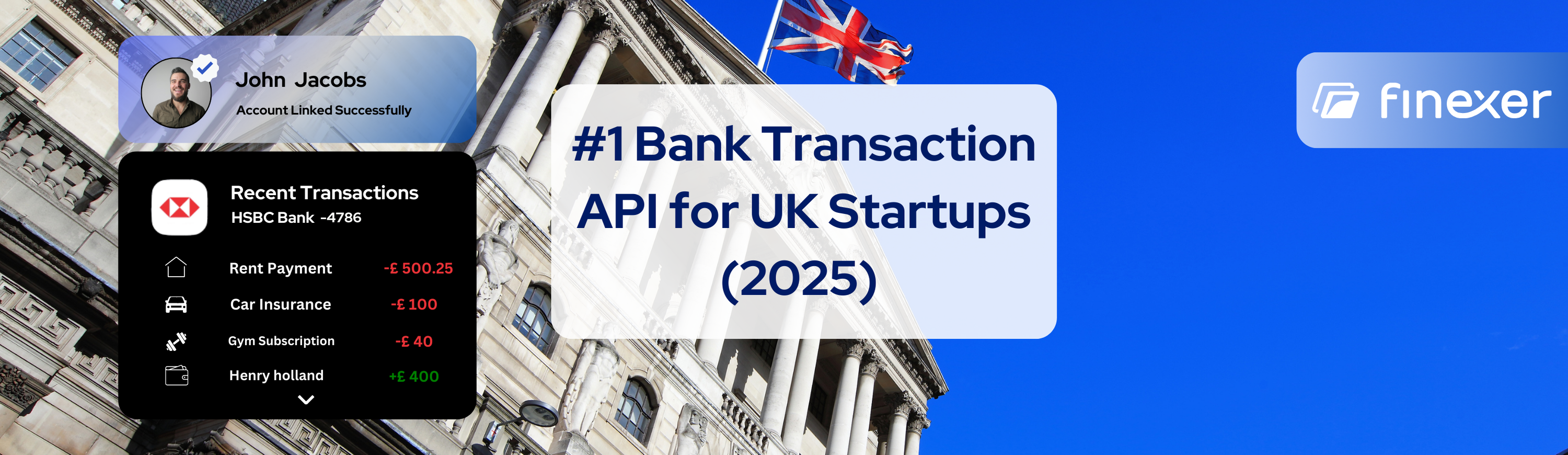

Bank Transaction API: Detailed Guide for UK Startups

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Businesses today run on data—but when that data lives inside a bank account, getting it out securely, reliably, and in real time is a challenge. That’s where Bank Transaction APIs come in. Whether you’re a fintech startup,…

Top 10 Accounting Software in the UK

Managing business finances can be time-consuming and stressful. Keeping track of invoices, expenses, and tax obligations while ensuring everything is accurate often feels like a full-time job. Relying on spreadsheets or manual bookkeeping increases the risk of errors, which can lead to cash flow problems or compliance issues. That’s why choosing the right accounting software…

Small Accounting Firms’ Guide to Instant Payments Collection

What You Will Discover: In the quiet hours after closing another client’s books, many small accounting firm owners face an ironic reality: while they excel at managing their clients’ finances, their cash flow remains trapped in a delayed payment cycle. Recent research from Accounting Today’s Practice Management Report reveals that small accounting firms wait an…

Don’t Look for Real-Time Payment Providers! Here Are the Best 5 Picked for You

Real-Time Payment (RTP) refers to a digital payment system that enables the immediate transfer of funds from one bank account to another. This system allows transactions to be processed instantly, 24/7, including weekends and holidays, ensuring that recipients receive the funds within seconds or minutes, rather than days. Introduction In today’s fast-paced world, waiting for…

AISP vs PISP: A Detailed Look at Open Banking Providers

AISPs provide ‘read-only’ access to users’ financial data across multiple banks, enabling insights into financial behaviour and management. PISPs have ‘read-write’ access, allowing them to initiate direct payments from users’ accounts, streamlining the payment process. Introduction In an era where digital innovation is reshaping the financial landscape, understanding the nuances of open banking and its…

Meet the Top 5 Pay by Bank Providers in the UK!

Pay by Bank refers to a method of online payment that allows customers to make purchases or transfer funds directly from their bank account, bypassing the need for credit or debit cards. This payment method leverages open banking technology, enabling a secure and seamless transaction process directly from the consumer’s bank account to the merchant…

2024’s Leading Open Banking Data Providers in the UK

Open banking data refers to the practice of allowing third-party financial service providers to access consumer banking, transaction, and other financial data from banks and financial institutions through APIs (Application Programming Interfaces). This data sharing is typically done with the customer’s consent and aims to foster innovation, competition, and transparency in the financial services sector.…

Comparing Open Banking Providers: A 2025 Guide for UK Businesses and Consumers

Open banking providers are third-party companies that enable the secure sharing of financial data between banks and authorised service providers through APIs. This allows consumers and businesses to access a wider range of financial services, enhancing control and improving financial experiences. We will guide you through: Purpose of the Guide: Open Finance Expansion By 2025,…

Understanding SPAA in a Nutshell

SPAA stands for “SEPA Payment Account Access.” It is a framework designed to enhance the way payment account data is accessed and used within the Single Euro Payments Area (SEPA). SEPA is a region in which individuals and businesses can make and receive payments in euros under the same basic conditions, rights, and obligations, regardless…

How Product Managers are Cutting Costs Upto 90% with Open Banking

Open banking is changing the financial services industry, paving the way for innovations that are redefining how businesses and financial institutions interact. The shift towards a more open infrastructure has created opportunities for accelerated modernisation and service diversity. What You’ll Discover in This Blog: 🗸 How Open Banking Features Cut Costs 🗸 Benefits for Product…

Your Ultimate Guide to Open Banking Standard v4.0

Open Banking Limited (OBL) – the Implementation Entity described in the CMA Order – built the UK’s world-leading Open Banking Standard and industry guidelines to drive competition, innovation and transparency in UK retail banking. What You’ll Discover in This Blog: 🗸 Understanding Open Banking Standard 4.0 🗸 Reasons for Changes in Standards 🗸 Role and Contributions of Open Banking Limited…

Everything You Need to Know About UK Bank Payments

The UK has developed its own unique local payment schemes, separate from the SEPA system, to support bank transactions. Traditional schemes such as Bacs manage a large share of the payment volume. Concurrently, the UK is leading the way in creating a real-time payment system, enhancing its core infrastructure. For more detailed insights What You’ll…

Guide to UK Bank Transfer Modes: CHAPS, BACS, SWIFT, and Faster Payments

Confused by different bank transfer modes? Uncover the differences between CHAPS, BACS, SWIFT, and Faster Payments, and find out which is best for your needs.

Income Verification in a New Era: The Role of Open Banking

Income Verification or Proof of Income is a set of documents required to verify an individual’s or a business’s monthly or annual income. Proof of income helps financial institutions determine a person or company’s ability to make payments when they apply for credit. What You Will Learn From this Blog 🗸 Transition to Modern Income…

Open Banking Data by Finexer

Open banking data is usually used as a synonym for the general term “open banking”. This practice allows third-party providers of financial services to access consumer account data and other relevant financial information with their express permission. Overview Open Banking Data by Finexer revolutionises the way businesses access and utilise real-time bank transaction data. Leveraging…

Instant Payment by Finexer

An instant payment enables businesses to transfer money quickly – usually between five and 30 seconds – although it can sometimes take a few minutes depending on system availability and the type of bank being used. Regular online bank transfers usually take at least one working day for the money to reach the recipient’s bank…

Bulk Payout – Multiple Payments in One Click by Finexer

A bulk Payout system is a banking system that enables you to make payments to multiple payees on a bulk list. The bulk list is made up of beneficiaries chosen to receive payment from a single account. Overview Finexer’s Bulk Payout solution is designed to streamline the process of making multiple payments with a single…

Instant Withdrawal by Finexer

Instant Withdrawal Payouts enables users to seamlessly and instantly make withdrawals and refunds from the app or service that they are using. This is accomplished by opening and pre-funding an e-money account, from which funds can be sent to users requesting a payout. Overview Finexer’s Payout Instant Withdrawal solution offers a revolutionary approach to managing…

The Role of Open Banking in Modern Credit Scoring

Open banking is a financial services model that allows third-party developers to access financial data in traditional banking systems through application programming interfaces (APIs). This model completely changes the way financial data is shared and accessed. What You Will Learn From This Blog ✓ Understanding Credit Scoring ✓Traditional vs. Open Banking Factors ✓ Impact of Open…

7 Top-Rated ERP Systems for UK SMEs in 2025

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Enterprise resource planning (ERP) is a software system that helps you run your entire business, supporting automation and processes in finance, human resources, manufacturing, supply chain, services, procurement, and more. Introduction In the fast-moving world of UK…

Unlocking Open Banking for Accounting and ERP Systems

Open Banking is a financial services model that allows third-party developers to access financial data in traditional banking systems through application programming interfaces (APIs). This model completely changes the way financial data is shared and accessed. What You Will Learn From This Blog 🗸 The fundamentals and historical evolution of Open Banking. 🗸 How integrating Open…

Open Banking: A New Era for Payroll and Invoicing Management

A payroll invoice is a formal document issued by an employer to an employee, detailing the wages or salaries earned by the employee for a specific pay period. It serves as a summary of the employee’s compensation, including basic wages, overtime, bonuses, commissions, and various deductions, such as taxes, Social Security contributions, and employee benefits.…

Wealthtech: The New Frontier of Open Banking

Wealthtech, a union of wealth management and technology, is a technology-driven approach to managing wealth. It has recently gained traction due to its ability to make the traditionally manual and labour-intensive wealth management process more efficient. What You Will Learn from This Blog: ✓ Impact of WealthTech on financial services. ✓ How Open Banking revolutionizes…

Open Banking: The Revolutionary Tool in Wealth Management – A Detailed Case Study

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Wealth management covers a wide range of financial services to address a client’s diverse needs, including investment advice, estate planning, accounting, retirement planning, and tax services. Introduction Open banking is changing wealth management by allowing secure data…