Verifying income is a critical task for HR professionals, payroll teams, lenders, and compliance officers. Traditional methods such as collecting payslips, bank statements, or employment letters are often time-consuming, prone to errors, and susceptible to fraud.

Recent data highlights the impact of these inefficiencies:

- 29% of HR professionals admit that manual onboarding processes frustrate new hires and increase dropout rates.

Manual income checks are no longer sustainable when accuracy, speed, and compliance are non-negotiable.

To address this, a growing number of UK organisations are adopting salary verification APIs, tools that connect directly to a user’s bank account (with consent) and fetch real-time income data such as salary deposits, frequency, and employer references. These APIs reduce friction, speed up decisions, and lower the risk of fraud.

In this article, we’ll walk through five leading tools that simplify salary verification using live bank feeds. Whether you’re managing onboarding, processing payroll, or performing financial checks, these solutions can help you move faster with more confidence.

Comparison: 5 Best Salary Verification Software for the UK

| Provider | Data Source | Deployment Speed | Verification Approach | UK Focus Level |

|---|---|---|---|---|

| Finexer | Live bank feeds | 2–3x faster than typical providers | Fully real-time, no documents required | Covers 99% of UK Banks(FCA authorised) |

| Konfir | Payroll, HMRC, and banking data | Fast setup via certified integrations | Real-time with limited banking visibility | UK-specific, UKDIATF-certified |

| Mistho | Employer payroll systems | Quick integration via SDK | Direct payroll sync, no document uploads | UK and EU supported |

| Sikoia | Bank data, payslips, tax returns | Depends on setup and data type | Hybrid: open banking + document parsing | UK-first with fintech partnerships |

| Plaid Income | Bank accounts, payroll, documents | Requires integration and user consent flows | Multi-source with fallback to uploads | UK supported, but global platform |

1. Finexer

Best for:

UK payroll and HR teams that need instant salary verification via real-time bank data with no documents, delays, or integration headaches.

Overview:

Finexer is purpose-built for UK companies that want to verify salary and income using live bank feeds without chasing payslips or building complex data flows. Its Open Banking API connects to over 99% of UK banks, pulling transaction-level income data with categorisation, employer tagging, and historical trend analysis.

Unlike larger providers that serve multiple regions or require custom pricing setups, Finexer offers transparent, usage-based pricing, white-labelled consent flows, and developer-friendly onboarding that gets most platforms live in days, not months. This makes it an ideal choice for UK-first HR systems, contractor onboarding platforms, and embedded payroll providers.

Key Features:

- Real-time bank-feed-based salary verification

- Automatically identifies recurring salary payments & employer references

- Categorises income by frequency (weekly, monthly, irregular)

- 12-month income history with optional affordability scoring

- Built-in white-label flows (no app download or redirect required)

- Works across both personal and business accounts

Pros:

- FCA-authorised and UK-compliance aligned

- 2–3x faster deployment compared to typical providers

- Zero setup or cancellation fees

- Developer sandbox with instant test access

- Scales easily for contractor-heavy or high-volume use cases

Cons:

- Built specifically for UK workflows only

Pricing:

Transparent usage-based pricing. No monthly minimums, no setup charges, and startup-friendly terms for scaling teams.

Trusted by UK Platforms Scaling Fast

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.”

— David Kern, CEO, VirtualSignature ID

“Our business isn’t about the volume of consents, it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

Penny Phillips, Chief Commercial Officer at Sysynkt.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

What is a salary verification API?

A salary verification API checks someone’s income using real data from their bank or payroll account. It helps confirm how much and how often they’re paid.

How does it work?

With the user’s permission, the API connects to their bank or payroll system. It then pulls verified salary details like deposit amounts, employer name, and pay frequency.

2. Konfir

Best for:

UK HR and payroll teams seeking instant, automated salary verification during employee onboarding and background checks.

Overview:

Konfir is a UK-based, government-certified platform that provides real-time employment and income verification through secure APIs. By connecting directly with payroll, tax, and banking data sources, Konfir enables HR professionals to verify a candidate’s employment history and salary details swiftly and accurately. This automation reduces administrative overhead and accelerates the hiring process.

Key Features:

- Instant access to verified employment and income data via API

- Integration with UK payroll and tax systems

- GDPR-compliant and FCA-regulated

- Eliminates manual document collection

- Enhances candidate experience with faster verification

Pros:

- Streamlines onboarding by reducing verification time

- Minimises risk of fraudulent employment claims

- Seamless integration into existing HR workflows

Cons:

- Does not provide visibility into recent banking transactions or salary deposit patterns, which may limit insight for variable or freelance income cases.

Pricing:

Custom pricing based on usage and integration needs.

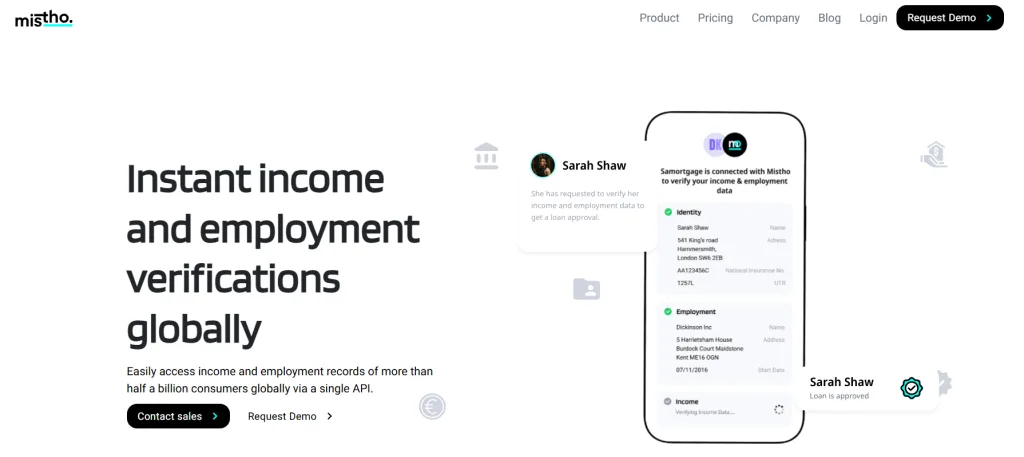

3. Mistho

Best for:

UK HR and payroll teams seeking direct integration with employer payroll systems for automated salary verification.

Overview:

Mistho offers an open payroll API that enables HR professionals to access verified employment and income data directly from an employee’s payroll system. This eliminates the need for manual document collection, reducing the risk of fraud and accelerating the onboarding process. Mistho’s solution is designed to seamlessly integrate into existing HR workflows, providing real-time income data with user consent.

Key Features:

- Direct access to verified payroll and employment information

- Eliminates manual document uploads, reducing fraud risk

- Seamless integration into existing digital HR flows via SDK

- Improves conversion rates and reduces verification time

Pros:

- Enhances candidate experience with faster verification

- Reduces administrative overhead for HR teams

- Supports compliance with GDPR and other regulations

Cons:

- Requires direct access to employer payroll systems, which may not be feasible for contractors, gig workers, or self-employed individuals without traditional payroll structures.

Pricing:

- Sandbox Access: Free of charge for initial development and testing.

- Pay-Per-Use: Suitable for applications with fewer than 2,000 API calls per month.

- Enterprise Grade: Offers lower cost per API call and a minimum SaaS fee per month for enterprise customers.

Are these APIs safe and legal to use?

Yes, the providers listed are GDPR-compliant. Some, like Finexer and Konfir, are also FCA-regulated in the UK.

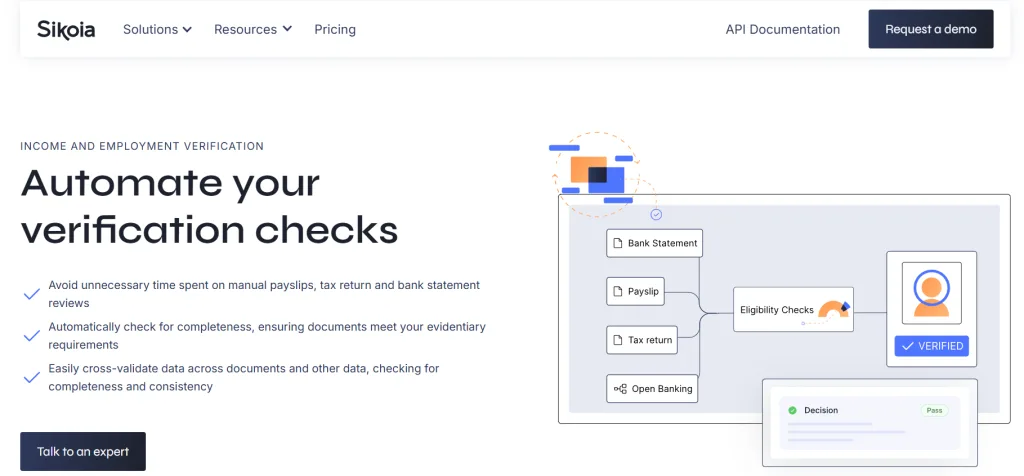

4. Sikoia

Best for:

UK HR and payroll teams seeking a comprehensive solution for automated salary verification and income assessment through multi-source data integration.

Overview:

Sikoia is a London-based fintech company offering an AI-driven platform that automates income and employment verification processes. By leveraging data from payslips, tax returns, bank statements, and open banking, Sikoia enables HR professionals to validate employee income efficiently and accurately. The platform’s capabilities have been recognised through partnerships with institutions like Tandem Bank, where it has significantly reduced the time required for income verification.

Key Features:

- Automated extraction and validation of income data from various documents

- Integration with open banking for real-time financial data access

- AI-powered document integrity checks to detect inconsistencies and fraud

- Customisable API for seamless integration into existing HR systems

- Compliance with FCA and GDPR regulations

Pros:

- Reduces manual workload by automating verification processes

- Enhances accuracy and consistency in income assessments

- Accelerates onboarding and payroll setup timelines

Cons:

- Relies partly on document extraction (e.g. payslips, PDFs), which can reintroduce manual steps and reduce the speed benefits of a fully bank-based API flow.

Pricing:

Custom pricing based on usage and integration requirements.

5. Plaid Income

Best for:

UK HR and payroll teams seeking a versatile, API-driven solution for real-time income and employment verification through multiple data sources.

Overview:

Plaid Income is an open banking-powered solution that enables businesses to access real-time financial data directly from users’ bank accounts, payroll systems, or uploaded documents. By leveraging open banking APIs, it facilitates accurate and efficient income assessments, helping HR professionals and payroll systems streamline their verification processes.

Key Features:

- Multiple verification methods: bank data, payroll information, and document uploads.

- Access to up to 24 months of categorised transaction data.

- Supports a wide range of financial institutions.

- Enhances automation and reduces manual intervention.

- Secure and GDPR-compliant data handling.

Pros:

- Accelerates income verification processes, reducing manual workload.

- Enhances accuracy by minimising manual data handling.

- Improves decision-making with real-time financial insights.

Cons:

- Requires user consent to access bank transaction data.

- May require technical integration efforts depending on existing systems.

- Bank coverage and payroll integration depth may vary across UK institutions, occasionally requiring fallback to document uploads for complete verification.

Pricing:

Custom pricing based on usage and integration requirements.

Why should HR teams use salary verification API?

It saves time, removes the need for payslips, and helps avoid fraud. Many UK HR teams use these APIs to speed up onboarding and payroll setup.

Can I verify income without documents?

Yes. Tools like Finexer and Plaid use bank data to confirm salary, no need to collect PDFs or payslips.

Cut the admin, keep the compliance! Finexer’s API-first income checks are built for UK payroll teams who need accuracy and speed without chasing payslips.

![Verify Income in Seconds: 5 Powerful Salary Verification APIs for UK Teams 1 Top 5 Salary Verification APIs for UK Payroll Teams [2025]](/wp-content/uploads/2025/05/Top-5-Salary-Verification-API-jpg.webp)