Finding the right way to accept payments isn’t as simple as it used to be. Businesses today face a growing list of challenges when it comes to processing transactions. Payment fees are rising, fraud remains a concern, and customers expect fast, secure, and familiar ways to pay, both online and in-store.

A poor payment setup can lead to:

- High transaction fees eating into profit margins, especially for businesses that rely on card payments.

- Slow processing times delaying cash flow, making it harder to manage day-to-day operations.

- Security risks such as fraud, chargebacks, and payment failures, which can disrupt revenue.

- Checkout abandonment, where customers drop off because their preferred payment method isn’t available.

With so many options available from debit and credit cards to digital wallets, BNPL, bank transfers, and Open Banking, choosing the right solution can be overwhelming. This series on the Top Payment Methods in the UK for 2025 will help you navigate these choices.

This guide will guide you through:

1. Debit and Credit Cards

Debit and credit cards continue to be a vital part of payment methods in the UK. They remain widely accepted by both consumers and merchants, offering a familiar and efficient way to handle transactions.

How Debit and Credit Cards Operates?

Debit cards deduct funds directly from a customer’s bank account, ensuring real-time payment. In contrast, credit cards provide a short-term loan, allowing consumers to make purchases up to a preset limit. Both play a significant role among payment methods in the UK.

Key Characteristics of Card Payments

- Widespread Acceptance: Almost every merchant, online and offline, supports debit and credit card payments.

- Instant Processing: Transactions are typically processed immediately, ensuring rapid confirmation.

- Robust Security: Built-in measures such as PIN protection and fraud monitoring help secure transactions, though chargebacks may occur.

- Cost Implications: While offering convenience, card payments incur higher transaction fees which can affect overall profit margins.

Benefits of Using Debit and Credit Cards for Businesses

Debit and credit cards offer several advantages that make them a cornerstone of payment methods in the UK:

Familiarity and Consumer Trust

- Customer Comfort: Consumers are well-accustomed to using their cards for daily transactions, which can reduce checkout abandonment.

- Brand Reliability: The extensive use of cards builds consumer trust, ensuring a smoother payment experience.

Operational Efficiency and Speed

- Quick Settlements: The near-instant processing of card payments helps improve business cash flow.

- Broad Reach: With nearly universal acceptance, businesses can cater to a larger audience by supporting card payments.

Considerations for Businesses Adopting Card Payments

When choosing payment methods in the UK, businesses should consider the following:

Transaction Costs and Fee Structures

- Higher Fees: Card transactions generally come with higher processing fees compared to other payment methods.

- Impact on Profit Margins: The cumulative cost of fees can significantly affect revenue, especially for businesses with high transaction volumes.

Security and Regulatory Compliance

- Chargeback Risks: The possibility of chargebacks due to fraud or customer disputes can affect revenue.

- Compliance Requirements: Businesses must keep up with evolving security protocols to meet regulatory standards and protect customer data.

In summary, debit and credit cards are a foundational element of payment methods in the UK. They combine convenience, speed, and security, making them indispensable for both consumers and businesses, despite some cost and security challenges.

2. Digital Wallets

Digital wallets have become an important part of the Top Payment Methods in the UK. They offer a modern way for consumers to make payments using their mobile devices, and their use continues to grow.

How Digital Wallets Work

Digital wallets allow customers to store their payment information securely on a mobile device. When making a purchase, users simply select their digital wallet option and authorise the transaction, often using fingerprint or facial recognition. This process speeds up checkout and reduces the need to manually enter card details.

Benefits of Digital Wallets

- Convenience: Digital wallets simplify the payment process by allowing users to complete transactions with just a few taps.

- Security: Built-in security measures, such as biometric verification and tokenisation, help protect sensitive data.

- Speed: Transactions are processed quickly, which can lead to faster order confirmation and improved customer satisfaction.

- Widespread Use: Many UK retailers and online merchants now support digital wallets, making them a popular choice among consumers.

Considerations for Businesses

When adding digital wallets to your range of payment methods in the UK, consider the following:

- Integration: Ensure your website or point-of-sale system is compatible with major digital wallet providers like Apple Pay, Google Pay, and PayPal.

- Costs: While digital wallet transactions are generally secure and fast, check for any processing fees associated with each provider.

- Customer Base: Evaluate your customer demographics. Digital wallets are particularly popular among younger, mobile-first consumers.

Digital wallets offer a secure and user-friendly option for processing payments, making them a valuable component of the Top Payment Methods in the UK. Their growing acceptance and ease of use can help businesses meet customer expectations and improve overall transaction speed.

3.Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services have become an attractive option among the Top Payment Methods in the UK. They allow customers to spread the cost of purchases over time, making expensive items more affordable without the need for traditional credit.

How BNPL Works

BNPL providers let customers complete a purchase immediately while paying in installments over a set period. The service typically involves no interest if the installments are paid on time, though some fees may apply for late payments. This approach appeals to consumers who prefer managing cash flow without taking on long-term debt.

Benefits of BNPL

- Flexible Payments: Customers can divide their total cost into smaller, manageable payments, making higher-priced items more accessible.

- Increased Conversion: Offering BNPL as part of your payment methods in the UK can encourage customers to complete purchases, as the upfront cost is reduced.

- No Immediate Financial Burden: By postponing full payment, consumers can make purchases without impacting their current cash flow.

- Attracting New Customers: BNPL is particularly popular among younger shoppers and those who prefer alternative financing options to traditional credit.

Considerations for Businesses

When integrating BNPL services into your range of payment methods in the UK, consider the following:

- Fee Structures: Understand the processing fees or service charges associated with BNPL solutions, as these can vary between providers.

- Customer Eligibility: BNPL services often require basic credit checks, which might limit accessibility for some consumers.

- Regulatory Compliance: Ensure that your BNPL offering complies with local financial regulations to protect both your business and your customers.

- Impact on Sales: Monitor how BNPL affects your conversion rates and average order values to assess its overall benefit to your business.

BNPL represents a valuable addition to the Top Payment Methods in the UK, offering flexibility to consumers and the potential to increase sales. Its growing popularity reflects a shift in consumer behavior towards more flexible payment options.

4. Bank Transfers and Direct Debits

Bank transfers and direct debits are longstanding components of the Top Payment Methods in the UK. These methods are known for their reliability and are commonly used for both high-value transactions and regular, recurring payments.

How Bank Transfers Work

Bank transfers involve moving funds directly between bank accounts. In the UK, the Faster Payments Service allows for near-instant transfers, while other methods like Bacs may take a few days. This method is widely used for:

- Large Transactions: Ideal for B2B payments and high-value purchases.

- Cost Savings: Generally lower processing fees compared to card payments.

- Security: Direct transfers reduce the risk of fraud since they do not require intermediary networks.

Benefits of Bank Transfers

- Reliability: Bank transfers offer a secure, well-established way to move money.

- Low Costs: With fewer intermediaries, the fees associated with bank transfers are typically low.

- Efficiency for Large Payments: Suitable for businesses handling substantial transactions.

How Direct Debits Operate

Direct debits allow businesses to collect recurring payments directly from a customer’s bank account with prior authorisation. This method is commonly used for:

- Regular Bills: Such as subscriptions, utilities, and memberships.

- Predictable Cash Flow: Businesses benefit from a scheduled payment process.

- Customer Convenience: Once set up, direct debits require minimal ongoing effort from customers.

Benefits of Direct Debits

- Automation: Recurring payments are handled automatically, reducing administrative work.

- Cost-Effectiveness: Typically associated with lower transaction fees.

- Customer Retention: Provides a reliable way for customers to manage ongoing payments without re-entering their payment details.

Considerations for Businesses

When incorporating bank transfers and direct debits into your array of payment methods in the UK, keep in mind:

- Processing Times: While Faster Payments are almost instantaneous, other bank transfers can take several days.

- Setup Requirements: Direct debits require proper customer authorisation and adherence to regulatory standards.

- Customer Preferences: These methods are trusted by many, but they may not be as popular for one-time or impulse purchases.

Bank transfers and direct debits are trusted, secure options that continue to be key components of the Top Payment Methods in the UK. Their low costs and reliability make them especially valuable for handling recurring and high-value payments.

📚Learn more about Bank Transfer Modes

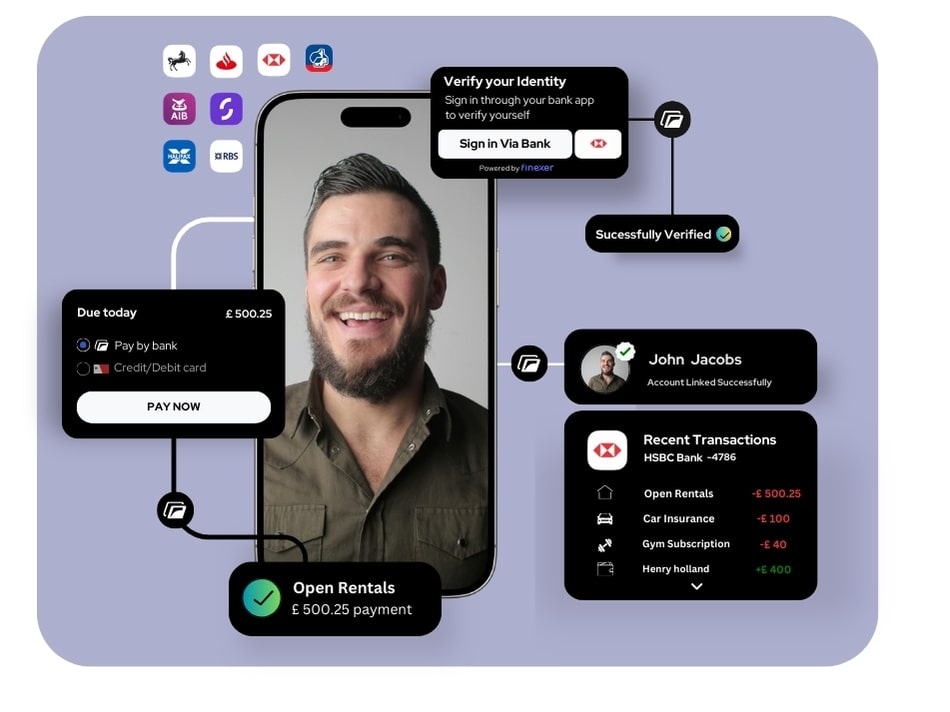

5. Open Banking – A Modern Alternative Payment Method in the UK

Open Banking is emerging as a valuable addition to the Top Payment Methods in the UK. This method allows customers to make payments directly from their bank accounts without relying on traditional card networks, providing an alternative that can reduce costs and enhance security.

How Open Banking Works

Open Banking enables secure, direct bank-to-bank payments by using APIs provided by banks. When a customer authorises a payment, the funds are transferred directly from their bank account to the merchant’s account. This process removes intermediaries, which can lead to lower fees and faster settlements.

Benefits of Open Banking

- Cost Savings: Direct transactions can lower processing fees compared to traditional card payments.

- Enhanced Security: By using bank-level authentication methods, Open Banking reduces the risk of fraud.

- Faster Settlements: Transactions are often completed instantly, which can improve cash flow for businesses.

- Transparency: Customers have clear visibility of their transaction details through their banking app.

| Service | Category | Description |

|---|---|---|

| Instant Payment | PIS (Payments) | Request to Pay-By-Bank for instant transactions. |

| Payout | PIS (Payments) | Instant refunds and withdrawals. |

| Bulk Payout | PIS (Payments) | Multiple payments in a single click. |

| Recurring Payment | PIS (Payments) | VRP (Variable Recurring Payments) and Sweeping. |

| Transactions Data | AIS (Data) | Real-time bank transaction data retrieval. |

| Balance Check | AIS (Data) | Access income, expenses, and balance information. |

| Authenticate | AIS (Data) | Retrieve account details, sort code, IBAN, and BIC. |

Considerations for Businesses

When considering Open Banking as one of the Top Payment Methods in the UK, businesses should evaluate the following:

- Integration Requirements: Implementing Open Banking requires technical setup and API integration with banking partners.

- Customer Adoption: While growing in popularity, it is important to assess whether your customer base is ready for this payment method.

- Regulatory Compliance: Ensure that the Open Banking solution adheres to local financial regulations and security standards.

- Transaction Volume: Evaluate if the potential cost savings and speed improvements justify the integration efforts for your business size and transaction volume.

Open Banking represents a modern, secure, and cost-effective option within the spectrum of payment methods in the UK. It offers a direct alternative to traditional card payments, making it a viable option for businesses seeking to reduce fees and improve transaction speed.

What are the top payment methods in the UK for 2025?

The top payment methods include debit and credit cards, digital wallets, Buy Now, Pay Later (BNPL) services, bank transfers, direct debits, and Open Banking. Each method offers its own advantages in terms of speed, cost, and security.

Why is choosing the right payment method important for my business?

Selecting the right payment method can help reduce high transaction fees, speed up cash flow, enhance security, and decrease checkout abandonment. It ensures that customers have a smooth, familiar, and secure way to pay.

What are the benefits of using debit and credit cards?

Debit and credit cards are widely accepted and familiar to consumers. They offer fast processing and robust security features, although they come with higher transaction fees and the risk of chargebacks.

How do digital wallets work and what advantages do they offer?

Digital wallets allow customers to store their payment details securely on a mobile device. They offer quick, easy transactions and enhanced security through biometric verification, making them popular for mobile payments and quick checkouts.

What is BNPL and how does it benefit consumers and businesses?

Buy Now, Pay Later (BNPL) lets customers split the cost of a purchase into smaller payments over time, usually without interest if paid on schedule. This flexibility can increase conversion rates for businesses and make higher-priced items more accessible for consumers.

What is Open Banking and why is it considered a modern alternative?

Open Banking enables direct bank-to-bank payments using secure APIs, bypassing traditional card networks. It can reduce processing fees and improve transaction speed while maintaining a high level of security, making it an attractive option among the Top Payment Methods in the UK.

Ease Payment process with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂